Published on September 2, 2021 by Hitesh Acharya

Cryptocurrencies are a digital medium of exchange that does not exist in physical form, is global in nature and typically uses decentralised control, as opposed to fiat currencies that are controlled by a country’s central banking system. Peer-to-peer verified, ledger technology (typically blockchain) is used to secure transaction records, regulate additional coin creation and transfer ownership. The most popular and preeminent digital coin is Bitcoin, which can be said to represent the entire cryptocurrency universe. Banks, which generally face the highest regulatory scrutiny among financial firms because of the broad nature of their operations and crucial role in the economy, have historically been reluctant to deal in the crypto space, preferring to focus on related technology, such as blockchain. The prevailing perception was that dealing in Bitcoin was far too risky for banks.

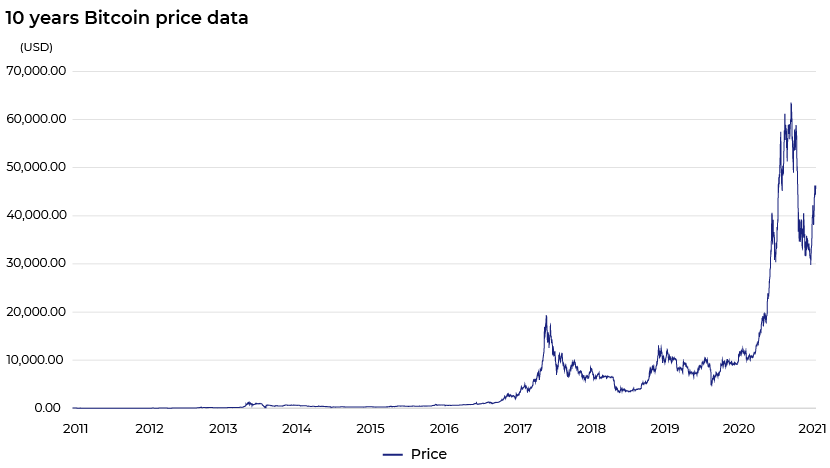

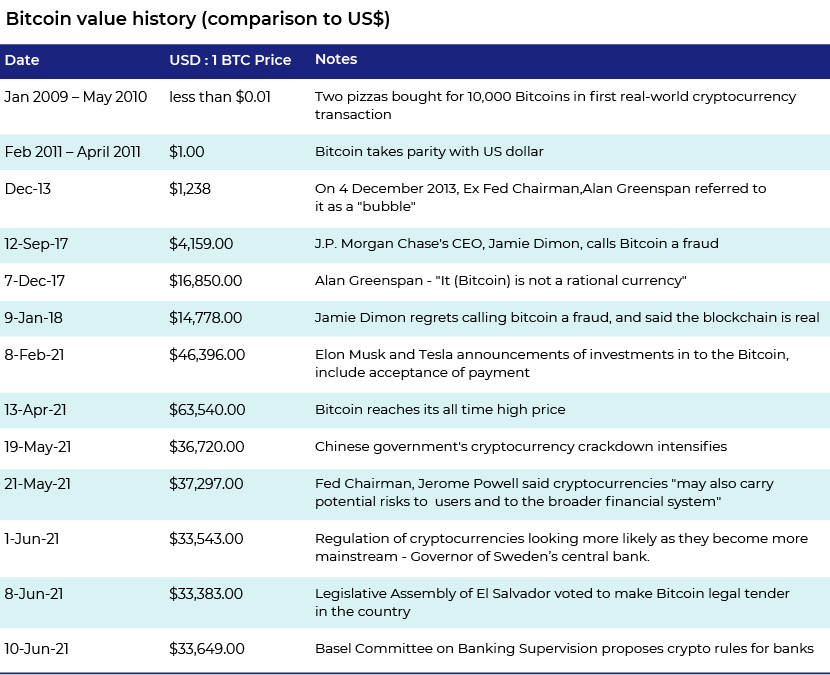

However, the recent surge in cryptocurrency prices and its adoption by notable investors and corporations sparked fear in banks of not benefitting from the boom. The price of Bitcoin surged by almost 300% in 2020 amid the pandemic and central banks’ liquidity injections, and had more than doubled in the opening weeks of 2021, rising above USD60,000 per coin. Yet, major banks’ opinions about the future of cryptocurrencies remain divided. This difference in opinion was clear in the reports issued by leading US and European banks in early 2021. Citigroup forecast in March 2021 that Bitcoin would play a larger role in the global financial system, saying it could become “the currency of choice for international trade”. In the same month, a report by Morgan Stanley laid the case for cryptocurrencies being on the verge of becoming an investable asset class. The bank also announced plans to offer investments in three choices of Bitcoin funds to its high-net-worth clients. However, Bank of America (BofA) took a negative stance on Bitcoin in its March 2021 report (titled “Bitcoin’s Dirty Little Secrets”), slamming it on the grounds of limited supply controlled by a few individuals, making it an unsuitable hedge against inflation. BofA also stated that Bitcoin prices remained very volatile, making it an impractical store of value or payments. On the other hand, Bank of New York Mellon has started offering cryptocurrency and digital asset custodian services to its asset management clients.

