Published on November 8, 2024 by Ishank Gupta

Introduction

Fixed wireless access (FWA) is a wireless internet connection that provides broadband network access to remote locations. The technology enables subscribers to connect to the network using radio signals, as opposed to traditional physical infrastructure, such as fibre optic, CAT6 or coaxial cables. It functions through the transmission of data over radio waves between the service provider's base station and the customer-premises equipment (CPE) situated within the subscriber's residence or place of business, whether positioned internally or externally. Since its inception, FWA technology has effectively mitigated the digital disparity by establishing connectivity in remote, unserved and underserved locales where the installation of physical cable networks is hindered by intricate logistical challenges or unfeasibility.

Outlook for the FWA industry

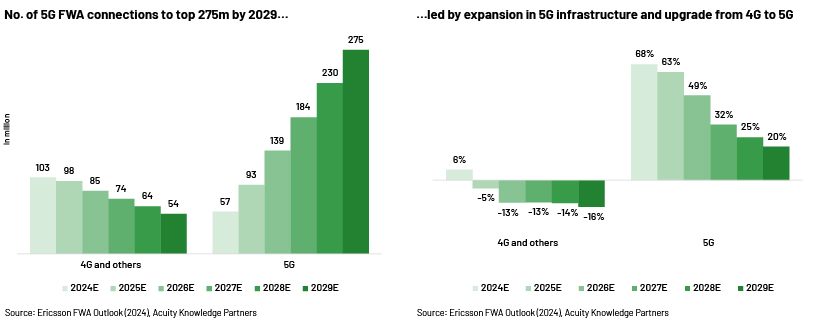

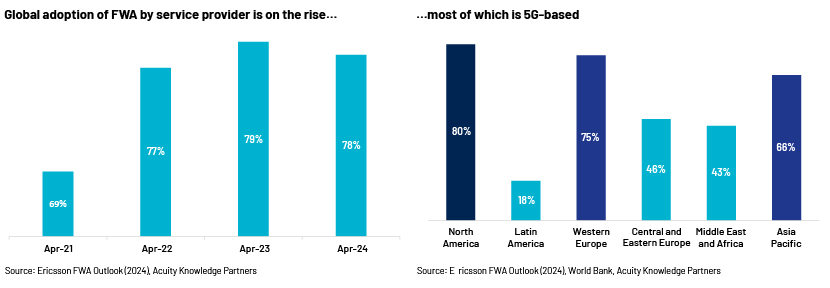

The expansion of FWA over 4G has reached its zenith, while the progression of FWA over 5G is gaining traction owing to the accrual of substantial advantages for both end users and service providers. Approximately 78% of global service providers were offering FWA service as of April 2024, with only 53% providing 5G service over FWA, according to estimates by Ericsson. The proliferation of options from diverse service providers is expected to bolster user confidence in transitioning to 5G, leading to heightened penetration, enhanced capacity utilisation and increased investment in the development of a more densely populated network of millimeter-wave (mmWave) frequency to deliver ultra-high-speed internet access. Furthermore, Ericsson projects that the number of 5G FWA users will grow at a 42% CAGR, to 275m in 2029 from 34m in 2023. Consequently, the total FWA subscriber count is expected to reach 330m, constituting approximately 18% – twice the current penetration – of the estimated 1.85bn fixed broadband subscribers globally.

