Published on February 10, 2022 by Mamatha Subbaiah and Venkatesh Krishnamurthy

Extremely-low-income renters in the US face a prolonged scarcity of homes available for rent, according to data from the American Community Survey (ACS). No state has an adequate supply of affordable housing for rent for those with the lowest income. ACS data reflects a shortage of roughly 7m affordable homes for extremely-low-income renters, whose household income is below the poverty guideline or less than 30% of a region’s area median income (AMI). Only 37% of affordable homes are available for extremely-low-income renter households.

Who are extremely-low-income renters?

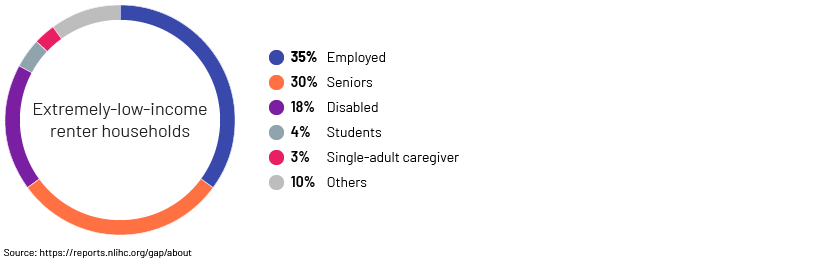

These are people who work low-paying jobs or are jobless. Of this group, 35% are employed, 30% are seniors, 18% are disabled, 4% are students and 3% are single-adult caregivers to young children or household members with disabilities.

The following chart depicts the various extremely-low-income renter households:

Reasons for the demand-supply gap

Of the 44m renter households in the US, approximately 10.8m are on extremely low income. Only 7.4m homes available for rent are affordable to these individuals nationally, considering only 30% of income is spent on housing. This translates into a shortage of 3.4m affordable rental homes in the US.

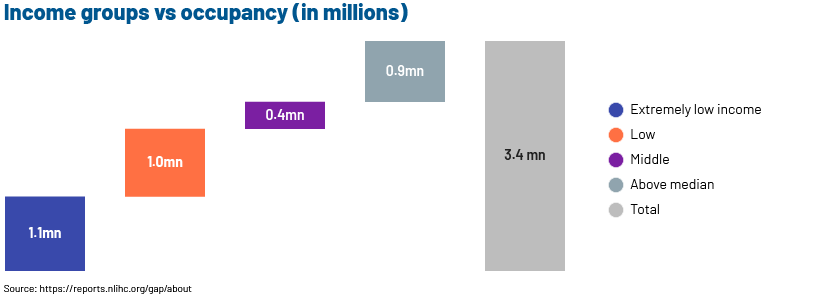

Of the 7.4m homes affordable to the extremely-low-income group, 1.1m homes are occupied by the extremely-low-income group, 1m by the low-income group, 400,000 by the middle-income group and 900,000 by the above-median-income group. As a result, only 4m homes are available at prices affordable to extremely-low-income renters. This means a significant shortage of 3.4m affordable homes versus the requirement of 10.8m homes for the extremely-low-income category.

The table below shows occupancy by income group:

The extremely-low-income renter group is the only income group facing this shortage of affordable homes, the main reason being the homes are “affordable, but not available”.

-

High competition:

Extremely-low-income renters need to compete with higher-income households. In the private market, homes affordable to extremely-low-income renters are not necessarily available to them. This is because higher-income households occupy rental homes affordable to lower-income households. -

Housing cost burden:

The cost of housing, including rent and utilities, is considered a burden when it consumes more than half a household’s income.

Despite of several affordable programs that are currently active, the availability of affordable homes for low and middle income group still remains a nightmare. In our opinion, few underlying issues are i) changing market dynamics coupled with ongoing foreclosures results in making affordability more costlier, ii) spike in development costs forces developers to contain costs due to significant cuts to housing funds at all levels of government, and iii) existing subsidies, policies and programs are benefiting higher income households, which leaves very limited availability for low and middle income households.

How to fix the shortage:

Stronger eviction moratoria and emergency rental assistance are vital if a government is to mitigate the ongoing public health and economic crisis, and fix the chronic housing shortage.

Additionally, federal policy should be strengthened to honour long-term commitments. The federal government could initiate and sponsor a permanent housing safety net to safeguard renters in need, eliminating the need to create programmes for every emergency. We also recommend the following measures:

-

Launching a national housing stabilisation fund to provide emergency assistance

-

Expanding the housing choice voucher programme

-

Protecting the supply of affordable homes for the lowest-income renters

-

Making a sufficiently large capital investment for rehabilitation and the preservation of subsidised and public housing

-

Providing housing assistance to all income groups, irrespective of immigration status

-

Supporting partnership with and building the capacity of community-based organisations

-

Creating awareness and prioritising outreach to all communities to ensure equal access to emergency resources

How Acuity Knowledge Partners can help

We are experienced in the affordable housing sector. We have strong credentials in the Community Development Lending (CDL) outsourcing space, helping banks centralise and standardise processes. We also have domain expertise in independently monitoring CDL portfolios in a timely and structured manner.

We partner with our clients to drive revenue, implement global best practices and transform their operating models. Our service offerings in the affordable housing space help banks improve speed to market, increase customer-facing time, manage higher volumes and utilise flexible staffing for one-time projects or spikes in work volumes. We also help clients streamline existing functions by value stream mapping and incorporating best practices.

Sources:

https://reports.nlihc.org/sites/default/files/gap/Gap-Report_2021.pdf

https://archive.curbed.com/2019/5/15/18617763/affordable-housing-policy-rent-real-estate-apartment

https://archive.curbed.com/2019/4/25/18515795/rent-income-housing-affordability

Tags:

What's your view?

About the Authors

Mamatha Subbaiah has over 10 years of experience in banking and commercial lending domains. Her area of expertise includes writing credit appraisal reports, industry reports, Cash Flow modelling, Slotting and client pitch presentations. At Acuity Knowledge Partners, she is part of sector and product-specialist teams in Commercial Lending, focusing on diverse sectors such as UK Real Estate, UK Agriculture, and US Real Estate. She holds a MBA (Finance) and a bachelor’s degree on Commerce.

Venkatesh Krishnamurthy has been with Acuity for over 10 years and has over 18 years of overall experience in Commercial Real Estate (CRE). At Acuity Knowledge Partners, he leads multiple CRE client engagements based out of US and is actively involved in client management, training, and quality control of deliverables. He holds a MBA (Finance) and a bachelor’s degree on Commerce.

Like the way we think?

Next time we post something new, we'll send it to your inbox