Published on October 4, 2024 by Bikramjeet Singh Sokhi

What is asset-backed finance?

Asset-backed finance (ABF) refers to the pooling of private income-generating assets, which forms an asset pool. It covers transactions that involve asset sales, financing and due diligence by investment managers. This form of private credit refers to a specific pool of assets divided by segments with unique characteristics.

ABF segments

ABF provides financing for a variety of purposes and, thus, touches all of us in multiple ways. One way of looking at ABF segmenting is by adding residential and commercial real estate financing to speciality financing, enabling the classification of speciality finance as part of ABF.

-

Consumer finance including financing for automobiles, credit cards and consumer loans

-

Hard assets including infrastructure, equipment, finance for receivables and against inventory

-

Real estate assets including loans against commercial real estate and residential mortgage loans

-

Financial assets including royalties, rights and trade finance

Asset-based lending vs ABF

Asset-based lending (ABL) and ABF are often used interchangeably in the sector, but they denote different subsets, and the differences are important.

ABL involves a loan or line of credit extended to a company. This “lending” is backed by the company’s assets, such as inventory, in the case of a manufacturing company. Such lending improves liquidity and cashflow.

ABF, on the other hand, has a much broader scope, encompassing not just ABL but also other asset-based lending private credit arrangements, including leasing, invoice factoring, and specialty financing. For example, in equipment finance, unlike with ABL where business assets are used as collateral, in ABF, the asset to be financed is itself kept as collateral.

Market size

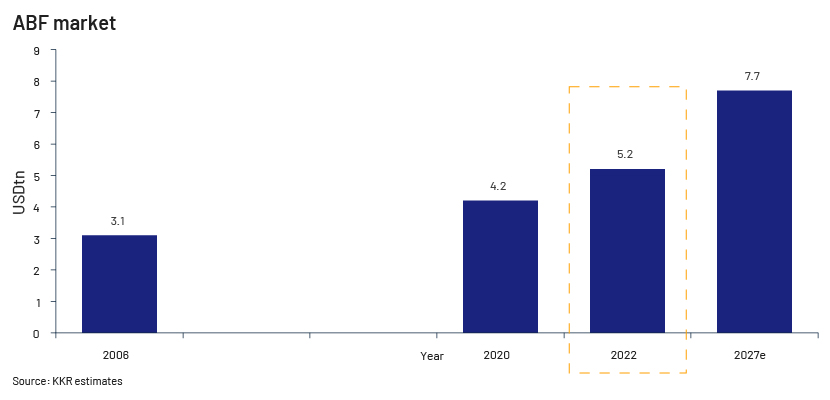

The asset backed finance (ABF) market was worth around USD5.2tn in 2022 (see figure below) and is estimated to grow to USD7.7tn at end-2027, according to a KKR report.

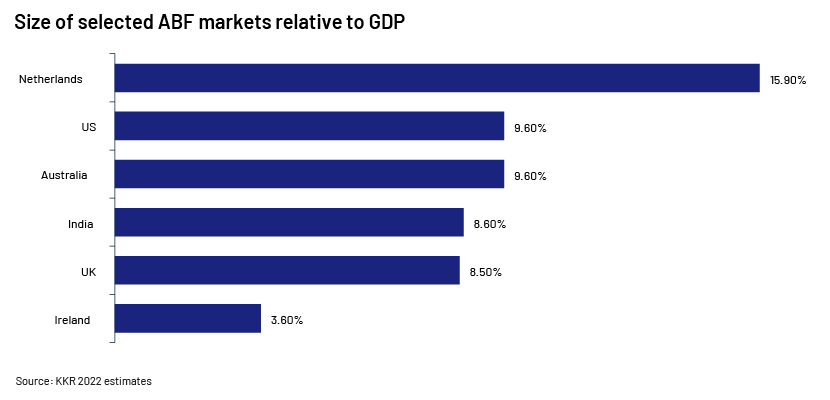

Geographically, North America dominates, with a 57% share, followed by Asia Pacific and Europe. The US home market is the largest sector, consisting of fixed-rate mortgages.