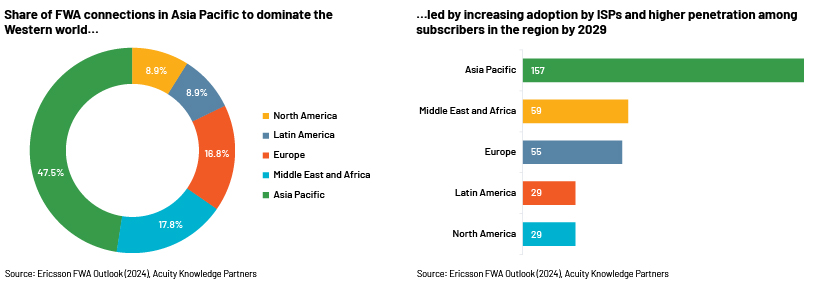

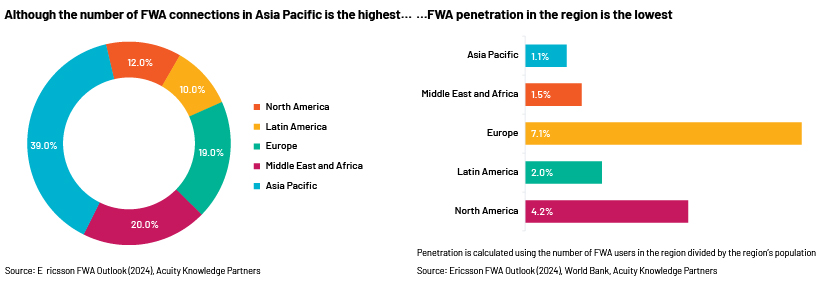

In Asia Pacific, the number of subscribers is forecast to grow at a 21% CAGR – to 157m in 2029 from 51m in 2023. Subscribers in the Middle East and Africa, Europe and Latin America are expected to grow at a 14% CAGR from 2023 to 2029. In North America, subscriber growth at an 11% CAGR is projected – to 29m in 2029 from 16m in 2023. This presents an opportunity for major FWA telecom companies in the region such as Verizon and T-Mobile. The availability of cost-effective plans and enhanced accessibility in the region may further drive user adoption, given that 5G FWA is a primary strategic approach for service providers to capture the market and encourage users to transition to faster technology from traditional, slower internet connections.

Benefits of 5G FWA to subscribers

Cost-effective and more efficient

Increasing adoption of the 5G FWA service by internet service providers (ISPs) has resulted in pricing and speed comparable to those of fixed fibre broadband. This has positioned 5G FWA as an attractive and cost-effective alternative for both new and existing internet subscribers. In contrast to earlier iterations of FWA, 5G FWA supports concurrent use across multiple devices requiring high-speed internet connectivity. The mobility of the internet device further reinforces its efficiency.

Lower upfront investment

With the increasing prevalence of 5G FWA among both users and ISPs, most of the devices offered by service providers are either bundled with a subscription plan or are refundable. This enhancement ensures a seamless experience for customers, eliminating the need to commit to a specific service provider.

Improved performance and user experience

5G FWA can deliver a superior user experience, led by improved speed, response time, cost-effectiveness, efficiency and mobility. These inherent characteristics would shield users from the impact of rapidly evolving technologies.

Benefits of 5G FWA to ISPs

Significant opportunity

The benefits of 5G FWA are expected to prompt a transition from cable/digital subscriber line (DSL) and fibre connections. Global adoption of 5G FWA is currently approximately 9% of total fixed broadband connections, and this is expected to grow to approximately 18%, equating to around 330m connections by 2029, according to Ericsson estimates.

Lower capex

ISPs typically incur significantly lower capex when establishing radio transmitting network equipment than when deploying a fibre broadband connection.

Lower opex

Implementing 5G FWA rollout judiciously and accurately results in a substantial reduction in network costs, specifically cost per bit per hertz, reducing opex and improving margins for the service provider.

Higher return on invested capital

5G FWA services are expected to enhance return on invested capital and free cashflow to equity by offering increased revenue potential, improved margins and reduced capital investment.

Proven enterprise application

5G FWA deployed using mmWave spectrum has demonstrated its ability to provide advanced mobile broadband (eMBB) capabilities. This technology can be implemented in large enterprise settings.

Risks and challenges facing the FWA industry

Restricted reach

The success of 5G FWA services relies on unobstructed data transmission between the base station and the user's CPE antenna. However, obstacles such as thick walls, underground floors or natural terrain can hinder the signal, impacting the user experience. Additionally, areas far from the base transmitter may experience poor signal reception, further dampening the user experience.

