Published on January 11, 2023 by Sandeep Somasekharannair

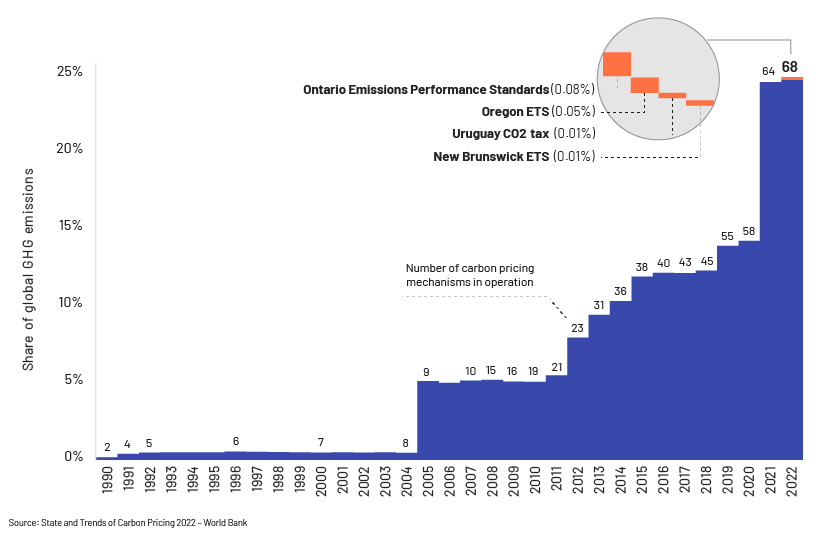

The world is facing an unprecedented crisis amid the aftershocks of the pandemic, financial turmoil and Russia’s invasion of Ukraine. However, climate change poses a bigger threat to humanity, according to the World Economic Forum’s latest Global Risks report (see Figure 1). Increasing temperatures are causing widespread destruction and impacting the livelihoods of billions. The Corporate Knights Earth Index report finds that the G20 countries, responsible for more than 75% of the world’s greenhouse gas (GHG) emissions, are in no way near meeting their climate goals. Since implementation of robust climate change-related policies is long overdue, it is crucial to consider measures such as carbon pricing to combat climate change. Carbon pricing is considered to be one of the best tools available for preventing extreme weather conditions, largely because of its unique features that enable it to affect every major sector that contributes to emissions – from electricity to industrial activity to transport. We believe a well-structured carbon pricing policy would help limit global warming to 1.5°C.

What is carbon pricing?

The general public bears the cost of pollution caused by GHG emissions in the form of floods, droughts or other extreme weather conditions. Carbon pricing captures these costs and charges the parties responsible for the emissions. The cost of emissions includes damage to agricultural crops, healthcare costs due to calamities and damage to property. Instead of forcing emitters to reduce emissions, carbon pricing is an economic signal that forces them to transform the way they operate and reduce emissions or pay a price for their emissions. This helps mobilise investments to stimulate clean-energy technology and innovate low-carbon drivers for economic growth.

It is a market-based incentive that provides economic incentives to countries or businesses to reduce their environmental footprint.

There are two main types of carbon pricing:

-

Emission trading system (ETS) or cap-and-trade system

-

Carbon taxes

ETS or cap-and-trade system

An ETS, also known as cap-and-trade, is a tradeable permit for GHG emissions. Tradeable carbon units are some of the most effective weapons in the battle against climate change. This system determines how much can be emitted and provides a financial incentive to reduce emissions. A cap is set on the total emissions companies can discharge each year. A fixed number of units are issued, and companies have to buy these allowances to cover their emissions or face consequences in the form of hefty fines. If a company does not have enough allowance, it needs to reduce emissions or buy extra allowance from a company that has excess allowance.

Carbon tax

A carbon tax is a form of tax charged on pollution. It is a fee imposed for burning carbon-based fuels such as coal, oil and gas. This is meant to reduce the use of fossil fuels and encourage parties to invest in more environmentally friendly alternatives, eventually reducing the impact of climate change.

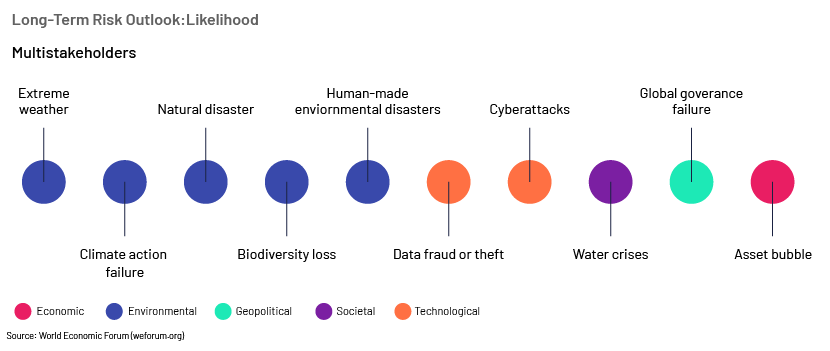

Understanding carbon credit markets

There are a number of demand/supply sources and frameworks that guide the operations of global credit markets. The credit mechanisms control supply requirements, while demand requirements are obtained from a collection of compliance obligations accepted under international agreements.

