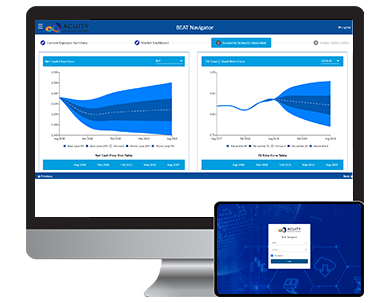

Acuity Knowledge Partners’ Navigator analytics engine can be used to analyse, quantify and visualise foreign exchange, interest rate and commodity price risk in portfolios, and further understand risk/return characteristics of a portfolio under different derivatives-based hedging strategies. Our solution condenses complex calculations into simple-to-use modules, with rich visualisations and a simple user interface.

Features

- Analytics to analyse, quantify and compare risks/returns of different hedging strategies

- Scalable framework that users can operate independently and with minimal training

- Simple-to-use solution that does not require specialist knowledge or expertise

- Intuitive user interface with rich visualizations

- Single application for desktop, web and mobile access

Approach & Impact

Approach

Approach

- Data feeds from client-proprietary data sources or public data sources

- Calibration algorithms to match stochastic models to the market

- Multi-asset Monte Carlo simulation framework for FX, rates and commodities

- Interactive visualisation and combination charts

Impact

Impact

- Comprehensive analysis with complex calculations

- Actionable insights for better decision making, with very little processing time

- Intuitive presentation of analysis output with rich graphics

- Timely and accurate reporting