Across the Atlantic, NatWest stated it will not engage with customers who accept payments in Bitcoin or similar cryptocurrencies, while HSBC announced that it would not permit transfers to or from digital wallets or allow its customers to purchase shares in companies associated with cryptocurrencies. Both these UK banks believe that cryptocurrencies are too risky in their current form and may not comply with existing compliance and regulatory frameworks. Deutsche Bank took an ambiguous stance, mentioning that Bitcoin prices have factored in the shift towards cross-border adoption of digital currencies, and that for Bitcoin to live up to its reputation, it has to demonstrate its value as a means of payment. Currently, less than 30% of Bitcoin’s transactional activity is related to payments. Thus, Deutsche Bank expects Bitcoin prices to remain volatile on account of its limited tradability. Its German rival, Commerzbank, had no such ambiguity, and termed Bitcoin a purely speculative asset, listing Bitcoin’s price volatility and threats from hackers as negatives.

Many banks and financial institutions have reversed their previous negative opinions about cryptocurrencies, in line with their growing popularity. Notable among these are JP Morgan Chase (JPMC), Goldman Sachs and BlackRock. In 2017, JPMC’s CEO Jamie Dimon referred to Bitcoin as a fraud that would not end well, and went to the extent of saying that he would fire any JPMC trader found dealing in it. However, in January 2021, JPMC strategists forecast that Bitcoin prices would reach USD146,000 per coin, and mentioned that insurance and pension funds could potentially invest USD600bn in Bitcoin. In December 2020, BlackRock’s CEO Larry Fink said he was “fascinated” by Bitcoin and that it could soon become a great asset class and evolve into a "global market" – a starkly different view from 2017, when he referred to Bitcoin as an “index of money laundering.” Goldman Sachs had entertained the idea of establishing a crypto trading desk in 2018, before shelving the project. It subsequently slammed Bitcoin, stating that it is not an asset class, and warned against hedge funds trading in cryptocurrencies. However, in mid-2020, it advertised for a VP of Digital Assets, and has begun trading Bitcoin futures with crypto-merchant bank Galaxy Digital. These examples show that banks’ opinions on Bitcoin and other cryptocurrencies vary widely and have changed over time.

In June 2021, Bitcoin prices crashed to below USD30,000 and were still down by close to 50% in at the end of the month from the April 2021 peak of USD65,000. Given this recent crash in Bitcoin and other “alt-coin” prices in May and June 2021, banks’ opinions and approaches may well change again. Detractors express concern over regulatory action – especially in China and India, potential price bubbles, capital efficiency, safety, insurance and custody of assets, and the environmental impact of cryptocurrencies. However, global banking and monetary systems are all set to undergo a comprehensive digital transformation in the new decade. El Salvador has already adopted Bitcoin as its official currency, while central banks of many countries, including China, the US and the UK, and the European Central Bank are on the verge of rolling out their own virtual money. Leading financial institutions such as Fidelity now provide crypto investing services. Banks are, therefore, unlikely to remain completely distanced from the digitisation of currency.

How Acuity Knowledge Partners can help

We keep our banking clients abreast of such emerging technologies and help them assess their impact. Our credit analysis, compliance and investment banking experts can help accurately calculate the benefits and drawbacks of emerging trends such as blockchain and cryptocurrencies on your institution’s operating model.

Sources:

CNBC– Bitcoin: JPMorgan, Goldman closer to accepting bitcoin as asset class (cnbc.com)

Reuters – EXCLUSIVE HSBC CEO says Bitcoin not for us | Reuters

Investopedia – BlackRock CEO Larry Fink's Views on Bitcoin Evolve (investopedia.com)

Reuters – JPMorgan's Dimon says bitcoin 'is a fraud' | Reuters

Forbes – The Case Against Bitcoin, According To Bank Of America Experts (forbes.com)

Financial Times – Wall Street banks diverge in views on bitcoin boom | Financial Times (ft.com)

Deutsche Bank – The_Future_of_Payments:_Series_2_Part_III__Bitcoin.pdf (dbresearch.com)

The Guardian – https://www.theguardian.com/technology/2021/apr/21/natwest-will-refuse-to-serve-business-customers-who-accept-cryptocurrencies

Bloomberg – Bitcoin ($BTC) Drops Below $30,000 For First Time Since January

Goldman Sachs – CRYPTO: A NEW ASSET CLASS? (Goldman Sachs Research Newsletter)

What's your view?

About the Author

Hitesh has over 14 years of experience in working with leading global organizations in the banking and commercial lending domains. His expertise spans a broad range of analyses, including credit appraisal, leveraged lending, stressed assets, industry reports, cash flow modelling, and client pitch presentations. At Acuity Knowledge Partners, he has led sector and product-specialist pilot teams in Commercial Lending, focusing on diverse sectors such as real estate, manufacturing, aerospace and defense, transport and logistics, and business services.

Hitesh holds a Masters in Management Studies from K.J. Somaiya Institute of Management Studies and Research, University of Mumbai, and a B.Com from University of Mumbai.

Like the way we think?

Next time we post something new, we'll send it to your inbox