Published on December 7, 2022 by Kalindu Herath

The digital landscape of the world of finance has evolved significantly in recent years, making financial markets and market participants very dynamic in nature. This evolution of digitisation in finance dates back to 1953, when the first banking mainframe was used by Bank of America to process cheques. Next, in 1966, Barclays launched the first debit card, allowing seamless banking across the world. In 1994, Stanford Federal Credit Union launched the first online banking system that enabled all its customers to transact with just a few clicks. This was the final landmark of evolution before the introduction of blockchain in 2008.

Technology-driven advancements have made the finance sector more efficient and accessible as a whole. Key advancements that continue to shape the future of the finance sector include AI-driven analytics, real-time cloud computing, transaction-process automation and the internet of things. A technology on the brink of routine adoption is blockchain.

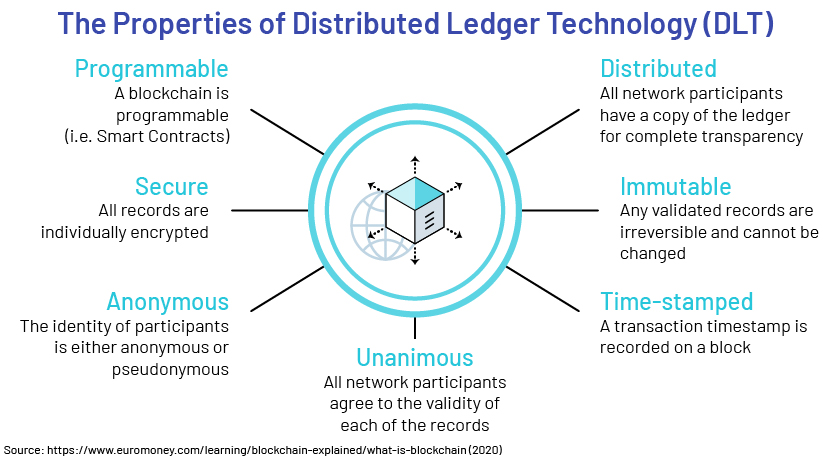

Blockchain is a distributed ledger technology (DLT) and operates as a decentralised network. It allows digitally storing records of ownership of assets and recording the movement of such assets. As data stored on blockchain cannot be modified, it is a very disruptive technology, with multiple use cases in the finance sector. One of the more recent developments of blockchain use in finance is blockchain securitisation.

