Published on August 9, 2024 by Tanay Devdhar

Introduction

Autonomous mobility is the frontier of automotive innovation. It aims to enhance safety and enable driverless vehicles, but also involves large investment and research on the part of players trying to gain a foothold in a still-nascent space. This blog strives to dive deeper into the intricacies of autonomous vehicles (AVs), the levels of autonomy and technologies that underpin them, major players in the space, the regulatory landscape and safety considerations.

Self-driving vehicles and levels of autonomous mobility

An AV or self-driving vehicle is one that can perceive its environment, monitor important systems, control the vehicle and navigate from origin to destination with reduced or no human input.

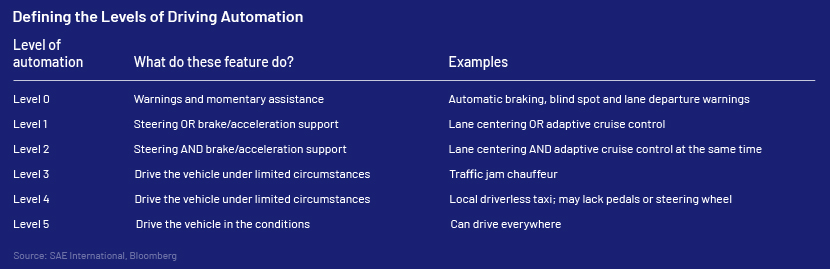

The Society of Automotive Engineers (SAE) defines the following levels of driving automation:

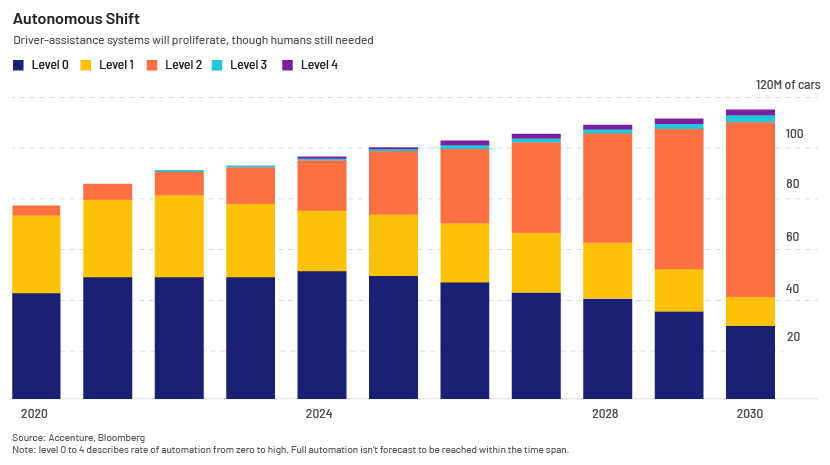

The proliferation of Advanced Driver Assistance Systems (ADAS) is expected to accelerate in the current decade. More advanced levels of autonomy, however, would initially be available in limited products, e.g., as robotaxis and in more premium offerings by OEMs. Fully autonomous vehicles (Level 5) are expected to take at least another decade, if not even longer, to enter the market.

Companies leading the AV charge and the technologies involved

AVs are seen today mainly in the form of robotaxis – self-driving, ride-hailing services offered in limited geofenced areas (e.g., within defined city limits). This is an essential first step towards mass adoption, as companies can build the tech required and obtain on-road data while users and regulators can gain confidence in vehicle capabilities. To this end, AV players are partnering with rideshare platforms, e.g., Uber and Google’s Waymo in Phoenix, USA.

Waymo, emerging as an early tech leader, deploys a Level 4 robotaxi with a suite of sensors (multiple LiDARs, radars and cameras). Taking a more cautious, gradual approach, it launched initially in Phoenix and San Francisco, trying to build a highly capable solution in those areas. It aims to combine the multiple redundant sensors and perception systems with data on miles driven to build a reliable AV experience. While potentially slower and capital-intensive (due to the large number of sensors required for a single vehicle), this approach is seen as ideal for building public trust and safety in a solution that can work in a variety of weather conditions and traffic situations. Waymo recently announced opening its San Francisco robotaxi service (earlier operating at limited capacity) to all users in June 2024, marking the second citywide rollout after Phoenix.

Tesla’s autonomous solution, called Full Self Driving (FSD), relies primarily on cameras for perception, combining this with large amounts of driving data from its on-road customer vehicles equipped with Autopilot, and using it to train neural networks on driving scenarios. Tesla’s camera-only approach intends to reduce sensor cost, but has yet to be proven reliable, as critics believe sensor redundancy is necessary for safety. Tesla’s event, planned for 8 August 2024, when it expected to unveil its much-anticipated robotaxi plans, is now postponed to October 2024, citing design changes.

Cruise, General Motors’ (GM’s) AV subsidiary, which uses a combination of multiple sensors in its robotaxi, faced a setback to its operations in San Francisco after a pedestrian collision, which led to licence suspension. The company halted operations, recalled vehicles, laid off workers and appointed a new CEO. It has since resumed supervised driving operations in Phoenix (Arizona) and Houston and Dallas (Texas). While GM has kept Cruise afloat by funding it with USD850m, it recently abandoned its ambitious, purpose-built Origin robotaxi in favour of the more conventional next-gen Bolt. GM maintains that it is reviewing how it will fund a business that is still seen as a significant cash burner and drag on profitability.

