Published on June 21, 2024 by Ambarish Srivastava

Infrastructure investment refers to allocating capital to construct physical systems and structures essential for the functioning of society and the economy. This includes investment in transport (roads, bridges, airports), utilities (water, electricity, gas), communication (telecom, internet) and social (hospitals, schools) infrastructure.

Infrastructure investment was traditionally dominated by governments, but with the advent of public-private partnerships, infrastructure investment began attracting significant investor interest. Subsequently, private-capital funds with a focus on infrastructure investment, especially on “real assets”, emerged as providers of required capital. AuM in real assets increased at a CAGR of 17% while overall private-capital AuM increased at a CAGR of 13%[1] over 2012-22, according to PitchBook.

This growth in AuM was driven by a range of supportive trends now fuelling the growth of infrastructure investment. This blog discusses a few of these.

Sustainable and green infrastructure – the new gold rush

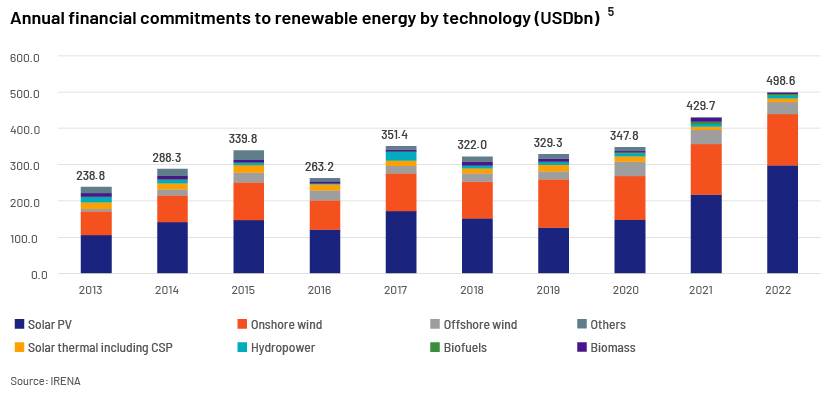

There is a growing trend towards investing in sustainable infrastructure that supports environmental goals, such as renewable-energy projects (wind, solar, hydroelectric power), energy-efficient buildings and electric vehicle (EV)-charging stations. This is driven[2] by (1) rising market demand, fuelled by increasing awareness of climate change and supportive government policies to curb carbon emissions, (2) improving efficiencies in renewable technologies, especially in solar and wind energies, and (3) a strong focus on ESG considerations.

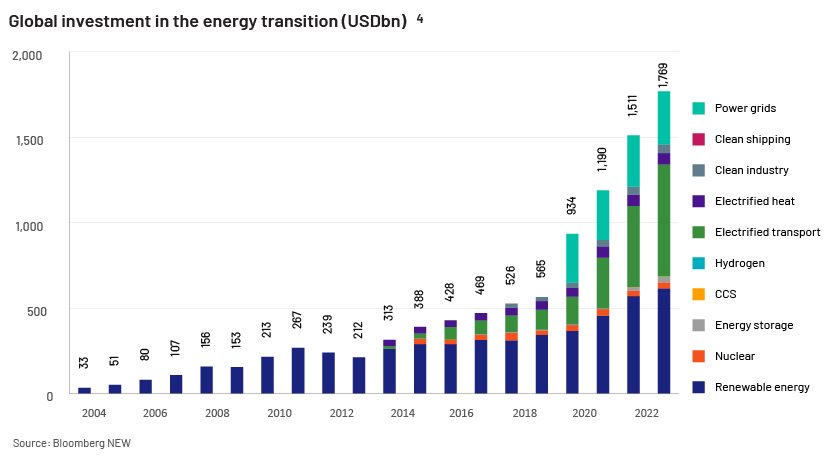

Investment in the energy transition reached USD18tn in 2023, of which three-fourths was from private sources. Major expansion started in 2020, with significant flow to power grids, transporting electricity and renewable energy.[3]

The EV-charging market is expected to grow at a CAGR in the range of 8.8%[6] to 44.5%[7] in the next six to seven years. Energy-efficient buildings, part of the broader ESG trends in commercial real estate, are the next frontier, driving significant interest among real estate investors.

