Published on December 15, 2023 by Ankit Gupta

The private markets have been discussing the concept of a business development company (BDC), and this has recently led to interest in this investment strategy. This blog aims to present an introduction to BDCs and their rise.

Fundraising in recent years not been as easy and convenient as it used to be. Tighter lending requirements have been implemented, mainly for companies that are small or not mature enough to raise capital from banks, compared to requirements before the pandemic. Such companies are, therefore, looking for alternative ways of financing their businesses, resulting in the BDC sector gaining momentum in the private credit space.

What is a BDC?

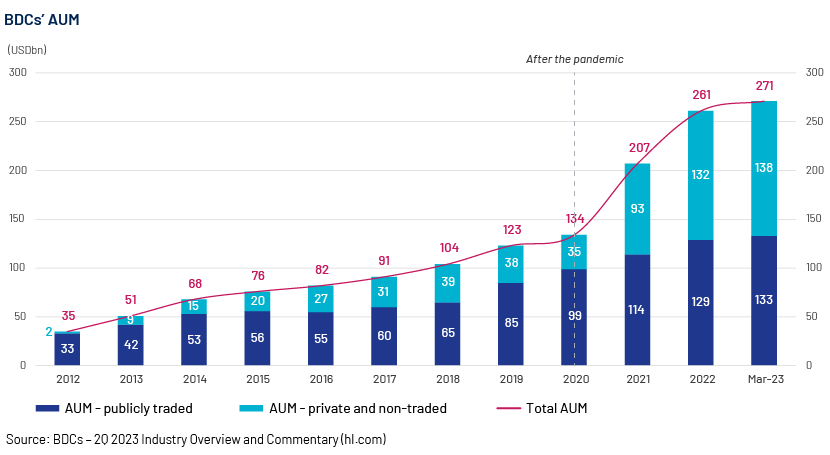

A BDC is an SEC-registered, closed-end, alternative investment vehicle company that is publicly traded or non-traded and provides financial solutions for small and medium-size enterprises (SMEs). It is similar to a speciality finance company and is focused on investing in privately owned SMEs, mainly in the US. According to the Business Development Council, BDCs are required to invest at least 70% of their capital in “qualifying assets” – private or public US companies with a market capitalisation of less than USD250m.

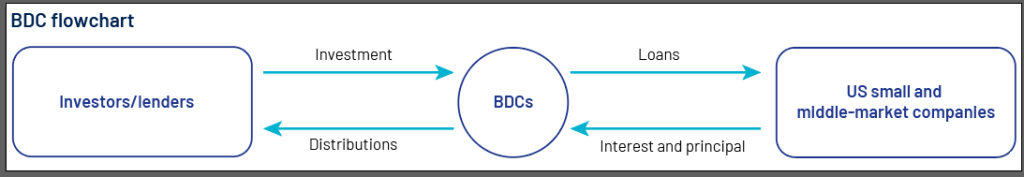

BDCs can be classified into three broad categories: publicly traded, private and non-traded. Publicly traded BDCs are listed on national securities exchanges and typically provide investors with more liquidity.

BDCs may be registered as regulated investment companies (RICs), which are elected corporations and differ from private equity and venture capital funds, as they allow investors to buy shares from the open market and raise funds from retail investors as well.

BDC investments could span the entire capitalisation structure but are mostly credit-focused. With c.USD300bn in total assets, loans account for more than 80% of a BDC’s portfolio and are an important source of private funding.

Expansion of BDCs

BDCs have grown around eight times from 2012 to 2023 in terms of AUM and has gained popularity in recent years, with exceptional growth in non-traded BDCs. BDCs have numbered 138 so far in 2H 2023, with more than USD270bn in AUM. Only c.47 of these are traded, highlighting the growth of non-traded BDCs since their launch 15 years ago.

Asset managers have launched more BDCs in recent years; the majority of them are non-traded, and their loan asset portfolios have grown to more than USD125bn from USD35bn in 2020. These portfolios have also exceeded the loan portfolios of publicly traded BDCs.

New entrants in the BDC space

Multiple asset managers, such as Oak Hill Advisors, Fidelity Investments, Jefferies Financial Group, Churchill Asset Management and Vista Equity Partners, have launched their first non-traded/private BDCs in 2023. With large fund houses and investors entering the space, BDCs have been able to extend credit to more borrowers and execute deals at higher values.

