Published on November 8, 2021 by

After the great financial crisis in 2008, traditional banks adopted strict lending standards following increased regulatory scrutiny and implementation of the BASEL III framework to make banks more resilient. In the light of the changing landscape and operating environment, banks are re-assessing and adjusting their business model and strategies, making it somewhat difficult for small and medium-sized businesses (SMBs) to secure loans from banks and financial institutions. Eventually, SMBs started looking at alternative lenders that can meet their needs. This created an opportunity for non-banks and alternative lenders to grow their market share among SMBs by offering speedier and more accessible loan processing via online platforms.

https://www.statista.com/outlook/dmo/fintech/alternativWhat is alternative business lending?

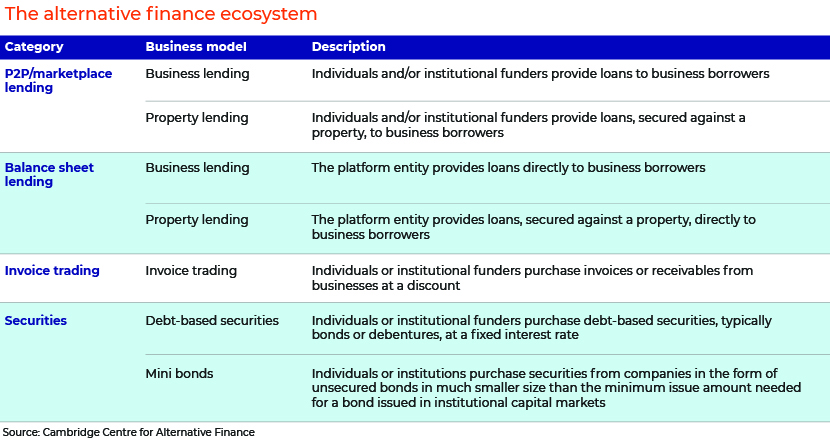

Alternative lending encompasses business loans secured from non-traditional banking institutions. Such lenders are private firms that leverage the online route to offer a suite of financing products, such as, business lines of credit, equipment financing, invoice financing and term loans.

Growth of alternative business lending

The chief reason alternate lenders are flourishing is the challenges SMBs often faced while seeking finance from traditional lending institutions. The two most important catalysts are:

-

Unmet financing need: As per International Finance Corporation, c.65m firms, or c.40% of the micro, small and medium-sized enterprises (MSMEs), have unmet financing need valued at c.USD5.2tn, making up 59% of MSMEs’ total loan requirement.

-

Technology – the biggest differentiator: We all know how fintechs have redefined the way transactions are carried out in the financial services space. Alternative lenders leverage technology to provide more efficient lending solutions, using a blend of intelligent credit scoring algorithms, artificial intelligence and machine learning to collect and analyse data to ascertain a borrower’s creditworthiness at a much faster clip.

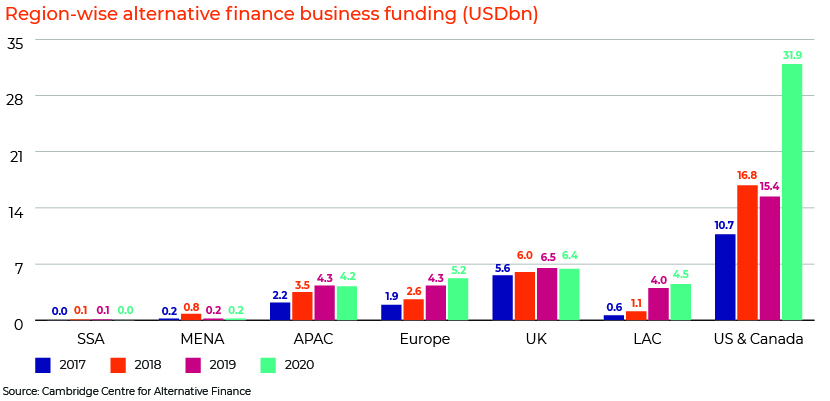

Over the last decade, the unmet demand of SMBs was fulfilled by alternate lenders through digital services. In 2020, the US (USD31.7bn) was the largest market, followed by the UK (USD6.4bn) and Europe (USD5.2bn).

SSA – Sub-Saharan Africa, MENA – the Middle East and North Africa, APAC – Asia-Pacific, LAC – Latin America and the Caribbean

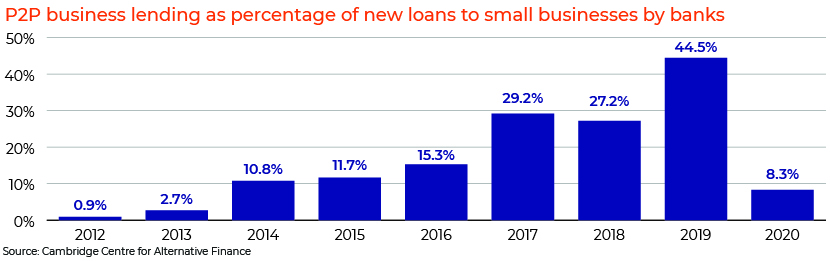

In the UK, peer-to-peer (P2P) business lending as a percentage of new loans to small businesses reached its zenith in 2019, at c.44.5%, before reaching 8.3% in 2020, adversely impacted by the COVID-19 outbreak.

Market size

Alternative lending started in 2006, when Zopa – a UK-based lender – introduced the concept of P2P lending to the world. Zopa was followed by US-based LendingClub and Prosper Marketplace in the same year

The alternative lending market (estimated at USD318.4bn in 2021) is projected to grow at a CAGR of 4.4% over 2021-2025 to USD378.8bn.

Conclusion

Although alternative lending may hold a minute share in the overall lending market, its proportion in SMB lending is growing at a much faster pace. To compete with these new-age lenders, traditional banks are revisiting their business models and embracing collaborative strategies to meet the demands of the modern-day business. Some banks have already begun to ally with alternative lenders, using underwriting technology to quickly approve and fund their loans or partnering with outsourced providers, such as Acuity Knowledge Partners, to develop technology-agnostic solutions to launch their products.

How Acuity Knowledge Partners can help

Our commercial lending solutions unite institutionalised knowledge of credit experts and intelligent automation capabilities to help banks centralise, optimise and standardise their lending function.

Sources/References

https://saratogainvestmentcorp.com/articles/alternative-lending/

https://www.businessinsider.com/smb-lending-report?IR=T

https://lendfoundry.com/alternative-lending-and-the-regulatory-environment/

https://www.worldbank.org/en/topic/smefinance

Cambridge Centre for Alternative Finance: The 2nd Global Alternative Finance Market Benchmarking Report

Tags:

What's your view?

Like the way we think?

Next time we post something new, we'll send it to your inbox