Published on October 10, 2024 by Kaustubh Datta

China has been engulfed in overcapacity in industries recently, as also highlighted by US Secretary of the Treasury Janet Yellen during her visit to the country in April 2024. She expressed the US’s grave concern vis-à-vis global industry – particularly in the high-tech (robotics and automation) and clean energy (electric vehicles, lithium batteries and solar panels) industries. Yellen’s concerns were reinforced by the EU as it implemented anti-dumping policies on imports of electric vehicles (EVs) from China in July 2024. Many European countries’ EV imports from China have surged, threatening domestic EV producers. The EU’s policies have, therefore, adversely impacted China’s economic growth.

Overcapacity trend in China

Overcapacity – production that exceeds market demand – is measured by utilisation rates, i.e., the amount of industrial capacity used for production. A lower utilisation rate implies surplus capacity, and companies with lower utilisation rates tend to reduce prices to generate demand, hurting the industry’s profitability.

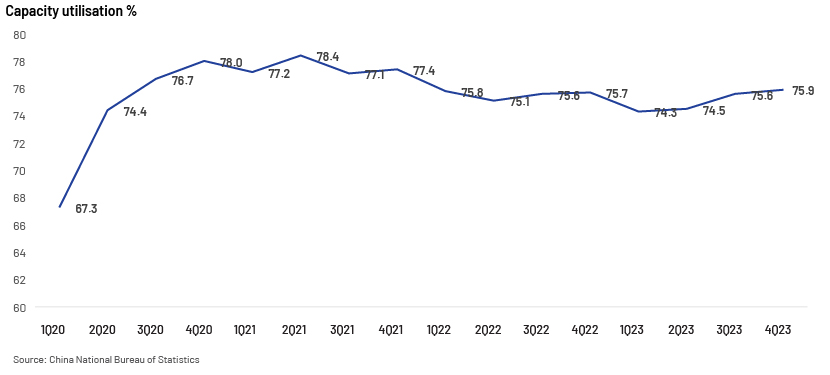

China’s capacity utilisation has historically been around 75%, according to the National Bureau of Statistics, well below the 80% level that is considered normal. The country also faced structural overcapacity from 2014 to 2016 due to the government’s stimulus package in response to the 2008-09 financial crisis. Capacity utilisation dropped below 75% in early 2023 and has been hovering around that level since. A number of micro and macro factors have contributed to the problem of overcapacity, especially in industries such as green energy (EV and solar), cement, lithium, aluminium and steel.

The US and the EU countering China’s trade expansion to safeguard local economy

The Chinese government has, via grants and low-interest-rate loans, historically encouraged its industries to operate with large capacity models. In 2023, the USD700bn of new loans at below the prevailing interest rate led to an increase in production of EVs, batteries and other products integral to the green transition. However, the slowdown in the domestic economy has since pushed such industries to cater to overseas demand, the biggest beneficiary being Build Your Dreams Company (BYD), which has expanded its market share in the battery EV (BEV) category in the EU. Both the US and the EU, therefore, have reasons to limit the growth of Chinese industry.

Domestic companies in the EU perceive a threat from Chinese industries such as BEV. Political tensions between the US and China have led to strict actions impacting Chinese industry, resulting in sanctions and anti-dumping policies.

