Published on February 22, 2023 by Tharindu Weerasinghe

Neobanks, a new generation of financial institutions that operate exclusively in the digital space, benefited immensely from the pandemic due to their contactless service offerings and gained traction, outperforming traditional banks. The low-cost operating model and the superior customer experience they enable have disrupted the banking sector and created an urgency for traditional banks to transform their operating structures. The trading premium of some neobanks over traditional banks is a testament to shareholders valuing their high ROE and growth, which traditional banks can strive to achieve.

Low-cost operating model and superior customer experience of neobanks disrupt the banking sector

Low-cost operating structure: Neobanks are able to reduce operating costs significantly by having minimum physical infrastructure compared with traditional banks. Most startups have distributed operating cost benefits such as maintenance fees, overdraft fees and ATM network access fees, reducing end-customer fees.

Superior customer experience: Almost all neobank apps are designed to be user-friendly, with streamlined processes for on-boarding and account opening. Startups also offer value-added services not provided by traditional banks, such as 24x7 access to banking and online customer support. SoFi, a US-based online lender, partnered with Coinbase in 2019 to add cryptocurrency trading ability to its investment platform.

In contrast to traditional banks, neobanks are able to personalise the user experience, targeting the non-banking population and segments not satisfied with the traditional banking systems. Gen Z customers accounted for 37% (as of 2021) of those who had chosen neobanks as their primary financial relationships (PFRs), according to EY.

Neobanks prompt traditional banks to focus more on innovation, with partnerships being the most popular strategy

Signs of change have already surfaced, with banks such as Citigroup, BBVA Compass, Bank of America and Capital One sharing their banking APIs with fintech startups and other businesses via developer hubs. Citibank’s API provides developers with access to eight categories, including account management, peer-to-peer payments, money transfer to institutions, Citi rewards, investment purchases and account authorisation.

Partnerships – a popular option for neobanks that are heavily regulated and traditional banks that are behind in innovation

. As obtaining a full banking licence in countries such as the US and India is difficult for neobanks, most startups have depended on other avenues such as partnerships with traditional banks, partnerships with BIN sponsors or fintech licences. In 2015, US-based neobank Zenbank partnered with WSFS Bank, a federal savings bank in the US, to launch the Zenbank account, a mobile-based multi-currency account targeting customers who live, work or travel across borders.Partnerships with neobanks have created opportunities for small and mid-scale regional banks to add value and convenience to customers, similar to top banks in the sector. In 2015, Radius Bank, a full-service regional bank in the US, partnered with neobank Aspiration to offer the Aspiration Summit Account. The high-yield personal checking account offered a higher interest rate than the market and excluded a monthly maintenance fee or minimum balance requirements. Radius Bank partnered with mobile payment startup LevelUp in 2013 to offer Radius Pay, a mobile payment and reward app.

Need for industry consolidation increases M&A activity in the banking space

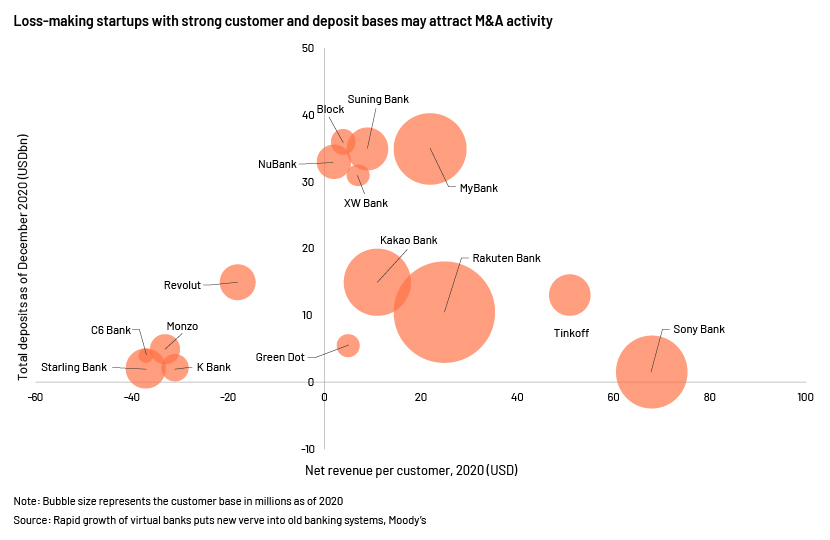

As more than 90% of neobanks are making losses, mainly due to limited revenue-generation capacity and the small size of customer deposits, M&A has become a viable exit route for most underperforming neobank startups.

In 2021, PNC Bank completed the acquisition of BBVA USA, with expected cost savings of over USD900m (equal to 35% of BBVA USA’s non-interest expenses) by 2022. The acquisition will see PNC Bank adopting BBVA’s data and certain technologies, while closing two of BBVA’s three neobank offerings – Simple and Azlo.

Neobanks with high ROE and growth see a trading premium over traditional banks

Valuation comparison between traditional banks and neobanks is a challenge due to the early stage neobank startups are in and the fewer listings. An analysis of listed neobanks indicates their trading premium over traditional banks, suggesting investors have rewarded the high growth and superior ROE of these listed neobanks.

These high ROEs are a result of their low operating cost structures. Compared to traditional banks, neobanks enjoy low customer acquisition costs and operating expenditure. Most of the customer acquisition is driven by social media and viral marketing, and new customers are often attracted by free services and lower fees. Furthermore, most of neobanks’ back-end technology is outsourced via APIs, resulting in lower capital expenditure. The agile nature of the operating structure also enables neobanks to scale up much faster than a traditional bank.

How Acuity Knowledge Partners can help

We have extensive experience in working with banks and financial institutions to transform their operating structures. Launched in September 2021, our retail lending support services help banks optimise their retail banking value chains across origination, processing, underwriting and closing and post-closing activities. We support all retail lending channels, including consumer mortgage, credit cards, personal loans and auto loans. Our loan support officers standardise and streamline the end-to-end loan approval, underwriting and servicing processes, aided by tech-enabled platforms, and help identify red flags in loan applications, such as high credit card utilisation, late payments or lack of credit history. Recent capacity additions allow us to support banks of all sizes looking to become more agile.

Sources:

-

https://realresearcher.com/media/younger-millennials-gen-z-prefer-neobanks-for-their-banking-needs/

-

https://www.finextra.com/newsarticle/36186/sofi-applies-for-bank-charter

-

https://files.pitchbook.com/website/files/pdf/PitchBook_Q2_2020_Emerging_Tech_Research_Fintech.pdf

-

https://www.globenewswire.com/news-release/2015/07/14/1302467/0/en/Radius-Bank-

-

https://www.nerdwallet.com/article/banking/neobanks-fintechs-to-watch

-

https://www.sia-partners.com/en/insights/publications/disruptive-fintech-during-covid-19-pandemic

What's your view?

About the Author

Tharindu Weerasinghe has over 12 years of work experience in auditing, research and analytics, with seven years in investment research at Acuity Knowledge Partners Sri Lanka and Costa Rica offices. He currently supports a European buy-side client. His expertise spans across a broad range of industries, financial modeling, and advance excel. He is an Associate Member of CIMA (UK) and holds a Bachelor’s degree in Statistics and Industrial Management from Wayamba University.

Like the way we think?

Next time we post something new, we'll send it to your inbox