Unavailability of spectrum

The 5G FWA internet service can be affected in urban areas with high density and high utilisation, as it shares spectrum with cellular telecom services. In these areas, ISPs or telecom companies may struggle to improve services due to spectrum deficiency. Additionally, in certain geographies, the FWA service may be unavailable due to government restrictions, such as for use only for military or other private purposes.

Evolution of FWA

FWA service is a globally adopted technology, with a history spanning over two decades. While FWA has been deployed over EDGE, WiMAX and 4G technologies, it is only with the advent of 5G that the true potential of FWA has been unlocked, owing to 5G FWA's enhanced spectral efficiency. Advancements in signalling and CPE have made it possible to use MIMO and beamforming techniques. 5G FWA uses hybrid (mid- and high-frequency) spectrum bands, by employing low-/mid-wave-frequency spectrum to transmit signals over long distances, while employing high-wave frequency (mmWave) to provide ultra-high bandwidth and faster speed for a superior user experience. This capability enables telecom service providers to effectively serve both retail customers (who prioritise affordability) and enterprise customers (who require ultra-high-speed internet access for heavy content transmission).

Current dynamics of the FWA industry

Subscriber trends

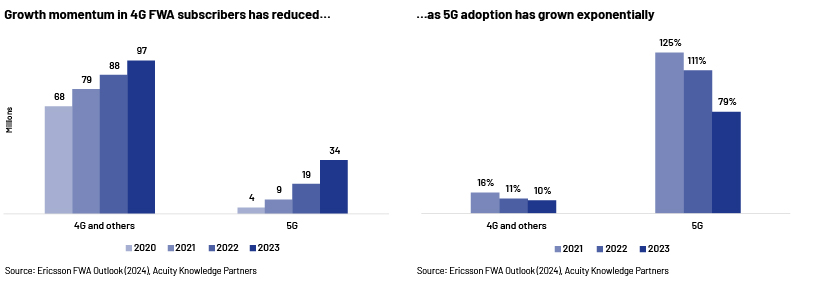

With the introduction of 4G/LTE, there was a surge in FWA subscribers, but the number fell short of the full potential. The number of FWA subscribers reached 107m by end-2020, representing only about 7% of total fixed broadband connections. As only a few consumers found 4G FWA more appealing than fixed broadband, 4G FWA subscribers grew at a mere 13% CAGR from 2020 to 2023. However, in the early 2020s, the emergence of 5G triggered a shift in the FWA industry, prompting subscribers to upgrade to 5G FWA services.

5G FWA service has effectively bridged the divide between wireless and wired broadband connections for residential use. It offers simplified installation, eliminating the need for physical wiring, wall penetrations and spatial limitations to wired access within the household. Furthermore, the consistent pricing structures of internet plans has resulted in heightened customer satisfaction, contributing to an elevated net promoter score (NPS) and driving a remarkable 104% CAGR in the 5G FWA subscriber base – to 34m over 2020-23 from 4m.

Penetration and share by region

The US, European countries and Middle Eastern countries were the first to launch 5G and 5G FWA services. It did not take long for ISPs and consumers to realise that 5G FWA services could match or even surpass traditional cable/DSL internet connections, often equalling fixed fibre broadband. As a result, FWA adoption started to increase; adoption is highest in Europe and North America. Similar adoption is expected in other regions, leading to a significant change in the FWA industry landscape.

Adoption by ISPs

The advent of 5G has empowered ISPs on a global scale to provide dependable internet connections through FWA. An estimated 78% of global ISPs were actively offering FWA services as of April 2024. The elevated user experience has prompted ISPs to expand their FWA offerings over 5G to maximise returns on their 5G investments. Furthermore, over 128 ISPs were delivering FWA services over 5G as of April 2024, representing roughly 53% of all FWA service providers. The US boasted the highest availability of 5G FWA services, with Western Europe and Asia Pacific following closely behind. Almost 18 more service providers have launched 5G FWA services in emerging markets in the past year, accounting for approximately 65% of global launches during the period. With the swift pace of launches and adoption, Asia Pacific is forecast to enhance the availability of 5G FWA among its service providers to meet escalating demand and capitalise on incremental revenue opportunities.

