Published on July 26, 2024 by Huijuan Luo , Yue Zhang , Ying Liu and Liguo Xin

Executive Summary

Global EV development can be traced back to the 19th century. The EV market is growing rapidly, driven by increasing concerns over climate change and the need for sustainable transportation. In recent decades, China has emerged as an EV leader. The rapid development of the EV industry in China is highly correlated to government policies to support and promote EV sales.

The intelligentisation trend in the EV industry has redefined the value proposition of vehicles. The adoption of technologies, such as autonomous driving and smart cockpit, improves the experience of EV users. The supply chain within China’s EV industry significantly localizes, ensuring a reduction in cost and minimising supply chain disruptions.

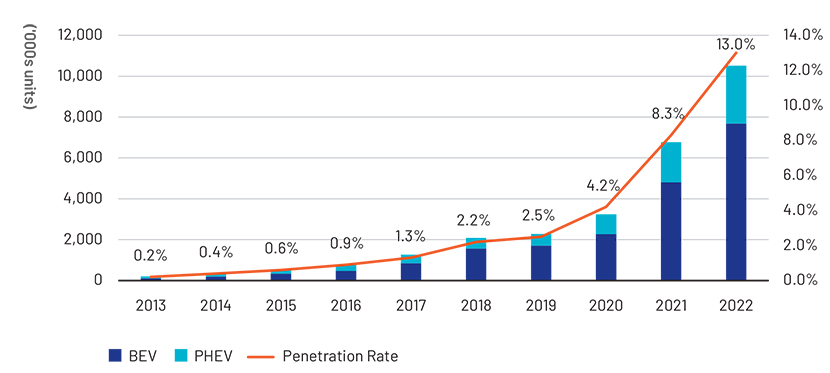

The country’s EV sales have grown rapidly, from 1.0mn units in 2018 to 1.1mn in 2020 and 5.7mn in 2022, clocking a 125% CAGR in 2020-2022. BEV models remain the most popular. However, the growth of PHEV sales in 2022 (157% YoY) was much higher than that of BEVs (75% YoY).

Traditional automakers boast advantages in supply chain management, technical expertise and sales channels, rendering them capable of offering more costefficient models to consumers in the middle and low market segments. The newcomers, on the other hand, concentrate more on delivering an enhanced consumer experience and integrating intelligence features, which is crucial for their competitive differentiation. In regard to global competitive landscape, domestic Chinese products prove to be competitive due to their favourable price-to-performance ratio.

The EV industry is experiencing rapid growth, as an increasing number of consumers are opting for environmentfriendly modes of transportation. This trend is presenting a wealth of emerging opportunities throughout the entire value chain of the EV industry.

However, we also see some risks in the industry, including geopolitical tensions, price volatility, the mining and production of lithium, as well as the disposal of lithium batteries, the shortage of semiconductor chips and the safety of EVs, etc.

Industry Background

Recent developments: The first commercial plug-in electric vehicle (PHEV) was made available in the US in 2010. Over the next few years, other automakers started rolling out EVs in the US. Given the EV boom, the US government began to introduce regulations and provide financial support to develop the EV ecosystem. At the same time, the government introduced the Recovery Act to build charging infrastructure nationwide to help accelerate EV penetration throughout the country. Other countries have also taken initiatives in recent years, especially after the Paris Agreement, which stressed on a low-carbon economy in 2016. The global EV penetration rate in 2022 was 13.0%, clocking a sales volume of +57% YoY and a five-year CAGR of +58%.

Exhibit: Global BEV and PHEV sales and penetration rate

Source: EV volumes.com, Acuity Knowledge Partners research

China Accelerates EV development: In 2018, China announced the abolition of foreign investment restrictions in the auto manufacturing industry, especially in EV manufacturing. Foreign EV makers could set up factories to produce EVs without establishing a JV with Chinese automakers. Consequently, Tesla set up its gigafactory in Shanghai. EV start-ups began to emerge and flourish in this period, with NIO becoming the first Chinese EV new force listed on the New York Stock Exchange (NYSE). Other than Tesla, some traditional automakers planned to build factories in China.

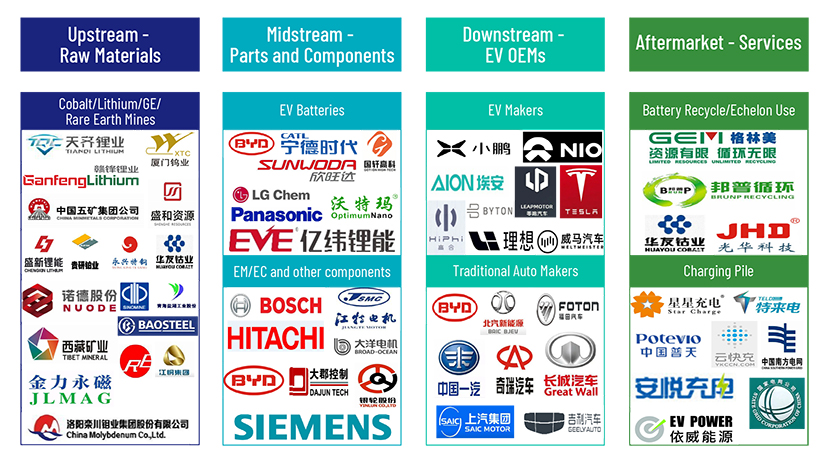

Value Chain and Bargaining Power of Suppliers

The EV value chain consists of all the processes and industries involved in production, distribution and consumption, which can be divided into four major segments: upstream segment (mineral resources), midstream segment (components), downstream segment (EV OEMs) and aftermarket (EV services). The chart below shows the EV value chain and China’s major players in each industry.