EU’s anti-dumping policies create resistance

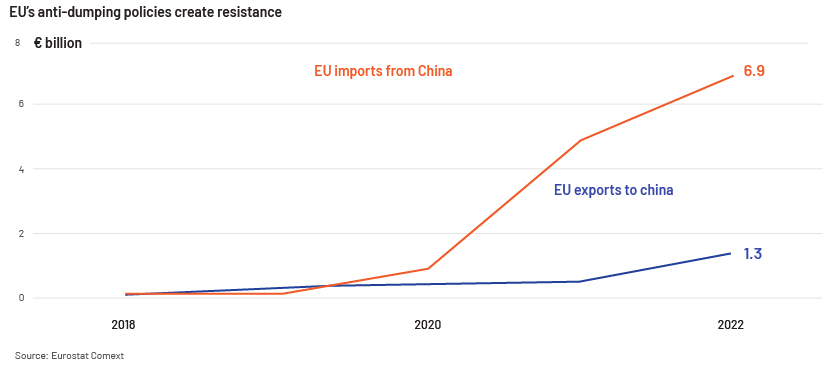

The clean technology industries – particularly China’s BEV industry – have been growing steadily in the EU recently. Anti-dumping is a protection policy implemented by domestic governments through increasing taxes on imports believed to be priced below fair market value. The value of BEV imports from China to the EU grew to EUR6.9bn in 2023 from less than EUR1bn in 2018, and the market share increased to 8% in 2023 from less than 1 % in 2019.

However, in September 2023, the EU launched an investigation of Chinese BEV companies. EU President Ursula von der Leyen stated that the global market is flooded with cheaper EVs, the prices of which “are kept artificially low” owing to “huge state subsidies”.

With the provisional conclusion of the investigation in June 2024, the EU decided to increase provisional duties on Chinese BEVs up to 37.6% for four months. As expected, this impacted China’s top BEV companies, such as BYD, Greely and SAIC, which incurred additional provisional tariffs of 17.4%, 19.9% and 37.6%, respectively. With definitive measures to be imposed after four months of provisional measures, demand for lithium batteries is likely to be impacted well. The Chinese government is pushing for a review of EU policies.

US-China tensions also having an impact

Amid the ongoing US-China tensions, the US revised its tariffs on the EV, solar and lithium battery industries in May 2024, in an effort to support domestic market growth. The US has already pumped in more than USD860bn in the form of business investments through public incentives in industries of the future such as EVs, clean energy and semiconductors. The tariff hike has had an impact on different industries in China, with the biggest impact on the EV and solar industries (with the 100% and 50% hikes, respectively).

| Changes in import tarrif in USA effective 1 August 2024 | ||

| Battery parts | 7.5% | 25% from 1 August 2024 |

| Electrical vehicles | 25% | 100% from 1 August 2024 |

| Lithium-ion EV batteries | 7.50% | 25% from 1 August 2024 |

| Semiconductors | 25% | 50% from 1 August 2024 |

| Solar cells | 25% | 50% from 1 August 2024 |

| Steel aluminium products | 0%-7.5% | 25% from 1 August 2024 |

Source: Executive Office, President of the USA

The US Department of Commerce also started an anti-dumping and anti-subsidy investigation of crystalline silicon photovoltaic cells manufactured in Cambodia, Malaysia, Thailand and Vietnam in an effort to protect domestic solar companies.

Micro factors impacting industries in China

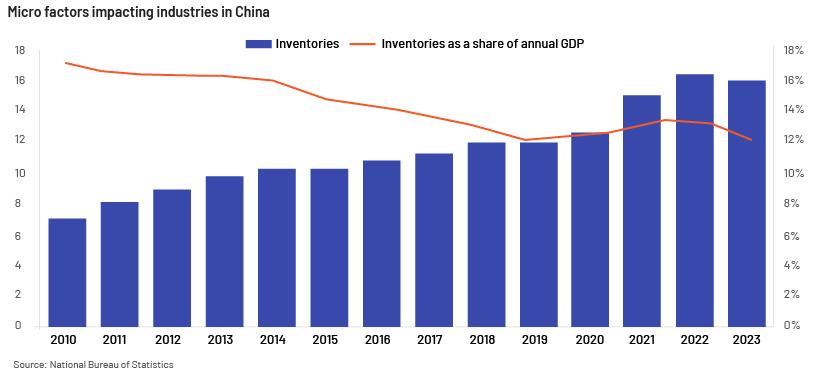

Overcapacity in China has led to increased inventory levels – of 12-18% over 2010-23. This suggests that industries in China are unable to find consumers domestically.

The collapse of Evergrade (China’s biggest realtor), together with rising unemployment, reduced the utilisation rates of the cement and glass industries. China also faces inflationary pressure, and the steps taken by the government have failed to boost consumer sentiment.

