Published on December 4, 2024 by Livingston Samraj

Introduction

Investment banks have been witnessing a digital transformation recently and are now increasingly interested in integrating and leveraging the power of artificial intelligence (AI) in their operations. They have used AI primarily to enhance customer interactions and automate data-related tasks over the past two decades.

What Is AI?

AI refers to technology for computers and machines to imitate the human mind and analytical tasks. AI's primary quality is its capacity to rationalize and take actions that have the best chance of achieving a specific objective.

Market opportunity

AI could enhance front-office productivity by 27-35%, according to Deloitte research, potentially generating an additional USD3.5m in revenue per front-office employee by 2026. In addition to improved efficiency and cost savings, the AI adoption supports talent retention and increases employee engagement.

With AI being the latest wave of digital transformation, investment banks expect to reap substantial benefits. Integrating AI into investment banking operations would impact areas such as deal-making, research and due diligence positively.

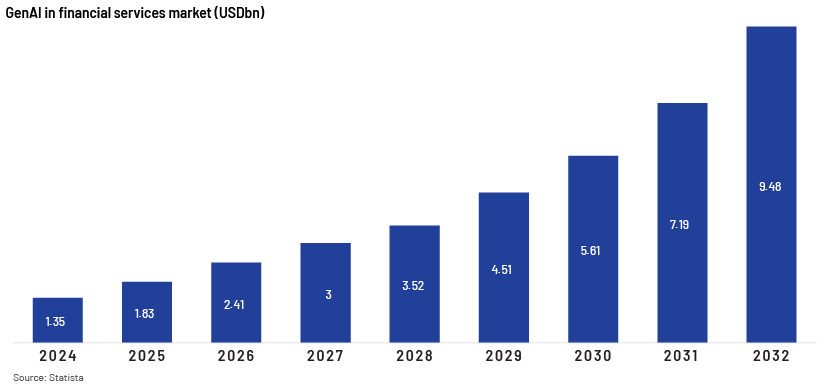

The global generative AI (GenAI) in financial services market is estimated at USD1.35bn in 2024 and is projected to reach USD9.48bn by 2032, growing at a CAGR of 27.58%, according to Statista.

AI could also improve the following areas of decision-making:

-

Sales and marketing: AI would help in areas such as customer service, personalised offerings, relationship management and budget allocation.

-

Human resources: AI could help HR managers monitor employee wellbeing, productivity, hiring, employee retention and career development.

-

Risk management and fraud prevention: AI can analyse large volumes of data to detect patterns to provide decision-makers with effective insights on time.

-

Automated and algorithmic trading: Most investment bankers use AI algorithms that analyse large amounts of financial data and identify patterns for automatic trade execution.

-

Portfolio management and asset allocation: AI enables personalised portfolio recommendation as it processes and analyses historical data, investor preferences and market conditions.

-

Target identification and valuation: AI tools can analyse large datasets to help choose prospective targets.

-

Predictive modelling: AI techniques can assist in the valuation process by analysing historical financial data, macroeconomic factors and market trends and providing useful insights.

AI can simplify the following daily routine tasks of corporate and investment banks:

-

Prepare account plans and proposals semi-automatically by leveraging the latest data and publicly available information.

-

Provide a 24x7 “virtual SME” bot trained on proprietary know-how client data, live news feeds and/or the latest publicly available information to answer spot questions.

-

Suggest client-specific actions (e.g., next-to-buy) to the front line by mining the latest corporate initiatives with a corporate action monitor.

-

Shape preliminary responses to steer live client calls based on product offering, previous Q&A, policies and past client logs.

-

Automate client call assessment and summarisation into actionable commercial next steps.

-

Create quick email drafts in response to client queries and reminders of action points.

Recent developments in the use of AI by major investment banks

-

JPMorgan – Introduced a product named IndexGPT in May 2024 that prepares regular, criteria-driven trading plans absorbed into indices for institutional clients.

-

Morgan Stanley – Launched AI @ Morgan Stanley Assistant last year. This is a chatbot that assists financial advisors to access databases of 100,000 research reports and documents. The investment bank is also developing a technology that will summarise meetings, compile draft emails and schedule appointments, according to Reuters.

