Published on October 10, 2024 by Manpreet Singh Jassal

Why Are Indian Banks Struggling with Deposit Mobilisation?

Banks are finding it challenging to retain depositors' savings in current accounts and savings accounts (CASAs), critical for maintaining balance-sheet strength and which function as low-cost funds. Customers find little incentive to keep their money deposited for longer due to expectations of higher returns, largely driven by high inflation. Consequently, they tend to shift their funds to riskier financial instruments, hoping for better returns, aided by new-age fintech and other tech-enabled financial services platforms that deploy money in capital markets. Banks are witnessing higher transaction flows, with it becoming easier for customers to instantly transfer or withdraw funds from their accounts. These return to banks as wholesale deposits, which are less stable than retail deposits. This pressures banks to provide more innovative products, such as term deposit sweeps (enabling transfer of excess funds from the savings account to the term deposit account). Banks are, therefore, implementing strategies to introduce more innovative solutions to ensure robust long-term retail franchise liability with less cash outflow.

-

Widening credit growth over deposits leading to higher CD ratios:

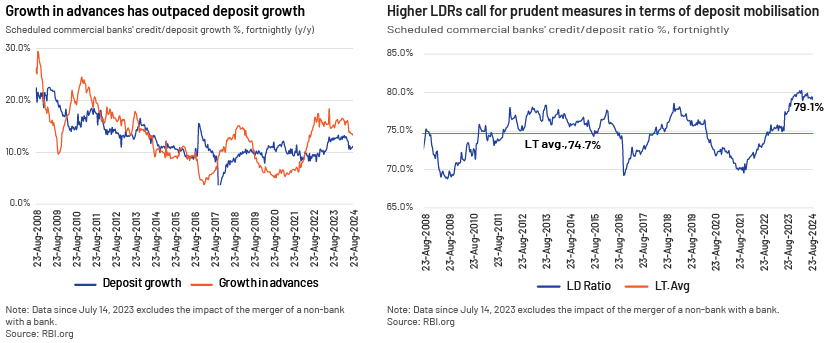

Since the start of the pandemic, lending in India has seen strong traction, especially in the retail credit segment, which has contributed to overall lending growth at a c.15% CAGR since March 2020, while deposits have lagged, at a CAGR of c.11%. Bank credit grew 13.3% y/y vs deposit growth at 11.1% y/y, according to fortnightly data reported by the Reserve Bank of India (RBI) on 6 September 2024. With the incremental pace of lending growth rates outpacing deposits, the loans-to-deposits ratio (LDR) has increased to an all-time high of c.80% vs levels of c.78% witnessed in 2013.

Chart 1: Growth in advances has outpaced deposit growth

Chart 2: Higher LDRs call for prudent measures in terms of deposit mobilisation

-

Deposit accretion is reducing, while demand for incremental deposits increases:

Banks raise and lend money and, therefore, require dynamic asset liability management. The need to fund excess demand squeezes liquidity, making deposit mobilisation critical. Additionally, consumers are parking funds in higher-yielding assets such as capital markets and other financial intermediaries. This presents structural issues for Indian banks in sourcing funds, squeezing their margins, as they would have to continue offering higher deposit rates.

Key Challenges Faced by Indian Banks in Mobilising Deposits

Amid high interest rates:

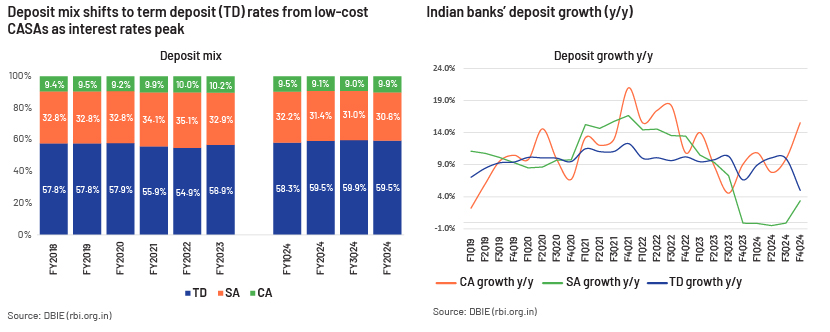

In this higher rate environment, where the repo rate has already peaked and inflation remains elevated, it is only natural for customers to lack the motivation to park their savings in CASAs (which offer low-cost funds for banks) as they seek higher rates such as those term deposits offer, which have traditionally been where they have parked funds for the longer term. The RBI has recently noted numerous instances of structural changes in customers' savings and their investment in riskier alternatives such as capital markets and other financial intermediaries instead of parking their funds in banks, increasing challenges in deposit mobilisation.