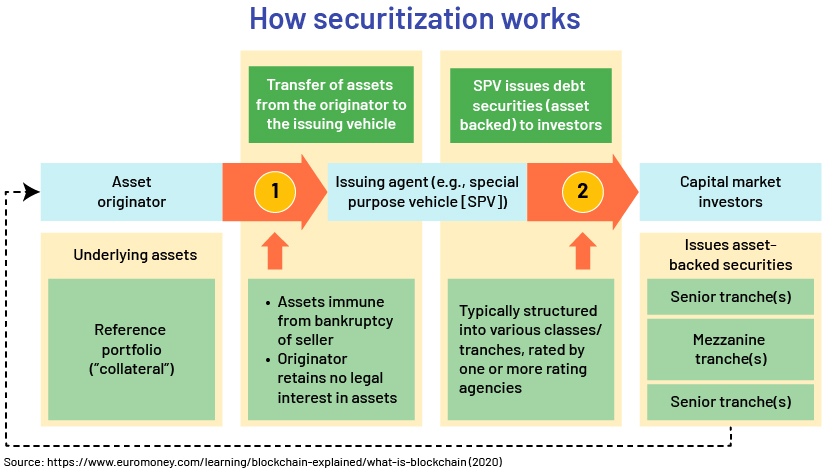

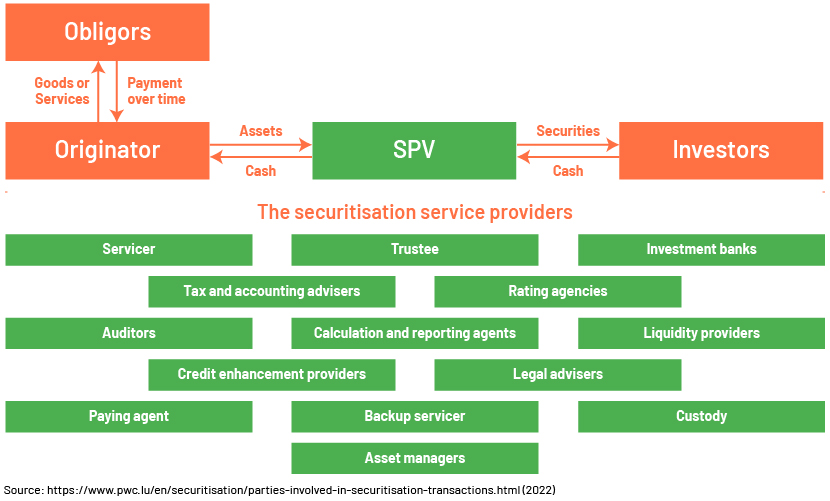

Securitisation is the core of structured finance. The fundamental concept of securitisation is where a company with illiquid, cashflow-generating assets would be able to use these assets as a form of collateral to obtain funds from the capital markets. Illiquid assets, such as loans and receivables, are transferred to a special-purpose vehicle (SPV), which would issue securities to investors who are repaid over time from the cashflow generated by the SPV’s assets.

Blockchain securitisation comes into play in the world of structured finance via a process known as “tokenisation”. In tokenisation, typical illiquid assets held by the SPV are converted into a number of “tokens” that represent the individual securities sold to investors on the blockchain. These tokens will then be distributed to each individual investor and act as proof of ownership of each individual security issued by the SPV. Blockchain securitisation would, therefore, catapult structured finance processes to the modern digital age.

Blockchain securitisation: the benefits

Blockchain securitisation has a number of advantages that would benefit the multiple parties involved in the securitisation process including originators, issuers, servicers and investors.

Higher quantity and quality of loan originations

First, it improves the loan origination and asset collateral pool via the creation of a set of smart contract templates for securitisation, allowing it to form the asset pool and issue the underlying securities at a faster pace. As a result, larger homogeneous asset pools can be created to adapt better statistical analysis and asset diversification. This reduces the possible economic stresses on investors, resulting in an additional form of credit enhancement to protect them.

Efficient reporting of transaction data allows better analysis

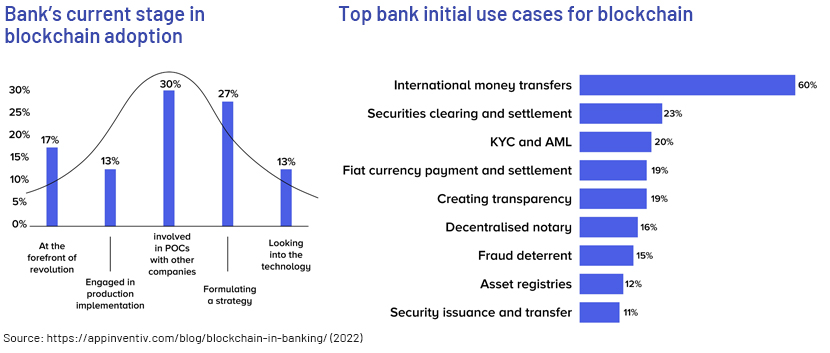

In blockchain securitisation, all cashflow between the parties involved in the securitisation process is recorded on the blockchain. This results in faster and more accurate cashflow reporting and greater transparency in executions, since every transaction is recorded and stored on the blockchain. A wider range of analytics in this technology provides for greater statistical inference, making outcomes more predictable. The following are the numerous banking processes that could use blockchain within the securitisation process, along with current adoption rates of blockchain technology in banking.