Apart from the US, other major countries where the ABF market has grown are the Netherlands, the UK and Australia. In Asia, India is a prominent ABF market, particularly when considered as a percentage of GDP.

The shaping of the ABF market

The key factor shaping today’s ABF market is the disintermediation of traditional channels of finance.

The traditional banking sector has been facing strong headwinds in the form of increased regulatory requirements. As a result, banks have taken a cautionary approach, leading to large numbers of creditworthy consumers and commercial borrowers. The number of commercial banks, bank branches, credit unions and community banks in the US has shrunk since the global financial crisis in 2008.

On the other hand, the number of non-banking financial institutions backed by financial technology applications has grown significantly, with large numbers of consumers being serviced.

The sharp rise in interest rates resulted in a drop in bank-based leveraged loan funding and an increase in non-bank funding lender (private credit)-based funding to 86% in 2023 from 61% in 2019, according to a report by Oliver Wyman quoting Pitchbook LCD.

All these factors – demand for business credit, growth of financial technology and constrained bank lending – do not indicate a change course, suggesting strongly that the market is set for growth even as the direct lending sector, as part of private credit, continues to stagnate.

Opportunities in private ABF due to asset-backed securities

ABF consists of asset-backed securities (ABS), which are public fixed income in nature and private ABF. An ABS can be defined as a pool of loans tranched into a number of securities that are sold off to investors and traded in the market. Private ABF, on the other hand, is a customised, privately placed instrument, negotiated between the investment manager and investor.

Key similarities:

-

Both involve a pool of assets with contractual cashflow such as lease loans receivable or real estate, auto or equipment loans

-

Both are non-recourse in nature, meaning the source of repayment is only the pooled assets and not the issuer

-

Lenders are given priority over the pool of assets before other corporate lenders

-

Credit terms include a payment waterfall, performance triggers and termination events

-

The notes may be rated

-

The assets are serviced by the originator and/or a third party

However, there are critical differences between approaches to private ABF and traded ABS investment. These may be broadly classified as follows:

-

Private ABF consists of a revolving pool versus a static pool of assets when it comes to traded ABS

-

Private ABF is usually held until maturity whereas ABS bonds are fairly liquid

-

Private ABF is usually a bilateral transaction whereas ABS bonds are placed through a third party and are widely distributed and traded

-

Private ABF is customised, with no fixed documentation, and can be in the form of a loan, credit-linked loan (CLN) or security whereas ABS bonds are traded securities identified by ISIN/CUSIPs and have a more or less standardised structure

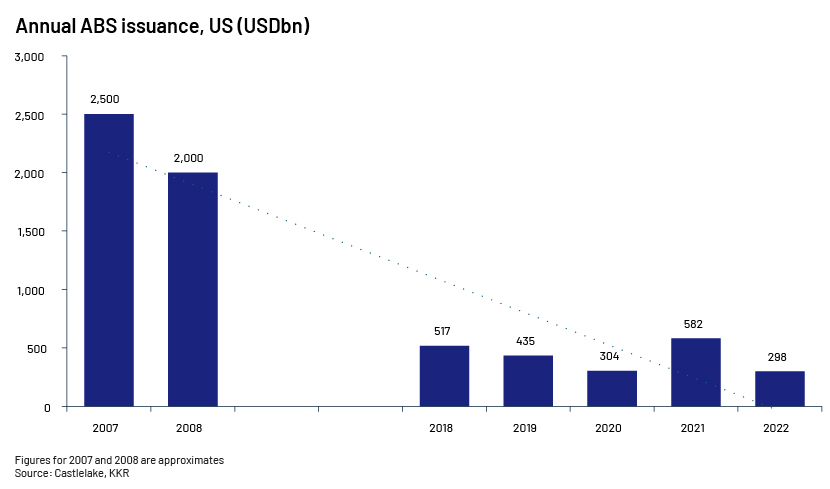

The bespoke market of private ABF transactions has been an offshoot of contracted ABS issuance after 2008, especially over the past five years (note issuance levels over the past five to six years versus those before the global financial crisis). Although the two classes are different, this connection between them indicates how the securitisation market is an important source of financing for the same assets.

