Published on August 8, 2024 by Archana Shankar

Charles River Investment Management Solutions (CRIMS), a State Street Company, is an investment compliance platform that provides centralised compliance monitoring and management over the investment lifecycle, aiming to reduce costs and in compliance with several global regulations. It is an automated application that shortens the investment process across asset classes, from portfolio management and risk analytics to trading and post-trade settlement, by combining compliance and managed data.

The Charles River system automates compliance workflow, codes rules in different formats, tests rules and views results, and performs functions such as data analytics, audit history and reporting. Its robust engine supports high volumes of trades, compliance rules, accounts and groups of accounts.

CRIMS provides a single platform for multiple businesses. It caters to requirements of institutional investors, wealth managers, insurers, banks and pensioners. Clients can access multiple businesses using the same application, reducing time and cost and leveraging its potentialities. State Street Alpha, a data platform created by combining State Street’s middle- and back-office functions and Charles River’s cloud-based front-office technology, provides end-to-end user support. This cloud-based technology helps managers streamline their operating models, making it user-friendly and enhancing portfolio monitoring services. It is the market’s first front-to-back investment management solution.

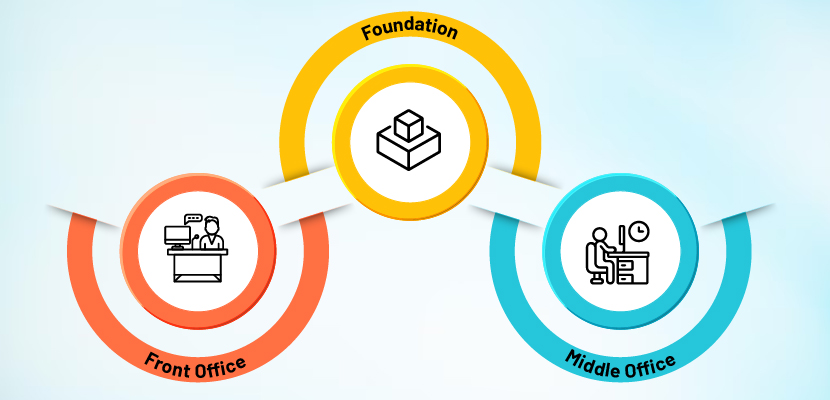

Investment process in a single platform

Foundation

The Charles River system is developed on a unique foundation consisting of large data and cloud-based solutions that provide investment managers with an end-to-end solution. The following opportunities are available in CRIMS:

Data market – The Charles River system consists of large and accurate datasets, enabling users to store more and use more correct information. Information such as live data, shareholding information, account details, regulatory prices, benchmarks and index data is available, enabling investment managers to rely entirely on the system and take timely decisions.

Regulatory requirements – CRIMS is committed to adhering to regulations and guidelines/IMA requirements, helping with compliance management. It serves as a centralised repository, enabling recording all the information and code rules required, and provides early warning of potential compliance breaches.

Real-time position – The Charles River system provides timely data, enabling users to view live cash positions of their accounts and current market values of their stocks and assets. This helps investment managers make decisions independently and accurately. The application maintains an investment book of records (IBOR) that stores real-time positions of asset classes, so managers do not need to look for information elsewhere.

Third-party leverage – CRIMS has partnered with multiple companies and investors, providing end users a wider approach to investment compliance and enabling them to use external information or applications. In addition to using the system for monitoring compliance rules, users can avail themselves of these compliance services.

Front office

Charles River won Best Front-office Platform at Waters Technology Asia Awards 2023, in recognition of its cloud-based front-office platform that distinguishes it from competitors. CRIMS run on the Microsoft Azure platform that helps build an architecture that provides a safe and secure environment with opportunities accessible to global investors.

Portfolio and risk management – The system manages all portfolios on a single platform, enabling users to access all information relating to trades and assets at once, and make the right decisions at the right time. Managers have access to all mandates/regulations and can foresee the impact of any decision. CRIMS helps view, monitor, calculate and predict a breach, so wrong decisions could be avoided.

Advanced rule coding, testing and analysis – Firms require enhanced capabilities for compliance rule building, testing and maintenance. The Charles River system helps investment managers code rules to follow the mandate and create a customisable reporting and audit history. This enables firms to meet changing requirements and maintain transparency. The system also streamlines workflow by incorporating compliance rules in what-if analyses, enabling firms to measure the impact of potential trades on compliance in real time.

Order management system – The Charles River system combines an order management system with multi-asset execution capabilities to create an order and execution management system (OEMS). With support across the trade lifecycle and the help of integrated compliance and workflow automation, investment managers can engage in high-profile trades, manage trade risk and ensure best execution. The OEMS reduces the number of interfaces, divides workflow, resolves order-related issues and enables having all this on one platform. Users need not switch to different sources for information, saving time and reducing error.

Middle office

A Charles River’s Middle Office Operations capabilities consist of book-keeping, calculating real-time cash positions, collateral administration and post-trade and settlement.

Investment book of records (IBOR) – Charles River’s cloud service enables investment managers to maintain books of records on one platform. This helps front-office operations in terms of information on global assets’ real-time cash positions, helping to streamline operations and decision-making. The data consists of current and historical positions, and trade and settlement dates. Data relating to corporate actions and reconciliation is also available.

Investment accounting – The system simplifies the work of front offices and back offices by providing the necessary records of accounting in a single repository. The Charles River system supports multi-book accounting, real-time data and maintenance of books of records such as on GAAP and IFRS. It also provides information on areas such as NAV, trading, profit and loss, and balance sheet.

Collateral service – The compliance system helps firms manage the entire process of products, from pre-trade to margin calculation and settlement. Decision-making tools embedded in the system enable front-office to manage orders and place trades wisely, and investment managers to use their stocks in their portfolios sensibly.

Post-trade and settlements – The automation of post-trade workflow is so efficient that it smooths the clearing-settlement process. Investment managers, traders, brokers, banks, agents and firms have the same real-time data and positions, avoiding discrepancy in the flow of trade. All transactions and confirmation details are available to stakeholders at any time, proving the end-to-end efficacy of CRIMS.

How Acuity Knowledge Partners can help

We are experienced in working on the Charles River application. As it is a well-designed application and meets clients’ requirements end to end, its operation can be somewhat challenging. We have a good understanding of each option available in the compliance system and can guide clients accordingly. We make complete use of the CRIMS platform and its advantages. We have multiple checks in place to ensure the rules are coded and tested correctly. Client mandates and regulations are our priority, and we aim to avoid any kind of risk likely to emerge in the investment trade cycle.

Sources:

Tags:

What's your view?

About the Author

I have 9 years of experience in Investment compliance relating to Post trade compliance, Guideline review and rule testing. I have been associated with Acuity Knowledge partners for last 6 years and previously was working in WNS Global Services.

Like the way we think?

Next time we post something new, we'll send it to your inbox