Published on February 3, 2023 by Sreenath Kesavan

Africa’s natural resources sector attracts strategic investments

Africa’s rich natural wealth has been identified for some years now. However, most of it remains untapped and also perceived to be risky due to politically unstable and corrupt governments in some countries. This seems to have reached an inflection point now, with investment flows picking up, mainly in the form of (1) greenfield investments, (2) firms operating directly or through JVs, (3) providing contract Africa’s resources are now attracting investor attention, primarily in the mining and energy sectors services and/or (4) the acquisition of mining concessions. These flows have been increasing due to high commodity prices, sanctions against Russia (a major metals producer) and developed nations’ (Europe’s and the US’s) need to secure the scarce and valuable raw materials the continent has to offer. Investments are poised to grow as Africa remains underpenetrated in terms of global FDI, while resources in developed countries are subject to strict environmental regulations or are in regions facing geopolitical conflict. African countries have also begun to realise the importance of their natural wealth and are likely to engage more with investors willing to forge strategic partnerships with their domestic companies. To benefit from these positive developments, global investors should watch for opportunities in sectors such as mining and energy. We note Russian and Chinese companies have well-entrenched business and trade relationships in Africa that could present a challenge, but the benefits of investing now would far outweigh the risks.

Africa has large untapped resources, although investors perceive them to be risky

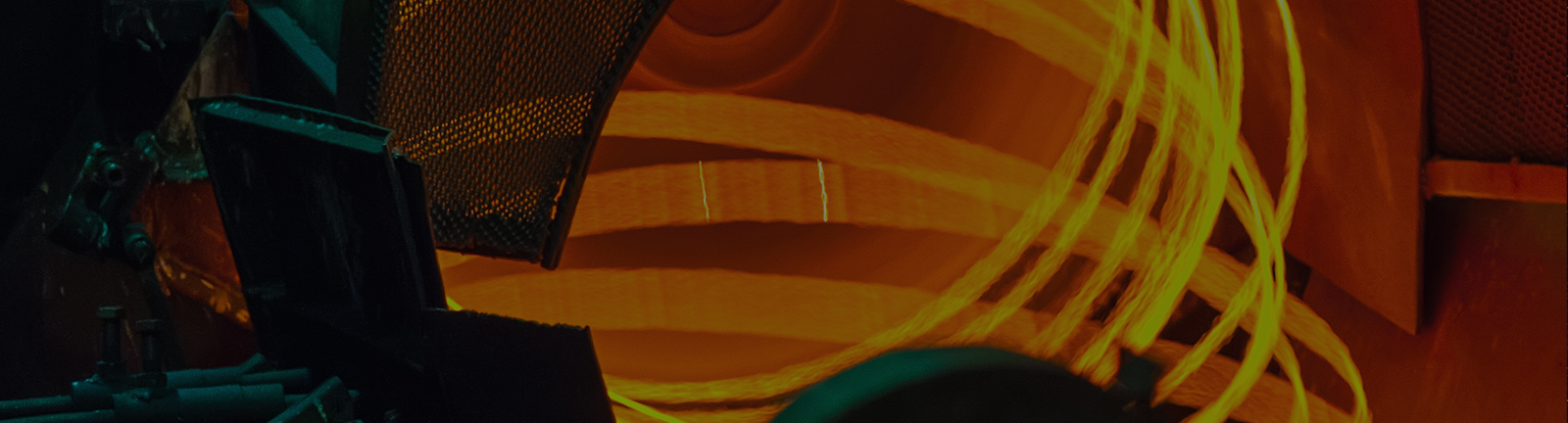

According to the UN, Africa holds 30% of the world’s mineral reserves, 12% of the world’s oil and 8% of the world’s natural gas reserves. The region also contains 80%+ of the world’s chromium and platinum reserves and around 40% of the world’s gold reserves. The continent has substantial mineral resources and is also a significant producer of minerals such as cobalt, chromium, manganese, tantalum, diamonds and uranium.

Cobalt is an essential ingredient for producing batteries, especially for electric vehicles (EVs). In 2020, the Democratic Republic of the Congo (DRC) produced about 67% of the world’s cobalt, according to the World Mining Congress. The DRC also holds nearly half of the world’s cobalt reserves. Tantalum is another metal used in electronic equipment such as mobile phones and laptops and in a variety of automotive electronics. The DRC and Rwanda together produced nearly 50% of the world’s tantalum in 2020.

Despite an abundance of natural wealth, most of it is untapped, due to politically unstable or corrupt domestic governments. Investments in African assets are generally considered risky, and the long gestation period of developing mines also acts as a dampener.

Africa’s resources are now attracting investor attention, primarily in the mining and energy sectors

Africa’s mineral wealth has been attracting the attention of companies and investors recently due to the following:

a) Commodity prices rebounding in the latter half of 2021, following the pandemic-induced restrictions

b) Sanctions on Russia, one of the top metals producers (aluminium, titanium, palladium and nickel)

c) The West’s need to secure raw material supplies to counter a belligerent China

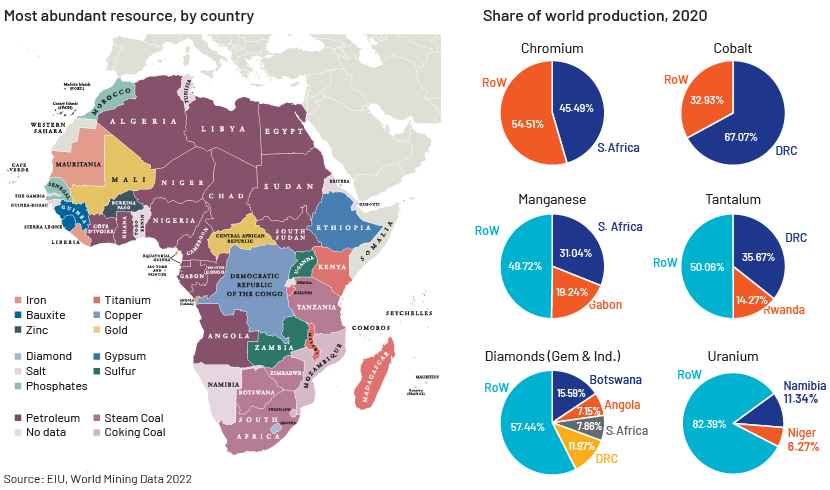

FDI inflows jumped in 2021, although a big chunk of it could be attributed to a single intrafirm financial transaction in South Africa in 3Q21. Excluding South Africa, FDI inflows to Southern Africa would have still amounted to USD42bn, indicating growth of 8% y/y, following the pandemic-induced slowdown in 2020, when FDI investment dropped by 15%. Investment in West Africa’s Nigeria doubled to USD4.8bn due to a resurgence of investment in the oil and gas sector, while mining projects increased Ghana’s FDI by 39% y/y to c.USD3bn. In East Africa, Ethiopia, a hub for China’s Belt and Road Initiative, saw a 79% y/y increase in FDI inflows to c.USD4bn. In North Africa, investment flows to Morocco rose by 52% to c.USD2bn in 2021, while FDI to Egypt fell by 12% to c.USD5bn, although it was the second-largest recipient in Africa. A slew of greenfield projects have been announced in Egypt, Uganda, Tanzania, Mozambique and Senegal. While Central Africa saw a slight decline in investments, FDI to the DRC grew by 14% to c.USD2bn.

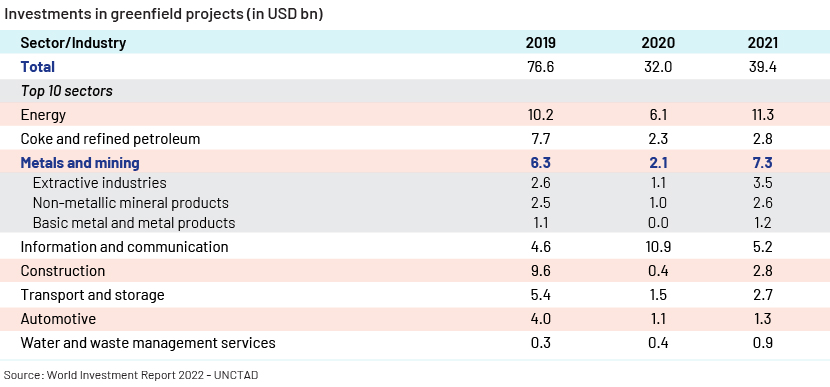

Investments flows have mainly been in the form of greenfield projects, foreign-owned firms operating directly or through JVs, providing EPCM or OEM contract services or the acquisition of mining concessions. In terms of greenfield projects, the following table shows that FDI growth has been in sectors such as energy products, mining and metals. Thus, most of these investments are strategic and long-term in nature.

We believe FDI inflows to Africa will continue on their growth trajectory, as investment penetration in the region is still low. Despite growth in 2021, FDI flows into Africa accounted for only 5.2% of global FDI vs 4.1% in 2020. Also, global resources outside of Africa are subject to strict environmental regulations in developed countries or are in regions facing geopolitical conflict, such as Russia or China. We also believe Africa is poised for the next leap of growth and is likely to engage more with investors willing to develop domestic companies related to mining, apart from energy and other key sectors such as information technology and construction.

Russia and China are deeply embedded in Africa, posing challenges for other investors

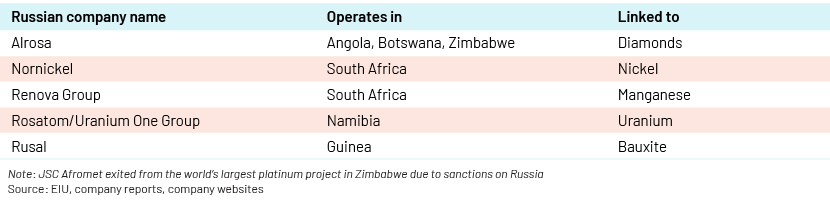

Russia has significant investments in metal and mineral concessions in Africa, mostly in poorly governed states such as Sudan, Guinea, the Central African Republic (CAR) and Mozambique. Russia has been gradually increasing its influence in these countries, mostly by working with local governments. For instance, Russia has agreements with 15 African countries to develop nuclear power and is developing Egypt’s first nuclear plant. Russia also holds major concessions in cobalt, gold, coltan (ore for niobium and tantalum) and diamond mines in the CAR and the DRC. On the corporate front, Russian companies have been spreading their presence across the continent. An illustrative list is provided below:

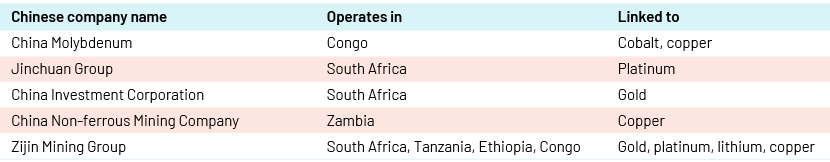

China has not been far behind and has been following a similar strategy in gaining a foothold in Africa. China has also used state-owned enterprises to dominate the minerals space in Africa.

Around 10,000 Chinese firms are present in Africa, according to McKinsey, more than those registered with the commerce ministry in Beijing, and 90% are private. Chinese phone handset firm Transsion has cornered almost half of the Sub-Saharan African market, more than twice the share of Samsung, its nearest competitor. In addition, China’s two main overseas development banks — China Export-Import Bank and China Development Bank — have invested around USD23bn in infrastructure projects in Africa, according to the Center for Global Development, a US think tank. This is USD8bn more than the investments of the other lenders among the top eight combined, including the World Bank, the African Development Bank, and US and European development banks.

Investors from other countries are likely to face challenges in working against these well-entrenched relationships, and it could be difficult in the near term to wean African states away from these incumbent players. However, we believe they should watch for opportunities in sectors such as mining and energy in Africa to benefit from the positive developments.

How Acuity Knowledge Partners can help

Global investment banks and asset managers leverage our research experience to rapidly increase internal analyst bandwidth and expand coverage. We set up dedicated teams of analysts (CAs, MBAs and CFAs) to support our clients on a wide range of activities including idea generation, financial analysis, thematic research, building databases and providing regular sector coverage. Each output is customised, based on the client’s requirement, and made available for their exclusive use. This ensures our clients a unique, sustainable edge, with insights also offered through metals and mining consulting expertise to help navigate investment opportunities in the region

Sources:

-

-

https://www.world-mining-data.info/wmd/downloads/PDF/WMD2022.pdf

-

https://pubs.usgs.gov/myb/vol3/2017-18/myb3-2017-18-africa.pdf

-

https://www.aljazeera.com/news/2018/2/20/mapping-africas-natural-resources

-

https://unctad.org/system/files/non-official-document/WIR2022-Regional_trends_Africa_en.pdf

-

https://unctad.org/system/files/official-document/wir2022-annex_tables_1.pdf

-

https://www.ft.com/content/69651ee4-6855-48eb-af1c-65a4e1f96e78

-

https://openknowledge.worldbank.org/bitstream/handle/10986/16390/9781464801266.pdf

Russia

China

-

https://www.taunggold.com/gold-sa/chinese-investment-in-south-africa

-

https://www.reuters.com/article/us-zambia-mining-idUSKCN1L71P7

-

https://www.reuters.com/article/us-acacia-mining-m-a-chinese-exclusive-idUSKCN1G01UC

-

https://hir.harvard.edu/chinese-investment-in-africa-a-reexamination-of-the-zambian-debt-crisis/

-

https://qz.com/africa/2125769/china-has-invested-23-billion-in-africas-infrastructure#:.

-

https://thediplomat.com/2021/11/the-quiet-china-africa-revolution-chinese-investment/

Tags:

What's your view?

About the Author

Sreenath Kesavan is part of the Investment Research team at Acuity Knowledge Partners. He has spent more than seven years in his current role covering the U.S. steel industry at Acuity Knowledge Partners and currently supports sell-side clients with research assignments including initiation and thematic reports, economic updates, data research and earnings review. He holds an MBA in Finance from ICFAI University, Dehradun.

Like the way we think?

Next time we post something new, we'll send it to your inbox