Published on September 16, 2020 by Harsh Gupta and Akanksha Sah

Why PIPE?

The global lockdowns have slowed economic activity. Most companies would need funding to both restart their businesses and keep them going. Gaining access to funding via debt or equity without much scrutiny is easy when markets are stable and everything is functioning smoothly. However, in difficult situations such as the one we are facing now, PIPE transactions are more suitable, as traditional sources of financing dry up in such circumstances. They are also a faster and bespoke source of financing.

PIPE transactions increased during the previous financial crisis. Companies raised more than USD120bn in 2008 (about an 86% increase over 2007).

Let us first understand what a PIPE transaction is. A traditional private investment in public equity (PIPE) transaction is a private sale of a publicly listed entity through a placement agent to selected private investors. This usually consists of primary issuance of shares (meaning direct issuance by a company); it may also be in the form of a secondary offering (a resale by the company’s current investor). Common shares are generally issued in such an offering, but it may also include an offering of warrants, convertible debt or preference shares.

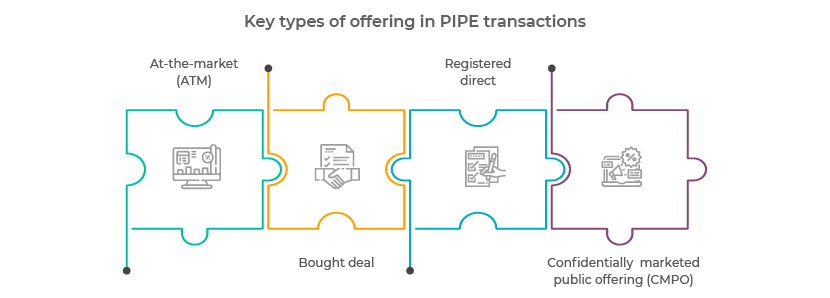

At-the-market (ATM): This is where a company sells its securities to an existing market at prevailing market prices in multiple transactions

-

This benefits companies with no immediate requirement for funding but that may require it at later stages (for example, a pharma company could use an ATM programme at a product development/marketing stage).

Bought deal: A securities offering where an investment bank offers to buy all the securities offered.

-

This eliminates financing risk for the issuing company, ensuring that it will raise the intended amount, although at a lower price.

Registered direct: This is a public offering of securities (registered with the SEC) to a targeted group of investors with the assistance of a placement agent. The shares in an RD offering are not restricted securities and may be resold by the investor without registration.

Confidentially marketed public offering (CMPO): This is a combination of an RD and a follow-on. Such offerings are marketed confidentially to institutional investors. Once deal terms are finalised, the deal is announced after close of market, and the public selling process is concluded before market open the following morning.

-

It minimises reaction in the share price, as it is marketed confidentially and is priced on an overnight basis.

-

In the event the offering is aborted, there is no impact on the price, as placement agents first get a sense of the market and investors before disclosing the company name.

Issuance in US PIPE and private placement markets

This time, the market slid quickly and deeply and did not give time for companies to raise funds at prices close to the levels at which they were trading during the last year. However, the current prices look attractive, and we see a very active PIPE market.

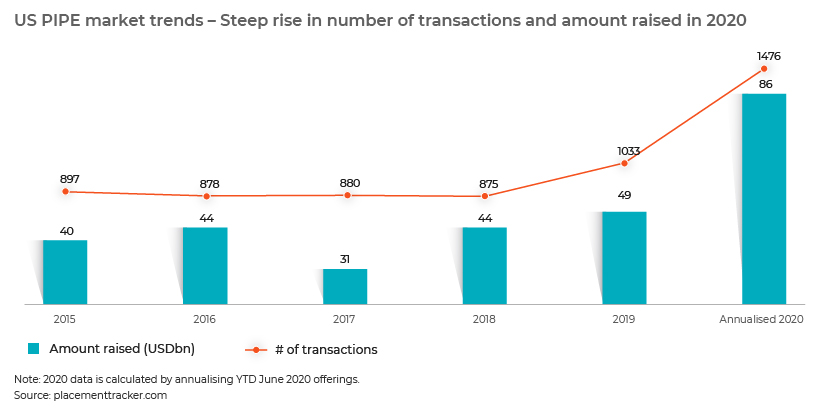

The number of PIPE transactions was stable in the past five years, and PIPE proceeds averaged more than USD42bn a year. Based on data for the year to June 2020, we think 2020 will very likely see a significant jump in PIPE deals to help companies weather the COVID-19 crisis.

