Published on January 31, 2019 by Binayak Ransingh

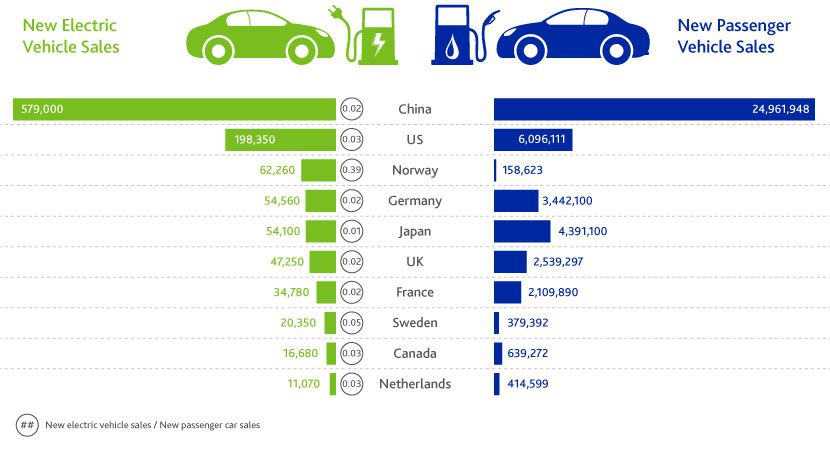

Burgeoning growth of the global EV market has led to a revolution in the automotive and energy sectors. New electric vehicle (EV) sales surpassed 1m units in 2017, growing 54% from 2016. The EV market is currently dominated by developed geographies such as China, the US, Japan, the UK, France, Germany, Norway and Sweden, which contribute more than 90% of global new EV sales. We expect supportive policies and cost reductions to drive the EV market significantly, to reach 125m units sold by 2030. In the International Energy Agency’s EV30@30 scenario, the number of electric LDVs could reach 220m units by 2030.

New EV sales vs. new passenger car sales, 2017

Source: International Organization of Motor Vehicle Manufacturs(OICA),International Energy Agency(IEA), Acuity Knowledge Partners

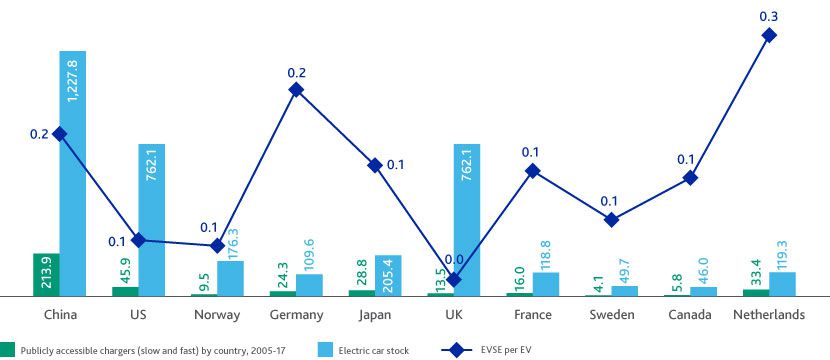

EV supply equipment stock vs. EV stock, 2005-17

Source: International Energy Agency(IEA),Acuity Knowledge Partners

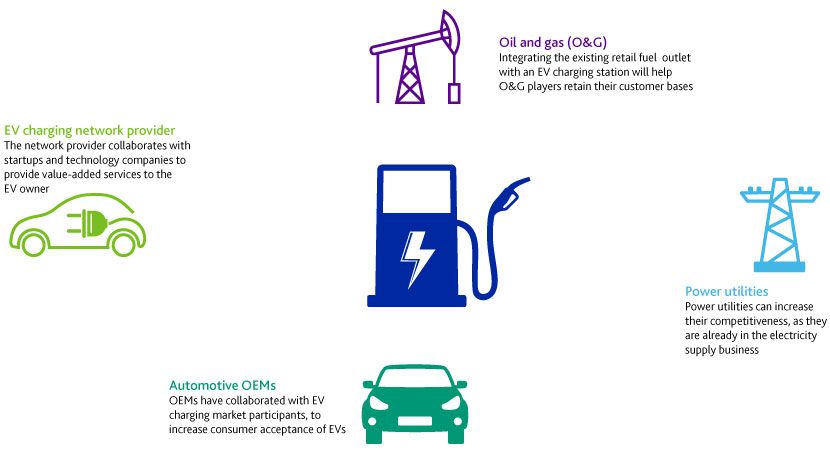

Players in various sectors have shown an interest in participating in the EV charging supply equipment ecosystem, to capture opportunities in the EV market. Oil and gas majors, power utilities, automotive OEMs, and other players in other sectors have started operating in the EV market through acquisitions and partnerships.

