Published on February 18, 2025 by Anurag Sikder

Asset managers (AMs) are operating in a rapidly evolving financial landscape marked by compressing fees, escalating regulatory requirements, accelerated time-to-market demands and the increasing need to adopt AI. The range of investment products available to investors is also undergoing unprecedented diversification. The asset management sector is poised to grow by 5.9% annually by 2028, driven largely by alternatives, which are expected to grow by 6.7% annually. Within alternatives, tokenisation (the process of using blockchain technology to convert an asset or ownership rights of an asset to digital form) is attracting a significant amount of interest, and tokenised products are expected to grow by 51% annually by 2028.

These tectonic shifts underscore the critical importance of quality and precision in enhancing investor relations, particularly as the sector continues its transition from active to passive products, with retail growth outpacing institutional expansion.

Adapting to diverse markets and complex regulatory environments poses significant challenges. To address these, AMs are assembling teams as varied as the issues they confront and embracing third-party technologies to drive innovation. Strategic mergers and acquisitions, combined with a focus on cultivating adaptable skills, have become central to maintaining competitiveness. Additionally, integrating AI and environmental, social and governance (ESG) principles is no longer optional but a necessity in this new paradigm. This transformation signals a shift towards a tech-enabled, globally collaborative model of asset management.

Firms that successfully navigate this dynamic environment by leveraging holistic strategies and fostering innovation are poised to unlock substantial opportunities while reshaping the future of the sector.

Staying ahead of the curve: AMs' strategies for embracing change

Confronted with complex challenges, AMs are tactically adopting diverse yet effective solutions such as the following:

1. Harnessing global capability centres for operational excellence

Global capability centres (GCCs) are a strategic linchpin for AMs aiming to cut costs and boost operational agility. The pandemic spurred the growth of GCCs, granting access to global talent, particularly from cost-effective, skill-rich emerging markets.

Establishing GCCs involves significant upfront cost due to the infrastructure investment required. However, these expenses can be recovered over time, making it advantageous for large AMs seeking to employ a minimum of 150 employees. Additionally, some AMs are partnering with third-party service providers despite establishing GCCs, to access specialised skills such as in RFPs, investment commentaries and consultant database updates.

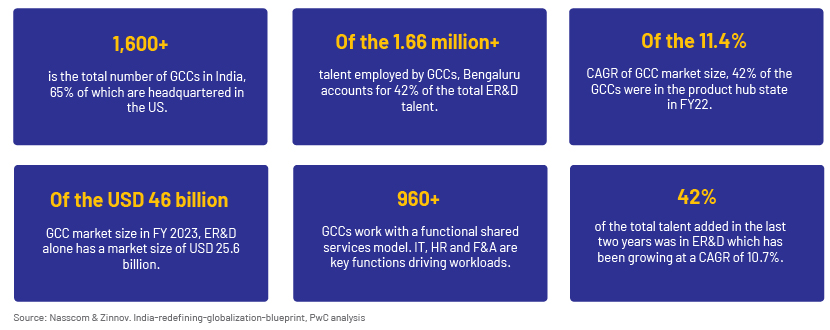

India's GCCs have seen remarkable expansion, according to a report by PwC, with the number of centres surpassing 1,600 in 2024. India's vast talent pool is a cornerstone of the global outsourcing sector, and this is particularly evident in the asset management sector. AMs worldwide are tapping into India's rich reservoir of skilled professionals to stay competitive and agile in a rapidly evolving market.

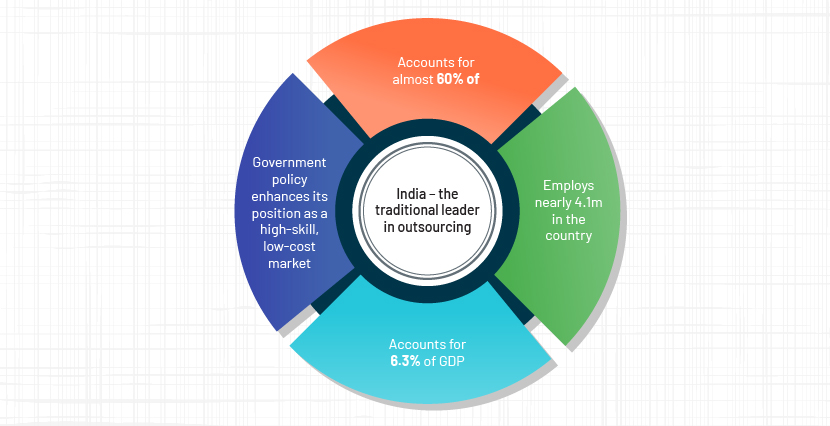

2. Increasing third-party staff augmentation in asset management

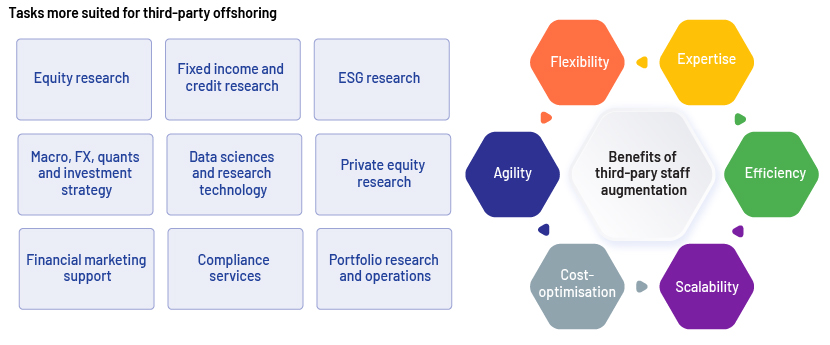

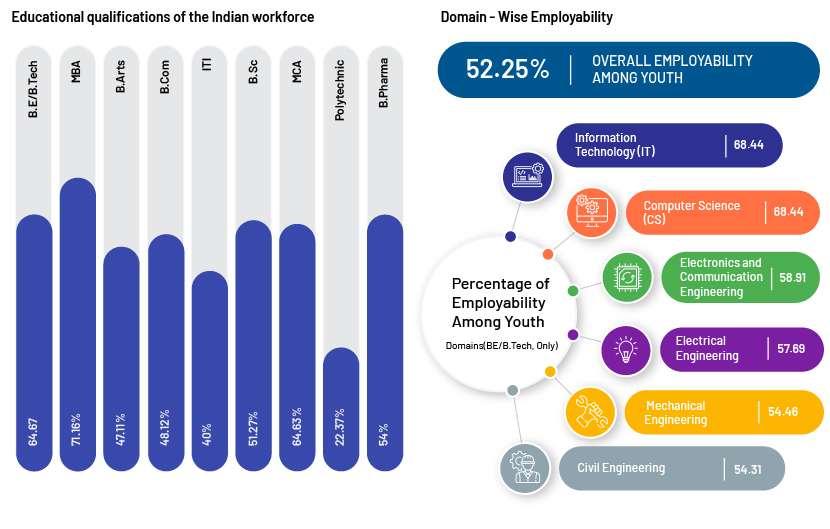

Staff augmentation is transforming asset management, with 23% of the world's top 500 firms using third-party partnerships to access a global talent pool. This approach alleviates the burden of fixed costs associated with full-time hires in developed markets. North America is at the forefront of this trend, with over 52% of AMs collaborating with external providers, highlighting the importance of these strategic alliances. A significant portion of external support comes from India, which accounts for 16% of the global talent pool and has emerged as the preferred outsourcing hub due to its exceptional talent. Its educational landscape produced an impressive number of graduates in 2024, further bolstering the country's position as a leading provider of specialised talent.

AMs have recognised the challenges posed by the new market dynamics and regulatory frameworks. In response, they are actively seeking external expertise to navigate these complexities. Partnership with Acuity Knowledge Partners (Acuity) enables AMs to harness specialised knowledge and capabilities, particularly in areas beyond their internal proficiencies. Notably, a trend among our elite 200 clients shows a shift towards outsourcing key financial marketing services. Acuity, as the preferred staff-augmentation ally for a third of the world's top AMs, delivers a broad spectrum of services, including analytics, compliance and risk management.

Outsourcing demands careful alignment with company objectives, offering AMs the flexibility to scale their workforce and enhance cost-effectiveness. With Acuity's expertise, they proactively navigate the financial landscape, ensuring they remain competitive and agile in a dynamic market.

3. Embracing the latest tech: Capitalising on global tech expertise in asset management

3. Embracing the latest tech: Capitalising on global tech expertise in asset management

In asset management, embracing cutting-edge technology is essential. Firms are quickly adopting intuitive tech, with leaders leveraging platforms such as Seismic and third-party expertise to avoid starting from scratch. AI's role is evolving from mere assistance to proactive action, with its market in asset management projected to grow at a 24.4% CAGR by 2030. A report by Accenture reveals that 95% of executives surveyed expect Generative AI to drive tech architecture modernisation. Consequently, IT and engineering have become the second-largest budgeted functions, following budgeted functions in the investment domain, and account for 14% of expenditure among the top 500 AMs, signalling the sector's tech-centric transformation.

AMs are harnessing AI to boost efficiency across functions. In sales and marketing, AI tools are instrumental in creating content and identifying promising leads, enhancing customer engagement. Investment management processes are refined through AI's ability to synthesise and analyse data, eliminating redundant efforts and fostering collaboration. AI accelerates operations with swift reporting and enhances risk management by proactively identifying anomalies. IT benefits from AI's predictive capabilities in infrastructure maintenance and user support. Finally, AI streamlines business management by facilitating strategic decisions and automating the review of legal documents. This comprehensive adoption of AI is transforming asset management into a more efficient and tech-forward sector.

