Published on by Priya Vaidyanathan

The asset management sector faces a series of challenges, including volatile markets, heightened regulatory pressures and rapid technological advancements. Margin pressures and a fiercely competitive environment have forced asset managers to differentiate themselves and generate alpha by moving beyond conventional analysis. Alternative Data in Asset Management plays a crucial role in this shift, enabling firms to leverage insights ahead of competitors and secure a superior return advantage.

With global asset managers constantly pursuing alpha generation to differentiate themselves, generating robust investment strategies becomes crucial. Clients demand quick and actionable insights and constant updates from investment managers. To stay ahead of the game, firms must constantly filter large volumes of data, sift through data reliability and provide portfolio readjustments as necessary. The need for risk management and the complexity of regulatory requirements add to the difficulty in alpha generation. . While firms have significant experience in handling traditional data, asset management firms are pursuing integrating alternative data in asset management into their decision-making process. Initially pioneered by hedge funds, alternative data sources – including social media trends, geospatial information and satellite imagery – are witnessing a spike in demand across the asset management sector. This entails investment in highly skilled investment research teams that could be complemented by data engineering, advanced analytics and machine-learning capabilities.

What is alternative data in investment research?

Alternative data in asset management refers to the non-traditional data sources used by asset managers in addition to the traditional sources such as company filings, market data and industry metrics to help in overall investment research. Tracking market sentiment and trends and analysing customer spending patterns are some ways in which asset managers corroborate their primary research and offer interesting insights.

Data sources typically used for research

| Traditional data | Proprietary data | Alternative data | |

| Sources | Company filings Press releases Market data sources Industry databases | Traditional data + analysis and interpretation by the asset manager Financial models, databases, valuation models | Social media, Geospatial information ESG metrics Satellite imagery |

| Nature | Limited volumes of structured data available at regular intervals | Structured data available for analysis within the firm | Large volumes of unstructured raw data available at high speed |

| Type of resources needed to collect and analyse data | Judgmental data is usually handled by in-house teams Supporting tasks such as financial modelling, data collection and report writing are generally outsourced | Need technology and skilled resources to analyse and interpret the data | |

Use of alternative data in investment research

| Financial modelling using predictive analysis | Company-specific insights |

| Investment idea generation | Trend analysis |

| Market sentiment analysis | Peer analysis and competitive benchmarking |

Challenges in using alternative data

While alternative data in asset management has high potential to augment research, it is associated with challenges such as a lack of standardisation, concerns around reliability, regulatory suitability and speed and volume of raw data. Data cleansing and validation are also key challenges firms face in using this data. Options available to investment research teams in using this data include the following:

| Challenges | Description | In-house solution (More expensive) | Outsourced solution (Cost effective) |

| Data integration, data quality and reliability | Assessing the accuracy and reliability of data sources is important, as data is usually obtained through unstructured formats and sources. Data integration with existing legacy systems requires advanced data-management solutions | Investing in advanced data-management solutions and skilled resources to collect and analyse the data would ensure usability of the data | Leveraging specialised providers, without significant investment in in-house solutions |

| Talent acquisition | The lack of skilled staff with domain knowledge and a data science and analytics skillset | Recruiting resources with relevant skillsets and upskilling existing resources Retention through attractive compensation packages | No hassle relating to talent management, training and retention Quick scalability Low cost Access to a specialised skillset |

| Regulatory requirements | Ensuring data is compliant with the evolving regulatory landscape | Investing in a strong legal team and a compliance framework that focuses on regular training, audits and processes/reporting | Time freed up for in-house teams to focus on high-end tasks and career progression Cost-effective access to specialised resources and domain expertise |

| Technology | Large volume of unstructured data requires competent technological infrastructure and supporting teams | Investments in technological infrastructure and a specialised skillset | Cost-effective access to domain specialists and technology experts |

How Acuity Knowledge Partners can help

While most asset managers have invested in a specialised data sciences team, retaining a scalable team is time-consuming and expensive. We offer bespoke solutions, based on a client’s nature of research, type of data and depth of data management and analysis required. Alternative Data in Asset Management is increasingly being integrated into investment strategies, and our solutions help firms effectively leverage this data for deeper insights. We provide a comprehensive research solution, complete with a team of domain specialists across asset classes (equities, credit research, ESG research and private market research), data analysts and technology experts. Our team of highly qualified and experienced analysts work as an extension of a client team. We have one of the largest pools of research analysts with professional degrees in finance (such as CFA and CPA), supported by our Training and Knowledge Management team and a CFA Institute-accredited equity research training programme.

Our ability to work across the value chain of investment research provides a risk-free and cost-effective solution that enables asset managers to offer differentiated research/investment ideas. We also provide the ability to ramp up or down, based on requirements, and our multiple delivery locations offer support across time zones.

Case Study: Bulge-bracket IBs: acquiring scalable alternative data sets to enhance equity research

Client sponsor: HoR, US and EMEA

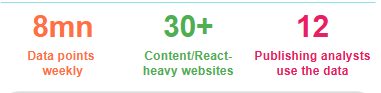

Client need: One of the pioneers to use alternative data for investment research, the bank wanted to add additional bandwidth to ramp up the data acquisition effort and creation of an in-house data lake. Acuity has a team of 7 equity researchers and 2 ML engineers dedicated for the bank

Targeted key performance indicators for 12 sectors

On a consumer stock, Acuity created a data product for 60,000 data points across 1,600 points of sale. Based on this unique operational insights, the analyst initiated a contrarian long view vs. the consensus

Tech Used :

Europe-Headquartered Bulge Bracket IB

Client sponsor: Head of Primary Research

Client need: Post MiFID II, the bank started leveraging a third-party platform to source alternative data. The platform had limitations on scaling up especially for complex websites. The bank deployed a Acuity team of 5 ML engineers and 1 Data Scientist to build a proprietary platform

Unique insights across 18 sectors by sourcing 20mn alternative data points

| Retail | Utilities |

| Auto | Healthcare |

| Consumer | Technology |

| Banking | Gaming |

Tech Used:

What's your view?

About the Author

Priya has over 20 years of experience in equity research and financial auditing. At Acuity Knowledge Partners, she currently manages client relationship and delivery for leading private banks. She has been with the company for over 19 years and has led teams in sell-side and buy-side engagements. She previously worked at Ocwen Financial Services and as an auditor at Deloitte. Priya is a Chartered Accountant and holds a Bachelor of Commerce degree from Bangalore University.

Like the way we think?

Next time we post something new, we'll send it to your inbox