Published on February 6, 2023 by Gaurav Agrawal and Rohit Srivastav

Key takeaways:

-

The macro economy began deteriorating during 2022 in the form of lower real GDP growth rates and higher interest rates, leading to a significant decline in 4Q22 corporate earnings estimates

-

The heady cocktail of weak earnings, higher borrowing costs and deteriorating leverage makes conditions ripe for distressed debt investors, as default rates are estimated to rise to c.4% from 1.0-1.5% in November 2022

-

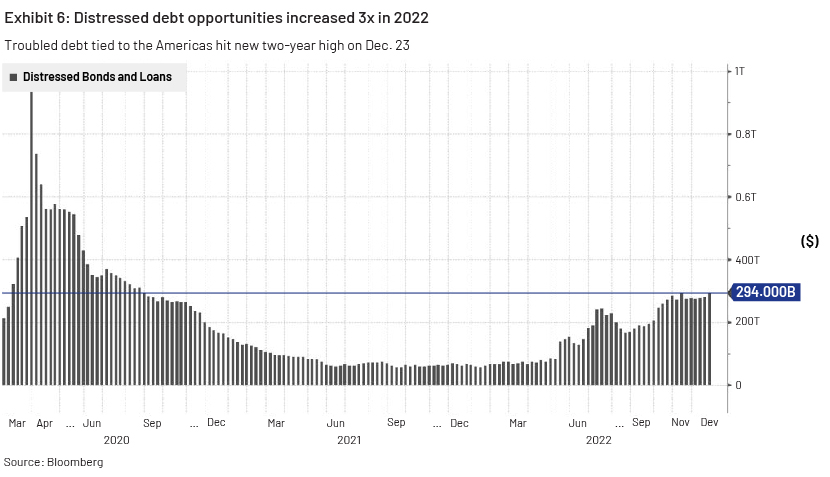

Distressed debt in the US had grown 3x to USD294bn in the 12 months to December 2022. Opportunities in some sectors would be more than those in others due to idiosyncratic factors. This would require distressed investors to pursue more niche and specialised strategies in the current distressed debt space

-

We have been supporting distressed debt and alternate investment managers through providing proprietary distressed debt support solutions since 2007

