Published on October 27, 2023 by Anitha Revanna and Tanya Raj

In an unprecedented move, the US Securities and Exchange Commission’s (SEC’s) Division of Examinations released its Examination Priorities 2024 on 16 October 2023 – two quarters ahead of its usual schedule. As expected, there is continued and enhanced focus on emerging risks to investors. While in previous years, the SEC has remained focused on fund managers and broker dealers, this year, it has expanded the scope to include all market participants including the Financial Industry Regulatory Authority (FINRA), clearing agencies and transfer agents. It is concentrated on consumer protection and enhancing trust in the overall markets and market participants. The Division applies a risk-based methodology to accomplish this objective by increasing compliance, preventing fraud, monitoring risk and advising guidelines.

Common themes that the SEC has put forward impacting all market participants include the following:

1. Information security and operational resilience

With volatile geopolitical conditions, there is increased threat of cyberattack; safeguarding investor information, therefore, remains at the fore of SEC’s priorities. The agency expects to have reasonable policies and procedures in place and to continue training staff on the risks of such threats. It also requires companies to strengthen their approach to third-party dealings, internal controls and practices in their global offices.

Additionally, the SEC has adopted rule changes to shorten the cycle for standard settlements for broker-dealer-related transactions. This now stands at one business day after the trade date versus the previous two business days. The deadline to implement this change and become compliant has been set to 28 May 2024.

2. Crypto assets and emerging financial technology

With last year’s Gamestop run by retail customers on the Robinhood app, which brought some of the largest hedge funds to their knees, and the latest collapse and ongoing trials of FTX, scrutiny of cryptocurrencies and fintech mobile applications has increased. The SEC is ensuring investor protection in these areas by solidifying procedures, including marketing activities of automated investment tools, artificial intelligence and trading algorithms/platforms. The Division aims to observe trading advisory, offer and solicitation activities of financial products via automated platforms. It is invoking the Bank Secrecy Act (BSA) and the Advisers Act (Rule 206(4)-2) to regulate crypto wallets and custody requirements.

3. Regulation systems compliance and integrity

In 2014, the SEC adopted Regulation Systems Compliance and Integrity (SCI) that includes national securities exchanges, clearing agencies, FINRA, the Municipal Securities Rulemaking Board (MSRB), plan processors and alternative trading systems to bolster the US financial system’s technical infrastructure. These entities are expected to have reasonable policies and procedures in place to ensure their systems have the capacity, integrity, resilience, availability and security required to continue adequate operations to maintain a fair and orderly market.

4. Anti-money laundering (AML)

The Bank Secrecy Act expects financial institutions to have robust AML programmes implemented and conduct appropriate due diligence, in line with the Customer Due Diligence Rule. This year, the Division will also be focusing on implementation and compliance with Office of Foreign Assets Control (OFAC) sanctions lists. Financial institutions are expected to adapt their AML programmes in accordance with the risks, conduct independent testing and meet SAR filing obligations with the Financial Crimes Enforcement Network.

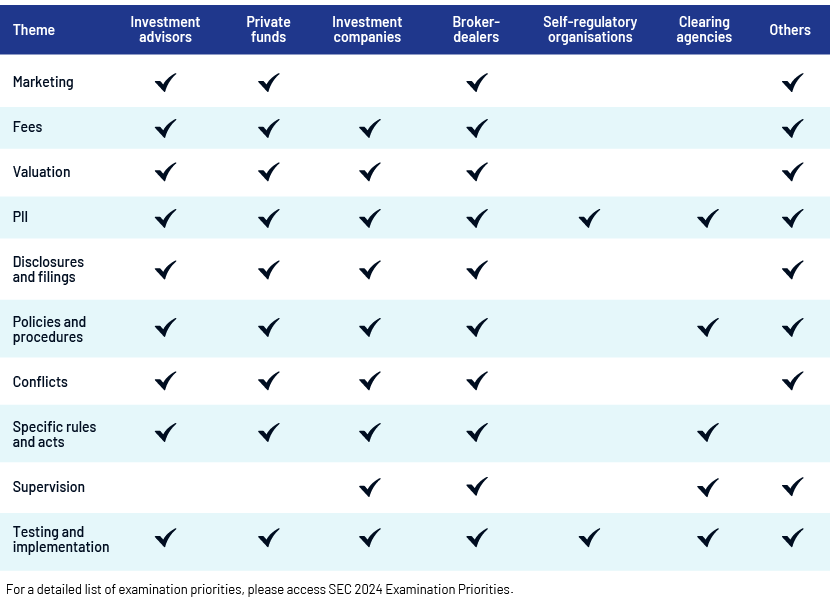

The SEC provides a detailed breakdown of the examinations each market participant will be subject to. The following table compares the priorities by type of firm:

For a detailed list of examination priorities, please access SEC 2024 Examination Priorities.

