Published on September 13, 2023 by Pankaj Bukalsaria and Oliva Rath

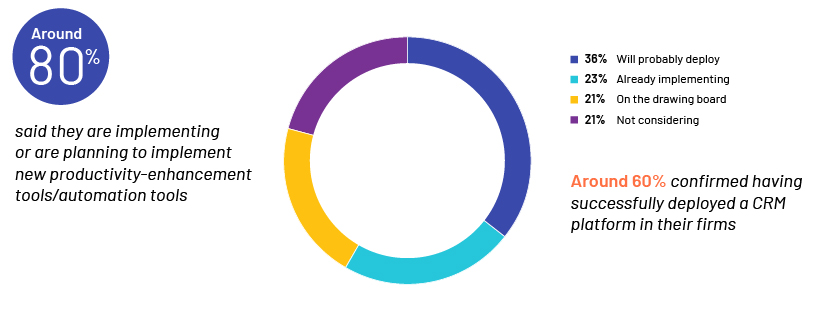

Client demands are ever-evolving and amid these challenging market conditions that have been compressing margins, investment banks and advisory firms continue to make progress in building new service ecosystems for their customers. Our survey also revealed that most firms have been implementing or are planning to implement new productivity-enhancement tools/automation tools in 2023.

We understand these efforts are critical for managing productivity and discovering innovative ways to capitalise on business opportunities

-

Investment banks may consider bolstering the customer experience by enabling front-toback modernisation

-

Automation could increase efficiency, eliminate redundancy and prevent legacy issues

-

Self-service models could be developed to execute transactions directly and quickly, connect flow models and reduce the time taken to close deals

-

To gain an edge amid the intensifying competition and augment digital product and service offerings, acquisitions of and partnerships with fintechs could be explored

-

Big data and AI technology could be effective in easing the onerous regulatory burdens by maintaining transparency in line with evolving ESG targets and regulatory norms, and managing and analysing large volumes of unstructured client data

-

Investment banks could also explore outsourcing some of their digital operations to other players in the ecosystem

Market challenges and uncertainties have often inspired innovation and encouraged companies to take bold actions. Download the full survey report now

Tags:

What's your view?

About the Authors

Pankaj has over fifteen years of experience in investment banking. He oversees multiple client engagements on front office research and analytics support across Corporate Finance / M&A, Capital markets including Islamic products, and Restructuring & Debt advisory. He has significant experience in working on Oil & Gas, Metals & Mining, Fintech and FIG sectors. A significant aspect of his work involves white boarding client requirements, proposing solutions and onboarding and managing client relationships across the globe, with focus on the Middle East, Africa and Asia. Prior to Acuity, he worked with UBS IB offshore team in India, where he led the set up and transition of Global Energy team..Show More

Oliva joined Acuity Knowledge Partners’ investment banking team in 2020. Well-rounded professional with 12+ years of experience in Investment Banking and Financial Services firms.

She has supported investment bankers on various pitches involving company/industry research, preparation of strategic research reports, pitchbooks, pre-IPO reports and investor PDIEs, competitive landscaping, market sizing & segmentation, case studies, macro-economic studies, and in-depth industry insights.

Extensive exposure in cross-industries primarily including FinTech, Insurance, Asset Management, Oil & Gas, Real Estate, Industrials, and Utilities. She has hands-on experience with prominent databases like Dealogic, Capital IQ, Factiva, FactSet, Pitchbook, and Crunchbase, along with other key industry associations.

Like the way we think?

Next time we post something new, we'll send it to your inbox