Published on July 27, 2023 by Aarti Madan and Devangna

In the biopharma sector, mergers and acquisitions (M&A) are as critical as a scientific breakthrough and have been a core pillar of leading companies’ growth strategies. For example, blockbuster oncology drugs such as Keytruda and anti-inflammatory drugs such as Embrel are the result of high-value acquisitions.

The number of high-profile acquisitions in the biopharma sector has spiked in recent years. As innovation is typically slow in biopharma, big pharma frequently turns to young biotech companies to boost product pipelines, making such acquisitions an existential necessity for pharma companies.

2023 likely to see a rebound in M&A activity

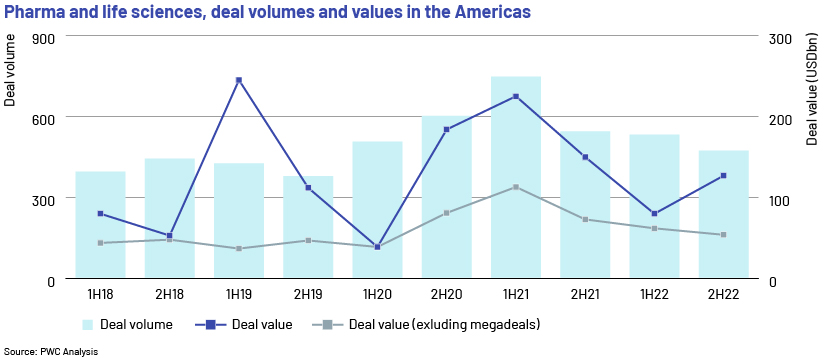

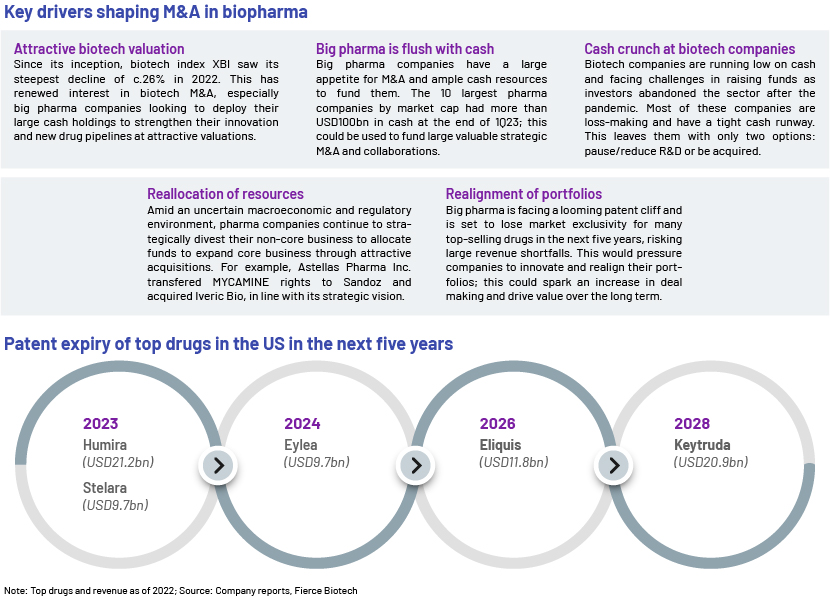

Deal making had a turbulent year in 2022, with fewer and smaller deals. M&A volume declined around 22% across the sector while deal valuations plunged 45% in 2022 vs 2021. That said, 2022 saw a number of new and exciting innovations come to market; these would be attractive candidates for acquisition by big pharma. With more attractive valuations for small biotech firms, we expect increased M&A activity in the sector in the coming months.

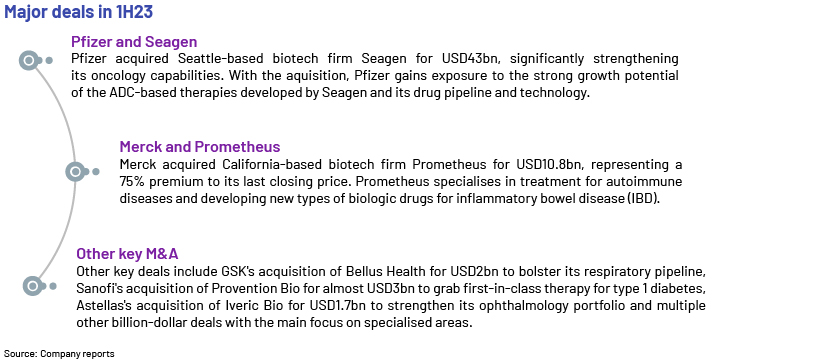

The second half of 2023 looks set to be an active period for M&A. Deal announcements YTD in 2023 include multiple transactions of more than USD1bn each, suggesting strong appetite for acquisition. For example, in 1Q23, Pfizer announced the acquisition of Seagen, an antibody-drug conjugate (ADC) leader, for USD43bn. This deal alone accounted for a quarter of total M&A spending in the sector for full year 2022.

