Published on February 10, 2022 by Lekha Gupta

The global economy is riding high on digitalisation, with a number of digital trends emerging daily. Artificial intelligence (AI) plays a key role in this digital transformation, and chatbots are revolutionising the way organisations operate. The pandemic has accelerated the need for reliable and cost-efficient responses to client queries as many business enquiries and interactions moved online or on-call from face-to-face encounters. Given their immediate responsiveness, standardised and more focused answers, round-the-clock availability and ease of use, chatbots have gained prominence, with many businesses looking at incorporating them into their digital customer interfaces.

This space has significant market potential. The global chatbot market is projected to grow at a rate of 28.7% to reach ca USD19.6bn by 2027 vs 2019 (according to a Research Dive report), driven by increased use of AI in major sectors such as retail, healthcare, banking and insurance.

What are chatbots?

Chatbots are computer programs designed using AI systems to imitate human speech and simulate interaction with an individual. The most commonly used chatbots or virtual assistants are Google Home, Alexa (Amazon.com), Siri (Apple) and Cortana (Microsoft).

Mechanism:

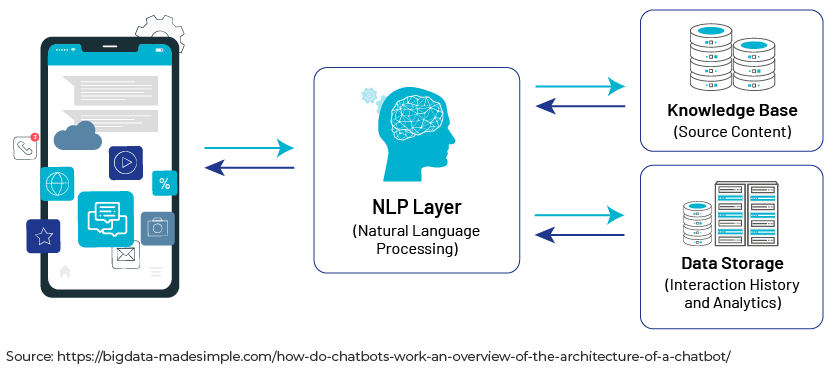

Natural language processing (NLP) is a deep-learning mechanism that helps chatbots analyse and communicate with users exactly as a human would. NLP assists chatbots to assess the meaning of user input and contextually analyse it to create a better response.

For example, a user asking, “Where is my payment receipt?” or saying, “I have not received a payment receipt” means the same thing; NLP helps understand this.

Advantages:

Immediate responsiveness and 24x7 support:

Chatbots provide after-work-hours client support and enhance the quality of customer service by offering real-time, 24x7 assistance and handling multiple customers at a time. In addition, a well-programmed chatbot can politely deal with angry clients and stick to protocol.

Employee productivity:

A number of minor client queries do not require human assistance and can be solved by AI. Chatbots can free up employee time to attend to complex client queries that require specific skill or expert guidance.

Personalised client experience:

Chatbots can be programmed with several functionalities and can be customised for specific age groups. For instance, younger generations prefer instant messaging, while older generations are more comfortable with voice commands. As chatbots typically have access to information relating to existing clients and verify this information before addressing the query, they can offer personalised solutions, suggesting tailored offers and promotions.

Concerns:

The major weakness of chatbots lies in the concept itself – “designed to talk to humans”. The misconception is that they will respond in the way a human would to a particular question. Hence, the main shortcoming is a lack of decision-making power. The best example of this is Microsoft’s Tay (a chatbot for Twitter), which was meant to learn and talk to Twitter users in an effort to become humane. The bot met with a very unfortunate end, as it turned racist and misogynistic trying to emulate users. Chatbots also require high financial outlay for installation and regular maintenance and updating.

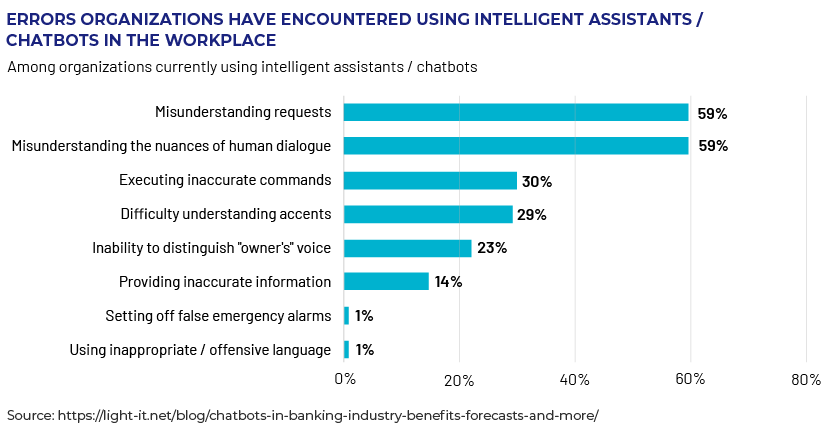

Common concerns among organisations that use chatbots include the following:

Impact on the financial services sector and PWM firms:

Amid the pandemic, banking, financial services and insurance companies are looking to accelerate digitalisation. Banking clients require constant, comprehensive personal assistance with wealth management. Chatbots are well equipped to handle their queries in bulk – from tracking daily expenses to giving investment advice at any time. Technical experts are upgrading chatbots to offer these clients a high-quality experience. New features include checking account balances, extracting bill information from third-party systems, locating ATMs and providing mini statements.

Wealth management mainly focuses on data analysis to study a client's financial situation, recommend a suitable way to create/preserve wealth and oversee the client’s finances. Integrating chatbots into the companies’ omni-channel service delivery models could help enhance the client experience. Some large private wealth management companies have vast client bases, and efficient management of client portfolios requires precision and quick responses. Chatbots can drive operational efficiency by interacting with several clients at the same time, analysing vast amounts of data constantly and generating insights to help customers individually.

The following are chatbots currently used by large private banks: Erica (Bank of America), Eva (HDFC Bank), Citi Bot SG (Citi Bank), HARO and DORI (Hang Seng Bank) and Amy (HSBC Bank).

In a nutshell:

Chatbots would inevitably revolutionise customer services, especially for financial service providers and private wealth management firms. They provide significant help in answering the most common questions and automating repetitive tasks. However, there is a long way to go in terms of using them to perform complex tasks that require decision making and reasoning. The use of more advanced programming techniques should benefit banks and financial service providers in monetary terms and enhance their reputation. In 2023, chatbot interactions will save ca 862m hours for banks (according to Juniper Research), translating into cost savings of ca USD7.3bn globally. This presents significant opportunities.

References:

https://medium.com/@virtua/advantages-and-disadvantages-of-using-chatbots-in-e-commerce-c3ae78aa3dd4

https://www.marutitech.com/nlp-based-chatbot/

https://www.techiexpert.com/role-of-chatbots-in-personal-wealth-management/

Tags:

What's your view?

About the Author

Lekha has over nine years of experience as an equity research analyst. She has been with Acuity since 2016, actively assisting sell-side equity research firms. In her current role, she is supporting regional investment banking clients and covering multi sectors. Lekha holds a Bachelor’s in Business Administration from West Bengal University of Technology and a Master’s in Business Administration from Brainware Business School.

Like the way we think?

Next time we post something new, we'll send it to your inbox