Published on July 2, 2024 by Saksham Khanna Bose

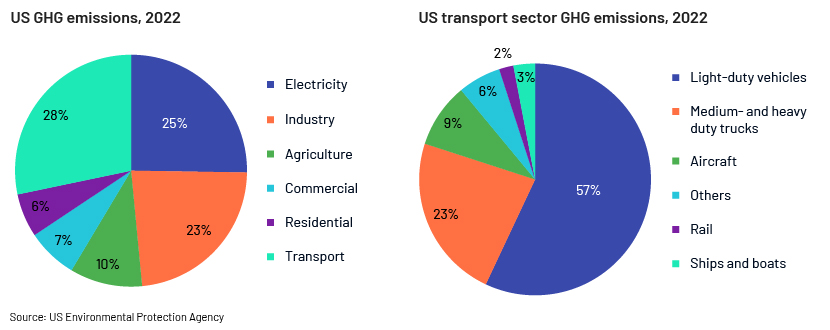

Decarbonisation, the process of limiting greenhouse gas (GHG) emissions through strategic initiatives, gained prominence following the 2015 Paris Agreement, which established the target to cap the annual increase in global warming well below 2°C. Governments across the world announced net-zero ambitions and implementation plans, with a specific focus on some of the most polluting sectors, including transport, utilities, materials and industrials. The transport sector accounted for 28% of the US’s GHG emissions in 2022; light-duty vehicles accounted for a large 57% of these emissions, followed by medium- and heavy-duty trucks accounting for 23%, emphasising the urgency for decarbonising the auto sector.

Decarbonisation efforts in the auto sector hinge on the electrification of cars, a supportive regulatory environment and the implementation of public charging infrastructure. In the commercial space, electric medium-duty trucks could prove to be useful in hub-to-hub application, while for the longer haul, hydrogen fuel cell technology could be more feasible. To achieve the goals under the Paris Agreement, the road-freight sector needs to slash emission intensity by more than 80% in less than 30 years. This requires a c.30% reduction before 2030, according to S&P Global, which will likely be challenging to achieve amid the ongoing slowdown in demand for electric vehicles (EVs), subdued mass EV adoption and lagging technological development in trucks.

Slowdown in demand for EVs

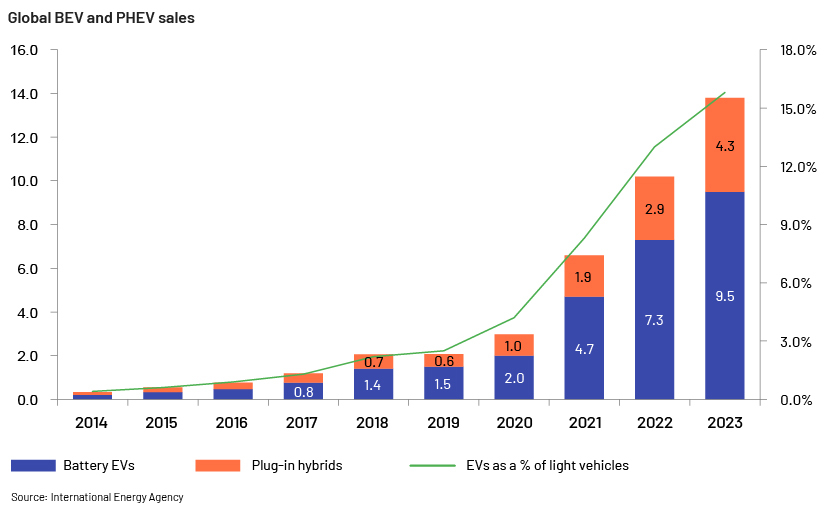

Following a rapid surge, EV sales have stalled due to the continued price disparity between EVs and internal combustion engine (ICE) vehicles. Customers are unclear about the limitations in EV charging and the lack of battery resilience at low temperatures, according to Alpine Capital Research. Germany’s auto association VDA cited the exhaustion of subsidies and subdued consumer purchasing power as headwinds to demand. This could drive a 9% contraction in German EV sales in 2024 (2023: -16%), including a 14% decline in sales of pure-battery EVs.

