Published on June 29, 2021 by Mohak Mantri

The term “four-minute mile” has historically been used to refer to something considered impossible to accomplish. It harkens back to the completion of a mile run in four minutes or less, first achieved in 1954 by Roger Bannister. Since then, more than 1,400 runners have accomplished this feat. Physical makeup and conditions have been the same since 1954, so what changed? Was it a change in mindset, or perhaps following Bannister’s training regimen?

Leaders of banking operations and risk management often have to juggle different priorities and challenges, and deliver cost savings, while meeting increasing customer demands. Added to the complexity is the intense competition among traditional industry rivals and fintechs. Leaders have to deploy a number of solutions – such as adopting robotic process automation (RPA), introducing lean and six-sigma practices and, in some cases, artificial-intelligence (AI) and machine-learning (ML) advanced analytics – to reduce operational costs, while providing a world-class service. The rapid evolution of technology coupled with the current economic dynamics demands even more decision making and commitment to efficiency and effectiveness to retain existing clients while acquiring ones.

Acquisition of new clients is extremely costly, and inadequate client management can be fatal for a business. Research shows that the cost of acquiring a new customer is five times higher than that of retaining an existing one. Increasing customer retention rates by 8% increases profits by 25-75%. Focus on delivery can increase client loyalty and retention, adding value to each new client acquired.

This blog discusses four easy steps to Operational transformation in lending for improved client experience along with market share and profitability without incurring extra cost:

-

Operational innovation and excellence

–Understanding client needs, coming up with entirely new ways to meet the requirements, developing products, servicing accounts or performing any other activity the client needs support with along with value creation. It is not just about bottom-line efficiencies and effectiveness, but also top-line growth. Both innovation and excellence have a clear impact – the adoption of related practices helps differentiate firms with comparable offerings and strategies. According to a study by Harvard Business Review, changing management practices, incorporating best practices and routines and following the beginner’s-eye principle can lead to a USD15m increase in profits.

The easiest way to start the process is by creating an end-to-end value chain – a comprehensive list of processes – and carefully capturing the costs and risks associated with each process. The following four precepts help in understanding value, flow and work visibility:

-

Cost optimisation – The biggest challenge is improving the efficiency ratio by reducing per unit costs in comparison to value generated for each process activity or transaction – such as the cost of origination processes, underwriting deals, portfolio management, collateral analysis, or operational needs such as account opening, creating loan document packages, servicing or account closures and lien releases. This requires continuous performance monitoring by defining, measuring, analysing, benchmarking and ultimately transforming middle- and back-office processes.

Informed and balanced decision making can only be done if it is backed by well-researched and analysed data. Once the analysis is conducted by carefully considering vital key parameters, an improvement plan should be formulated considering technology or a hybrid (tech + people) option to decrease costs and enhance the user experience.

-

Technology accelerators – “Digital Transformation in Lending :

Evaluating bespoke technology solutions such as new-generation loan management systems, automated data extraction and evaluation bots, and process automation or straight-through processing driven by ML models. RPA or tech intervention can help improve staff productivity, enabling banks to handle more transactions without an incremental change in headcount. However, before initiating digital transformation in lending and adopting a new technology platform, it is imperative to first review affected end-to-end processes to ensure the new technology or system actually improves the banking operations, rather than just adding to them. The success of digital transformation depends on how streamlined the current process/data is. To analyze this, banks have to critically examine and record all the exceptions built into the process for bespoke support.

-

Testing a hybrid model: Selecting a vendor closely aligned with the bank’s business objectives and that provides support across segments with people and technology. Deploying off-the-shelf technology hurts a bank’s efficiency ratio rather than helping it, not just because there are additional costs of customization to support exceptions, but also because such projects (involving testing, deployment and execution) last for two to three years – an extremely painful period for both clients and internal staff.