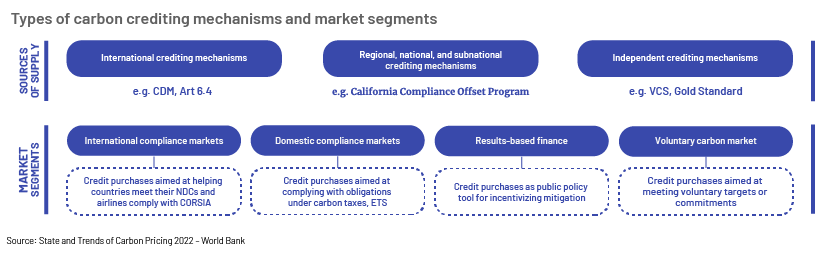

Share of global GHG emissions covered by carbon-pricing instruments

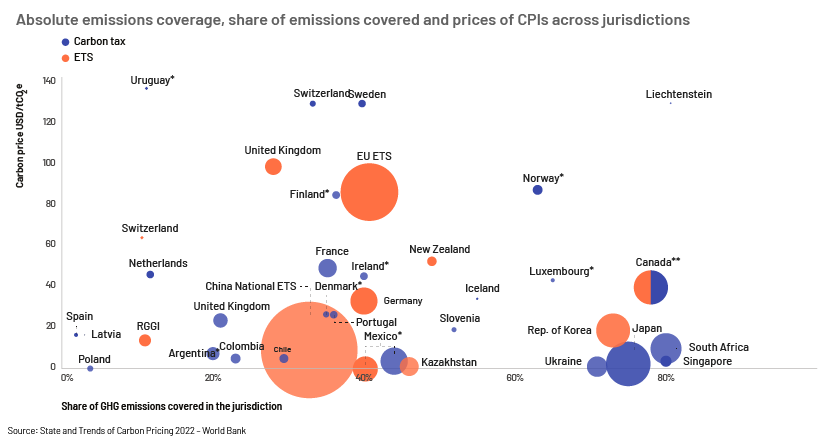

Sixty-eight carbon-pricing instruments are currently in operation, covering 23% of global GHG emissions, according to the latest World Bank report. These include 37 carbon taxes and 34 ETSs.

The International Maritime Organization is considering placing a price on emissions from international shipping activities, which account for nearly 3% of global carbon emissions.

Markets for carbon credits

-

China’s carbon market is the world’s largest by emissions. China launched its carbon-trading market on 16 July 2021, beginning with the power sector, which accounts for more than 40% of the country’s combined emissions. It is also planning to relaunch its terminated voluntary carbon credits plan – China Certified Emission Reduction (CCER) – soon. Despite a record 99% compliance rate, there are allegations against a number of companies for using falsified emissions data to show achievement of targets, according to the Ministry of Ecology and Environment.

-

The European Union (EU) ETS is the largest in the world by traded value. This was set up in 2005 to combat global warming and is the world’s first scheme. Amendments to the system were approved by Members of the European Parliament (MEPs) on 17 May 2022. The EU’s plan to reduce GHG emissions by at least 55% compared to 1990 levels by 2030 was formalised; this is known as the “Fit for 55” initiative. This would help the EU achieve climate neutrality by 2050.

