Published on April 26, 2023 by Shilpa Sukumar and Anindita Mitra

China has emerged as a highly-sought-after destination for wealth management services. Buoyant macroeconomic tailwinds in the past several years have driven strong momentum in China’s private wealth sector. Benefiting from favourable policy initiatives directed at boosting domestic and international trade, businesses in the country have thrived over the past two decades, enhancing household income. Notably, this rapid surge in wealth in China has come at a time when financial products are aplenty and becoming more complex, and investment advice more sophisticated.

China’s wealth management market is set to undergo a transition, led by growth in individual wealth and increasing risk appetite, regulatory reforms and technological advancements. Moreover, the persistent push by the Chinese authorities to liberalise China’s capital market should bring further standardisation and internationalisation in the country’s wealth management sector. Against this backdrop, we expect wealth players operating in China to experience multi-year growth, amassing a vast base of high-net-worth and mass-affluent clients open to looking beyond traditional investments. This would necessitate the following:

-

Investments in developing a comprehensive suite of wealth management services and building expertise spanning financial investments, insurance, tax and estate planning

-

Regular interaction with clients and providing timely, bespoke research insights and actively rebalancing client portfolios

-

Strengthening digital platforms to enhance ease of service delivery and speed to market

-

Deepening collaboration between international and domestic wealth management players; setting up localised teams or partnering with third-party local service providers to access the high-net-worth pool

China: riding on increasing disposable income and wealth accumulation

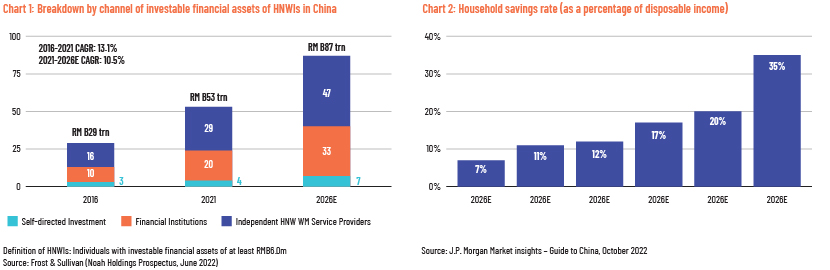

China has emerged as a destination with immense potential for wealth management players, having registered an impressive 14x jump in per capita income over 2000-22 to c. USD12,970 (according to IMF estimates). The country now ranks fourth in terms of its high-net-worth-individual (HNWI) population, after the US, Japan and Germany. With increasing disposable income and wealth accumulation, the number of HNWIs in China grew to 2.1m in 2021 from 1.3m in 2016, and their investable financial assets recorded a notable CAGR of 13.1% to RMB53tn over this period, according to research by Frost & Sullivan. Investable financial assets are expected to grow by a further 10.5% CAGR over 2021-26. Growth in recent years has been underpinned by high household savings rates in China, as well as its transition from a controlled to a market-driven economy, enhancing retail participation in its capital market.

China’s burgeoning household wealth could draw in over RMB100tn (USD16tn) of inflow to the wealth management market, with the potential to triple sector revenue by 2030, according to Morgan Stanley estimates, clearly placing the sector in a sweet spot. The shift in HNWIs’ preference from self-directed allocations to curated formal/institutional advice amid the availability of a number of financial products, volatility in the capital market and increased risk appetite could act as a tailwind.

Key wealth management players

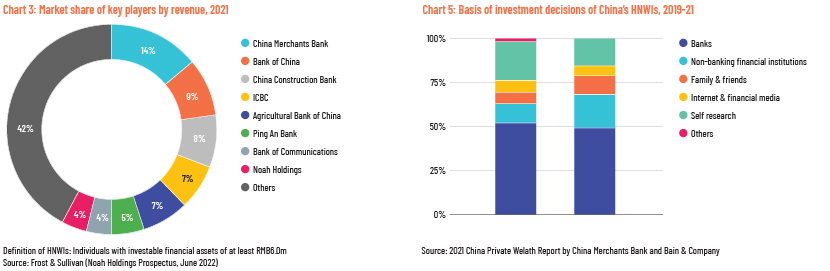

Domestic banks dominate China’s wealth management sector

China’s wealth management services sector primarily comprises private banking divisions of domestic banks and independent wealth management service providers. The top 10 players in the country’s HNWI wealth management sector represented a c.64% market share (in terms of total revenue in 2021, Chart 4), with banks accounting for over 55% of the market. Other financial service providers such as brokerage houses have also garnered decent market share, leveraging their customer relationships. Furthermore, multiple digital wealth management platforms have emerged in China, catering predominantly to the mass-affluent class.