One of the best ways to overcome this is to on-board a vendor that not only works as an extension of your team but also acts as a process consultant and improves/eliminates exceptions by completing a process-mapping exercise. This ensures that any exceptions/overlapping activities are eliminated and improvements flow directly into the re-engineered process. This is the time to integrate a new technology platform for improved efficiency and client experience. Maintain strong vendor performance by clearly documenting service-level agreements and scorecards to monitor performance.

-

-

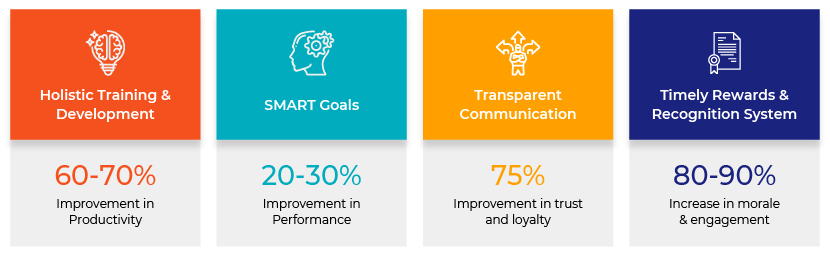

Performance management and staff productivity – Productivity improvement is not linear; it cannot be achieved by focusing only on process and technology. The most important resource is “PEOPLE”. It is extremely important to clearly define and evaluate success criteria for the workforce to yield the required benefits.

This would boost the delivery team to look at the processes and generate ideas for improvement in terms of approach and execution on an ongoing basis and helps convert employees from being passive participants who only notice problems to active participants who have the drive to solve them. Practices such as mobility for offsite work, flexible work arrangements and outsourcing less specialised activities could also be considered as it helps in redefining roles increasing overall morale and engagement levels

-

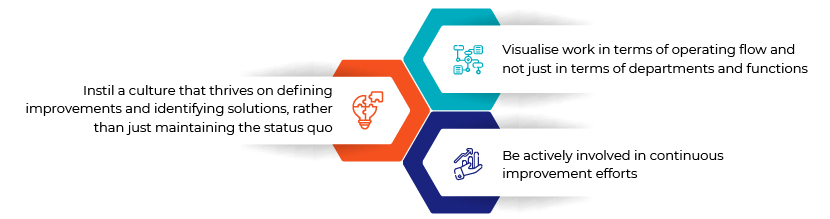

Culture of discipline – It takes a lot more than just efficiency to improve client satisfaction along with market share and profitability. It requires visible commitment of the leadership team to balance value and cost and redefine expenses (which are well-defined and quantifiable metrics), and a sense of accountability (which encourages individual attention to improving efficiency and effectiveness and, in turn, profitability). Leaders should embrace candour by challenging directly, while caring personally, even after all the business improvement initiatives have been implemented.

Acuity Knowledge Partners can help you address these key issues. Leveraging our deep industry and domain experience across the lending value chain, we help clients streamline existing functions by value stream mapping and incorporating best practices. Our suite of Business Excellence and Automation Tools (BEAT) and expertise help reduce costs, increase productivity and improve end-client experience. To know more, please visit Corporate and Commercial Lending Services | Acuity Knowledge Partners (acuitykp.com)

Sources:

Articles:

https://hbr.org/2004/04/deep-change-how-operational-innovation-can-transform-your-company

Books:

The Effortless Client Experience

The Amazement Revolution

Delivering Happiness

Tags:

What's your view?

About the Author

Mohak is part of the Commercial Lending Projects and Transition team at Acuity Knowledge Partners. He has over 13 years of experience in transitioning global projects and leading operations teams for wholesale lending, leasing operations, treasury services and consumer banking functions. Mohak is dual Six Sigma Green Belt certified and has expertise in consulting projects across operations and risk-based control testing and monitoring. He holds an MBA in International Business Strategy from the Indian Institute of Foreign Trade (IIFT) Delhi.

Comments

13-Jul-2021 07:24:11 am

It\'s a very informative blog on how the banking leaders should conduct and implement the strategies to strive for better client experience with the optimum utilization of resources.

Like the way we think?

Next time we post something new, we'll send it to your inbox