Published on March 14, 2023 by Ajit Singh

"American roads are not good because America is rich, but America is rich because American roads are good"

– John F Kennedy

Roads are the veins of infrastructure through which the fuel for development of a nation runs. They boost a region’s economy by connecting local economies to the national economy. Of the four major types of roads in India, village roads are the longest, but it is via national highways that most goods are transported across states, making them commercially viable for private equity players. National highways and expressways are the most attractive brownfield investment for private players, especially in the developed states.

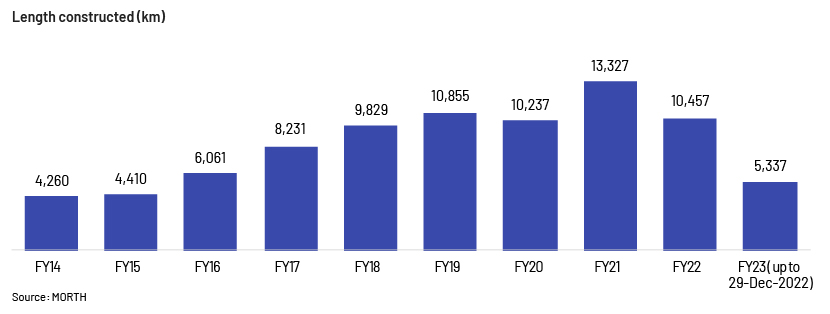

India has the second largest road network in the world, totalling 6.4m km; national highways cover 144,634km and state highways 186,908km as of 30-Nov-2022. At the end of FY22 (ended 31-Mar-2022) an estimated 2,485km of expressways and 5,924km of access-controlled roads are under construction. The government plans to increase the national highways to 200,000km by 2024. (Source: Ministry of road transport and highways (MORTH))

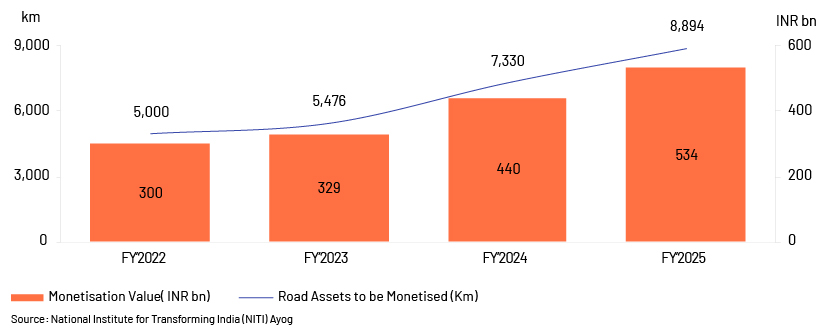

Asset monetisation plan for roads

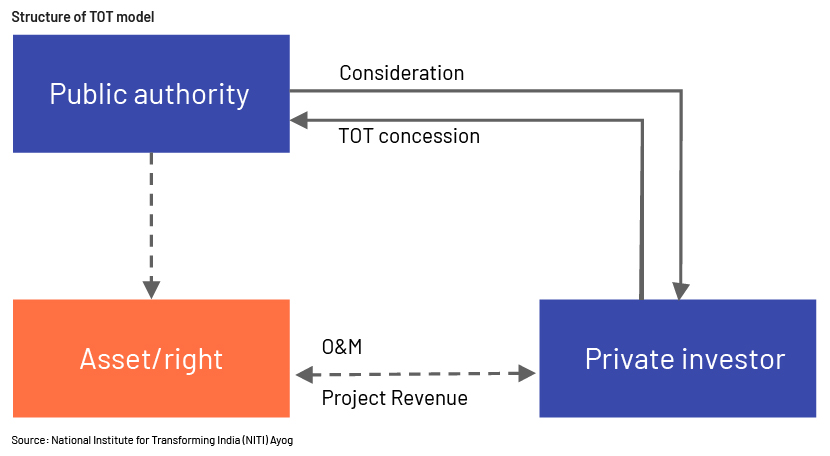

The asset monetisation plan aims to create a cycle of “develop, commission, monetise and invest” in national infrastructure. It aims to unlock value in brownfield projects by engaging the private sector, transferring to them revenue rights and not ownership in the projects and using the funds generated for infrastructure creation and reducing its debt burden. In the FY22 budget, the government announced an asset monetisation plan of INR6,676.1bn; the road sector accounted for 27% of this, totalling 26,700km for FY22-25.Under the plan, the government/public authority aims to transfer its road assets to a private investor for a limited period of time and for an upfront payment/concession; this organisation would be responsible for operation and maintenance of the road, and could recover its investment by collecting tolls.

Methods adopted by National highway authority of India (NHAI) for asset monetisation

-

Toll-operate-transfer (TOT) model

-

Infrastructure investment trust (InvIT)

Toll-operate-transfer (TOT) model

The TOT model is preferred for projects that have completed at least one year of operation and are constructed by the government’s own fund, or for PPP projects whose concession period is over. The length of contract may vary –10 years or more. Eight financing rounds of TOT were completed and the ninth and tenth rounds were in the bidding process as of August 2022.

