Published on February 21, 2024 by Rabin Thakur

The Corporate Sustainability Reporting Directive (CSRD) came into force in January 2023. On similar lines as its predecessor, the Non-Financial Reporting Directive (NFRD), it focuses on enhancing the reach of applicability of sustainability reporting. The CSRD is designed to increase disclosure by obligated entities by focusing on aspects such as governance, strategy, due diligence and risk management along with targets and metrics.

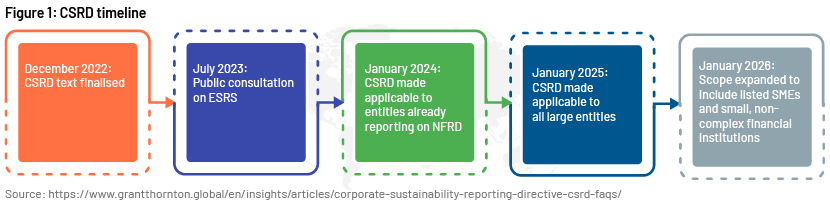

The CSRD was in preparation stage for a long time; the text was finalised around December 2022. After public consultation around mid-year 2023, the directive was first applied in January 2024, when entities already obligated to report under the NFRD were expected to report under the CSRD as well[1].

The CSRD differs from the NFRD because of the European Sustainability Reporting Standards (ESRS) it incorporates. The ESRS includes an increased scope and differing timelines for application and introduces mandatory reporting.

Reporting under ESRS is similar to reporting on Principal Adverse Impact (PAI) indicators under the SFDR regime; the significant difference is that it does not rely solely on a few metrics to meet the mandatory reporting criterion.

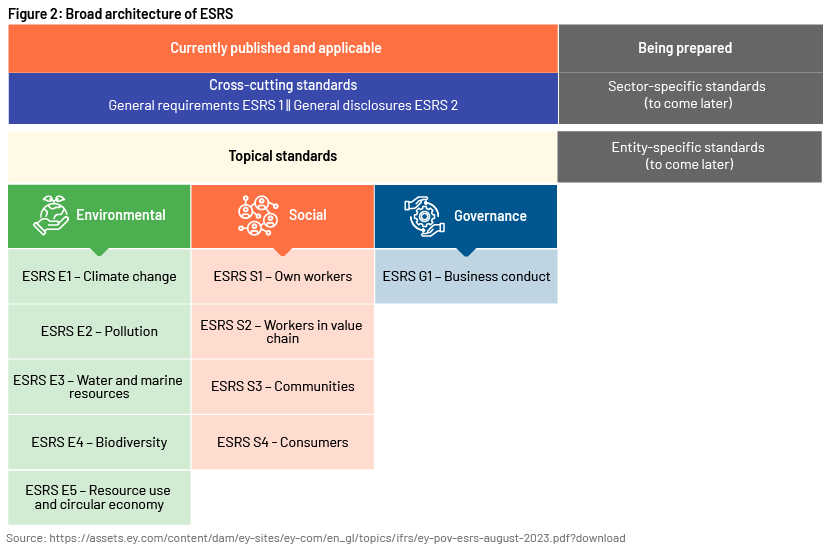

The first set of ESRS was adopted on 31 July 2023. It applies to all companies obligated to report under the CSRD. ESRS requires disclosures to be made on three layers – sector-agnostic, sector-specific and entity-specific[2].

The current published standards have only the sector-agnostic layer, with the sector-specific and entity-specific layers to be introduced at a later stage. Obligated entities are, therefore, required to report only on the sector-agnostic layer, which includes cross-cutting standards (applicable to all sustainability matters) and topical standards (including disclosure on environmental, social and governance matters).

“General requirements ESRS 1” outline the mandatory concepts and principles around which the CSRD expects sustainability statements to be made. They include materiality, due diligence, risks and opportunities and disclosures relating to the value chain[3].

The broad architecture of “General disclosures ESRS 2” is similar to the Task Force on Climate-Related Financial Disclosures (TCFD). There are four reporting areas: Governance, Strategy, Risk Impacts, and Metrics and Targets. Being a standard to meet sustainability reporting requirements, the topics covered are Environmental, Social and Governance.

Of the cross-cutting standards, ESRS 2 is a mandatory disclosure for all entities. On the other hand, ESRS 1 disclosures depend on the result of the materiality assessment. Certain portions may be omitted in the event the specific requirements and data can be disclosed through alternative means[4].

The topical standards include disclosures around environmental, social and governance matters. Subtopics under environmental matters include climate change, pollution, water and marine resources, biodiversity and resource use. Subtopics under social matters include considerations relating to workforce (both own and value chain), communities impacted and consumers. Subtopics under governance matters touch on aspects of responsible business conduct.

Disclosure requirements across topical standards are governed by the reporting areas under ESRS 2, i.e., governance, strategy, risk impacts and metrics. Particular topics for disclosure are chosen on the results derived via the “double-materiality analysis” under ESRS 1.

How Acuity Knowledge Partners can help

We are the leading provider of ESG services to the private markets. Our capabilities are developed around ESG data collection, aggregation, analysis and reporting. We have helped our clients navigate through and develop systems relating to reporting on regulatory requirements of the SFDR and EU Taxonomy. We support clients on either side of the maturity continuum to set up ESG reporting processes.

Sources

-

[1] https://www.grantthornton.global/en/insights/articles/corporate-sustainability-reporting-directive-csrd-faqs/

-

[2] https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/ifrs/ey-pov-esrs

-

[3] https://www.getsunhat.com/blog/esrs-cross-cutting-standards

-

[4] https://www.linkedin.com/pulse/esrs-1-2-deeper-look-sustainability-reporting-jonkman-kulyabina--ftm7e/

Tags:

What's your view?

About the Author

At Acuity, Rabin is overseeing multiple ESG engagements which includes research, analysis and reporting assignments for clients in the US and Europe. Overall, Rabin holds an experience of ~11 years which is spread across various areas of client management and interface within the domain of ESG and Sustainability. Rabin holds a post-graduate diploma in Sustainable Management from Indian Institute of Management, Lucknow

Like the way we think?

Next time we post something new, we'll send it to your inbox