The PIPE structure makes the transaction process quick and able to be effected without public disclosure. This shields a company from public scrutiny as well. It saves time and cost of disclosure, and helps the company understand market conditions.

PIPE transactions can give a company access to a substantial amount of cash and that too without offering a large discount, making it beneficial for both the issuer and the investor. According to a Harvard Law Review Forum on Governance, based on a comprehensive sample of 3,001 common stock PIPE transactions by US firms listed on the NYSE or Nasdaq from 2001 to 2015, median investment size was USD10m, equal to 9.1% of the issuer’s market capitalisation. In 80.9% of the transactions, the company issues unregistered equity, meaning that investors cannot sell their positions until the issuing firm registers the equity, on average, 100 days after the closing date of the offering. PIPE investors purchase shares at an average discount of 6.3% to the market price.

PIPE transactions have attracted interest of investors such as private equity firms, mutual funds and corporates. The placement agent plays an important role in matching the right investor to the firm. To this end, the agent maintains a database of investors, including investment criteria of the different investor types.

Regulations

There are restrictions relating to the issuance of shares in PIPE deals, but there has been discussion on relaxing some of these rules in the wake of the current crisis

The NYSE on 6 April 2020 filed an immediately effective rule change with the SEC that waived the application of certain shareholder approval requirements for new equity issuances through 30 June 2020. This was subsequently extended to 30 September 2020. The relief is intended to provide NYSE-listed companies with the flexibility to raise capital quickly during the COVID-19 crisis.

Conclusion

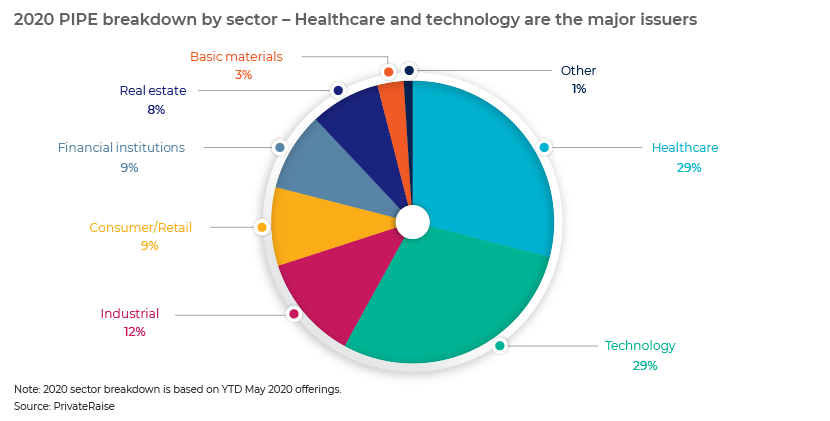

Many companies are already working with investment banks on PIPE transactions to improve liquidity in the current scenario. A number of sectors are exploring this option, as evidenced by the spike in the number of PIPE transactions executed this year

Acuity Knowledge Partners has expertise in supporting clients on alternate financing deals, including PIPE offerings. Our team of experts supports clients with funding requirement analysis, due diligence, investor database processes, past-offering analysis, pitchbook compilation, industry research, league tables, competitor analysis, pricing analysis and other deal-related work

For our other equity capital market (ECM offerings), please visit our ECM Solutions page

References

https://www.pillsburylaw.com/en/news-and-insights/pipes-current-market-considerations.html

https://corpgov.law.harvard.edu/

https://www.jdsupra.com/legalnews/update-on-the-market-for-pipe-73083/

https://media2.mofo.com/documents/faqatthemarketofferings.pdf

Tags:

What's your view?

About the Authors

Harsh has been with Acuity since 2006 and has experience working with investment bankers across the globe with various sector coverage teams like Fintech, Banks, Industrials, Chemicals, Cleantech, Healthcare as well as Equity Capital Markets teams. He has an extensive experience of supporting bankers on Financial models (LBO, DCF, acc/dil, etc), valuations, PIPE offering, SPAC Research, Capital Market products, industry overviews, and idea/peer/target identification. Harsh is a qualified Chartered Accountant and a Bachelor of Commerce.

Akanksha has around 4 years of work experience in Acuity investment banking analytics teams. In her current role, she supports on all types of alternative funding structures analysis to the leading investment bank in PIPE and RD transaction markets. Prior to this, she provided support in various Investment Banking tasks which involved valuation, peer analysis / company screening, company and industry research, case studies, benchmarking among others with focus towards the healthcare sector. She holds a Post Graduate Diploma in Management with specialization in Finance and a Bachelor of Commerce degree.

Like the way we think?

Next time we post something new, we'll send it to your inbox