A deteriorating macro environment

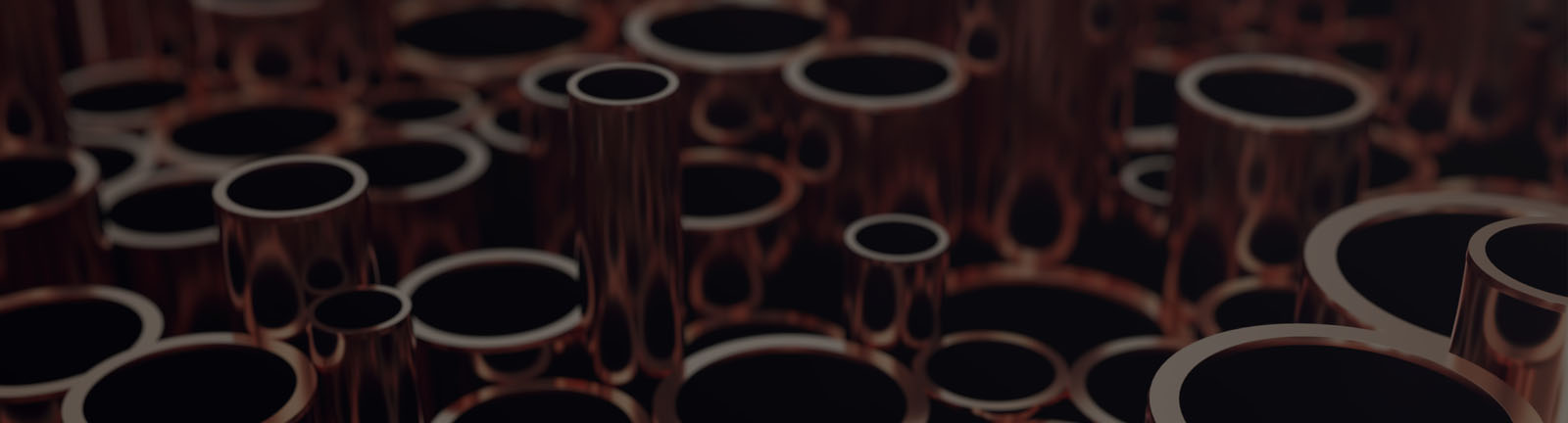

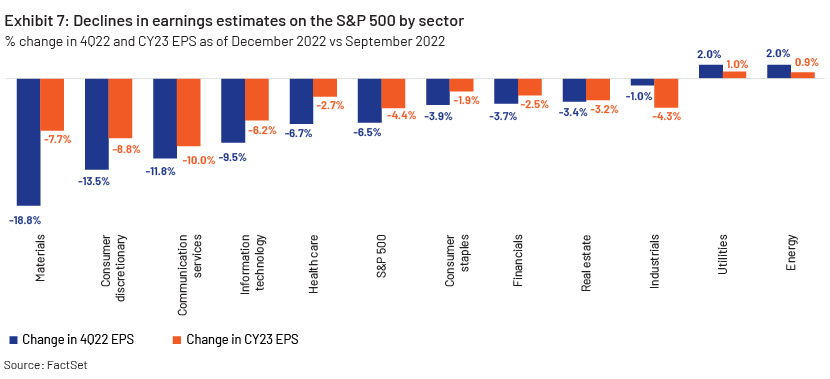

The US Fed’s expectation of macroeconomic conditions has deteriorated significantly, with real GDP expected to grow 0.5% in 2023 (vs the earlier expectation of 2.2%), with benchmark rates also expected to be significantly higher (Exhibit 1) as the Fed hikes aggressively to engineer a soft landing and tame inflation. Expected earnings also dropped a substantial 6.5% in 4Q22, according to S&P (Exhibit 2).

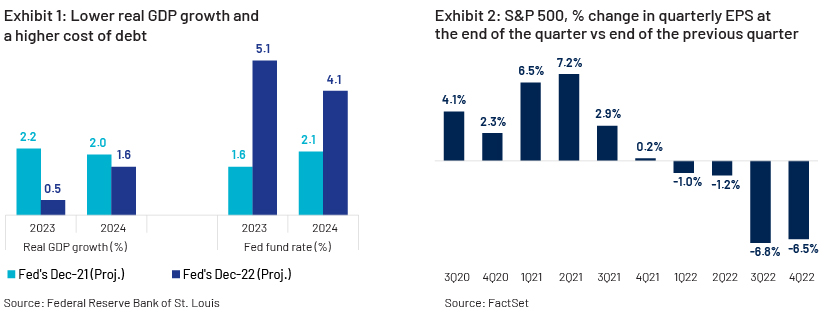

Stress in the US leveraged loan markets increased in 2H22 as a weak macro environment resulted in lower earnings and weak top-line growth, while tightening monetary policy and liquidity conditions drove refinancing costs higher. Consequently, leverage ratios (Exhibit 3) and debt affordability have been deteriorating across the US leveraged loan markets and are expected to continue doing so in 2023