Banking companies and their affiliates will continue to dominate China’s wealth management space, supported by their comprehensive product portfolios (spanning wealth products, insurance, asset management, brokerage services, venture capital, etc.), broader geographical reach and increased regulatory scrutiny/transparency vs non-banks’.

Easing regulations attract international players

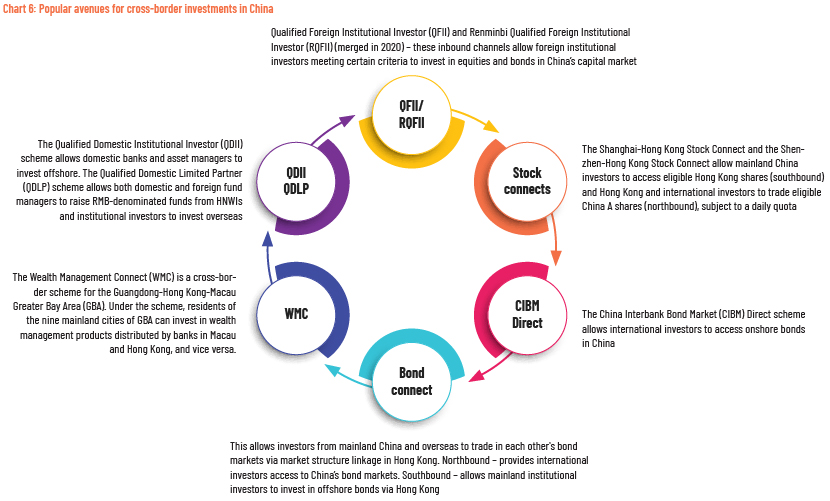

The significant opportunity in China’s wealth sector, together with policymakers’ efforts to open its capital market for better integration with global markets, has drawn international wealth management players to the country. The Chinese government recently simplified the approval processes for inbound investments, widened the permissible investment limit and relaxed several stringent criteria. Amid a more favourable operating environment, global firms are increasingly seeking to tap opportunities to invest and operate in China’s onshore markets and raise capital from Chinese investors to invest in offshore markets. There are currently several routes to access Chinese investments for international HNWIs, both directly and indirectly, through financial institutions/asset managers (mainly via Hong Kong). Chinese nationals also have access to global markets, but there is still stringent control on outflows from the country.

JV – the most preferred route to foray into China

International asset and wealth management players can access the wealth of Chinese investors by establishing legal frameworks such as the following:

-

Wholly foreign-owned entity public fund management companies (WFOE FMCs)

-

Wholly foreign-owned entity private fund managers (WFOE PFMs)

-

Joint-venture wealth management companies (JV WMCs)

JV seems to be the most-sought-after route currently, following the relaxation of foreign-ownership regulations in 2019 that allowed foreign financial companies to set up majority-owned ventures in partnership with wealth management units of China’s regional banks. Such JVs benefit from the global expertise, product capabilities and integrated services of the foreign firms while leveraging local players’ resources and networks. In 2020, Amundi BOC Wealth Management (a JV between Amundi, one of the largest asset managers in Europe, and the wealth management subsidiary of Bank of China) became the first foreign-controlled JV in China. Several other foreign players have rushed to form JVs since then, including BlackRock, Goldman Sachs, Schroders and BNP Paribas.