Drivers for lenders and borrowers

Key characteristics of BDCs that continue to attract lenders/borrowers are as follows:

Lenders/investors

-

They give investors the flexibility to invest in smaller and mid-size businesses

-

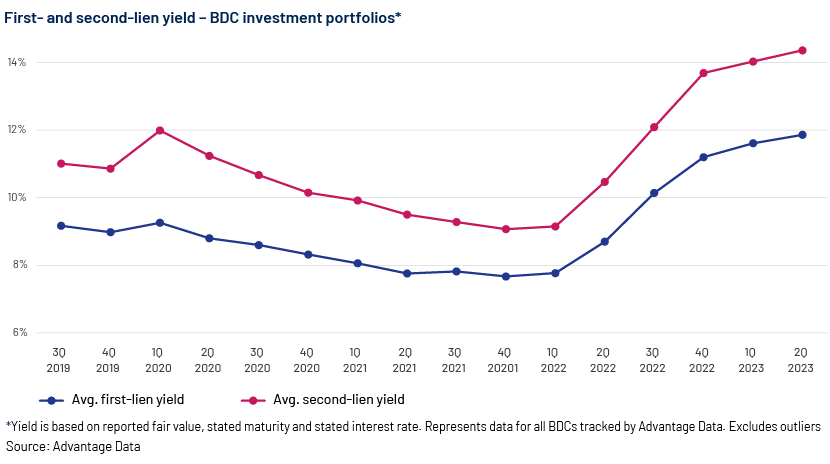

Most of the investments are tied to floating interest rates, acting as a hedge against inflation and rising interest rates

-

More investors can participate, whereas investing was previously limited to high-net-worth individuals and large institutional investors

-

Minimum initial investment amount capped at USD5,000 enables even small investors to participate

-

Provides access to diversified portfolios and transparency, with filings and disclosures

-

Provides management expertise

-

Provides relatively easy access to capital in times of tight banking norms and regulatory changes

-

Initial fundraising is made possible at seed stage to promising small companies

Lucrative returns

BDCs were permitted to have a leverage ratio of 1:1 until 2018; after the amendments in 2018, the capacity was increased to 2:1, enabling BDCs to provide more loans. This made access to capital much easier for asset managers and the strategy more lucrative, with the added potential to generate higher returns for the investor.

BDCs benefit from raising funds at cheaper rates from investors and charging high interest rates on these funds from borrowers.

Despite pressure in recent quarters from rising interest rates and macroeconomic conditions, BDCs continue to reward their investors due to this floating-rate feature, resulting in higher yield.

Market positioning and outlook

Demand for private credit has continued to spike in recent years, and BDCs have been driving funding within this strategy, particularly direct lending. They have expanded especially due to the recent turmoil in the investment space amid high interest rates and pressure in the banking space. They have been able to bridge this gap by providing financing to businesses facing challenges in raising funds through traditional means such as bank loans or bond issues.

Amid the Federal Reserve’s continuous rate hikes, with no near-term visibility on rate cuts, the direct lending strategy will likely continue to strengthen in the private markets space, and we expect small businesses to increasing look for funding from BDCs. Retail investors rarely had an opportunity to gain exposure to the private equity space in the past, but BDCs providing access to private credit strategies have attracted them recently. With less than 20% of market share in direct lending, these companies have significant scope for growth.

Additional benefits over other types of lenders, such as faster execution, greater certainty of closing, lower fees and increased privacy, would make BDCs preferred partners, more than banks and financial institutions. Many businesses that seek alternative financing solutions also turn to asset based lending services offered by BDCs, which provide tailored credit options based on collateral value rather than traditional credit metrics.

How Acuity Knowledge Partners can help

We have more than two decades of experience in providing solutions to private market firms. We have also been supporting clients on the BDC space in recent years – from portfolio monitoring of underlying BDC investments to modelling funds for launching new BDCs. With our vast talent pool and wide range of expertise, we offer end-to-end support and due diligence to asset managers launching new BDCs.

Sources:

-

A Game-Changing Business Development Strategy to Achieve Consistent Growth – Hinge Marketing

-

8 Business Development Metrics to Help You Fill Your Pipeline (bluleadz.com)

-

Pre-Conference-Session-The-ABCs-of-BDCs.pdf (publiclytradedprivateequity.com)

-

The BDC – Business Development Company – A Rapidly Growing Industry (carpenterwellington.com)

-

A Closer Look at Business Development Companies (gurufocus.com)

-

Why Business Development Company Investing Makes Sense – Cabot Wealth Network

-

Starting A Business Development Company – What You Need To Know! (thediamondlab.org)

-

3 Business Development Companies Yielding Over 7% | InvestorPlace

-

Business Development Companies in Solid Shape: 3 Stocks to Buy | Nasdaq

-

An introduction to business development companies – CAIS (caisgroup.com)

-

Why Business Development Company Investing Makes Sense – Cabot Wealth Network

Tags:

What's your view?

About the Author

Ankit has over 11 years of experience in research and analytics and has served multiple private equity clients and investment banks. Currently he is leading multiple teams and plays a crucial role overseeing valuations across strategies for multiple clients. He is managing end-to-end client solutions in Private Equity space from project planning, scoping, client servicing, etc.

He has work across different domains like equity research, valuation, financial modeling, credit reporting, capital structure analysis and covenant monitoring, among others and possess rich exposure working with multiple PE teams supporting on different strategies like Direct Lending, Funds of Fund, Distressed-debt, Credits and loans and others. Recently he has also been..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox