Analysts spend a lot of time on creating and maintaining financial models as they populate historical and forward-looking financial data. Financial models also include a detailed valuation analysis that uses cash flow estimates and trading multiples to arrive at a target price for the subject company. Creating shadow and credit assessment models is time consuming as well, as analysts build a rating methodology tool and collate the relevant data.

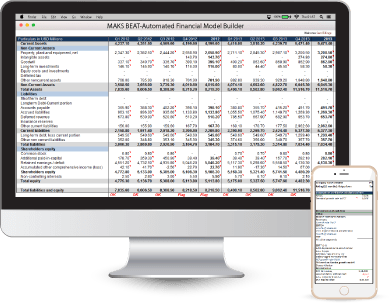

To help analysts significantly lower the turnaround time and tackle the above-mentioned operational challenges, Acuity Knowledge Partners introduces the Automated Financial Model Builder, which automatically retrieves financial statement information from company filings and populates relevant data points in standardised MS Excel templates. It also automates the manual and time-consuming process of searching through multiple company filings for financial information and updating Excel models with data.

Features

- Automated data population: Significantly reduces the time taken to enter historical data

- Wide coverage universe and automated supplementary checks: Unique IDs mapped to line-items reduces the possibility of omission errors; eliminates manual errors altogether, ensuring data accuracy

- Pre-formatted, sector-specific templates: Eliminates manual fixes, ensuring template uniformity

- Enables multiple model updates and facilitates faster time-to-market, when coverage companies announce results simultaneously

- Lookback referencing functionality: Easy lookback functionality to check the information extracted. A single key stroke on the data point opens the page of the PDF the data point has been sourced from and highlights the data

- Automatic backup generation: Creates a backup document of all information extracted from the company filings in PDF format, with the data highlighted

Approach & Impact

Approach

Approach

- Automation of standard processes (from data extraction to model updates) and the introduction of processes for faster review and course correction

- Automation of relevant information extraction and representation

- Robust model generation and updation using an exhaustive list of sector-based categorizations that are customised for each key sector

Impact

Impact

- Potential time-savings of up to 30-40%

- Can be used by any level of skilled resource, unattended execution

- Highly customizable Excel interrogation framework for publishing virtually any section of the analyst model for web and mobile viewing

- Ability to quickly merge two complicated rating methodologies to analyze a special situation, such as an M&A.

- Analysts can spend more time on assigning relevant weightages and then take informed and quick investment decisions