Tough macro + Weak liquidity = Higher default rates

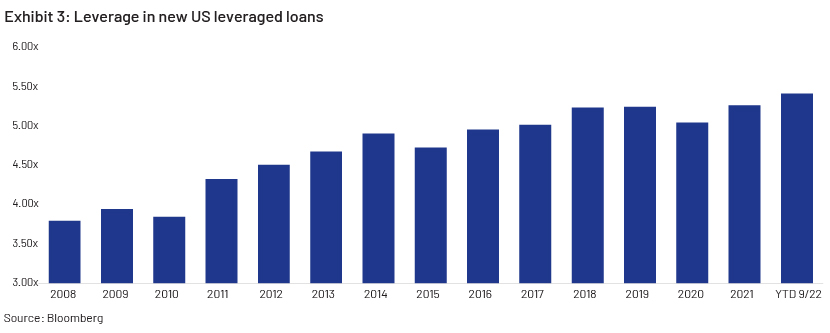

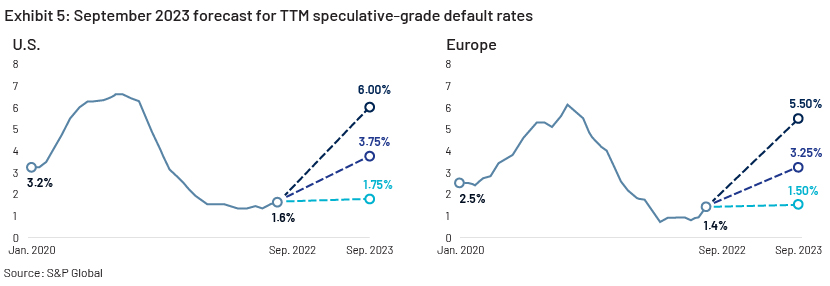

Default rates in high-yield and leveraged loans in the US and Europe (compared below) are set to increase due to the double whammy of lower earnings and a higher cost of capital. Fitch Ratings (Exhibit 4) believes the US institutional high-yield 2023 default rate has risen by 200-250bps and the US leveraged loan default rate by 75-125bps since 2021 end.

This would have a multiplier effect on lower-rated debt instruments, and default rates in speculative-grade debt instruments are expected to be steeper (Exhibit 5).

…and create opportunity in the distressed space

Inexpensive liquidity is now a thing of the past; tightening monetary policies would result in reduced earnings. As such, the environment seems ripe for distressed debt players. Not surprisingly, Bloomberg statistics (Exhibit 6) suggest that the distressed debt market in the US alone jumped more than 3x to USD294bn in the 12 months to December 2022 and is expected to grow further in the coming year. The real estate crisis in China and stress in the media and entertainment and real estate sectors in selected geographies in Europe and the US would continue to present opportunities for distressed debt managers.

Fitch expects defaults of roughly USD40bn of fresh volume in 2023, the third-largest amount since Fitch began tracking in 2007. The agency expects 60 defaults this year; this is high compared to the 36 defaults averaged over 2016-19 and a sharp acceleration from 2022. This would present further investment opportunities to distressed investors.

Opportunities in different sectors…

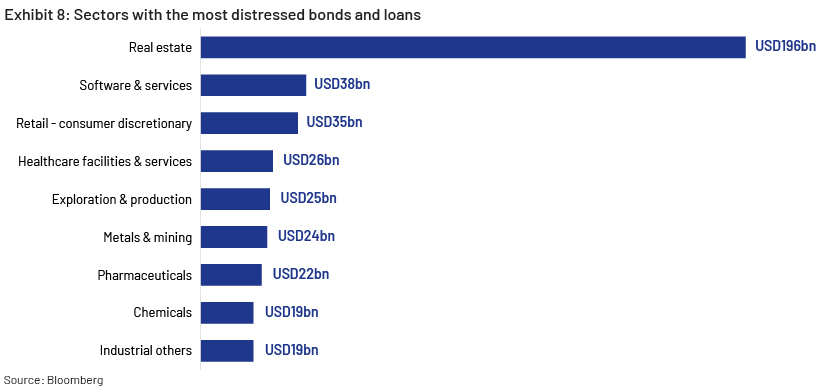

Nine sectors in the US show declines in earnings estimates (Exhibit 7); the sector showing the most distress globally is real estate (Exhibit 8), of c.USD196bn, in part due to the ongoing stress in China’s real estate market (which represents one-fourth of China’s economic output and one-fourth of China’s bank loans). The UK housing market is also expected to slow, with all housing indicators flashing red; the average house price dropped by 2.5% in 4Q22, according to the latest Halifax House Price Index.

Opportunities leading to increased investment by hedge funds

Twenty-three percent of the respondents to a BNP Paribas survey showed they were increasing their allocations to speculate on "special situations" such as bankruptcy or restructuring, up by 10% from 2022, along with an expected increase of 35% of allocations to hedge funds focused on US corporate debt and 29% on European credit over the next 12 months. These investors are increasing allocations to distressed funds, hoping to buy cheap debt for companies looking for a new source of capital in this slowing economy.