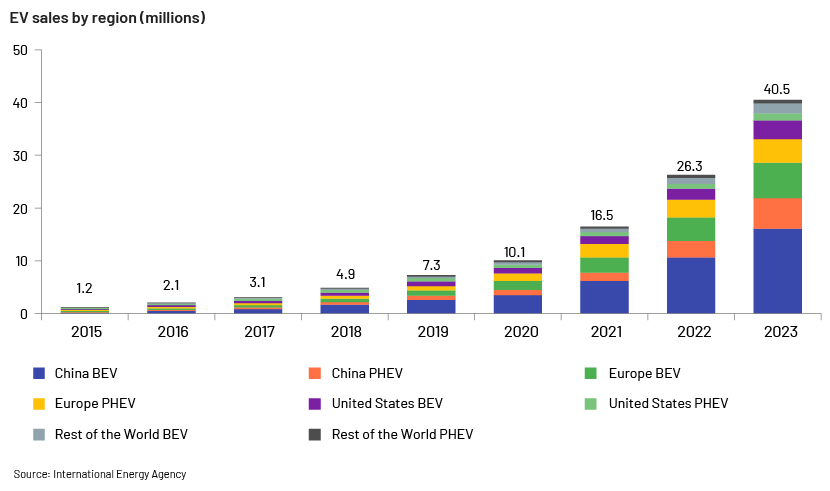

Skewed geographical dynamics in EV transition

The lack of mass adoption of EVs is reflected in the skewed geographical dynamics as well. Of the c.14m new EV registrations in 2023, c.95% were from China (60%), Europe (25%) and the US (10%). S&P Global attributes the US’s lagging performance to the country’s inferior policy scale and lower investment in charging infrastructure.

In 2023, US auto dealers cited customer hesitation in transitioning to EVs due to price disparity, longer lead time (vs conventional vehicles’) and a lack of charging infrastructure. The Biden administration targets a national network of 500,000 public chargers by 2030, with a specific focus on conveniently accessible charging ports. However, certain government experts believe the target is underwhelming, with the Department of Energy’s National Renewable Energy Laboratory estimating the requirement at 1.2m ports (current availability: 175,000 ports; source: Alternative Fuels Data Center). This compares with the EU’s far superior infrastructure comprising 632,423 public charging points by end-2023 and the European Commission’s more ambitious target of launching 3.5m charging points by 2030 (for 55% CO2 reduction for cars). However, the European target implies an annual installation rate of 2.9m charging points over the next seven years, which is far behind the current level (2023 installations: 153,000) and the European Automobile Manufacturers Association’s estimate of 8.8m charging ports (1.4m annual installations). Meanwhile, China has established the world’s largest public charging infrastructure (c.1m ports by end-2022; c.2x Europe’s and 8x the US’s), justifying its leadership in EV adoption.

Commercial vehicles lagging behind

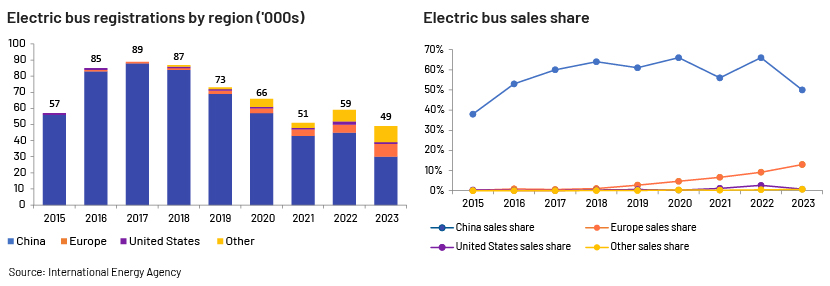

Within commercial vehicles, buses are witnessing far superior electrification versus other heavy-duty-vehicle segments. In 2023, the share of global electric buses in the sales mix stood at c.3%. The share was more than 50% in several European countries (Belgium, Switzerland and Norway) and China, but overall penetration is weighed down by subdued adoption in certain emerging and developing economies (EMDEs) and certain major markets (the US and Korea).