Top focus areas in 2023

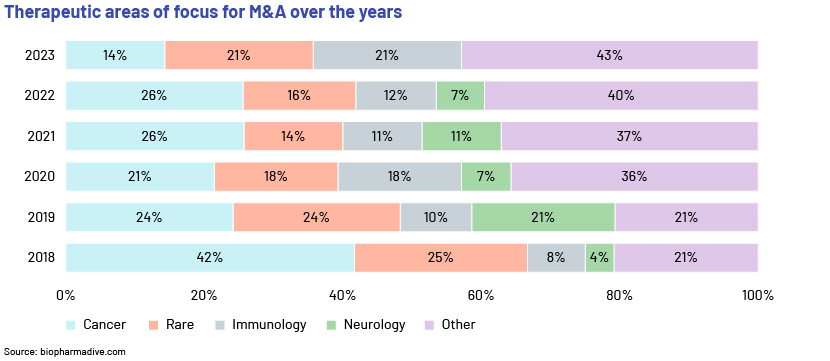

Typically, these M&A deals focus on strengthening core assets and expanding capabilities of the acquirer in specialised areas such as immunology, oncology and gene therapy. As long as fundamentals for M&A remain intact, a pharma company’s favoured targets are likely to be smaller companies with innovative drugs in targeted therapeutic areas.

As the chart below shows, the focus of big pharma M&A is now shifting to therapeutic areas such as immunology, neurology and others versus cancer and rare diseases previously (36% in YTD 2023 vs 42% in 2022 vs 67% in 2018). We expect the trend to continue and believe there will be more deals in diversified therapeutic areas in 2H23 and into 2024.

Biopharma sector to see an acceleration in M&A activity in 2H23 and 2024

While macroeconomic conditions may remain challenging for the rest of 2023, pharma companies are expected to deploy their accumulated cash to address gaps in their innovative pipelines. Big pharma will also likely consider high-value acquisitions to reallocate resources to compensate for patent losses, stay ahead of the competition and reach growth targets.

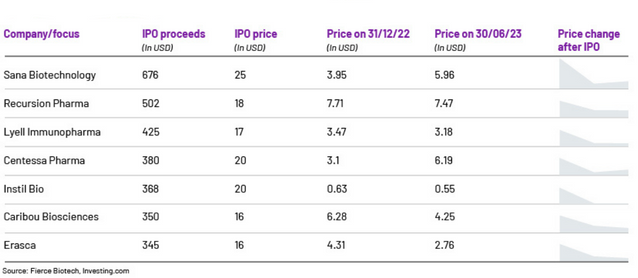

We believe there will also be plenty of willing sellers given that a large number of innovative biotech companies were founded and funded in recent years. In addition, 2022 proved difficult for the slew of biotechs that raced to Wall Street (>100 in 2021), as they saw large declines in their share prices after listing (an average 75% decline to date for the top seven IPOs since listing in 2021). Such companies would find it difficult to raise additional equity at their previous valuation benchmarks. M&A would be an attractive alternative for realising their long-term potential and would provide an exit to early investors.

From a regulatory point of view, we believe the potential increase in scrutiny by the Federal Trade Commission (FTC) of certain M&A transactions would make megadeals more complicated or delay deal timelines; however, this would not have a significant impact on the value or volume of the deals.

All these factors should help drive a strong M&A wave in 2H23 and into 2024.

How Acuity Knowledge Partners can help

We have 1000+ analysts supporting sell-side and buy-side firms in research, publishing, and operations. Global investment banks and other research firms leverage our experience to rapidly increase internal analyst bandwidth and expand coverage of equities and credit. We set up dedicated teams of analysts (CAs, MBAs and CFAs) to support our clients on a wide range of activities including idea generation, building financial models, financial analysis, thematic research, building databases and providing regular sector coverage. On the publishing side, we help clients with supervisory analyst, editorial, design and formatting support. We also support research operations in areas such as customer relationship management, broker votes, corporate access, and expense and invoice management.

Sources:

-

https://www.pwc.com/gx/en/services/deals/trends/health-industries.html

-

https://www.pharmexec.com/view/biopharma-m-a-year-in-review-ripples-ahead

-

https://www.biopharmadive.com/news/biotech-pharma-deals-merger-acquisitions-tracker/604262/

-

https://www.fiercepharma.com/special-report/top-15-blockbuster-patent-expirations-coming-decade

-

https://companiesmarketcap.com/pharmaceuticals/largest-pharmaceutical-companies-by-market-cap/

-

https://www.fiercebiotech.com/biotech/biotech-ipos-current-public-market-dump-its-little-silly

- Company PR and SEC filings

What's your view?

About the Authors

Aarti Madan has more than nine years of overall work experience, with over six years in equity research and financial modelling. She has been with Acuity Knowledge Partners (Acuity) for 2.5 years, supporting a US sell-side client focusing on the biotech sector. Before joining Acuity, she worked with a Japan-based start-up covering Japan’s pharma and biotech sector. Aarti has completed her M.Com and holds a company secretary qualification from the Institute of Company Secretaries of India (ICSI).

Devangna has over 5 years of work experience in equity research. She has been with Acuity Knowledge Partners (Acuity) for the past 1 year and supports a US sell-side client covering the US biotech sector. Prior to Acuity, she worked with a European investment bank, covering the food retail and delivery sector. Devangna holds an MBA (Finance) from the ICFAI Business School, Hyderabad, and has passed CFA Level I.

Like the way we think?

Next time we post something new, we'll send it to your inbox