Published on March 26, 2024 by Saswata Mohanty and Akshata N. Upadhyaya

Changing landscape for technological advancement

Technology has been evolving, and a number of processes are being automated. IB firms, too, are adopting technological tools to improve their efficiency.

Wall Street has also adopted technology to improve operational efficiency and streamline processes and is positioning itself to offer better-quality services. The future of IB depends largely on how well IB firms adapt to the changing technological advancements and keep abreast of regulations.

Technology landscape

IB firms are adopting ever-evolving technology, and some of the new trending technologies have already had an impact on the market, improving operations and reducing redundancies.

Automating redundant tasks with AI:

AI helps automate tasks and improve efficiency, freeing up front-end office resources’ time to focus on client-facing activities and building relationships with stakeholders. We expect AI to help generate initial deal structures and to be used in due diligence, valuation and compliance and in drafting legal and other documents.

Benefits of implementing AI

-

JPMorgan Chase recently introduced ChatGPT-like software, a trademark product called “IndexGPT” that analyses and selects securities customised based on customer needs

-

Deutsche Bank has been developing AI strategy since 2021; it invested in expanding its AI workforce in September 2023

-

ING Group introduced Holmes, a tool to help front-end office employees accelerate background processes such as finding and using rating reports and credit documents

-

Wells Fargo introduced Fargo™, a virtual assistant to answer banking related questions

IB service vendors use AI-enabled offerings and are investing heavily in new technology.

-

Pitchbook introduced VC Exit Predictor, a tool that leverages ML and PitchBook’s database on venture capital firms, financing rounds and investors to forecast outcomes of an exit

-

Bloomberg introduced BloombergGPT, a large language model built using 50bn parameters specifically for the finance domain

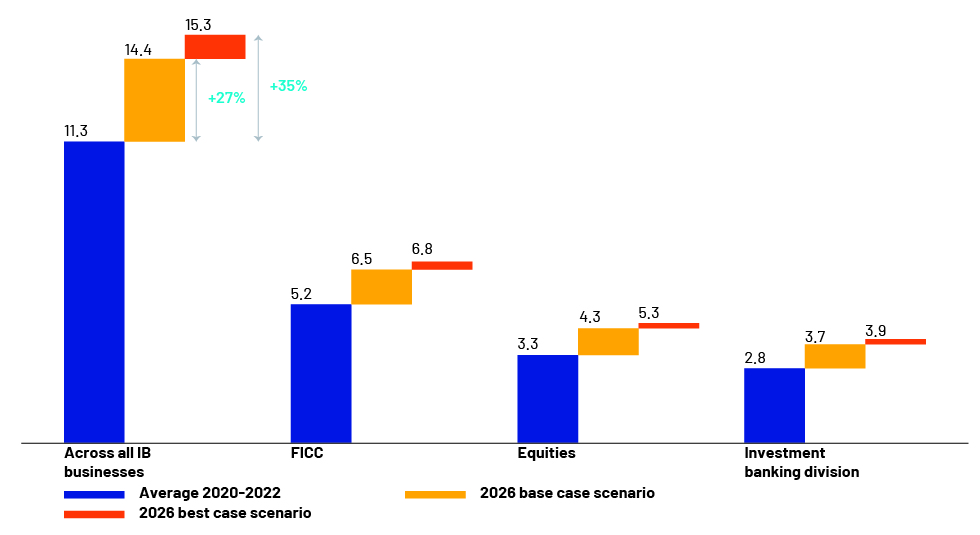

Generative AI will boost productivity unevenly across investment banking business lines Productivity gains per full-time employee (US$ million)

The use of AI will benefit IB the most, followed by equities and fixed income, currencies and commodities (FICC) trading. It is expected to increase productivity by 35% on average.

Attractive solutions from natural language programming (NLP):

NLP is a sub-field of AI. Combined with AI, NLP helps structure unstructured data. The financial services sector uses NLP to reduce the number of manual tasks, assess financial sentiment and risk associated in trading and build successful portfolios.

NLP is used mainly to locate relevant/essential information in large sets of documents and analyse quarterly results and news for the purpose of investment analysis.

NLP is widely used in equities trading, as it helps gauge financial sentiment not only via analysing financial statements but also via understanding market sentiment towards a company. NLP helps particularly when a large amount of data has to be deciphered quickly.

-

JPMorgan Chase has developed COIN, a software to help legal departments assess thousands of legal papers

With NLP gaining momentum, companies are focusing more on developing and implementing it in their operations. The NLP market is worth USD9.2bn and is expected to grow 18.4% by 2028. The focus is more on the accuracy and feasibility of NLP applications.

Growing cryptocurrency and central bank digital currency (CBDC) markets:

The recent growth of cryptocurrencies has increased interest in digital currencies. Keen investors expected regulatory restrictions on cryptocurrencies, but market momentum was positive in 2023. Bitcoin prices increased more than 70% YTD and Ethereum prices more than 30% in 2023.

Clear regulations governing the crypto market could pave the way for more investment in the digital currency market in 2024. The headwinds in the digital currency market are interest rate hikes and a slowing economy, which discourage investors from investing in riskier assets. Bitcoin and Ethereum currently account for more than two‑thirds of the market, and 2024 is likely to see other cryptocurrencies enter the market.

CBDCs are not decentralised, unlike cryptocurrencies, but recent developments in the digital assets market could pave the way for growth in CBDCs. A number of countries expect to develop and implement their own CBDCs in 2024.

The dynamic and innovative future of IB would depend largely on how well IB firms adapt to technological advancements. It is, therefore, important that they stay abreast of regulatory restrictions and risks associated with technology adaptation.

What's your view?

About the Authors

Saswata Mohanty has over 13 years of experience working across different value chain in the Investment Banking domain. Currently, supports Public Finance / Project Finance team, with a focus on Municipal Finance and Infrastructure - Public Private Partnership(P3). He is also responsible for quality check and overall functions of Investment Banking team, for a U.S. based mid-market Investment Bank, in Bangalore. Prior to joining Acuity, he was with Verity Knowledge Solution (affiliate of UBS) for close to 6 years. He holds a Master’s degree in Business Administration in Finance.

Akshata is a Delivery Lead at Acuity Knowledge Partners, completing a decade of experience since joining the company as a fresh graduate. Akshata is an integral member of a mid-market U.S. Investment Bank’s team based in Bangalore. Throughout her tenure, she has adeptly navigated through various roles, supporting a diverse range of sectors and product teams. She actively engages with onshore bankers and supports across the value chain, from deal origination to execution, for various live pitches. Alongside the service delivery, Akshata takes an active role in delivering training to enhance team competencies and mentoring

Like the way we think?

Next time we post something new, we'll send it to your inbox