-

Wells Fargo – Its virtual assistance app, powered by Google Cloud AI, can engage in close to 100m interactions per year. The investment bank also joined Stanford University’s Financial Services and AI Corporate Affiliate Program, and 4,000 employees were trained via a series of webinars.

-

Deutsche Bank – It has a multi-year partnership with NVIDIA, and the technology deployed through this partnership will enable traders to manage risk, promote efficiency, strengthen customer support.

-

Goldman Sachs – Ongoing projects include English-language command codes and technology that generates documentation in line with updates by Applied Innovation Co-Head George Lee.

Risks and challenges associated with AI in investment banking:

-

Bias and model explainability: At times, it is difficult to understand AI-modelled decisions. AI models could generate results based on biases, leading to discrimination.

-

Unreliability of trading applications: AI-based suggestions could be unreliable amid unforeseen events such as market volatility, natural disasters and war.

-

Regulatory compliance: There is significant risk is involved if AI systems fail to meet regulatory standards (e.g., anti-money-laundering laws, data-protection laws).

-

Human oversight: Despite the benefits of adopting AI, human intervention is still needed to interpret AI-generated data and provide contextual understanding. In addition, skilled professionals are required to maintain and monitor AI-based models.

-

Continued learning and adaptation: A company could fall behind if it does not keep pace with rapidly evolving AI technologies.

-

Risk management: Firms must implement strong governance frameworks to oversee AI application development and deployment. Continued testing and monitoring are essential for managing risks effectively.

-

Investor trust and confidence: There is risk of reputational damage if AI systems lead to adverse outcomes or ethical breaches.

Conclusion

The integration of AI ML in banking presents a transformative opportunity. AI can significantly increase the efficiency and accuracy of decision-making processes. However, it is crucial to address the challenges and risks to ensure responsible and effective implementation. AI technologies often struggle with explainability and can perpetuate biases if not properly managed. Adhering to regulatory compliance and establishing legal responsibility frameworks are essential. Continuous human oversight is also necessary to provide contextual understanding and ensure that AI systems operate within acceptable boundaries.

Despite these challenges, the potential benefits of AI in investment banking are substantial. The era of AI presents a significant opportunity for investment banks to outsource their operations, leveraging specialised AI technologies and expertise of third-party providers. This could lead to cost savings, access to cutting-edge innovations and effective operations.

How Acuity Knowledge Partners can help

We are a trusted global offshoring partner to the financial services sector. We take great pride in being the world’s leading provider of bespoke research, analytics and technology solutions to the financial services sector for more than two decades. Our 6,000+ full-time employees currently assist more than 600 clients globally. Our Data and Technology Solutions team offers defined automation processes for investment banks, advisories and private equity firms. The team’s expertise ranges from digital engineering services to data engineering, data science and AI and enterprise platform services. The team also plays an instrumental role in guiding and supporting our clients towards effective implementation of emerging technologies in their financial operations.

Sources:

-

https://www.alpha-sense.com/blog/trends/generative-ai-in-investment-banking/

-

https://www.mckinsey.com/industries/financial-services/our-insights/been-there-doing-that

-

https://www2.deloitte.com/us/en/insights/industry/financial-services/financial-services-.html

-

https://www.forbes.com/sites/jackkelly/2024/04/23/how-ai-is-growing-fast-on-wall-street/

-

https://www.finalis.com/blog/ai-in-investment-banking-trends-and-risks

-

https://www.reuters.com/technology/morgan-stanley-launch-ai-chatbot-woo-wealthy-2023-09-07/

-

https://hai.stanford.edu/news/wells-fargo-joins-stanford-hai-corporate-affiliate-program

-

https://www.globalmarketestimates.com/market-report/ai-in-investment-banking-market-4558

-

https://www.statista.com/statistics/1449285/global-generative-ai-in-financial-services-market-size/

Tags:

What's your view?

About the Author

Livingston Samraj is a Delivery Lead at Acuity Knowledge Partners’ Investment Banking division. He brings over 13 years of work experience as a researcher. He is currently part of the research team for a US-based mid-size investment bank, providing support on library services and complex data requirements across sectors. He also plays an active role in training and mentoring team members. He holds a master’s degree in Business Administration (Finance and International Business) from Karunya University, India.

Like the way we think?

Next time we post something new, we'll send it to your inbox