Pricing

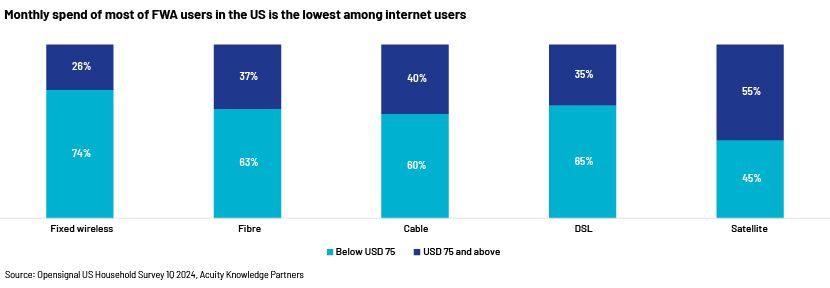

In rural and underserved areas with no fixed broadband access, FWA service pricing was set at a premium compared to pricing for cable or DSL internet connections. However, service providers have invested heavily in spectrum and network equipment in recent years to offer 5G services, resulting in significant economies of scale. This has enabled them to introduce 5G FWA services at similar pricing to fixed fibre connections or even lower than pricing for cable/DSL connections. Furthermore, offering FWA over 5G allows for shared spectrum capacity, enhancing utilisation and expanding revenue potential. According to a household survey conducted by Opensignal in the US, approximately 74% of FWA users spend less than USD75 per month, compared to 63% of fibre users, 60% of cable users and 65% of DSL internet users. Therefore, it can be inferred that with widespread adoption, the pricing of FWA connections can be brought on par with or be even lower than that of wired internet connections, enabling service providers to improve returns on their 5G investments.

Impact of FWA opportunity on telecom companies

5G FWA is gaining momentum globally due to its mobility, adaptability, ease of installation and ability to provide high-speed internet compared to fibre connections with ultra-low latency. This presents a significant revenue opportunity for telecom service providers, requiring only a fraction of the capex needed for laying fibre networks and setting up costly backhaul network equipment. By promoting this service to their extensive existing user bases, providers could maximise their revenue-generating potential. All service providers should, therefore, prioritise the launch of 5G FWA services. This would enhance their returns on existing investments, leading to higher network capacity utilisation, increased revenue, improved return on invested capital and greater free cashflow for shareholders.

Central banks globally are on the verge of a rate-cutting cycle, and with improved growth and free cashflow of telecom companies, investors could expect higher dividend payouts. Thus, investors could lock in investments for a higher dividend yield in a declining-interest-rate environment.

How Acuity Knowledge Partners can help

Global investment banks and asset managers leverage our sector-specific experience to rapidly increase internal analyst bandwidth and expand coverage. We set up dedicated teams of analysts (CAs, MBAs, CFAs) to support our clients in a wide range of activities including idea generation, macroeconomic research, financial analysis, thematic research, building databases and providing regular sector coverage. Each output is customised, based on the client’s requirement, and made available for their exclusive use. This ensures our clients a unique, sustainable edge.

Sources:

-

Technology Review: Fixed wireless access on a massive scale (ericsson.com)

-

Fixed Wireless Access: Economic Potential and Best Practices – Networks (gsma.com)

What's your view?

About the Author

Ishank Gupta is part of buy-side research team at Acuity Knowledge Partners. He is a chartered accountant with experience of over six years in equity research, financial modelling and valuation analysis for Banking, IT Services, Internet, and Telecom sector. He has been supporting US based Hedge Fund client with equity research and financial modelling for their coverage universe. Prior to joining Acuity Knowledge Partners, he worked as a Senior Research Analyst covering Indian TMT sector with Crisil Limited.

Like the way we think?

Next time we post something new, we'll send it to your inbox