Published on April 24, 2024 by Sathiaseelan Sathiamoorthy

China has undertaken significant reforms to bolster its pension ecosystem as it prioritises the long-term financial wellbeing of its rapidly ageing population amid unprecedented demographic challenges. The sector is in the midst of sweeping reforms, buckling under the pressures of falling birth rates, decelerating fertility rates, an ageing population, rising healthcare costs and funding gaps. These would present significant opportunity for fund/asset management and related activities.

China’s demographic crisis – an ageing population

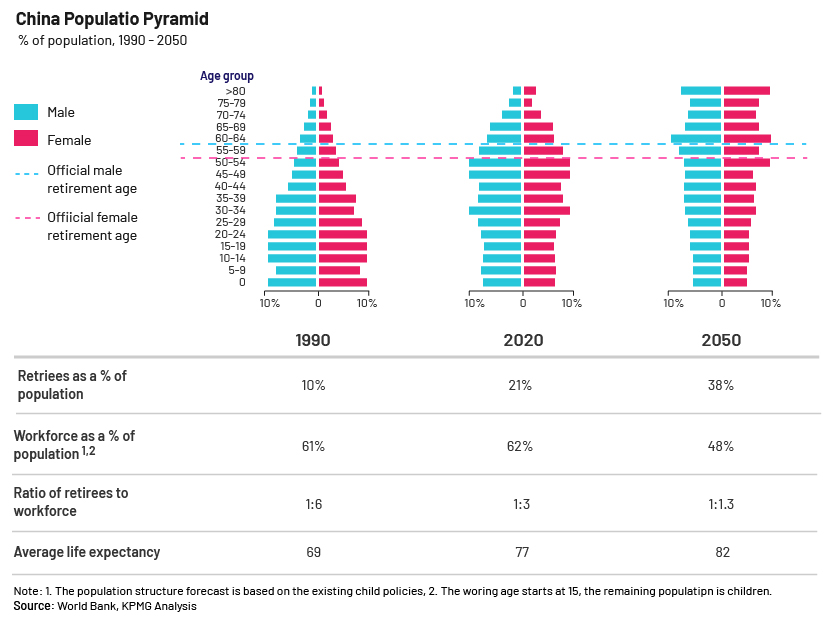

China's population fell for a second consecutive year in 2023, by 2.08m to 1.409bn, a steep drop from a decline by 850,000 in 2022. Its fertility rate, at 1.09 in 2022, is far below the replacement level of 2.1 needed to maintain the population at current levels. This could lead to a top-heavy population pyramid; retirees accounted for c.21% of its population in 2020 (versus 10% in 1990), and this could rise to 38% by 2050. This implies that the pension system (dominated by Pillar 1 and 2), which relies heavily on government subsidies, would find it difficult to fund pension obligations when the retiree-to-worker ratio increases to 1:1.3 in 2050 (versus 1:3 in 2020).

A country reaches “aged” status when 14% of its citizens cross 65+ years. China (USD11,200) joined the list of countries with low GDP per capita, including the US (USD55,700), Japan (USD29,500) and the UK (USD21,600), in 2021, and its policy response to boosting the fertility rate has yet to show promising results. Japan reached “aged” status in 1994 but was better placed, with a well-funded pension system. However, repeated attempts to counter the ageing population have not yielded the expected results, with Japan’s birth rate declining and its dependency ratio rising over the past 30 years.

| Japan (1994) | China (2021) | |

| Social security (% of GDP) | 34% | 6% |

| GDP per capita | USD29,500 | USD11,200 |

| Birth rate | 1% | 0.8% |

| Fertility rate | 1.5% | 1.15% |

Furthermore, the standard of living for retirees on pension plans is very poor in China; its pension-to-income replacement ratio was 44% in 2021 (versus the OECD average of 62%).

China’s pension system skewed more towards a basic, state-led pay-as-you-go model

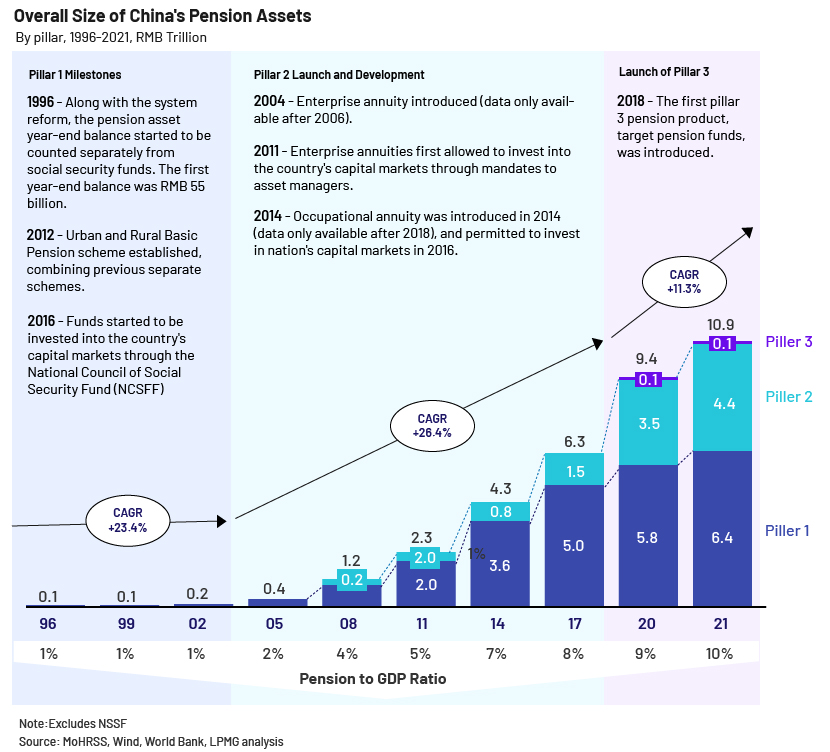

China’s pension system is modelled on the World Bank’s multi-pillar system: The first and main pillar is the basic state pension system established in the 1990s to ensure universal coverage, with RMB6.4tn in assets (5.6% of GDP) and 1.03bn participants. Enterprise annuities introduced in 2004 as the second pillar had pension assets of RMB4.4tn (3.9% of GDP) at end-2021, covering just 0.4% of corporate entities and c.3% of the working population. The third pillar, launched in 2022 with the introduction of individual retirement accounts (IRAs), is very modest in size but has significant growth potential. China's pay-as-you-go public pension system has struggled to cover pension payments, as these payments rely heavily on fiscal subsidies.

Funding gap in China’s pension system needs to be bridged

China’s overall pension fund assets, at c.11% of GDP, are far below those of OECD member countries at 75%+. The problems are further compounded by the structural imbalance between the three pillars. For China, pension assets are skewed more towards pay-as-you-go Pillar 1 (c.60%), while for the US and other developed countries, they are concentrated more towards Pillars 2 and 3 (90%).

China faces a pension shortfall, with the Chinese Academy of Social Sciences (CASS) warning that a declining worker-to-retiree ratio means that the National Social Security Fund (NSSF) established in 2000 to finance future obligations would likely be depleted by 2035. This could be partly attributed to the government’s decision to dole out pension payouts to residents who retired before 1997 but had not contributed to their personal accounts. The deficit crisis is further exacerbated by China's early retirement age and rising cost of living due to increasing life expectancy. China’s retirement ages of 55 for women and 60 for men are among the lowest in the world; in developed countries such as the UK, Japan and Germany, it is 65+. Life expectancy, at 78 years as of 2021 (versus 44 years in 1960), is on par with the US’s and is projected to reach 82 years by 2050. The burden of healthcare on the elderly is rising rapidly, with those >65 years of age spending 1.5x the national average. It also now accounts for a larger chunk of their spending, with costs of hospitalisation, medicine and nursing care spiralling, combined with rising incidence of illness.

The pay-as-you-go system feels the impact of the funding gap more as the number of those paying into the pension pool shrinks in relation to beneficiaries, straining the pension’s funded status. Attempts to bridge the gap, by capping benefits or increasing the age of retirement and contributions, do not work. In addition, an ageing population and a smaller employable workforce mean anaemic economic growth and savings, as well as taxes, impacting the government’s fiscal resources available for spending on social welfare.

