Published on June 28, 2024 by Tarun Shah

Introduction

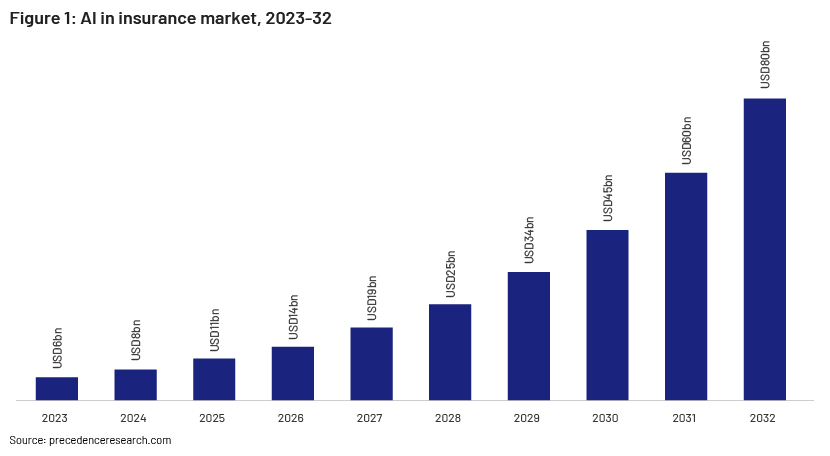

AI refers to computer systems or applications that can execute tasks that historically required human intelligence for voice recognition, decision-making and identifying patterns. AI covers a wide range of technologies including ML, deep learning and natural language processing (NLP). US insurance companies are witnessing a competitive and challenging environment and are exploring options to gain competitive advantage, including integrating ML technology across the insurance value chain. The global “AI in insurance” market was worth USD6.1bn in 2023; this is expected to reach c.USD79.9bn by 2032, growing at a CAGR of c.33.1%.

Snapshot by region

North America held the largest market share (37%) for AI in insurance in 2023; growth is expected to be driven by partnerships and collaborations, the regulatory environment and the presence of large players. However, Asia Pacific is expected to grow at the highest CAGR during the forecast period, driven by increasing demand for insurance products and the launch of initiatives and policies to accelerate the integration of AI across sectors, boosted by government support and funding for AI research and development.

Snapshot by segment

The software segment accounted for 70% of the global AI market in 2022, followed by the services segment for 23% and the hardware segment for 7%.

The global AI market can be classified based on offering, deployment, technology, organisation size, end user and application. By offering, the software segment is expected to account for the largest share, driven by increased automation of fraud-detection processes.

On a deployment basis, the cloud segment is projected to account for the largest market share, as it enables insurers to reliably manage and access data required for AI-powered analytics and decision-making. Based on technology, ML is projected to account for the largest market share, driven by substantial use in applications such as fraud detection and prevention, claims processing and risk assessment. The ML segment accounted for a more-than-45% share of the AI in insurance market in 2023.

By organisation size, the large-enterprise segment is projected to account for the largest market share, driven by the use of AI-powered predictive analytics to collate business insights and the use of AI-powered chat-bots and virtual assistants for enhancing customer engagement. The large-enterprise segment accounted for more than 70% of the AI in insurance market in 2023.

By end user, the life and health insurance segment is projected to account for the largest market share during the forecast period, driven by increasing implementation of AI-powered underwriting models for more precise risk assessments.

By application, the fraud detection and credit analysis segment is projected to account for a significant share of the market. The underwriting and claims assessment segment accounted for a more-than-27% share in 2023.

Investment highlights

In 2023, the global insurance sector invested USD1.4bn in AI-driven predictive analytics solutions, USD950m in AI technologies aimed at improving agent support and productivity, and USD560m in developing AI-enabled insurance data management and governance solutions.

Notable areas where AI is impacting the insurance sector

-

Automating underwriting processes:

By leveraging AI, exhaustive datasets containing historical claims data, customer information and external factors can be analysed, automating and streamlining the underwriting process

-

Enhancing risk assessment and pricing:

Through integrating real-time data and a wide range of variables, AI increases the precision of risk evaluation, enabling insurers to price policies more explicitly based on individual risk profiles

-

Predictive analytics for claims management:

Through analysis of historical claims data and other apposite data items, AI can predict the possibility of claims, identify potential fraud and streamline the claims process

-

Personalised customer experiences:

AI helps insurers offer more personalised and reactive customer experiences. Instant support provided by chat-bots and virtual assistants driven by AI to policyholders includes answering queries, guiding them through the claims process and offering personalised policy recommendations

-

Fraud detection and prevention:

Leveraging AI algorithms can help significantly in detecting potential fraud by identifying unusual patterns, inconsistencies and anomalies in claims data. Using ML to enhance fraud-detection models helps insurers outsmart fraudulent activity and reduce financial loss

-

Operational efficiency and cost savings:

AI can perform repetitive tasks such as document processing and routine administrative tasks more efficiently than manual labour, increasing operational efficiency and cost savings for insurance companies

-

Telematics for usage-based insurance:

Telematic systems powered by AI and ML in insurance enable companies to track and analyse real-time vehicle data, allowing them to calculate personalised premiums based on usage, driving behaviour, and risk patterns.