Benefits of TOT model

-

Structured contractual partnerships with defined KPIs and O&M standards

-

Securitisation of toll receivable by collecting upfront payment

Challenges of TOT model

-

Higher variation, significant loss before being compensated

-

Funding issue, lenders’ discomfort prior to appointed date

-

Risk of road expansion when toll freezes to 75% of existing toll

Infrastructure investment trust (InvIT)

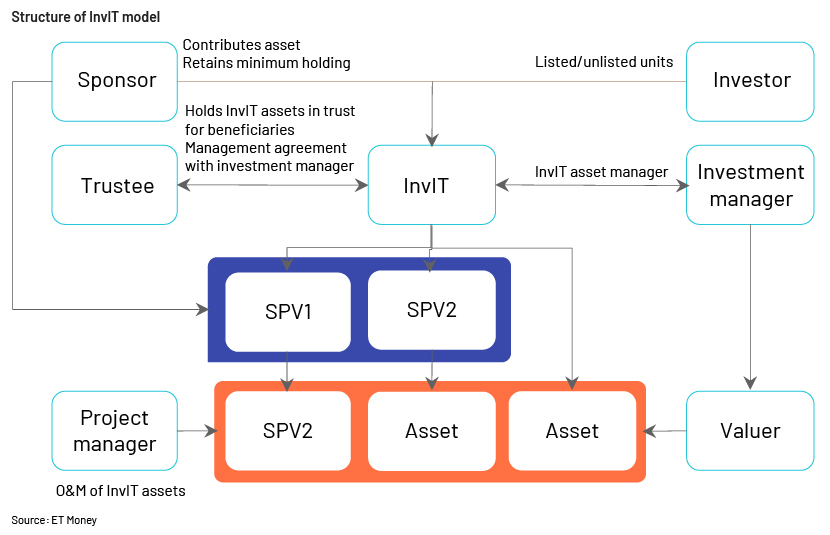

An InvIT is an investment trust created for investors to buy into infrastructure projects with investor funds. The NHAI InvIT is currently open only to selected institutional investors, and the government is exploring options to open it to retail investors.

Benefits of InvIT

-

Raise money without incurring debt

-

Tax benefits of trust

-

Distribute at least 90% of income as dividend, providing regular income

Challenges of InvIT

-

Changes in taxation or policies concerning infrastructure may have a ripple effect

-

Rising inflation may impact the performance

-

Long gestation period increases asset risk

Key investments

-

Brookfield Asset Management Inc. has announced exiting five operational road projects with enterprise value of INR99.4bn (June 2022) to Indinfravit Trust.

-

Macquarie’s overall investment in the road sector amounts to INR116.0bn (May 2022), including the first toll-operate-transfer (TOT) model.

-

KKR entered India’s highway sector in July 2021 signing definitive agreements to acquire Global Infrastructure Partners’ (GIP’s) entire stake in Highway Concessions One (HC1) and seven highway assets totalling 487km.

-

Canada Pension Plan Investment Board and Ontario Teachers’ Pension Plan Board became anchor investors in November 2021, sharing 25% each for NHAI InvIT. Total enterprise value of the initial portfolio of five roads was pegged at INR80.1bn.

Conclusion

It is too early to discuss the success or failure of road asset monetisation, as there have been mixed reactions; many projects attracted multiple bidders while some projects either failed to attract bidders or received a lower-than-expected bid value, leading to cancellation.

-

Many TOT bundles have failed to attract investors at the desired price

-

11 of the 19 InvITs registered from 2016 to 2022 were in the road sector

-

Asset monetisation is a win-win situation for the government and the private investor, as assets are completed and fully functional; the government receive the fair present value, and investors gain from its potential future value.

-

Monetised assets are better targeted, as only users and not all the taxpayers pay for their upkeep.

The way forward

To ensure a higher success rate for road asset monetisation, there must be clarity in regulation for acquiring and exiting investments, and the investments must give investors suitable returns.

-

The expected value of the asset selected must be in line with market expectations.

-

The concession period offered by the government must be long enough to make the investor to invest in higher quality standards.

-

There must be an efficient and effective dispute-resolution mechanisms for design and execution of asset monetisation.

-

Explore other options of raising funds such as setting up development finance institutions and raising share of infrastructure investment in central and state budgets.

-

Attracting private investors requires maintaining a transparent bidding process for adequate realisation of the asset value.

-

Adopting NITI Ayog’s recommendation of bringing InvITs under the Insolvency and Bankruptcy Code helps lenders access a faster and more effective debt-restructuring and resolution option and provides tax breaks to attract retail investors.

How Acuity Knowledge Partners can help

With two decades of experience in delivering research and analytics services, we have built a robust and sustainable ecosystem of people, process and technology. We have strong credentials within the private equity segment, supporting private equity players across the value chain. We provide customised solutions to clients across the private equity sector.

Note: INR/USD – 82.8

Sources:

NITI Ayog:

-

Ministry of Road Transport and Highways: https://morth.nic.in/sites/default/files/Annual%20Report_21-22-1.pdf

-

Press Information Bureau: https://pib.gov.in/pressreleaseiframepage.aspx?prid=1769301

News articles:

-

Financial Express: https://www.financialexpress.com/infrastructure/roadways/asset-monetisation-nhai-to-get-rs-6267-crorefrom

-

India Infrastructure: https://indianinfrastructure.com/2022/05/30/asset-upkeep/

Tags:

What's your view?

About the Author

Ajit Singh is part of the Private Equity & Consulting team at Acuity Knowledge Partners. He has 4+ years of experience in research, and currently supports private equity clients with research assignments including initiation and thematic reports, economic updates, data research and company presentations. He holds a Master’s degree in Business Economics

Like the way we think?

Next time we post something new, we'll send it to your inbox