Returns in the distressed space

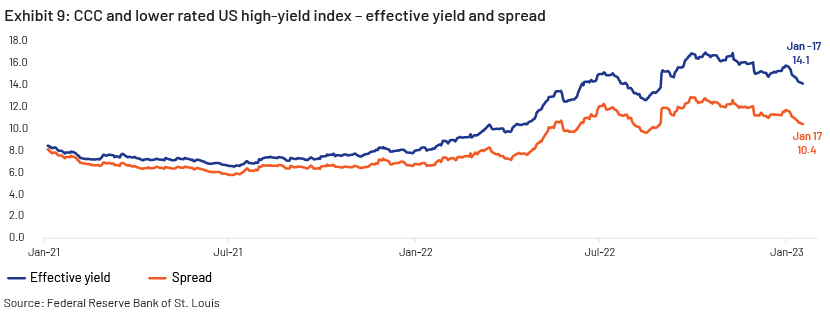

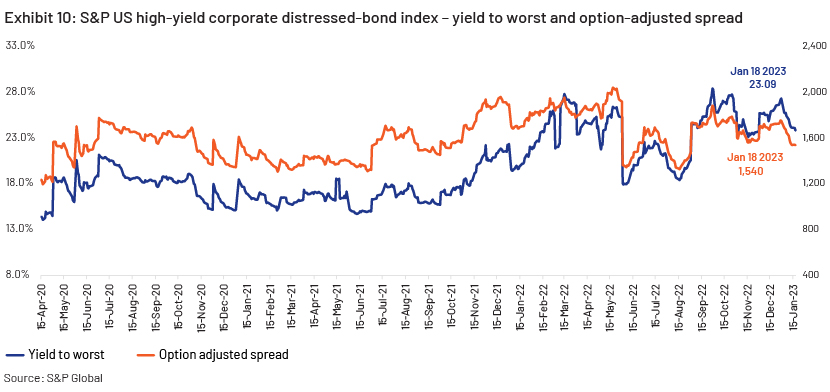

Yield on CCC and lower rated US high-yield index (Exhibit 9) has widened by more than 550bps over the past two years to 14.1%, with a similar trend in distressed-space yields (Exhibit 10). This widening reflects weakening earnings, a lack of investor confidence and fund outflows in the riskiest portion of the fixed income universe. However, this trend has shown a hint of reversal, with bonds rated CCC gaining 2.74% in first week of January 2022, outpacing the 2.35% gains notched by bonds in the B tier, according to Bloomberg, indicating that investors are beginning to increase their exposure towards distressed debt.

How Acuity Knowledge Partners can help

The current market situation has shifted the focus of credit investors, possibly making this the best investment scenario for distressed debt investing since the global financial crisis. The significant increase in debt outstanding, high leverage and deteriorating investor protections (covenant-lite loans and bonds) have laid the foundation for distressed opportunities to flourish, with relatively less recovery. Increased demand for distressed investing requiring opportunistic investment and in-time decision making would make the distressed debt investor’s job more challenging.

We have been supporting distressed debt managers and hedge fund investors since 2007, enhancing our domain expertise and our ability to provide customised solutions. We provide sufficient bandwidth and handle high-volume work such as screening, modelling and compiling call notes so onshore teams could focus on valuation and high-value-add work.

Sources:

Tags:

What's your view?

About the Authors

Gaurav has over 14 years of experience in investment research and corporate finance, with expertise in High Yield corporate and alternate investing strategies. He currently provides research and analytical support in fixed income investments in the developed markets to one of the largest alternate asset manager, globally. He has wide experience in fundamental credit research, target identification, due diligence support, portfolio monitoring (mainly high yield debt) and equity investments in various sectors from developed markets. Gaurav has extensively worked on relative valuation and peer analysis; creation and updating operating/financial models; industry and macro research. He holds a PGDM (equivalent to MBA) from IMT Nagpur.

Rohit has been a part of Acuity’s investment research team for over 3 years. He currently supports the Principal Finance division of a big financial group, and is the primary point of contact for UK region for the client. He provides the research and analytical support to the client in preparing and monitoring the financial models on high yield investments. He has an extensive experience in providing the due diligence support, SWOT analysis, Peer Benchmarking and preparing presentation decks for the clients. Rohit holds a MBA degree from University School of Management Studies, Delhi.

Like the way we think?

Next time we post something new, we'll send it to your inbox