4. Adopting a hybrid approach to staff planning and technology

Asset management is transforming with a hybrid model that fuses staff flexibility and advanced technology. Third-party experts are increasingly offering solutions that combine staff augmentation with high-tech platforms, enhancing efficiency and agility in volatile markets. Acuity's RFP Pulse and Edge tools, supported by comprehensive managed services, are rapidly gaining traction among AMs, enabling them to improve operations and adapt to financial shifts.

Building on this foundation, strategies such as Bring Your Technology (BYT) and Bring Your Team are taking flexibility and innovation to new heights. These approaches, which integrate external expertise and innovation into an AM's operations, exemplify the sector's shift towards flexible, collaborative work environments. They enable AMs to access specialised skills and scale operations swiftly, ensuring sustained competitiveness and sector leadership.

5. Using mergers and acquisitions (M&A) as a growth lever

M&A is pivotal for growth in asset management. In 2023, M&A activity in the investment and wealth sectors increased by 5.5% and continued into 2024. Firms with over USD10bn in AuM are prime targets, indicating a trend towards consolidation and diversification. M&A facilitates distribution expansion, service enhancement and global presence.

AMs strategically acquire firms for their technology and talent, notably AI-driven platforms, to bypass development time and address regulatory challenges, expanding their market reach. Despite inflation, geopolitical tensions and high capital costs, which prompt caution in deal sizes, transformative M&A still occurs.

M&A trends have reshaped asset management, as evidenced by the following key insights:

-

Talent and tech acquisitions: BlackRock’s and Vanguard's acquisitions (FutureAdvisor and Just Invest) for fintech and direct indexing tech

-

Market expansion: Amundi's purchase of Pioneer Investments for growth in the European market

-

Product enhancement: JP Morgan's acquisition of 55ip for tax-efficient investing tech

-

Operational scale: Invesco's takeover of Oppenheimer Funds for larger client operations and digital enhancements

-

Strategic growth: Significant deals by BlackRock, Japan Post Insurance, Victory Capital, Guardian Capital Group, Riverbridge Partners and Lincoln Peak highlight the sector's focus on strategic growth and innovation to gain a competitive edge

What have we done:

Acuity is a classic example, with an impressive clientele of 20% of the top 500 global AMs selecting its services, although 10% of these firms have their own GCCs. Acuity’s endorsement becomes even more compelling when considering that 30% of the world’s top 250 AMs trust Acuity as their exclusive service provider. Acuity's commitment to innovation and customisation makes it a strategic ally to sector leaders.

Acuity’s relationship with a US-headquartered global AM

Acuity has been extending support across multiple verticals to a global trillion-dollar AM. The relationship began in April 2017 and has grown rapidly to become a 120 FTE+ team.

Acuity supports the client in the following areas:

-

Financial Marketing Services (FMS): The teams within FMS have addressed pain points and delivered long-term value for the client in areas such as RFPs and content management, client reporting, product research and marketing, and digital solutions. Within Acuity, the FMS team has grown significantly, to more than 90 FTEs.

-

Data Analytics: The teams work to deliver quality data insights to the client through a developed analytical framework created to provide a consolidated view of CRM data quality.

-

Technology Solutions: The team has built analytical tools for the client to measure and monitor performance efficiently. Value addition has been delivered on both an application development and an automation front.

-

Credit Research Support: The team provides investment research support across multiple sectors such as healthcare, energy, telecom, gaming and leisure, F&B and technology.

Value additions

Conclusion

The asset management sector stands at a critical juncture. Embracing a globally integrated workforce enriches operations, as it introduces diverse perspectives and specialised expertise, while the adoption of AI and tech solutions streamlines processes and enhances efficiency. The proven resilience of a hybrid approach – combining human talent with technology – enables firms to swiftly adapt to market and regulatory dynamics. As the sector evolves, those adept at merging human expertise with digital innovation will lead the next wave of advancement and innovation.

Sources:

-

https://www2.deloitte.com/us/en/insights/industry/financi.html

-

https://www.bcg.com/publications/2024/ai-next-wave-of-transformation

-

https://www.accenture.com/us-en/insights/technology/technology-trends-2024

-

https://ansr.com/blog/indias-gccs-the-rising-force-in-global-finance/

-

https://www.mckinsey.com/~/media/McKinsey/Business%20Functions/

What's your view?

About the Author

Anurag Sikder has over 13 years of experience in producing content for a wide range of industries. At Acuity, Anurag leads a range of different teams providing qualitative insight for numerous sectors in the form of market reports, white papers, thought leadership pieces, and commentaries.

Like the way we think?

Next time we post something new, we'll send it to your inbox