Published on September 11, 2024 by Jiaping Zhang

Background

China has consistently been one of Japan's most important trading partners: Japanese food continues to be enjoyed, and Chinese tourists often engage in shopping sprees in their travels to Japan.

However, the countries have seen instability in trade emerge after the pandemic.

In September 2023, preliminary trade statistics published by Japan's ministry of finance (Japanese: 日本財務省) for August revealed that food exports to China totalled JPY14.186bn, a significant 41.2% decrease from the same period in 2022. This is the largest decline since the formal sharp decrease in exports since the Great East Japan Earthquake in 2011.

Comparison of data

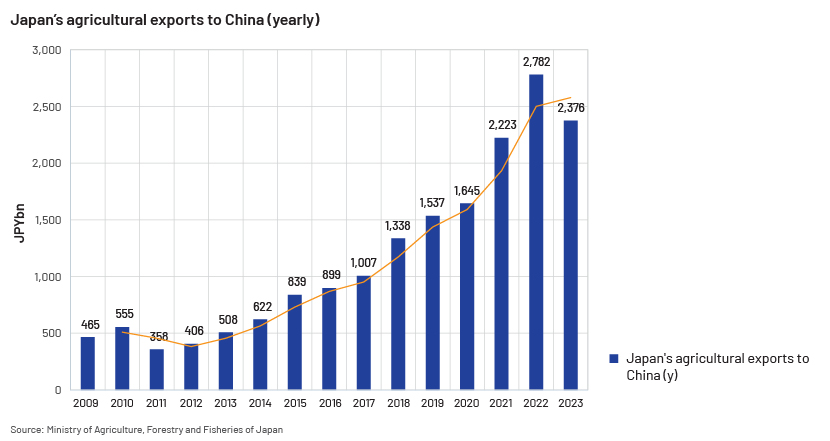

The chart above shows that Japan's food exports to China experienced a large-scale decline in 2011 and did not return to the levels of 2010 until 2014, verifying what we explained earlier.

The number of agricultural products imported from Japan to China showed a gradual increase before 2021. Even from 2020 to 2022, at the height of the pandemic, imports increased significantly.

However, in 2023, the decline was significant, as noted above, although imports were still higher than the levels in 2021.

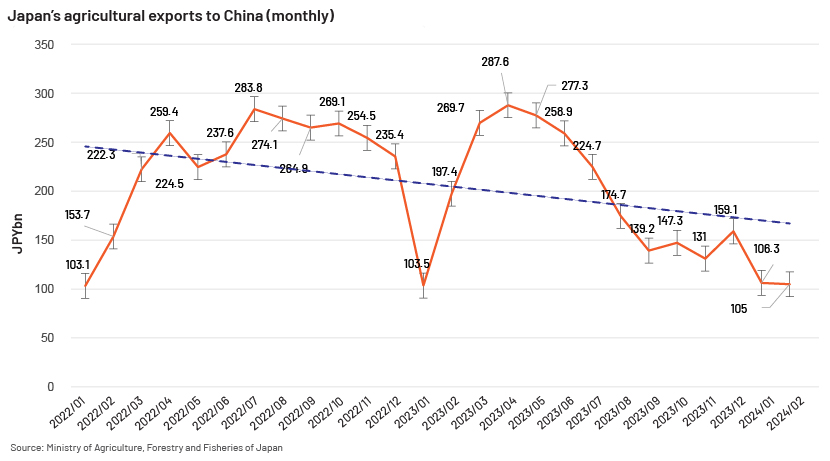

The chart above shows the cyclical nature of import data, highlighting the lowest point in January, followed by significant increases until returning to the lowest point in January the next year.

There was a significant decline from December 2022 to January 2023, followed by a rapid recovery. Imports in April 2023 exceeded the highest monthly imports in 2022 but declined significantly thereafter compared with 2022. The overall trend is downward.

The agricultural products imported to China that decreased the most in 2023 were fresh scallops, whiskey and sake, according to statistics from Japan’s Ministry of Agriculture, Forestry and Fisheries. Seafood was the most affected.

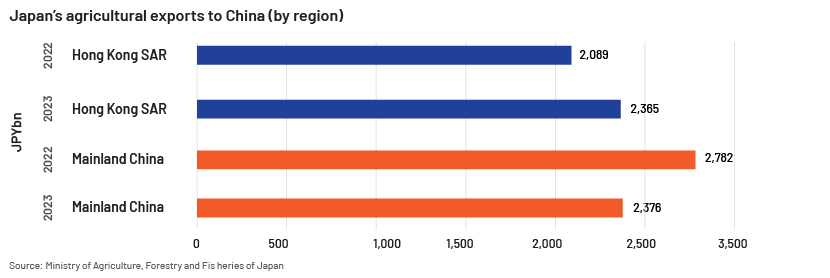

The chart above shows data from mainland China (excluding Hong Kong, Macau and Taiwan). Where did these reduced imports of agricultural products go?

Annual imports to Hong Kong are similar in scale to those to mainland China. The chart shows that while mainland China reduced imports of agricultural products from Japan in 2023, Hong Kong increased them.