Exhibit: EV value chain and major players in China

Source: Acuity Knowledge Partners research

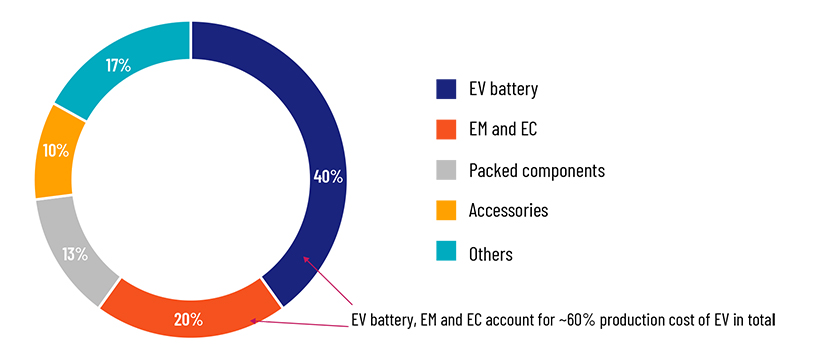

In the EV value chain, EV battery production accounts for the largest proportion of EV’s total production cost (approximately 40%), followed by cost of electric motors and electric controllers (20%). In total, EV battery, EM and EC account for about 60% of EV production cost.

Exhibit: Cost structure of EV

Source: Digitimes, Acuity Knowledge Partners research

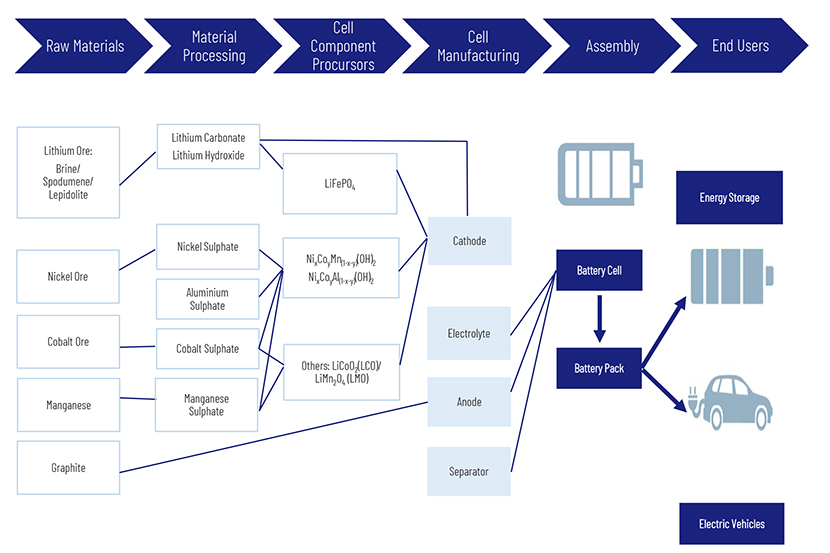

Upstream: Raw materials used in manufacturing EVs include lithium, cobalt, nickel and rare earth. These materials are mined or extracted from the earth and refined into usable forms for EV components. Lithium, cobalt, nickel and manganese are used to produce mainly EV battery, and rare earth minerals are essential in making EM, EC and EV battery, especially EM.

Exhibit: Value chain in EV battery

Source: Acuity Knowledge Partners research

Tags:

What's your view?

About the Authors

Huijuan is an Associate Director in Acuity Beijing’s Investment Research team. She supervises buy-side teams at Acuity Beijing that serve hedge funds, mutual funds, asset management firms and private equity firms in countries and regions such as Hong Kong, Japan, Singapore, Europe and the US. She has 13 years of investment research experience at Acuity, covering China and Japan markets by leveraging her trilingual capabilities and a total of 17 years of working experience. Huijuan holds a master’s degree in Finance from the University of International Business and Economics, China.

Yue is an Assistant Director in Acuity Beijing’s Investment Research team. She has over 10 years of working experience at Acuity including over 5 years in a management role. She supervises Acuity Beijing’s sell-side equity research teams in Mandarin, Japanese and English. Yue previously supported multiple equity research teams at a Europe-based global investment bank, most notably in China’s internet and Japan’s precision machine sectors. She holds a master’s degree in Finance from the University of Sydney, Australia. Yue is an ACCA Affiliate.

Ying is an Associate in Acuity Beijing’s Investment Research team. She has over five years of working experience in investment research, focusing on China’s TMT and industrial sectors. She currently supports a global sell-side equity research client, covering China’s internet sector. Prior to Acuity, she worked as a research analyst with an asset management firm in Hong Kong. Ying holds a master’s degree in Social Work from the Chinese University of Hong Kong. She has passed CFA Level 2.

Liguo is an Associate in Acuity Beijing’s Investment Research team. He currently supports an international sell-side equity research client, covering China’s financials sector. He previously supported equity research teams of multiple top-tier global investment banks, covering Asia’s commodity and China’s EV sectors. He holds a master’s degree in Finance from the University of Iowa (US). Liguo has passed CFA Level 2.

Like the way we think?

Next time we post something new, we'll send it to your inbox