Who We Are

Acuity Knowledge Partners works with global banks and advisory firms, offering tailored support across the banking value chain – including front-, middle- and back-office support. This encompasses all facets of banking – from advisory, credit analysis and equity research to loan origination and portfolio monitoring.

We deliver specialised solutions that streamline operations, manage risks and enhance decision-making. Our expertise in optimising processes, ensuring compliance and driving growth empowers banks to stay competitive in a rapidly evolving financial landscape. Combining deep industry knowledge with innovative technology, we help banks and advisory firms improve efficiency and achieve their strategic goals across functions.

Key Highlights in Numbers

Industry Shifts Redefining the Banking Landscape

Who We Serve

Our Service Offerings

M&A & Advisory

The full suite of M&A services to investment banks and boutique advisory firms, offering end-to-end research and analytics support from deal origination to execution

Learn MoreLending Services

Tailored corporate and commercial lending solutions blending credit expertise, industry-leading practices and cutting-edge technology

Learn More- Support across Loan Books

- Services across the Lending Value Chain

Capital Markets and Lending / Financing Solutions

Empowering banks with comprehensive offshore services for efficient lending and financing

Learn MoreGlobal Markets – Research and Operations

End-to-end support across the global market function including trade desk research, prime brokerage and custodian operations, trade operations, loan operations, treasury and cash management, and product control and reporting

Learn More- Trade desk Research

- Prime Brokerage & Custodian Operations

- Trade Operations

- Loan Operations

- Product Control and Reporting

- Equity Research

- Fixed Income and Credit research

- Research publishing

- Research operations

- Editorial and Content services

- Sustainable finance / ESG

- Quant modeling and multi-asset research

- Macroeconomic, FX, rates, index research

Investing Activities

Bespoke research and analytics powered by fundamental research and analysis, and technology-driven insights for primary financing activities

Learn MoreSpecialised Support

Enhancing efficiencies with our critical support functions including treasury and cash management, presentations and graphics, library functions, paralegal services and middle-office and back-office support

Learn MoreOur Perspective

Our Approach to Embracing Technology Responsibly

The banking industry is presently faced with several technological challenges as it adapts to a rapidly changing landscape. Navigating these challenges requires a strategic approach and a willingness to embrace change and innovation. Some of the challenges common to the industry are:

Integration with and transitioning from legacy systems.

Regulatory and compliance related issues

Data management and utilization

Digital transformation

Cost and competitive pressures

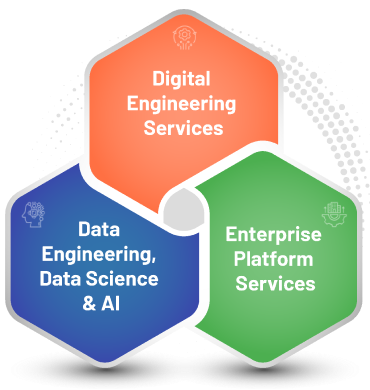

Technology Offering for Banking Clients

Key Differentiators

Domain-centric solutions

3,000+ subject-matter experts working closely with 220+ banking clients across geographies including the US, Europe, the Middle East, Asia and Australia

Flexible engagement models

Customised coverage for clients including weekend support, extended-hours coverage and multilingual support

Strong automation capabilities

Diverse capabilities in developing and implementing cutting-edge technology solutions to improve efficiency and turnaround time for banking clients

Success Stories

What Our Customers Say About Us

Awards/Recognitions

Acuity Knowledge Partners Wins Prestigious 2024 European Credit Award for ‘Portfolio Management System of the Year’

View more