-

Regulatory compliance and reporting:

AI-powered automated systems can monitor and analyse vast amounts of data to ensure compliance with regulatory requirements. This can reduce the risk of compliance errors and facilitate seamless reporting to regulatory bodies

-

Evolving roles of insurance professionals:

Integration of AI in the insurance space is changing the role of insurance professionals by enhancing the capabilities of underwriters, claims processors and other insurance professionals, enabling them to focus more on complex tasks that need critical thinking and decision-making capabilities

Drivers of AI integration in the insurance sector

-

Increase in data volumes:

The increase in the number of consumer-connected devices such as smartphones and fitness trackers, driven by their rising popularity, has led to vast amounts of data needing to be processed by the insurance sector. Insurers can leverage this data to analyse customer profiles more accurately

-

Strong potential for automation:

McKinsey predicts that c.25% of the insurance sector will be automated by the end of 2025. The sector has several areas yet to be disrupted by automation, including claims management and policy cancellation

-

Open source everywhere:

With the vast amounts of data accumulated in the insurance sector, open-source protocols are becoming a conventional way to ensure the use and sharing of this data. The private and public sectors are collaborating to create reliable platforms over which data can be shared

-

Better response to the pandemic:

The pandemic took a significant toll on the insurance sector. However, those insurers that had integrated intelligent technologies appeared to be better prepared for such an unforeseen event, able to process claims faster and more precisely, despite most of their professionals working from home

Challenges and considerations relating to AI in the insurance sector

-

Inefficient data collection:

ML solutions are driven by data, and the performance of future ML models depends mostly on the data fed to their algorithms. However, in cases where insurers lack ML expertise, the process of data collection can be tedious and a redundant task if the insurers do not know what data to collect

-

Regulatory compliance:

Integrating AI technologies while complying with the composite regulatory structure of the insurance sector can be burdensome, as compliance requirements vary between jurisdictions

-

Expertise and technical competence:

Integrating AI in the insurance sector requires handling enormous amounts of personal data. Ensuring strong data privacy and security measures are in place becomes crucial to building trust with policy-holders

-

Explainability and transparency:

Interpreting AI models, particularly those based on ML algorithms, can be complex and difficult. Ensuring transparency and interpretability of an AI-powered decision process becomes a must for an insurance company

-

Digital mindset and culture:

Integrating ML would not be sufficient if the professionals involved refuse to use it in day-to-day activities. Therefore, building a data-driven corporate culture with clear cooperation between IT and other departments becomes essential for an insurance company

Conclusion

With the continued improvement of AI-powered technologies, insurance companies that incorporate these technologies would gain a competitive edge in this fast-changing landscape. AI is restructuring the insurance sector by helping insurers provide more responsive, data-driven and customer-centric solutions through processes such as automating routine tasks, enhancing customer interaction, faster claims processing and better risk assessment. By analysing past data and patterns, insurance providers could accurately forecast events and potential risks. Although the development and launch of such technologies would require significant investment in management time and resources, it would result in substantial benefits including deeper customer insights and increased profitability and operational efficiency.

How Acuity Knowledge Partners can help

With a talented pool of experts, we serve investment banks focusing on the reinsurance and insurtech sectors, supporting them with in-depth research, analysis, investment decision-making and strategy. Our more than two decades of experience in supporting investment banks and expertise in the insurance sector position us well to partner and support their teams in day-to-day workflow.

References:

-

https://www.precedenceresearch.com/artificial-intelligence-in-insurance-market

-

https://www.linkedin.com/pulse/ai-insurance-market-hit-usd-91-billion-2033-markets-us-xrooc/

-

https://intelliarts.com/blog/applications-of-machine-learning-in-insurance/

-

https://riskandinsurance.com/insurance-industry-increasingly-adopting-ai-technologies-study-shows/

-

https://www.clarity-ventures.com/artificial-intelligence-ecommerce/insurance-ai

-

https://www.marketresearchfuture.com/reports/ai-in-insurance-market-8465

Tags:

What's your view?

About the Author

Tarun is an Associate at Knowledge Partners, having more than three years of experience in Investment Banking team. Currently, part of Financial Institutions Group team, with a focus on Insurance sector supporting a Global Investment Bank. He holds a Post Graduate Diploma in Management in Finance and Analytics from JAGSOM Bangalore.

Like the way we think?

Next time we post something new, we'll send it to your inbox