Pillar 3 and the way forward

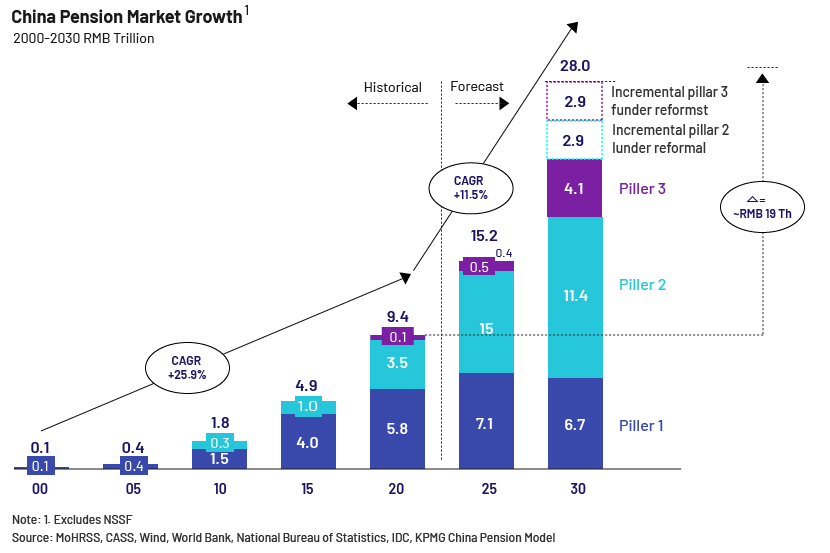

KPMG expects China’s pension market to grow 3x from 2020 to 2030E – from RMB9.4tn to RMB28tn – led by Pillar 3 assets (currently negligible).

We believe that the Chinese government’s reforms strive to share the burden among key stakeholders (the state, businesses and individuals) in a fair and sustainable manner. The introduction of individual private pensions under Pillar 3 would not only help plug the funding deficit, but also give Chinese investors more investment options for the purpose of diversification.

China’s household savings rate is one of the highest in the world. We believe that the introduction of the private pension scheme is unlikely to lead to net increases in household savings. However, it could help divert savings away from real estate and bank deposits into capital markets. Furthermore, the low interest rate, together with the ongoing turmoil in China’s real estate market, would make the shift to equities and mutual-fund products attractive. This bodes well for professional money managers with international experience, with success resting on their ability to offer pension products with diversification and superior long-term risk-adjusted returns.

How Acuity Knowledge Partners can help

We work with wealth managers as an extension of their research teams and help build their proprietary research products across equity, credit and funds. Apart from research and advisory, we provide services in sales and marketing, portfolio management, compliance and credit risk analysis. Our integrated solutions across asset classes and functions help wealth managers improve investment performance, enhance client servicing, attract new client assets and retain assets in the current complex business environment. Partnering with us, our clients have been able to achieve cost savings of 50-60% versus performing these functions in-house.

Most global asset and wealth managers lack on-the-ground presence in China and, hence, find it difficult to plan and execute face-to-face meetings with management teams of Chinese companies on their own. Language-related challenges, cultural differences and a lack of geographical knowledge are also key hurdles for global buy-side analysts. Given the challenges, wealth managers are increasingly turning to China-based third-party research firms for corporate access support. Our Beijing centre, for example, is able to leverage its decade-long presence in the city and vast pool of bilingual research analysts to help wealth-management client analysts through the entire process of corporate access, providing timely research and operations-related support.

Sources:

-

https://kpmg.com/cn/en/home/insights/2023/06/china-pensions-reform.html

-

https://www.ey.com/en_cn/strategy/a-new-era-of-chinas-pension-system

-

https://foreignpolicy.com/2023/06/29/china-pensions-aging-demographics-economy/

What's your view?

About the Author

Sathiaseelan Sathiamoorthy has around 17 years of experience in investment research. He has been with Acuity Knowledge Partners (Acuity) since 2012 and has worked in buy-side engagements. He currently manages delivery for leading global hedge funds and buy-side clients, supporting them with their research needs, covering multiple sectors and regions. Prior to joining Acuity, he worked with Netscribes Research. He has experience in equity research, financial modelling, and customer relationship management. Sathia has cleared CFA level 2 and holds a post graduate diploma in Management from Bharathidasan Institute of Management Trichy.

Like the way we think?

Next time we post something new, we'll send it to your inbox