Oil and gas majors looking for opportunities beyond the petroleum sector

Oil and gas (O&G) companies have started to invest in the EV charging space through acquisitions in the past two years. They are diversifying beyond petroleum, to compensate for the decline in petroleum product sales due to the increase in the number of EVs. Retail fuel outlets are being integrated with EV charging stations so that more EVs could be served. This helps O&G companies to make a quick move in the market space and compete with the utilities.

|

November 2018 |

EV charging network provider ChargePoint secured a USD240m investment through its latest funding round for its expansion in North America and Europe. The investors list includes American Electric Power, Chevron Technology Ventures, Daimler Trucks & Buses, Canada Pension Plan Investment Board, and Quantum Energy Partners. |

|

September 2018 |

HPCL collaborated with Tata Power to plan, develop and operate commercial charging infrastructure at its retail outlet and other locations in the country. |

|

September 2018 |

Total acquired G2mobility and partnered with Nexans to expand its reach in the EV charging ecosystem by diversifying its portfolio, starting from designing smart charging stations to optimizing energy usage management and further selling integrated services. |

|

June 2018 |

BP acquired the UK’s largest EV charging company Chargemaster. The USD170m acquisition helps the O&G major to offer both fast and ultra-fast charging stations in the UK (a high-value potential market). |

Power utilities – Potential players in the EV charging space

The increase in the number of EVs has afforded power utilities easy entry into the EV charging space. The utilities benefit from already being in the electricity supply business and from being able to add to market competition by charging EVs at lower costs than other players. The utilities could also integrate vehicle-to-grid solutions with their existing business model to generate additional revenue. This would benefit the EV owner and the utilities, providing the infrastructure for energy transmission from the EV to the grid.

|

October 2018 |

EDF partnered with Nuvve to deploy EV and V2G solutions in the European market. Under the partnership, Nuvve will provide bi-directional charging stations and services. |

|

October 2018 |

National Thermal Power Corporation (NTPC) of India collaborated with seven cab aggregators to set up public charging infrastructure for EVs. The state-run power generation utility also collaborated with Indian Oil Corporation Limited (IOCL), Hindustan Petroleum Corporation Limited and Delhi Metro Rail Corporation (DMRC) to develop public charging infrastructure. |

|

October 2018 |

Enel acquired eMotorWerks (a leading North American supplier of EV charging stations) through its subsidiary EnerNOC. The acquisition helped Enel to enter the US EV market by offering customer-focused products and services such as smart charging, integrating EVs and distributed generation resources, and grid balancing and V2G services. |

|

March 2018 |

Engie acquired Netherlands-based EV charging service provider EV-Box to strengthen its position in the EV charging space by offering attractive, innovative and comprehensive EV charging and related energy services to customers. |

Automotive OEMs’ ambitious EV plans – Dependent on the EV charging infrastructure

Automotive OEMs have collaborated with utilities, charging network providers, oil and gas companies, financial services and leasing companies, vehicle users and charging infrastructure providers to increase consumer acceptance of EVs. They have also partnered with other OEMs, forming associations to provide EV charging infrastructure to consumers. Some OEMs like Tesla and Volkswagen directly provide their own network to their customer base. Hence, automotive players have the option of building their own EV charging networks or relying on third-party networks. This represents a new ecosystem within the EV charging market, which would play a key role in the establishment and growth of the global EV market.