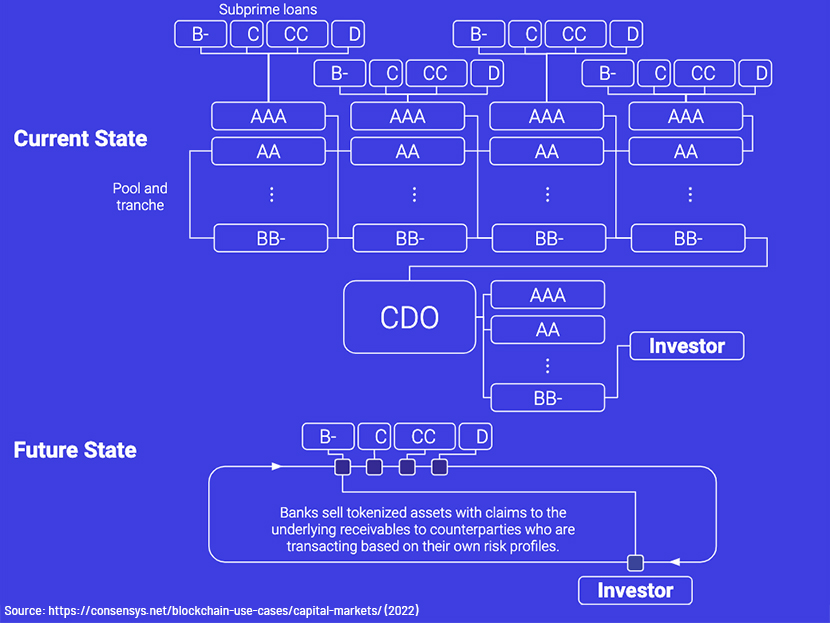

Surpassing the traditional securitisation process in place since the 1970s

Securitisation has been criticised for its complex transaction structures, which partially fuelled the 2008 financial crisis. Blockchain securitisation would simplify these structures and provide transparency to external parties such as regulators and auditors. This would, in turn, result in greater demand for securitisation-led structured finance solutions around the world, higher originations for investors and a more diversified landscape of structured finance products that borrowers could enjoy.

Headwinds to successful adoption of blockchain securitisation

Despite the growing use and influence of blockchain in modern banking activities, the blockchain securitisation process has several risks and limitations that need to be understood.

Lessons learnt from the 2008 global financial crisis – very tight laws and regulations blocking adoption

First, it is important to note that the finance sector is one of the most heavily regulated sectors in the world. Securitisation transactions are of key interest to regulators because such transactions, including collateralised debt/mortgage obligations, played a vital role in the 2008 global financial crisis.

Due to the inherently complicated structure of securitisation transactions, this area of finance is tightly regulated, so the use of decentralised technology such as blockchain could be a red flag to financial regulators and watchdogs.

An example of the legal and regulatory barriers faced in this space is the Uniform Electronic Transactions Act (UETA) in the US. This act currently covers only preliminary electronic fund transfers and is not updated to reflect the structure and performance of blockchain-based transactions.

Many central banks and monetary authorities around the world are yet to accept blockchain-based tokenised assets as legitimate assets due to their digital nature and lack of centralised control. This includes smart contracts the blockchain securitisation process relies on to work efficiently.

This poses a risk to successful global securitisation since a transaction can involve issuers, servicers, borrowers and investors around the world to transact seamlessly. Countries imposing restrictions on blockchain-based financial transactions would disrupt the global securitisation framework of those structured finance transactions.

Blockchain’s novelty makes immediate incorporation difficult in the current environment of macroeconomic uncertainty and due to the lack of strong blockchain-based infrastructure

A key factor to note about blockchain technology is that it is not an application that companies can easily adopt. Well-built blockchain securitisation models require all participating organisations to have strong core infrastructure to handle high-end digital transactions. The lack of proper infrastructure would hinder the blockchain’s effectiveness in the securitisation transaction. This could lead to a disruption in the payment waterfall and risk default.

Structured finance risk guidelines are yet to be revised to accommodate blockchain securitisation. An example of this is S&P’s operational risk guidelines for structured finance transactions, which reflect a new type of key transaction parties such as blockchain technology providers, who were previously not related to traditional securitisations.

As with any automated system, the foundation for blockchain securitisation is based on human input required to create the relevant blockchain technology and associated smart contracts. Any human error in creating this environment could result in a party failing to meet its obligations. This would cause the entire securitisation structure to collapse, leading to high monetary damage.

Interoperability is another key risk to consider in blockchain securitisation. For blockchain to be applied on an end-to-end securitisation throughout the securitisation lifecycle, the market participants in the transaction must be able to collaborate and establish common standards and procedures. This is particularly important for intermediaries such as trustees and custodians who would interact with multiple parties around the world on a global securitisation platform. As shown below, all securitisation service providers are important for the continued operation of a securitisation structure.