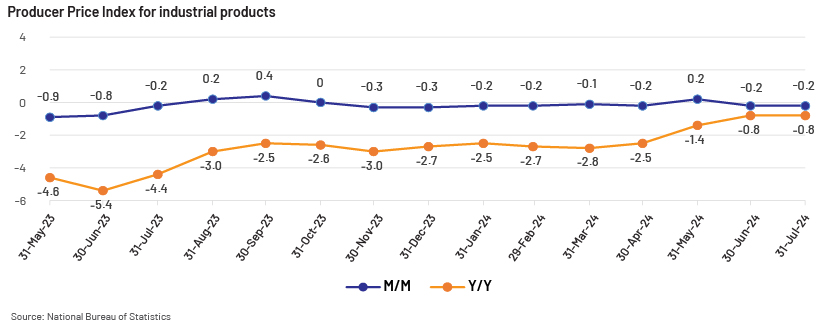

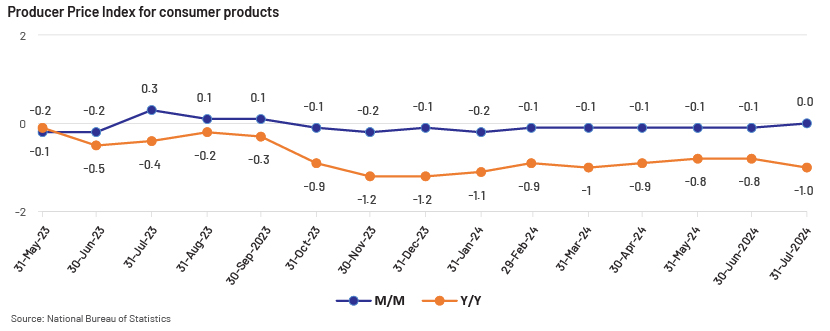

The Producer Price Indices for industrial products and consumer products highlight the deflationary pressure due to a lack of consumer demand and a slow recovery. With rising unemployment, the government’s efforts to stimulate the economy have not helped boost demand. The y/y trend also indicates that the government needs to consider more countercyclical and demand-side policies, rather than supporting supply only, if it is to achieve its target of 5% GDP growth in 2024.

To mitigate overcapacity, we believe China should stabilise its microeconomic environment and manage its macroeconomic policies in line with those of other countries. With China, the EU and the US facing an imminent slowdown, China’s task of managing its policies in line with those of the US and the EU is made a little more difficult. Both China and the US are racing to be the leader in the emerging BEV and green energy industries. Ironically, however, both nations would need each other if either is to have a chance to grow in these industries.

How Acuity Knowledge Partners can help

With our global network of over 6,000 analysts and industry experts, we are a prominent consultancy serving the financial services sector. We specialise in bespoke research services and solutions, including supporting asset managers in tracking industrial trends and specific themes. We help financial services clients stay up to date on new investment frontiers, industry trends and evolving business models. Our offering includes deep-dive analyses, thematic research, competitive landscape analyses and company coverage.

Sources:

-

China's manufacturing overcapacity threatens global green goods trade – Atlantic Council

-

Breaking down Janet Yellen's comments on Chinese overcapacity – Atlantic Council

-

Industrial Capacity Utilization Rate in the Fourth Quarter of 2023

-

China's industrial capacity utilization rate at 75.7 pct in Q4

-

EU to investigate 'flood' of Chinese electric cars, weigh tariffs – Reuters

-

EU announces an investigation into Chinese subsidies for electric vehicles – Reuters

-

EU hits Chinese EVs with tariffs, drawing rebuke from Beijing – Reuters

-

EU-China BEV trade – European Parliamentary Research Service

Tags:

What's your view?

About the Author

Kaustubh Datta has over 6 years of work experience in equity research, supporting both buy-side and sell-side clients. He has been with Acuity Knowledge Partners for over 3 years, and has worked with buy-side fund manager in Consumer and TMT sectors. Kaustubh has completed his Post Graduate Diploma in Management with specialization in Finance from Institute of Management Technology, Hyderabad.

Like the way we think?

Next time we post something new, we'll send it to your inbox