Based on current policies, the International Energy Agency (IEA) expects electric bus sales to jump to 0.5m by 2035, accounting for 30% of total sales. This is expected to be supported by electrification of city buses, which have a standard driving pattern and shorter regular travel distances. Supportive regulations such as the EU’s updated CO2 emission standards for heavy-duty vehicles and California’s Advanced Clean Fleets rule could provide further impetus.

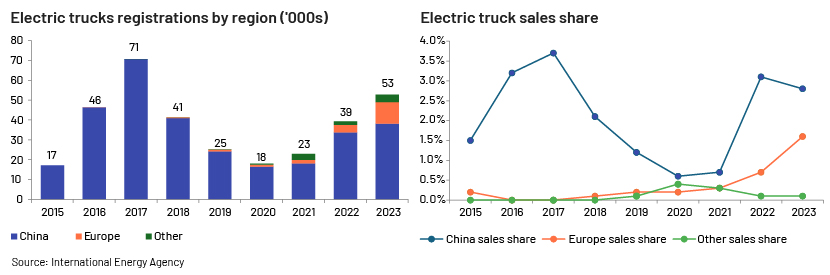

Decarbonisation of trucks is at levels lower than that of cars, with S&P Global estimating a lag of 7-13 years in major global markets. The truck segment could be challenging to decarbonise, due to the size and weight of batteries and their dynamic requirements, according to the IEA. Based on current policies, the IEA expects electric medium- and heavy-duty trucks to represent more than 20% of sales by 2035. This implies a more than 30x jump in corresponding sales, from 54,000 in 2023. Infrastructure for electric charging and hydrogen refilling, comprehensive carbon pricing schemes and supportive measures for transport operator investments could aid rapid decarbonisation of the heavy-duty transport sector, according to the European Automobile Manufacturers Association. The 2030 heavy-duty-vehicle decarbonisation targets set by Europe would require more than 400,000 battery-electric and hydrogen-powered vehicles on the road, along with at least a 33% zero-emission share of new registrations. Importantly, Europe would need to have at least 50,000 charging stations (the majority being megawatt charging systems) and 700 hydrogen refilling stations to achieve the target.

How Acuity Knowledge Partners can help

We specialise in bespoke research services and solutions, including supporting asset managers in tracking industrial trends or specific themes. In terms of decarbonisation of the auto sector, we help clients capitalise on lucrative opportunities by identifying key players involved in the drive. This includes identifying potential leaders and laggards, conducting comparative analysis and tracking financial updates from corporations. Our automotive industry research capabilities enable clients to gain in-depth insights into the latest trends, investment opportunities, and regulatory shifts shaping the future of mobility.

Sources:

-

Decarbonizing road transportation: When will we get there? – S&P Global

-

European, US carmakers race to lower EVs costs as China competition heats up – Reuters

-

Industry pain abounds as electric car demand hits slowdown – Reuters

-

Biden's climate agenda: Only 4 states have federal EV charging stations – AP News

Tags:

What's your view?

About the Author

Saksham Khanna Bose is a part of Acuity’s Buy-Side Investment Research and has over 4 years of experience in Equity Research. She has worked across a range of sectors and industries including Consumers, Industrials, Hospitality and Leisure. Saksham holds a Bachelor of Business Administration (BBA) from Guru Nanak Dev University, Amritsar and Post Graduate Diploma in Management with Finance specialization from Pune Institute of Business Management (PIBM), Pune.

Like the way we think?

Next time we post something new, we'll send it to your inbox