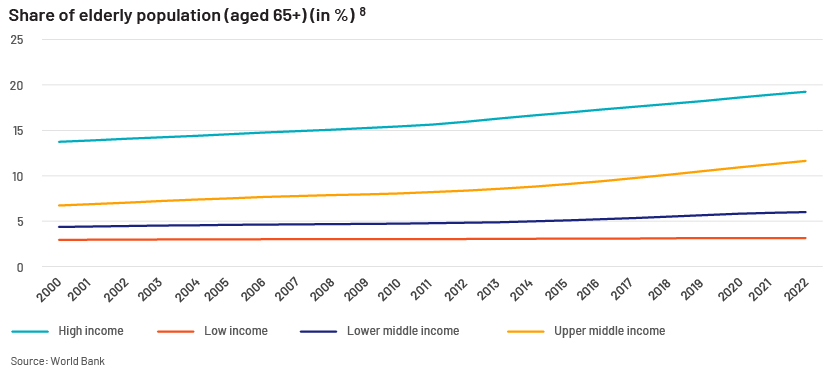

Demographic shifts influence demand for certain types of infrastructure

Ageing populations in developed countries are driving demand for healthcare and senior living facilities. In addition to supportive technologies in healthcare, developed countries are adding hospital capacity, with an increase in private investment, especially in Europe.

For example, in Europe, governments, healthcare providers and financiers are facing challenges in developing infrastructure for health services. Such infrastructure is capital-intensive, and there is uncertainty due to rapid changes in technology and policy. In such a scenario, regions such as Europe that traditionally relied on public funding are increasing the participation of private funding.[9]

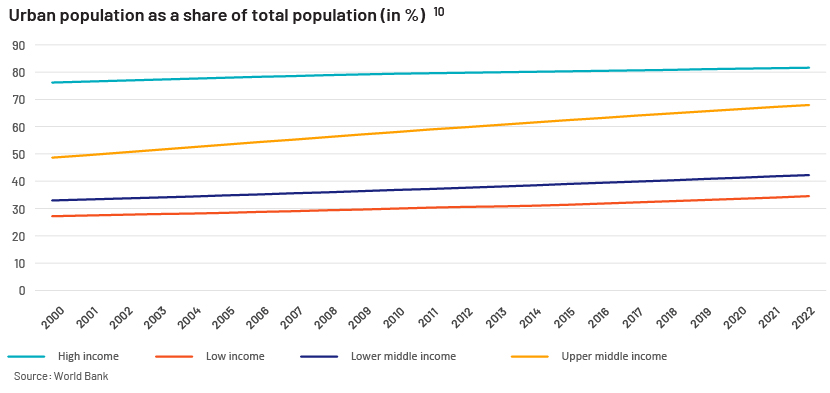

Urbanisation in developing countries is also increasing, driving demand for infrastructure investment.

Countries in the upper-middle-income category are witnessing rapid urbanisation, leading to congested cities and requiring substantial investment in all civic services and infrastructure, including mass transport, affordable housing and sanitation. The table below lists examples of recent mass-transit projects that have attracted approximately USD20bn in investment.

| Project | Country | Description |

| Mumbai Metro Line 3 | India | Connect Colaba in South Mumbai to the Bandra-Kurla Complex |

| Bengaluru Metro Phase 2 | India | Expand the metro network by 150km |

| Jakarta Mass Rapid Transit (MRT) Phase 2A | Indonesia | Extend the MRT line from Bundaran HI to Kota |

| Ho Chi Minh City Metro Line 1 | Vietnam | Connect Ben Thanh Market to Suoi Tien |

| Lagos Rail Mass Transit Blue Line | Nigeria | Connect Okokomaiko to Lagos Marina |

| Addis Ababa Light Rail Transit Phase 2 | Ethiopia | Extend the light rail network by 10km |

| Cairo Metro Line 4 Phase 2 | Egypt | Extend the metro line from El Matariya to New Cairo |

| Mexico City Metro Line 12 Extension | Mexico | Extend the metro line by 7km |

| Bogota TransMilenio Phase III | Colombia | Extend the bus rapid transit system by 20km |

| Santiago Metro Line 7 | Chile | Connect Renca to Vitacura |

Public-private partnerships (PPPs) are gaining traction, especially in the Americas