View from our desk

For investment advisors, including those for private funds, the SEC is focused on reviewing advisors’ policies and procedures on investor best interest. As always, firms should ensure adherence with compliance rules and regulations, marketing practices, fees and expenses, records and disclosures. Due diligence practices should also be refreshed and maintained. For investment companies, programmes, procedures, disclosures to investors and accuracy are the key areas. Being compliant in all matters is critical. Riskier products such as derivatives should be traded or promoted with the care needed to ensure the guidelines set by the Company Act are met.

For broker-dealers, the key focus is on Reg BI, Form CRS, rules and trading practices. Any recommendations to investors should abide by compliance guidelines, and all trading practices need to be reviewed. The SEC tasks self-regulatory organisations, specifically national securities exchanges, FINRA and the MSRB, with ensuring compliance with rules relating to managing operations, enforcement activities and regulatory duty reviews. This is in addition to compliance with SRO rules, federal laws, FINRA operations and regulatory programme risk assessment.

For the clearing agencies, the examinations are designed to be conducted at least once a year. The Division will evaluate compliance with the SEC's requirements on core risks, processes and controls. For other market participants, specifically municipal advisors, security-based swap dealers and transfer agents, the priority is on recordkeeping and registration requirements, being compliant, safeguarding funds and making the required filings.

In terms of the broader categories, there is enhanced focus on cybersecurity risks and data privacy, prioritising procedures for preventing service interruptions and protecting client data and assets, including crypto assets, maintenance of standards and risk disclosure review. The Division will also examine SCI entities’ policies and procedures in place to meet these requirements, including for AML, know your customer (KYC), keeping track of company activities and meeting SAR filing and OFAC obligations. Establishing the best customer identification programme would be a means to ensuring compliance.

Conclusion

It is clear from this year’s priorities that the SEC’s focus is on rules, regulations, policies, procedures and recordkeeping activities. Any lapse in these activities would not only entail penalties being imposed by the authority, but would also damage the overall standing of markets, leading to financial and reputational loss. Firms with effective policies and procedures in place and that employ the services of compliance professionals would be at an advantage.

Success would, therefore, depend on having robust compliance frameworks able to predict risk. Compliance professionals with invaluable experience could help limit the business risks.

In the ever-evolving landscape of compliance challenges, Acuity Knowledge Partners' dedicated compliance experts and tailored compliance processes are the trusted partners you need. Our ability to work seamlessly with multiple clients, implementing best practices discreetly, positions us as your trusted partner for meeting the 2024 Examination Priorities. With our support, you would be able to confidently steer your compliance efforts while focusing on what truly matters – your core business objectives.

Tags:

What's your view?

About the Authors

Anitha has 10+ years of experience in Marketing Compliance. She has previously worked with State Street Global Advisors. Her expertise spans across compliance and risk sector, focusing on compliance reviews of marketing/advertising materials and social media contents. At Acuity Knowledge Partners she is part of the central compliance team and specializes in marketing material review and social media reviews. Anitha is an MBA graduate from RV Institute of Management, Bangalore University.

Tanya heads Forensic and Central Compliance practices. She has over 15 years of experience in the financial services industry. Prior to joining Acuity Knowledge Partners, she worked at Goldman Sachs as Vice President,GSAM Compliance as Bangalore team manager, line compliance officer for the India businesses, and lead for forensic and marketing compliance initiatives. Tanya has also handled marketing strategy and communications at GSAM and market research at Thomson Financial. Tanya holds Bachelor of Business Management, PGD in Psychology from University of Oxford, PGD in Social Media Marketing from Northwestern University.

Like the way we think?

Next time we post something new, we'll send it to your inbox