Stiff competition for deposits as customers’ investment-related preferences change:

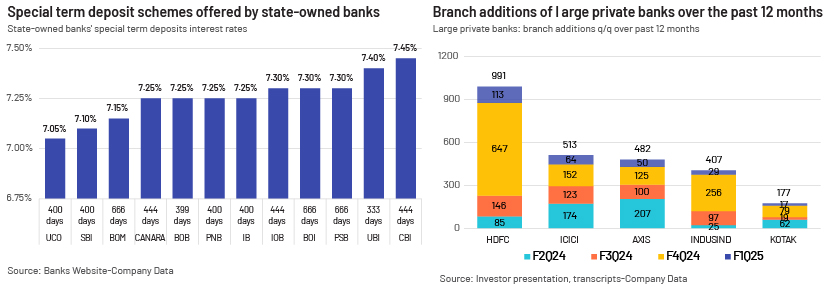

Since the pandemic, we have seen a shift in customer preference in terms of their investment of household savings in alternative assets such as stocks and mutual funds that have generated higher returns than term deposits, which have managed only to beat inflation (plus c.1%/2%). All state-owned banks (which hold c.60% of total system deposits) have launched special deposit schemes to attract deposits and are offering higher interest rates – 7.15-7.30% for tenure less than two years.

Investors no longer find it lucrative to park their funds in CASAs, which provide banks with low-cost funds and strengthen their balance sheets (CASAs accounted for 40.5% of funds in FY24 vs 43% in FY23 and 45% in FY22).

The advent of new-age mobile applications and tech-enabled banking has made it easier for customers to instantly transfer/withdraw funds from their accounts, and this questions customer stickiness in the banking environment (source: RBI Governor’s Statement, 5 April 2024). Banks are, therefore, implementing strategies to introduce more innovative solutions to ensure robust long-term retail franchise liability with less cash outflow. To remain relevant, they are attempting to cross-sell retail asset and liability products to existing depositors to boost transactional floats.

Digital advancements threaten customer stickiness:

Banks are investing heavily in their IT to offer a wider range of digital products and provide a personalised customer experience through apps. This has helped attract new customers via digital channels, fintech partnerships and cross-selling other lending products and loans, opening new avenues to meet growing demand for credit. We expect this demand to remain strong, but banks may face constraints in money supply, which could lead to reduced lending.

New liquidity coverage ratio (LCR) requirements demand higher stable deposits to fund loans:

The RBI recently launched draft guidelines on increasing banks' liquidity requirements (currently, an LCR of 100% has to be maintained) for stable deposits received through mobile and internet banking with a higher run-off factor (unanticipated withdrawal of deposits) of 10% from 5% previously and 15% for less stable deposits, as they can be withdrawn easily and would require banks to have an adequate stock of government securities to withstand 30 days of stressed outflow of deposits; this would moderate their lending outlooks too. The new LCR guidelines would require banks to take prudent measures to attract and maintain more high-quality stable deposits.

Chart 3: Deposit mix shifts to term deposit (TD) rates from low-cost CASAs as interest rates peak

Chart 4: Indian banks’ deposit growth (y/y)

What Strategies Are Indian Banks Using to Mobilise Deposits?

New-branch opening:

Despite increased adoption of digital accounts, banks are also resorting to the tried and tested method of adding physical branches; this would partially resolve the deposit-mobilisation issue as they cater to a wider cross-section of depositors. With state-owned banks already having more branches, it is mostly the private banks that have accelerated deposit growth, and adding more branches would help in deposit mobilisation. While the digital journey has been quite rewarding, branch banking remains core to connecting with semi-urban and rural areas. For example, HDFC plans to add 1,000 branches in FY25 vs 1,481 in FY24. Kotak Bank plans to add 175-200 branches vs 150 in FY24, and others such as RBL Bank and Karur Vysya Bank are also keen to increase branches.

What New Banking Products Are Banks Offering to Retain Deposits?:

Introducing attractive term deposit schemes to reduce customer flight: Banks have launched special schemes by providing higher rates on shorter-term buckets to manage their asset-liability mismatches and are attracting deposits by offering rates 40-50bps higher than the usual rate. This is in expectation that as the interest rate cycle reverses, they would not find it difficult to service high-cost deposits for longer tenures.

Term deposit sweep-in facility, enabling automatic transfers from savings accounts to fixed deposits when the balance falls below a threshold limit, reducing the need for costly borrowing and reducing dependence on wholesale funding. This helps banks maintain short-term liabilities with longer-term assets and meet regulatory requirements by getting additional liquidity and provides an opportunity to cross-sell other banking products and services to customers. This can be explained by the following snapshot from the HDFC website.

| Particulars | SavingsMax Account | Women’s Savings Account | Kid’s Advantage Account |

| Sweep-out facility threshold | In the event of the balance in SavingsMax account exceeding / reaching Rs.1,25,000/-, the amount in excess of Rs. 1,00,000/- will be swept out in to a Fixed Deposit | In the event of the balance in Women’s Savings Account exceeding / reaching Rs.1,00,000/-, the amount in excess of Rs. 75,000/- will be swept out in to a Fixed Deposit | In the event of the balance in Kid’s Advantage account exceeding / reaching Rs.35,000/-, the amount in excess of Rs. 25,000/- will be swept out in to a Fixed Deposit |

| Minimum amount of FD booked through sweep-out | Rs 25,000/- | Rs 25,000/- | Rs 10,000/- |

| Minimum amount retained in Savings account post Sweep-out | Rs 1,00,000/- | Rs 75,000/- | Rs 25,000/- |

| Maximum amount of FD booked through sweep-out | Rs. 14,99,999/- | Rs. 14,99,999/- | Rs. 14,99,999/- |

| Example - 1 | If the balance in the a/c reaches Rs.1,35,000/-, amount retained in the a/c will be 1,00,000/- & value of FD booked will be Rs.35,000/- | If the balance in the account reaches Rs.1,10,000/-, amount retained in the a/c will be 75,000/- & value of FD booked will be Rs.35,000/- | If the balance in the account reaches Rs.40,000/-, amount retained in the a/c will be 25,000/- & value of FD booked will be Rs.15,000/- |

| Example - 2 | If the balance in the a/c reaches Rs.1,24,900/-, total amount is retained in the a/c, no fixed deposit would be booked | If the balance in the account reaches Rs.99,900/-, total amount is retained in the a/c, no fixed deposit would be booked | If the balance in the account reaches Rs.34,900/-, total amount is retained in the a/c, no fixed deposit would be booked |

Chart 5: Special term deposit schemes offered by state-owned banks

Chart 6: Branch additions of large private banks over the past 12 months

Conclusion: Navigating Deposit Pressures in a High-Rate Environment

As the monetary policy cycle shifts and the Monetary Policy Committee (MPC) initiates cuts to the policy repo rate, Indian banks are poised to face significant challenges in maintaining their current margins. This trend is likely to mirror the actions of the US Federal Reserve relating to interest rates, creating a complex environment for financial institutions.

A considerable portion of loans in India is linked to the external benchmark lending rate (EBLR), which is subject to quicker repricing than for deposits. This dynamic poses a challenge, particularly as many deposits are locked in at higher interest rates and will reprice only gradually. Consequently, banks may find themselves squeezed, as their interest income from loans may decline faster than the interest they pay on deposits.

Apart from banks' internal efforts and measures to provide innovative products and use their extensive branch networks to mobilise stable retail deposits from household savings, it is increasingly evident that funding through organic deposits is under pressure. Banks have begun sourcing more non-retail deposits to meet growing demand for credit. They need to maintain high deposit rates for an extended period of time, address new LCR requirements for unstable and digital deposits, manage their pace of lending and navigate liquidity management without compromising their margins.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners conduct in-depth research tailored to specific sectors and countries, providing insights that help clients navigate complex markets. We provide comprehensive analysis of investment opportunities, including equity and debt instruments, to assist clients in making informed investment decisions. We develop detailed profiles of sectors, including market size, growth trends, competitive landscape and key players, to help clients understand their operating environment. We conduct rigorous financial analysis, including forecasting, valuation and performance benchmarking, to support strategic decision-making. We explore emerging trends and themes that could impact sectors, helping clients stay ahead of market developments. We analyse macroeconomic indicators and foreign exchange trends to provide clients with insights on economic conditions and currency risks. We help clients build and maintain databases that support their research and decision-making processes. We also provide ongoing coverage of specific sectors, delivering timely updates and insights to keep clients informed of market changes.

Sources:

-

cd ratio: Tide turns: Deposit inflows outpace credit offtake – The Economic Times (indiatimes.com)

-

Reserve Bank of India – Scheduled Bank's Statement of Position in India (rbi.org.in)

-

Reserve Bank raises concern over falling deposit mobilisation (newindianexpress.com)

-

RBI’s new liquidity coverage guidelines for banks could slow credit growth

-

Fixed Deposit interest rates up to 9% – Compare the latest FD rates of more than 40 banks (msn.com)

-

Monetary policy in a tight spot – Opinion News | The Financial Express

What's your view?

About the Author

Manpreet has over ten years of equity research experience in sell-side account roles across various sectors. In his current role at Acuity Knowledge Partners, he covers the banking sector, showcasing proficiency in client management, idea generation, report writing, industry research, financial analysis & modeling and database management. Manpreet holds an MBA in finance and bachelor's degree in finance too.

Like the way we think?

Next time we post something new, we'll send it to your inbox