Although originators may continue to rely on the securitisation market to some degree, private ABF will become an important alternative for borrowers, according to Castlelake (2022).

The opportunity for private and bespoke ABF transactions is best captured by having direct access to the originator, reviewing their investment priorities and understanding their financial position. This would enable an investor to assess loan-/credit-level risk at a level not accessible in a traded ABS strategy, making private ABF a strong alternative for bespoke asset backed investments.

Key trends in ABF

Consumer finance and real economy spending in the US in particular would continue to drive the move towards seeking support from the non-bank sector as banks continue to face regulatory and structural headwinds. Consequently, as more asset financing shifts to private markets, originators would continue to seek bespoke solutions, and lenders would continue to offer such solutions. From a lender’s point of view, they would be able to better position themselves in the capital structure to take advantage of risk-reward exposure.

A report by Oliver Wyman observes that private credit has moved on from bypassing banks to originate assets directly to partnering with banks, where banks use an originate-to-distribute model to streamline their balance sheets. Private credit funds, on the other hand, get access to established bank origination platforms for these specialised assets.

The report further notes a number of partnerships announced between banks and private credit firms. Of interest to us is the growing number of partnerships focused on ABL. Since the private credit market is more developed in North America, major banks in this reqion are actively involved in such partnerships.

It would not be surprising if the trend becomes popular, with regional and mid-size banks using this model to monetise their relationships with private credit funds.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners offer structured credit support as part of private markets support across asset classes. We are uniquely positioned to leverage our experience in public ABS products and services in private ABS. Having worked directly with lenders, we have unique experience in shaping bespoke deals due to the visibility on the publicly traded ABS sector. Deploying our teams with traded ABS experience for support with private ABF is a ready way to seize opportunities in the evolving private ABF landscape.

Our structured credit expertise spans the buy side and the sell side. We work as a strategic partner and solution provider, offering end-to-end support, from origination support and loan-level underwriting to deal surveillance and cashflow modelling.

We have more than two decades of experience in offering support to global clients working in the private markets space. We work as pure extensions of their onshore teams, providing end-to-end support across the investment cycle.

References:

-

Asset-Based Lending Commitments Grew in 2023 with Fewer New Clients, Larger Deals – Monitordaily

-

The Tailwinds Behind Asset-based Finance – Goldman Sachs Asset Management (gs.com)

-

Beyond Corporate Credit: Exploring Asset-Based Finance for 2024 | KKR

-

Oliver Wyman_Private-Credits-Next-Act.pdf

-

Asset-Based Finance: Private Credit’s Key Diversifier | AB (alliancebernstein.com)

-

The Difference Between Asset-based Lending (ABL) and Asset-based Financing (ABF) | eCapital

-

Asset-based finance cast as next act for evolving private credit market – PitchBook

-

asset-based-finance-a-fast-growing-frontier-in-private-credit.pdf

-

*Apollo-Global-Asset-Backed-Finance-White-Paper.pdf

-

SFA-Research-Feature_Harnessing-the-Potential-in-Private-Asset-Based-Finance-1.pdf

-

*Castlelake_Asset-Based-Private-Credit-Whitepaper_April-2024.pdf

-

Bloomberg_Rob-Camacho-BX-Says-Private-Credit-Coming-For-Asset-Based-Debt.pdf

What's your view?

About the Author

Bikramjeet is part of private markets team. He has fifteen plus years of work experience in various organizations and in different roles. He has worked in Commercial real estate, structured finance/Securitization and capital markets, including roles in CMBS ratings, real estate valuations and credit analysis. Academic background includes a MBA from the University of Sheffield (U.K), and a Masters in Sociology from Annamalai University.

Like the way we think?

Next time we post something new, we'll send it to your inbox