|

October 2018 |

Hubject, a joint venture between BMW Group, Daimler, Siemens, and the Volkswagen Group collaborated with Blink (an owner, operator and provider of EV charging station products and networked EV charging services). The strategic partnership will provide US EV drivers with expanded charging coverage and communication capabilities. |

|

October 2018 |

National Thermal Power Corporation (NTPC) of India collaborated with seven cab aggregators to set up public charging infrastructure for EVs. The state-run power generation utility also collaborated with Indian Oil Corporation Limited (IOCL), Hindustan Petroleum Corporation Limited and Delhi Metro Rail Corporation (DMRC) to develop public charging infrastructure. |

|

October 2018 |

Volkswagen’s subsidiary Electrify America will invest USD2bn over the next decade for developing a nationwide web of fast chargers accessible to all brands. |

|

June 2018 |

Webasto Group, a leading supplier in the automotive industry, acquired AeroVironment to strengthen its position in its core business areas such as sunroofs, convertibles, and thermo systems and to participate in new potential business areas such as EV charging stations and battery systems. |

|

April 2018 |

CTEK, a Sweden-based provider of maintenance and care of vehicle batteries, acquired Chargestorm AB to enter the EV market. Chargestorm AB is a Swedish developer of products and systems for charging EVs. |

|

October 2017 |

Daimler, BMW Group, Ford Motor Company and the Volkswagen Group (with Audi and Porsche) partnered to form IONITY, for installing the most powerful and fastest EV charging network with digital payment capability in Europe. It aims to launch c. 400 high-power charging stations by 2020. |

|

January2017 |

Nissan partnered with FLO. The automotive OEM will recommend FLO’s home charging stations to Leaf owners. FLO will also provide free access cards, for Leaf owners to access its charging network in Canada. |

EV charging network provider – An attractive gateway to the EV charging ecosystem

Acquisition of an EV charging network provider has become the most attractive gateway for other industry participants to enter the EV charging space. However, some individually operating EV charging network providers such as ChargePoint and Blink dominate the market and have further strengthened their positions in the increasingly competitive market by diversifying their reach through partnerships and expanding their service portfolios through acquisitions and collaborations with EV charging equipment manufacturers and technology startups. The hardware used by these network providers is individually owned and financed. The companies also offer different payment mechanisms, in an effort to enhance their customer bases.

|

June 2017 |

ChargePoint, Inc. acquired GE’s EV charging network, adding more than 1,800 commercial and about 8,000 residential charging spots to its network. It also provided GE customers with access to its network. |

|

February 2017 |

EVgo partnered with ABB to deploy high-power fast-charging stations in California, with a maximum charging rate of 150kW. The charging system will be able reach charging speeds of up to 350kW with an upgrade. |

Other industry participants have also shown interest in the EV charging ecosystem

Other industry participants are also trying to benefit from the opportunities afforded by this new market. Installing charging stations to attract EV owners to commercial areas (such as malls, restaurants, and pubs) has become a trend in most developed markets. A number of technology startups have also joined the mainstream players, integrating their services with the EV charging network. In addition, many public agencies have taken steps to install charging stations, to encourage the use of EVs. All this market activity drives the EV adoption rate in most developed markets. We believe such steps should be taken in other markets with high potential.

Increasing competition in the EV charging market amid an uncertain future and low demand

The EV charging market faces the risk of uncertainty in the near future. Establishing profitable business models has also become a challenge for market participants because of high upfront investment costs, competition from home charging, and low demand. Nevertheless, they are investing in the market to strengthen their positions in different geographies. We believe this will increase competition in the EV charging market and that companies should, therefore, adopt long-term, sustainable business models to tap the opportunities in the EV charging ecosystem.

Acuity Knowledge Partners’ Energy & Utilities team has been actively supporting its clients in various areas such as market and competitive intelligence, strategy research, financial modelling, M&A support, valuations, and supplier management research support. The team has 40 years of combined industry experience and has executed projects on trending themes such as smart grid, renewable energy, EV and charging infrastructure, small-scale LNG, process automation, home generation, and connected homes.

What's your view?

About the Author

Binayak Ransingh is an Energy & Utilities practice lead in Acuity Knowledge Partners’ Private Equity & Consulting vertical. He has over six years of experience in the power and utilities sector, helping clients with various consulting and business research projects involving market assessment & intelligence, competitive benchmarking, market entry & expansion strategy, technology impact analysis, and business model analysis. Binayak holds an MBA in Power Management and a bachelor’s degree in Power System Engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox