Published on May 29, 2024 by Venkatesh Krishnamurthy

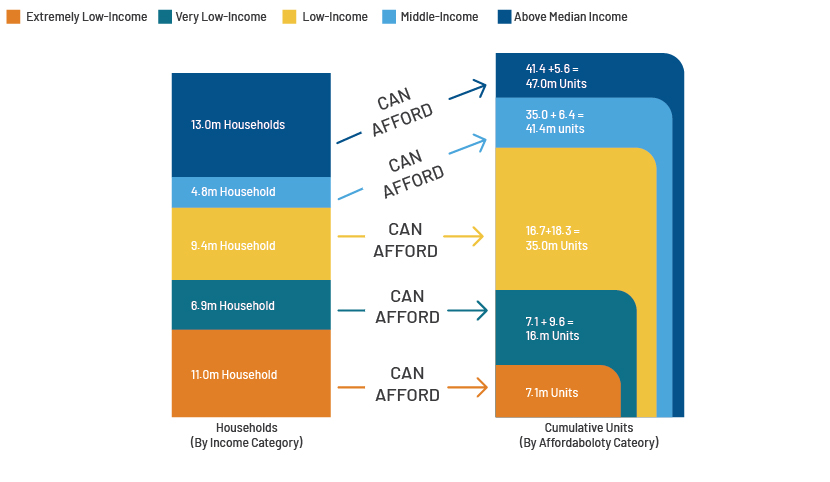

The US has been facing a significant shortage of available and affordable housing for extremely-low-income households for a long time. US renters face an acute shortage of c.7.5m affordable homes, according to the National Low-Income Housing Coalition, which means that just 33 affordable homes are available for every 100 low-income households.

This shortage of available, affordable housing units for extremely-low-income households increased from 2019 to 2021, driven by a number of challenges relating to health due to the pandemic, skyrocketing inflation, broad-based unemployment and increasing costs, in addition to debt becoming expensive.

Extremely-low-income renters are the category affected the most, as only 7.1m affordable rental homes are available for 11.0m households. The section below explains this acute shortage by income:

Source: https://reports.nlihc.org/gap/about

Categories of renters

:| Income category | Definition |

| EXTREMELY LOW INCOME (ELI) | Households with income at or below the federal poverty guideline or 30% of area median income (AMI), whichever is higher |

| VERY LOW INCOME (VLI) | Households with income more than ELI and less than 50% of AMI |

| LOW INCOME (LI) | Households with income more than 50% of AMI and less than 80% of AMI |

| MIDDLE INCOME (MI) | Households with income more than 80% of AMI and less than 100% of AMI |

| ABOVE MEDIAN INCOME | Households with income more than 100% of AMI |

Source: National Low-Income Housing Coalition

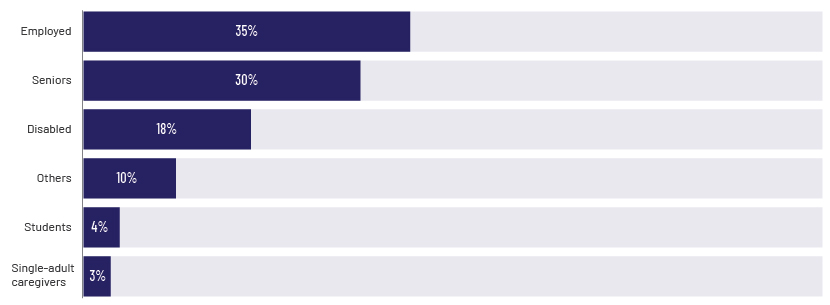

Who are extremely-low-income renters?

These are households with income at or below the federal poverty guideline or 30% of AMI, whichever is higher, essentially those who work for less-paying jobs or are unemployed.

The following chart summarises the extremely-low-income renter household category:

Source: https://reports.nlihc.org/gap/about

The Department of Housing and Urban Development (HUD) spearheads the housing efforts in the US. State and local governments can increase supply of new affordable units using the HUD’s Community Planning and Development (CPD) funds. Programmes under the HUD include the following:

Community Development Block Grant (CDBG):

Provides state-, city- and county-level funding for development of feasible urban communities. It primarily supports low- and moderate-income households. The programme provides housing-related activities including acquisition, demolition, rehabilitation and, in a few instances, new construction.

HOME Investment Partnerships (HOME):

Initiated by Congress, this provides funding for participating jurisdictions at both the state and local levels. The flexible funding primarily supports low-income renter households and homebuyers/homeowners with funds for affordable housing. Authorised activities include covering costs relating to acquisition, new construction, rehabilitation and rental assistance for tenants.

Housing Trust Fund (HTF):

Provides grants to states for development and to preserve affordable housing. It primarily assists extremely-low-income households with rental housing. Eligible activities include acquisition, new construction, rehabilitation and providing operating subsidies for the long-term financial stability of assisted projects.

Section 108 Loan Guarantee (Section 108):

Assists eligible CDBG grantees to use annual CDBG grant funds to access low-cost, adaptable financing for community and economic development-related projects. Helps in activities eligible for CDBG assistance, including rehabilitation, acquisition, preparation of site for development and, in a few instances, new construction of affordable housing.

Despite the availability of grants/programmes supporting affordable housing, the chronic shortage remains and has in fact increased year over year. We recommend the following measures:

-

Permit building more affordable housing units

-

Legalise accessory dwelling units (ADUs). ADUs are independent residence units located in a basement or above a garage

-

Reduce parking requirements, freeing up space to build more residence units

-

Accelerate approval process of developments that comply with zoning laws and regulations

-

Provide approvals to build more affordable units near transport hubs for ease of use of public transport

-

Cities to create trust funds for affordable housing rather than depending only on federal and state funds

-

Increase housing choice voucher programmes significantly

-

Plan and allocate underutilised land for affordable housing

Conclusion

Although most economic indicators suggest that the US economy is recovering, supply of affordable housing for extremely-low-income households is insufficient. Current local reforms are inadequate and require federal resources to eliminate the shortage. State and local governments should (1) provide more subsidies, (2) restructure zoning laws and (3) reduce the number of other local restrictions.

How Acuity Knowledge Partners can help

We are experienced in the affordable housing sector and have strong credentials in the community development lending (CDL) outsourcing space, helping banks centralise and standardise processes. We also have domain expertise in independently monitoring CDL portfolios in a timely and structured manner.

We partner with clients to drive revenue, implement global best practices and transform their operating models. Our service offerings in the affordable housing space help banks improve speed to market, increase customer-facing time, manage higher volumes and access flexible staffing for one-time projects or spikes in work volumes. We also help clients streamline functions by mapping value streams and incorporating best practices.

Sources:

-

https://www.multihousingnews.com/affordable-housing-outlook-what-challenges-will-2024

-

https://commonbond.org/how-can-we-increase-the-supply-of-affordable-housing/

What's your view?

About the Author

Venkatesh Krishnamurthy has been with Acuity for over 10 years and has over 18 years of overall experience in Commercial Real Estate (CRE). At Acuity Knowledge Partners, he leads multiple CRE client engagements based out of US and is actively involved in client management, training, and quality control of deliverables. He holds a MBA (Finance) and a bachelor’s degree on Commerce.

Like the way we think?

Next time we post something new, we'll send it to your inbox