The agricultural products imported to Hong Kong that increased the most in 2023 were pearls, non-perishable scallops and tobacco, according to statistics from Japan’s Ministry of Agriculture, Forestry and Fisheries. The significant increase in pearl imports was influenced by the 2023 Hong Kong International Jewellery Show. Imports of non-perishable food products increased as well.

Reasons for the decline

1. Market for imported food products expands amid increasing focus on domestically produced items

As the purchasing power of Chinese consumers continues to increase, imported food products are becoming accessible not only to the affluent but also to the middle class. While food products imported from Japan are often associated with high quality, healthier options and delicate flavour, the quality of domestically produced Chinese food products improving, coupled with the increase in patriotic themes, referred to as China chic (in Chinese: 国潮), has resulted in the blind pursuit of Japanese food diminishing, particularly among young consumers.

At the same time, many Chinese restaurant brands are de-Japanising, removing Japanese elements from brand names, designs and descriptions and adding Chinese elements. For example, tea brand Naixue changed its English name from "Nayuki" (the Japanese pronunciation of Naixue) to “Naixue” (the Romanised Chinese for the brand name).

2. Reputation loss caused by nuclear wastewater discharge

China announced a comprehensive suspension of imports of seafood originating from Japan on 24 August 2023, citing concerns over the risk of radioactive contamination due to the discharge of treated water from the Tokyo Electric Power Company's Fukushima Daiichi Nuclear Power Plant into the ocean (water treated to levels below national regulatory standards for radioactive substances).

The discharge of nuclear wastewater has affected not only China but also surrounding countries, causing significant negative repercussions globally. Citizens of Japan and a number of other countries are protesting against this discharge. In response, the Chinese government suspended the import of seafood from Japan in August 2023.

3. Chinese customs authorities tighten inspection of food imported from Japan

The Chinese customs authorities announced on 7 July 2023 that they will strengthen inspection of food imported from Japan. The Chinese government previously required radioactivity certificates and proof of origin for all food products imported from Japan, including marine products, but the latest announcement calls for a suspension of food imports from 10 districts, including Fukushima.

In addition, for other foods imported from Japan, especially marine products, the Chinese customs authorities will rigorously check all required documents and conduct inspections.

It appears that the authorities are stipulating a 100% radioactivity test. Since imported products are held until the test results are received, Japan has stopped exports due to the risk of deterioration of fresh fish.

For example, customs clearance of frozen products at Tianjin Port now takes 20-30 days (instead of the usual 1-2 days).

Potential opportunities for Japanese companies

1. Strengthen branding and publicity

Japanese food companies could increase marketing efforts to regain popularity among Chinese consumers. For example, marketing could be conducted through online advertising; establishing official accounts on social media platforms such as WeChat, RED and Douyin; or cooperating with key opinion leaders (KOLs) and influencers to publish marketing content. Emphasising and promoting the health benefits of Japanese food would help attract the attention of consumers, especially the young, and restore trust in Japanese food brands.

2. Embrace digital platforms and ecommerce

Japanese food companies could take advantage of China's booming internet economy and build a strong supply chain via popular online shopping platforms such as PDD, JD.com and Taobao. Ecommerce strategies such as tapping the Double 11 online shopping event promotions across China and targeted user advertising could help increase their visibility and drive sales, as would collaborating with Chinese internet food delivery giants such as Ele.me and Meituan to deliver fresh Japanese food in a timely and efficient manner.

3. Cultural integration and localisation

The importance of cultural integration and localisation in marketing is self-evident. Therefore, Japanese food companies customise local product packaging in China, advertising activities that are in line with the psychology of Chinese consumers, and remove the Japanese element in the context of China chic, which could attract Chinese consumers.

Simultaneously, integrating traditional Chinese culture and popular words from Chinese media into products or marketing material may differentiate the brand from the competition.

4. Focus on health and safety

Japanese food companies need to pay more attention to food safety and consumer health, especially the adverse effects of nuclear radioactivity. They should prioritise disclosure of information about the food production process and place of origin and implement more stringent quality-assurance measures such as using natural ingredients.

How Acuity Knowledge Partners can help

We have a deep understanding of emerging global and local trends such as China’s view of Japanese food products. This, combined with our expertise in the food and global trade sectors, helps our clients make informed business decisions.

Sources:

-

https://www.maff.go.jp/j/tokei/kouhyou/kokusai/attach/pdf/yusyutu_2312.pdf

-

https://spap.jst.go.jp/investigation/downloads/r_2021_02.pdf

-

https://www.maff.go.jp/j/shokusan/export/e_info/attach/pdf/zisseki-71.pdf

-

https://www.jetro.go.jp/biznews/2023/07/b73dfc022de5285b.html

What's your view?

About the Author

Jiaping Zhang works as an analyst in Acuity Beijing . He is currently providing Japanese and multi-language support in Consulting & Corporates team. He holds a master’s degree in Tianjin Foreign Studies University. Prior to Acuity, he worked as a Research Analyst in Refinitiv with a focus on Japan market company research.

Like the way we think?

Next time we post something new, we'll send it to your inbox