Global carbon-pricing revenue

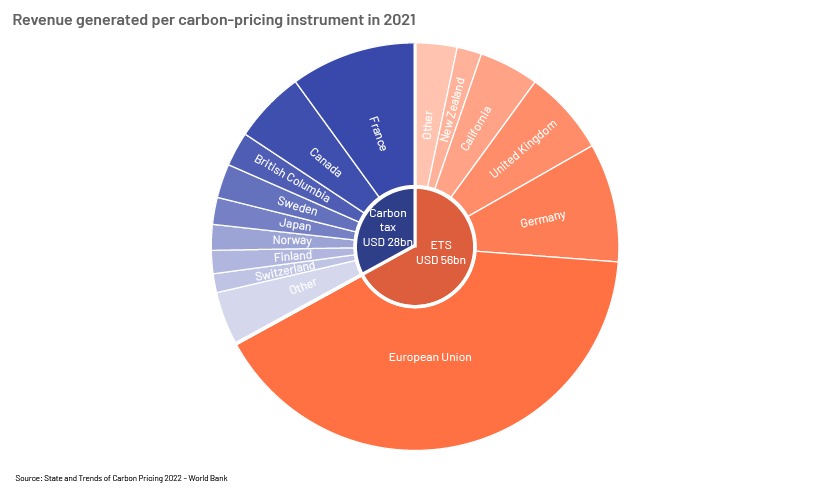

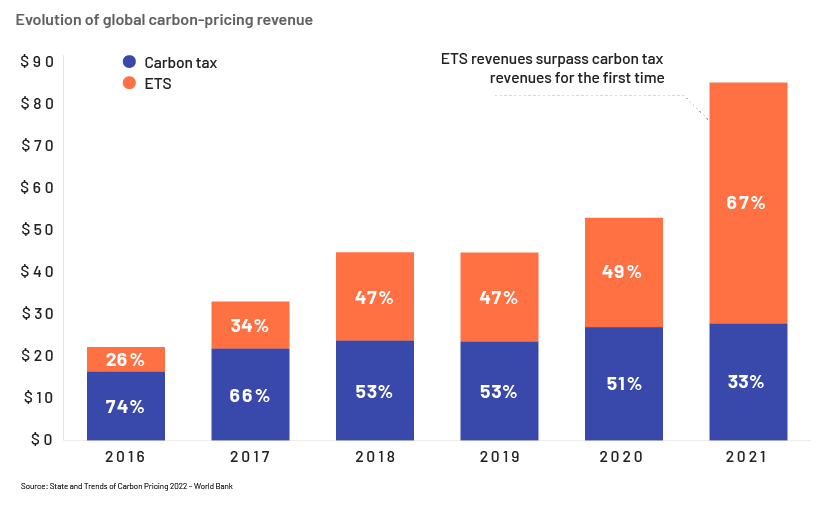

Revenue generated from carbon pricing increased a significant 60% to USD84bn in 2021 from 2020. These funds helped drive a sustainable economic revival, financing long-term fiscal changes and providing financial backup for communities to transition to a low-carbon future, according to the World Bank’s annual State and Trends of Carbon Pricing report. Despite reporting a spike in revenue in many jurisdictions, prices generally remained below requirements to meet the Paris Agreement’s goals.

For the first time, revenue generated from ETSs exceeded revenue from carbon taxes, due to increasing prices of ETS instruments compared to fixed instruments and the higher contribution of auctioned allowances versus free allocation.

Impact of rising energy prices on carbon pricing

Global oil and gas prices have increased sharply due to a number of reasons, including increased demand on the back of economic recovery, supply constraints and the Ukraine/Russia conflict. Oil and gas prices are expected to continue increasing, particularly in the EU, in light of the commitments to reduce reliance on Russian oil and gas. Inflation has skyrocketed in many countries, impacting the livelihoods of economically weaker sections of society, and putting a price on carbon would worsen the situation. However, this also presents an opportunity for governments to invest heavily in renewable energy sources in the long run, reducing the need for energy imports and lowering energy prices for consumers.

Main benefits of carbon pricing

-

Flexibility – It enables companies to decide on the most efficient method to control emissions

-

Equal marginal costs of abatement – A uniform carbon price enables companies to equalise costs of controlling emissions

-

Encourages conservation – It encourages individuals and businesses to reduce emissions more than required by regulations. Unlike carbon pricing, conventional regulations do not offer financial incentives

-

Economic improvements – Revenue generated from carbon pricing can be allocated to improve infrastructure and fund green alternatives

-

Human health – Air pollution causes health issues, and carbon pricing encourages emitters to mitigate these

-

Employment opportunities – The transition to clean energy would create more jobs than does the traditional fossil fuel sector

-

Energy independence – Recent geopolitical tensions and rising oil prices reiterate the need for energy independence; carbon pricing could help countries achieve this

-

Affordable clean energy – The correct implementation of carbon pricing would help reach the net zero target much faster, and the revenue generated through programmes such as carbon dividends would keep energy affordable for many

Conclusion

Many are still unfamiliar with “carbon credits”, and to ensure a cleaner environment for future generations, a widespread awareness campaign is necessary. Despite the economic impact of the pandemic, a number of countries are accelerating the transition through pledges to become carbon neutral. Meeting these commitments largely depends on the mass implementation of innovative mechanisms such as carbon pricing that combine green recovery policy interventions with energy transformation strategies.

How Acuity Knowledge Partners can help

We are the preferred partner for sustainable finance solutions. We offer our expertise in carbon trading mechanisms and clean-energy markets, along with in-depth market research capabilities across the energy value chain, helping some of the biggest companies in the world transition to sustainability and carbon-neutral operations. Our large pool of experts is experienced in the power and energy sectors and support companies active in investing, developing and promoting clean energy and cleantech solutions across geographies.

Sources:

What's your view?

About the Author

Sandeep Somasekharannair is part of the Commercial Lending team at Acuity Knowledge Partners, Bangalore. He has been associated with Acuity Knowledge Partners since 2019 and currently supports a leading UK based bank in monitoring the power and infrastructure portfolio. He has over 10 years of experience in Commercial and Retail lending in a previous role with a leading Australian Bank.

Like the way we think?

Next time we post something new, we'll send it to your inbox