As evident from the above, autonomy requires sensing, perception, world modelling and navigation if it is to be successful. On the hardware front, sensing and perception requirements have necessitated sensors on AVs, including radar, LiDAR and vision (cameras).

Innoviz, Luminar, Ouster and Hesai Technologies are some of the major players that manufacture LiDARs for automotive applications.

Mobileye is another key supplier, providing OEMs with full-stack AV solutions including vision, chips and self-driving software. Its SuperVision solution is seen as a Level 2+/Level 3 system, providing the “hands-off” navigation capabilities of an AV, although it still requires drivers to be attentive and keep their “eyes on” the road. Such technologies are closely watched as a more near-term bridge to the longer-term goal of “eyes-off” full autonomy. Mobileye’s Chauffeur solution is aimed at full eyes-off autonomy for consumer AVs, using multiple redundant sensors and chips, while Drive is its robotaxi and MaaS offering.

Regulatory landscape and ethical and safety considerations

A major goal of autonomous mobility is to minimise accidents due to human error. This requires robust regulations to govern the safe and sustainable growth of the AV industry.

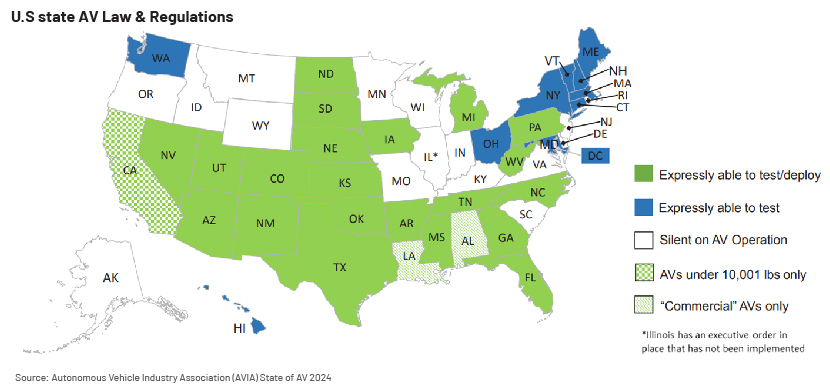

The US National Highway Traffic Safety Administration (NHTSA) provides guidance and policy recommendations relating to AVs. Many US states have enacted laws relating to AVs. The federal government has issued guidelines such as the Automated Vehicles Policy, but there is no comprehensive regulatory framework yet. In the UK, the Automated Vehicles Act paves the way for driverless cars to be allowed by 2026. Several other countries are working to develop regulatory frameworks for AVs, with a focus on safety, accountability, technology and infrastructure integration.

Conclusion

The road to AVs is a long one, with varying and often opposing ideas on which technology and applications are best suited to them. It appears that a fusion of sensors (e.g., camera, LiDAR, radar) will eventually be the way to go, and over time, as the technology improves, industries (such as the LiDAR industry) would see consolidation and the emergence of market leaders. Regulations and government support would play a large role, with robotaxis initially looking to succeed on a smaller scale (e.g., within individual cities/states in the US) and then grow exponentially. Safety would remain the #1 focus area, as any issues and incidents would raise concern and cause setbacks. Investments and support on the tech front would also be key, as larger players may reassess their goals and level of involvement and decide to seek external funding and technology to grow their AV divisions.

How Acuity Knowledge Partners can help

We support global investment managers by leveraging our sector-specific experience. In the automotive sector, we can aid investment firms with idea generation, competitive landscape analysis on emerging trends (such as AVs) and analysis of investment opportunities through comprehensive research and sector coverage support.

References:

-

Autonomous Vehicle Industry Association (https://theavindustry.org/)

-

AVIA State of AV 2024 (https://theavindustry.org/resources/2024_StateOfAV.pdf)

-

Bloomberg: Self-Driving Cars? Not Yet. Here’s Why Your Ride Still Needs a Human Co-Pilot: Quicktake by Stefan Nicola (https://www.bloomberg.com/news/articles/2024-05-13/self-driving-cars-why-your-ride-still-needs-a-human-co-pilot)

-

Society of Automotive Engineers (https://www.sae.org/)

-

S&P Global Mobility newsletter (https://www.spglobal.com/mobility/en/research-analysis/fuel-for-thought-waiting-for-autonomy.html)

-

CleanTechnica (https://cleantechnica.com/)

-

Wikipedia (https://www.wikipedia.org/)

-

Understanding AI (https://www.understandingai.org/)

-

NHTSA (https://www.nhtsa.gov/)

-

US EPA (https://www.epa.gov/)

-

Road to Autonomy – blog (https://www.roadtoautonomy.com/)

-

Waymo (https://waymo.com/)

-

Tesla (https://www.tesla.com/)

-

Tesla’s FSD tracker (https://www.teslafsdtracker.com/)

-

GM’s Cruise (https://www.getcruise.com/)

-

Mobileye (https://www.mobileye.com/)

Tags:

What's your view?

About the Author

Tanay Devdhar has 5 years of experience, including over a year of experience in equity research. In his current role, he supports a buy-side fund manager, covering auto and auto component stocks in the US, Europe and Asia regions. Prior to Acuity, he worked at a European investment bank as an Analyst in their Equities Delta One team in Mumbai. He is a Chartered Accountant from The Institute of Chartered Accountants of India and has passed CFA Level 2.

Like the way we think?

Next time we post something new, we'll send it to your inbox