Governments are increasingly turning to PPPs to finance, build and operate infrastructure projects. PPPs ensure that returns have minimal impact amid volatility, such as high interest rates, inflation or both.[11] PPPs in infrastructure development are expected to reduce default on infrastructure loans.[12]

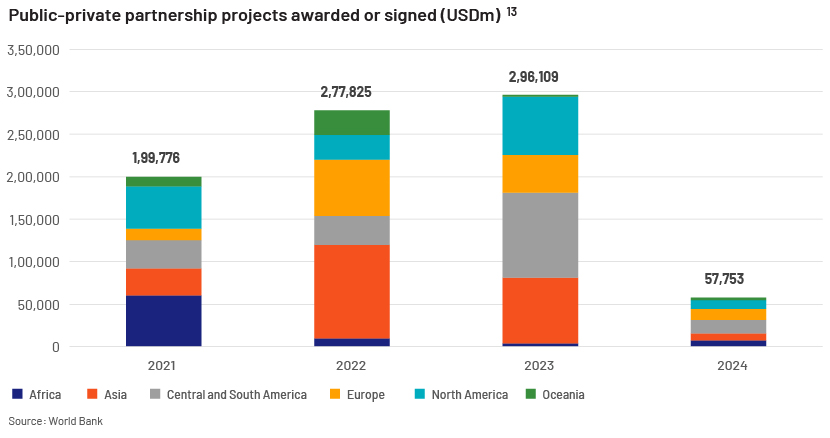

The value of PPP projects increased from 2021 to 2023, with significant activity in the Americas – North America (17% CAGR) and Central and South America (73%). Europe and Asia also delivered growth in 2022 compared to 2021, but saw a decline in 2023 compared to 2022.

PPPs enable sharing risks and rewards between the public and private sectors and can lead to more efficient project delivery. The three prominent PPP models in practice[14] are (1) build-operate-transfer (BOT), (2) build-own-operate-transfer (BOOT) and (3) design-build-finance-operate (DBFO).

Outlook for infrastructure investment is strong

There is strong demand for infrastructure to meet the needs of growing populations and resource requirements such as for energy and data. As a result, infrastructure investment, especially in real assets, is rising significantly, driving investor interest in this sector. Infrastructure support to private markets will continue to play a pivotal role in shaping the future of global infrastructure investment, ensuring efficient capital deployment and sustained economic growth.

How Acuity Knowledge Partners can help

We have years of experience in serving infrastructure strategies of global private equity firms in all key infrastructure sectors – core and core+, providing support on deal sourcing, due diligence, portfolio management, CRM and back- and middle-office operations.

Sources

-

[1] 2Q 2024 PitchBook Analyst Note: Private Capital's Path to $20 Trillion

-

[2] https://bspeclub.com/the-rising-tide-of-private-equity-in-renewable-energy/

-

[3] Global Clean Energy Investment Jumps 17%, Hits $1.8 Trillion in 2023, According to BloombergNEF Report | BloombergNEF (bnef.com)

-

[4] Global Clean Energy Investment Jumps 17%, Hits $1.8 Trillion in 2023, According to BloombergNEF Report | BloombergNEF (bnef.com)

-

[6] EV Charging Station Market Size, Share, Forecast, Report, 2030 (marketsandmarkets.com)

-

[11] https://www.minterellison.com/articles/2023-investment-and-ma-trends-in-infrastructure

-

[12] https://cdn.gihub.org/umbraco/media/5416/infrastructure-monitor-report-2023.pdf

-

[14] https://www.afr.com/companies/infrastructure/public-private-partnerships-to-ease-the-burden-20230711-p5dndc

Tags:

What's your view?

About the Author

Ambarish has about 17 years of experience in business research, analysis and consulting. He is engaged in leading deep-dive strategic projects, due-diligence support, issue-focused trend analysis and similar assignments for our Private Markets clients. His previous experience includes tenures with startups, the Big Four and consulting organisations, where he focused on industry studies, price forecasting, company analysis, macroeconomic studies and other strategic engagements.

Like the way we think?

Next time we post something new, we'll send it to your inbox