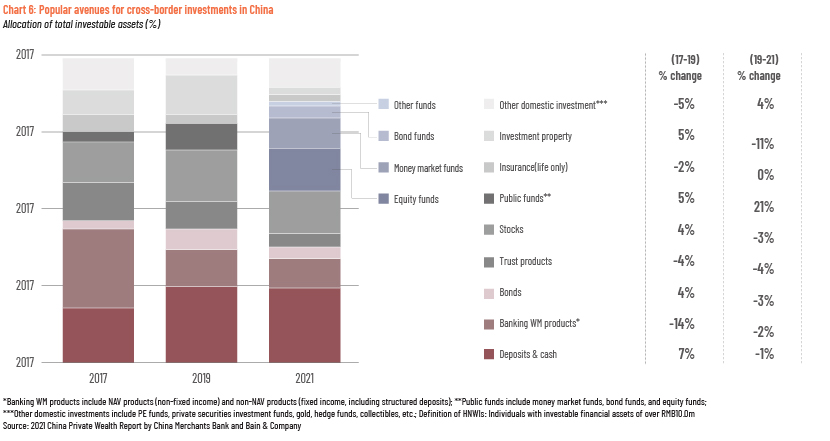

Asset allocations becoming more diverse

Mutual funds, equities and bonds gaining traction

A large part of individual financial assets in China is still highly over-concentrated in real estate (c.two-thirds of total wealth). However, customers are now increasingly diversifying their liquid portfolios. For instance, demand for (life only) insurance products has gained traction after the pandemic. Public funds are growing on the back of an enhanced registration mechanism and greater transparency, and allocation towards domestic equities and bonds is also increasing.

Wealth management products (WMPs) still attract investor interest, although their share has dipped

Since 2009, short-term WMPs issued by banks, financial institutions and property developers were marketed with returns significantly higher than regular deposit rates, at times with explicit principal and return guarantees. However, these unregulated off-balance-sheet products led to an increase in shadow banking (with short-term funds flowing into long-term investments, mainly into the then buoyant real estate sector). Owing to these deficiencies and broader concerns about systemic risks, a series of stringent regulations have been introduced since 2018 to regulate WMPs. With these regulations in place, WMPs still continue to attract investor interest (outstanding: USD4tn+ currently), although their share in overall allocations has moderated significantly.

Increase in demand for overseas investments

China’s HNWIs and ultra-HNWIs are gradually embracing cross-border investments. The Southbound Stock Connect has gathered momentum, with Chinese investors investing in selected China-based and Hong Kong-based companies listed on the Hong Kong Stock Exchange. This has also spurred secondary listings of Chinese companies on the Hong Kong Exchange. Recent cross-border products, Wealth Management Connect and Exchange Traded Fund (ETF) Connect, have attracted interest. However, we note that direct investments by investors are still in nascent stages and HNWIs largely prefer to gain diversified exposure indirectly through domestic funds with international asset allocations.

Emergence of retirement savings WMPs

An ageing population, an underdeveloped pension market and mounting pressure on state pensions and corporate-run annuity schemes have called for urgent reforms in China’s private pension sector. At end-2021, regulators launched 4 pilot retirement savings WMPs; the number has since risen to c.50. In November 2022, China extended its private pension scheme, permitting qualified banks and wealth companies to commence individual pension businesses. Financial institutions are looking to capitalise on this promising opportunity (private pension market to grow 6x to at least USD1.7tn by 2025, according to a Reuters report). For instance, BlackRock CCB Wealth Management (a JV between BlackRock and China Construction Bank) launched its first retirement WMP in April 2022. Pension wealth products could emerge as a good investment option to channel retirement savings.

An upbeat outlook on favourable macro drivers

Revenue of HNWI wealth management service providers rose at a 14% CAGR over 2016-21 to RMB118bn and is estimated to rise further, at a CAGR of 9% over 2021-26 to c.RMB182bn (source: Frost & Sullivan research, June 2022). The growth momentum in China’s wealth sector is likely to be supported by several structural tailwinds including the following:

-

Rising number of HNWIs

-

Slump in China’s property market due to regulatory crackdown, resulting in increased demand for equities, mutual funds and other financial investment products

-

Rapid digitalisation of the wealth management sector that should help cost-efficient customer acquisition and servicing

-

Opening of China’s capital market for foreign investors and vice versa

-

New regulations in asset and wealth management that seek to reduce vulnerability and improve transparency

-

Surging demand for environmental, social and governance (ESG)-compliant investments

-

Intergenerational wealth transfers, particularly from first-generation entrepreneurs who are now aged 60+

Conclusion

China’s wealth management sector is all set for a long-haul journey. The country has seen tepid economic growth over the past three years due to its stringent Zero-COVID policy. The easing of restrictions is a welcome change. Moreover, the IMF’s real GDP growth forecast for China at an average 4.9% over 2023-24 (vs an estimated 3.0% in 2022) indicates a stable recovery path. Against this backdrop, China’s high savings rates should lift overall consumption and spur demand for multiple wealth management-related products/services from its affluent and HNWI population. While the regulatory crackdown on sectors such as real estate, technology, chemicals and gaming has impacted the performance of its capital market in recent years, this should be viewed as a temporary pain directed at the long-term strengthening of the overall financial system. This should introduce greater transparency, enhance inventor protection and boost HNWI participation in financial markets. Overall, we see a promising outlook for wealth players in China.

How Acuity Knowledge Partners can help

We work with wealth managers as an extension of their research teams and help build their proprietary research products across equity, credit and funds. Apart from research and advisory, we provide services in sales and marketing, portfolio management, compliance and credit risk analysis. Our integrated solutions across asset classes and functions help wealth managers improve investment performance, enhance client servicing, attract new client assets and retain assets in the current complex business environment. Partnering with us, our clients have been able to achieve cost savings of 50-60% versus performing these functions in-house.

Most global asset and wealth managers lack on-the-ground presence in China and, hence, find it difficult to plan and execute face-to-face meetings with management teams of Chinese companies on their own. Language-related challenges, cultural differences and a lack of geographical knowledge are also key hurdles for global buy-side analysts. Given the challenges, wealth managers are increasingly turning to China-based third-party research firms for corporate access support. Our Beijing centre, for example, is able to leverage its decade-long presence in the city and vast pool of bilingual research analysts to help wealth management client analysts through the entire process of corporate access, providing timely research and operations-related support.

Sources:

-

www1.hkexnews.hk/listedco/listconews/sehk/2022/0629/2022062902037.pdf

-

https://am.jpmorgan.com/wr/en/asset-management/liq/insights/liquidity-insights/china-

-

https://worldwealthreport.com/pdf/Capgemini_WWR_2022_VFinal_Digital.pdf

-

www.oliverwyman.com/content/dam/oliverwyman/v2/publications/2018/march/Global

-

https://www.chinadaily.com.cn/a/202210/31/WS635f0ac3a310fd2b29e7f4ba.html

-

https://fundselectorasia.com/bnp-paribas-receives-green-light-for-china-wealth-management

-

https://www.bloomberg.com/news/articles/2022-05-23/china-s-16-3-trillion-cash-hoard

-

https://asia.nikkei.com/Opinion/Impact-of-Chinese-wealth-will-transcend-slowing-economy

-

https://www.chinabondconnect.com/en/About-Us/Company-Introduction.html

-

https://www.scmp.com/business/banking-finance/article/3175442/blackrock-ccb-china-asse

-

https://www.ft.com/content/72a1eb6f-f1e2-4268-8ce2-9c9aa0d9bed0

-

http://www.china.org.cn/china/Off_the_Wire/2022-12/06/content_78554063.htm

Tags:

What's your view?

About the Authors

Shilpa Sukumar has around 13 years of experience in investment research. She has been with Acuity Knowledge Partners (Acuity) since 2013 and has worked in both sell-side and buy-side engagements. She currently manages delivery for leading global private banks and wealth managers, supporting clients with their equity research needs, covering multiple sectors and regions. Prior to joining Acuity, she worked with CRISIL Ratings (bank loan ratings) and CRISIL Global Research and Analytics. She has experience in equity and credit research, financial modelling and customer relationship management. Shilpa holds a post graduate diploma in Management from T A Pai Management Institute and a bachelor’s degree in Commerce from..Show More

Anindita Mitra has around 10 years of experience in investment research. She currently supports a leading UK-based private wealth manager. She has expertise in multiple sectors, with proficiency in financial statement analysis and preparing coverage initiation reports, quarterly earnings reports, IPO notes, credit notes and macroeconomic reports. Prior to joining Acuity Knowledge Partners, she worked with organisations such as Wells Fargo as a Credit Portfolio Manager and Anand Rathi as an Equity Research Analyst. Anindita holds an MBA (Finance) from Jadavpur University and a bachelor’s degree in Accountancy from Burdwan University.

Like the way we think?

Next time we post something new, we'll send it to your inbox