Finance giants’ sustained interest in blockchain securitisation supports technology upgrades

Despite the many risks of blockchain securitisation, its positive implications have driven much attention to this new form of structured finance, which is likely to continue to grow in terms of global adoption. Many stakeholders in the finance sector have shown great interest in the use of blockchain in finance, with blockchain securitisation at its heart.

From 2020 to present, Vanguard, one of the US’s well-known investment management companies, has been heavily invested in developing blockchain-based securitisation solutions. By June 2020, Vanguard had collaborated with other participants in the finance sector such as Symbiont, BNY Mellon, Citi and State Street to develop a blockchain pilot designed to digitise the issuance of asset-backed securities.

In March 2020, Figure Technologies was in the spotlight as it announced the first asset-backed securitisation that was completely sustained on the blockchain. All processes of this transaction including origination, servicing, financing and sales were performed on the blockchain, further shaping a strong future for the global adoption of blockchain securitisation.

Financial markets are still quite new to the concept of blockchain securitisation, with very few major transactions to support its success, and it will take time for the concept to become mainstream. However, blockchain securitisation continues to grow in popularity among the many global financial market participants due to its ability to open up new market opportunities not seen in traditional securitisations.

Taking a global approach to blockchain securitisation, including standardising global regulations and establishing strong technological interoperability, is key to expanding this concept. Having the necessary support and the optimistic behaviour of all stakeholders would be the main drivers of exponential growth of blockchain securitisation.

How Acuity Knowledge Partners can help

We provide the latest lending and fintech solutions to our banking clients, helping them optimally utilise and benefit from such emerging technologies and innovations. The digital landscape of commercial lending is evolving rapidly, and it is, therefore, important to identify which modern solutions would be the most viable.

Our Lending Services team is experienced in conducting credit research on structured finance transactions, monitoring securitised portfolios and flagging early warning signals, and evaluating risks to appropriately price global securitisation arrangements and other structured finance products.

Sources:

-

https://www.ijirr.com/evolution-technology-financial-markets

-

https://www.euromoney.com/learning/blockchain-explained/what-is-blockchain

-

https://www.imf.org/external/pubs/ft/fandd/2008/09/pdf/basics.pdf

-

https://www.jdsupra.com/legalnews/asset-tokenisation-on-blockchain-1400635/

-

https://www.spglobal.com/en/research-insights/articles/what-blockchain-could-mean-for-

-

https://theconversation.com/securitisation-the-complex-financial-product-that-fuelled-the

-

https://iclg.com/practice-areas/securitisation-laws-and-regulations/1-blockchain-securitisation-

-

https://www.khuranaandkhurana.com/2022/03/01/revisiting-the-concept-of-consideration-un-

-

https://www2.deloitte.com/us/en/pages/risk/articles/blockchain-security-risks.html

- https://repository.tudelft.nl/islandora/object/uuid:3bb77179-d9ad-4b78-ad31-

-

https://www.garp.org/risk-intelligence/technology/blockchain-shows-promise-in-securitization

-

https://www.businesswire.com/news/home/20200311005452/en/Figure-Achieves-

-

https://www.mckinsey.com/cn/our-insights/our-insights/seven-technologies-shaping-the-future-

-

https://www2.deloitte.com/content/dam/Deloitte/us/Documents/regulatory

-

https://www.pwc.lu/en/securitisation/parties-involved-in-securitisation-transactions.html

Tags:

What's your view?

About the Author

Kalindu has over three years of work experience in Tax, Audit, Assurance and including one year in Lending Services. Currently he is an Associate, attached to the Global Balance Sheet Distribution (GBSD) sector team and responsible for carrying out credit reviews, risk raters, covenant validation and monitoring, collateral monitoring and other credit workflows for the GBSD sector of a leading European based bank. Prior to joining Acuity Knowledge Partners, he worked as a Senior Accountant in the Tax, Audit & Assurance division of an audit firm. Kalindu holds a B.Sc. (Hons) Applied Accounting Degree from the Oxford Brookes University, is an ACCA Affiliate and has passed Level 1 of..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox