Published on February 25, 2025 by Priya Vaidyanathan and Nuwan Jayawardana CFA

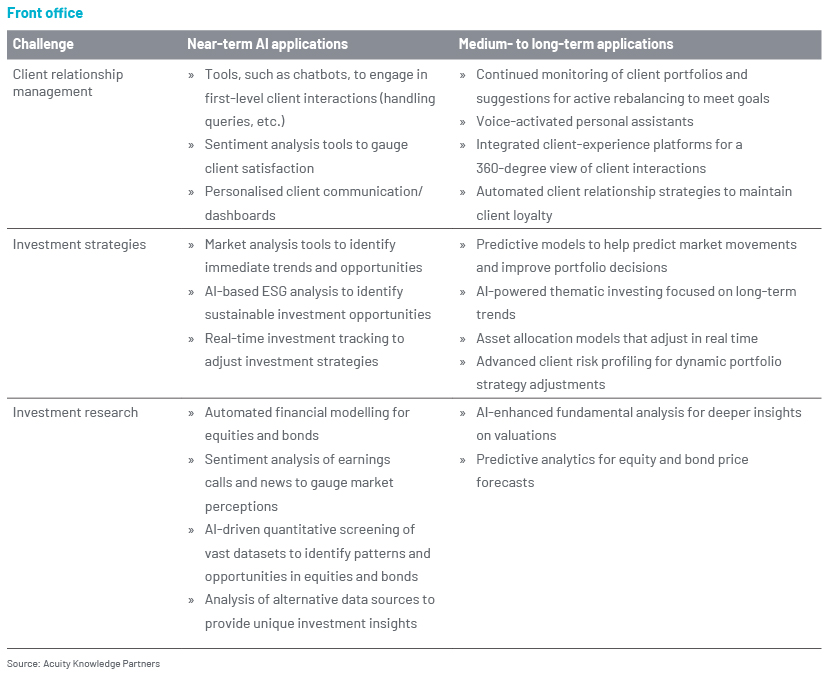

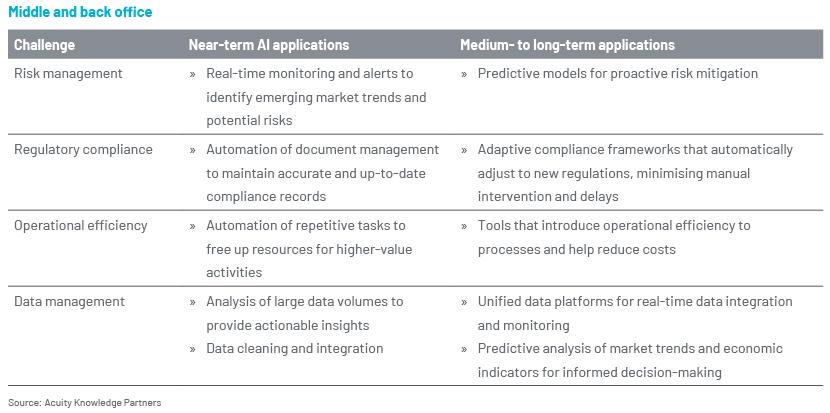

Embarking on an AI journey may enable asset managers to achieve sustained operational efficiency. AI in Asset Management offers tools through automation and improved data management, enhancing decision-making and cutting costs across functions. However, there are potential challenges relating to AI adoption; these are discussed separately in this paper. Below, we analyse the near-, medium- and long-term impacts of AI across asset-manager functions

While AI in Asset Management can address several middle- and back-office challenges, as outlined above, some areas warrant higher attention due to their importance. Risk management and compliance management are two such areas where AI-powered solutions would redefine how asset managers navigate both market and regulatory complexities. By leveraging AI for Asset Management, firms can enhance risk assessment, streamline compliance processes, and improve overall operational efficiency.

Read the full outlook for Asset Management 2025 here.

What's your view?

About the Authors

Priya has over 20 years of experience in equity research and financial auditing. At Acuity Knowledge Partners, she currently manages client relationship and delivery for leading private banks. She has been with the company for over 19 years and has led teams in sell-side and buy-side engagements. She previously worked at Ocwen Financial Services and as an auditor at Deloitte. Priya is a Chartered Accountant and holds a Bachelor of Commerce degree from Bangalore University.

Nuwan provides global leadership to the traditional asset management segment within the Investment Research Buy-side business unit. As a senior leader in Acuity Knowledge Partners’ (Acuity’s) Sri Lanka delivery centre, he provides oversight to the Buy-side research teams, including resource management.

Nuwan also spearheads the Colombo University Outreach programme, bringing Acuity’s global expertise to Sri Lanka’s brightest minds.

His journey started over 20 years ago as Sell-side Equity Analyst covering the mortgage-backed securities sector. After seven years in the domain, he moved to fixed income research to expand Acuity’s credit research franchise in the Sri Lanka delivery centre. Subsequently, he was appointed Head of fixed income, focused on..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox