Published on January 23, 2025 by Yu Yang

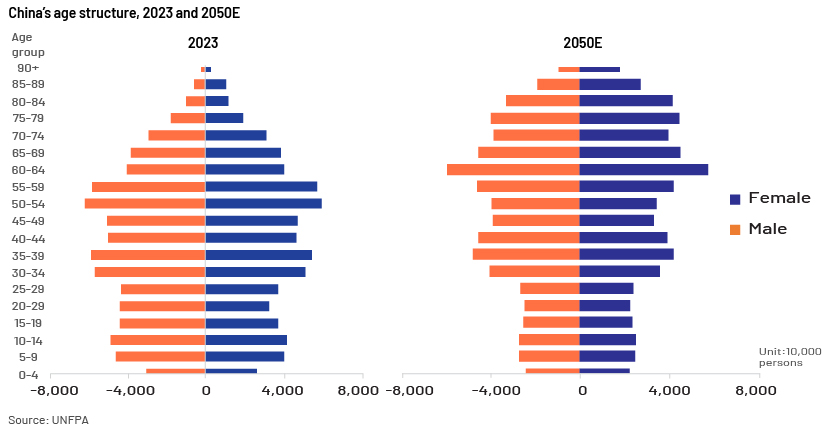

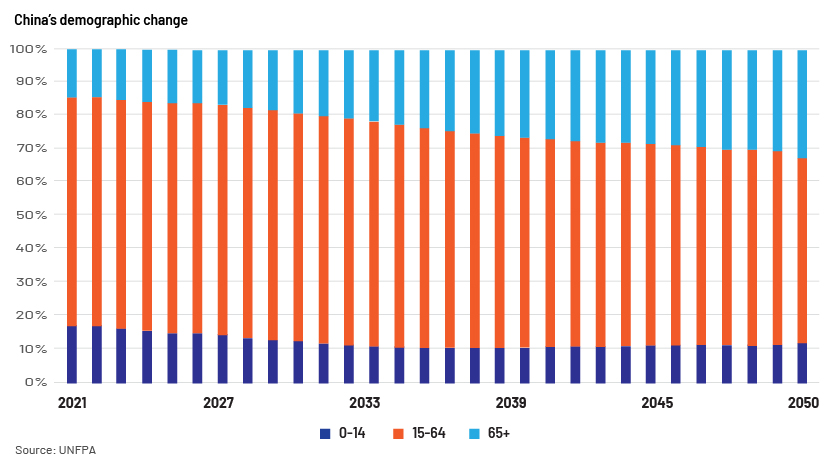

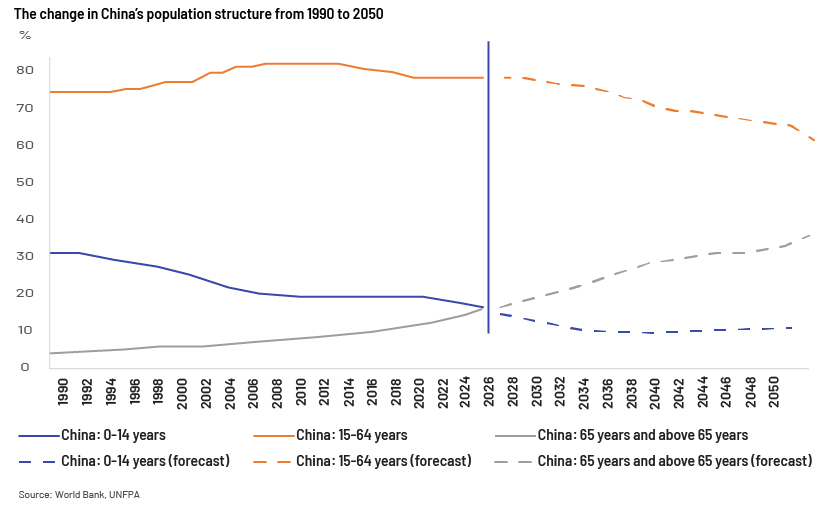

China is undergoing a profound demographic transformation, with an ageing population presenting both challenges and opportunities. The elderly demographic has entered a phase of rapid expansion. Data from the seventh national census in 2022 indicated that individuals aged 60 and above numbered 280m, representing 19.8% of the total population and marking an increase of 0.9% from 2021. Those aged 65 and above reached 210m, accounting for 14.99% of the population, an increase of 0.7% from 2021. In terms of the United Nations’ planning standards(1), China has transitioned into a “moderately aging society”. The challenges posed by China’s ageing population are set to significantly influence economic and social development over the next 30 years. United Nations Population Fund (UNFPA) projections suggest that by 2050, the percentage of the population aged 65 and above in China will surge from 14% in 2021 to 33%. This trend is propelled by a sustained decrease in fertility rates and an increase in life expectancy. The elderly population is expected to outnumber children aged 14 and below by 2.6 times, leading to an “inverted pyramid” population structure.

Opportunities and challenges due to an ageing population

The National Bureau of Statistics of China highlights that population ageing is an important trend in development and a fundamental condition that will likely exist for a long time. This demographic shift presents both challenges and opportunities. The challenges of an ageing population include a reduction in labour supply, a heavier burden on families to provide elderly care, and pressure on public services. On the other hand, it catalyses growth of the “silver economy”: expanding the scope of elderly care, boosting consumer spending in this sector, and encouraging technological innovation, opening new avenues for growth.

This blog discusses the multifaceted nature of the ageing dilemma, examining its impact on pension insurance, healthcare, the elderly-care sector and the burgeoning “silver economy”. It is a narrative of dualities – where challenges and opportunities are intertwined and overcoming challenges presents opportunities. By navigating these complexities, the narrative of ageing could be transformed from a burden on society to a wellspring of opportunity.

1. Pension insurance

This is a cornerstone of social stability, and as China’s elderly population grows, the nation is feeling the mounting pressure on its pension funds. Pension insurance, a vital part of the social security system, ensures a stable income and basic living security for retirees, directly impacting the country’s overall social stability.

As China confronts the realities of an ageing population, the sustainability of its pension system is under scrutiny. Despite a commendable cumulative surplus of nearly RMB6tn in basic pension insurance funds by the end of 2023, a worrying trend has been observed since 2012: the rate of increase in pension contributions has not kept up with the rising pension payouts. This growing disparity hints at potential future deficits, especially as the ageing population expands more rapidly than the workforce. The implications of such a demographic shift are profound, potentially leading to significant pension shortfalls that could affect the nation’s economic stability. It is, therefore, imperative that strategic measures are taken to ensure the pension system can sustainably support China’s ageing society.

Diversifying commercial insurance is one potential solution to this challenge. China’s pension insurance system is based on the three-pillar model proposed by the World Bank in 1994:

-

The first pillar: Mandatory basic pension insurance, the mainstay of old-age support, accounting for 67.3% of the total (2021 data)

-

The second pillar: Enterprise annuities fully funded and accounting for 31.5% of the pension system

-

The third pillar: Commercial pension insurance, currently underrepresented at just 1.2%

This imbalance has prompted China to focus on bolstering the third pillar – commercial pension insurance. Tax-deferred commercial pension insurance has been piloted since 1 May 2018, including tax deductions, to bridge the pension gap through individual purchases of commercial pension insurance.

Nevertheless, the data shows that pilot tax-deferred pension insurance has not been effective, hindered by limited coverage, weak incentives, complex operational processes and inadequate services. To address these issues, commercial insurance companies must continue to innovate, introducing high-quality products and services that cater to the evolving needs of the pension market. By doing so, they can provide robust support to the elderly, ensuring their healthcare and pension needs are met, and contributing to the nation’s social and economic stability.

2. Medical and elderly-care sector

a) The current situation

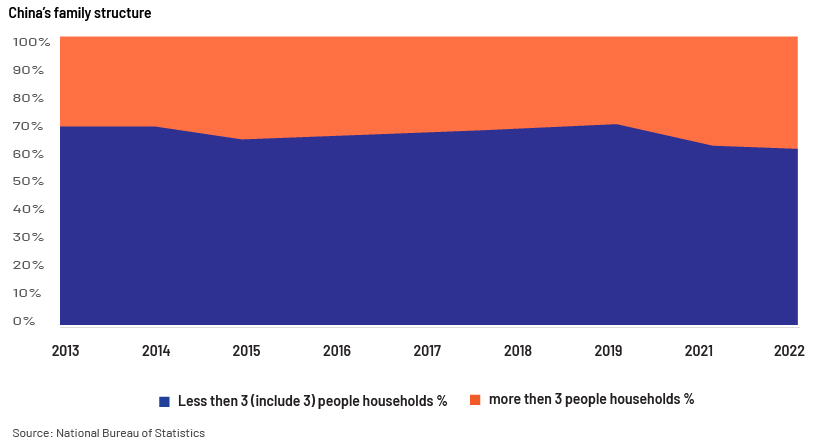

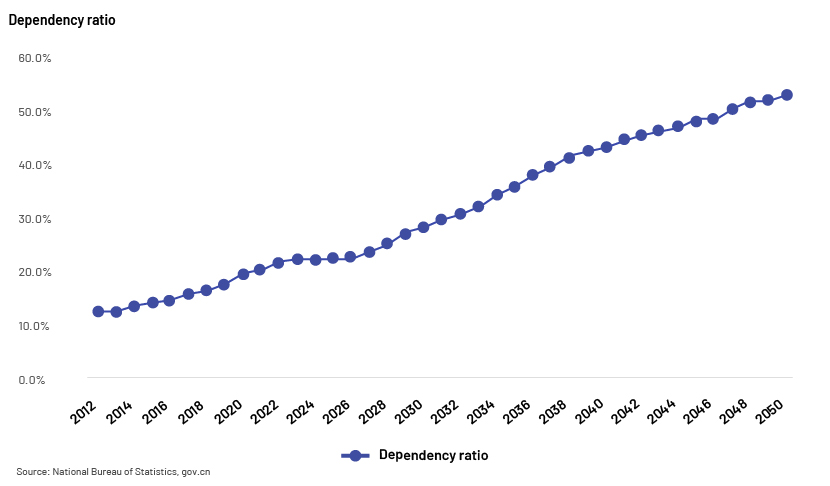

China’s elderly care has shifted from family care to external care, driven primarily by factors such as fewer children due to the one-child policy in force over 1979-2015 (with families with fewer than three members accounting for over 60% of the population in the past eight years) and the increasing dependency ratio (the dependency ratio of those aged over 65 is likely to rise to 53% in 2050 from 13% in 2012). Consequently, there would be no family member to take care of the elderly.

The primary methods of elderly care in China are categorised into three types: home-based, community-based and institution-based. Surveys indicate that most of China’s elderly population prefer home-based care. However, they still require medical attention, leading to family care within communities becoming the predominant form of support for the elderly. Typically, this model is divided into two categories: community-based home-care services and community-based facility services.

-

Community-based home-care services primarily involve providing door-to-door services for the housebound elderly. These services include physiotherapy, traditional Chinese medicine treatment, nutritional care, speech therapy and psychological counselling.

-

Community-based facility services include constructing community health stations that offer medical treatment and prescription services in close proximity. The number of nursing-care beds, together with short-term caretaking services to meet demand for professional care of the elderly, has also increased.

Professional institutions that provide elderly care include rest homes, elder apartments, geriatric rehabilitation institutions, nursing homes and hospices. Services are provided according to the needs of the elderly.

-

Rest homes provide help with activities of daily living, physical recuperation and entertainment.

-

Elder apartments are designed specifically for the aged, enabling senior citizens to have their own living space and enjoy social activities, restaurant services and other amenities.

-

Geriatric rehabilitation institutions focus on rehabilitation.

-

Nursing homes provide medical treatment and care for those of advanced age and the ill.

-

Hospices can reduce pain, increase comfort, enhance quality of life and protect the dignity of patients in the last stages of their lives.

b) Challenges

In general, community-based home-care services in China currently face a number of challenges, including a shortage of effective supply, substandard service quality and improper allocation of resources. Specifically, the distribution of treatment resources within the community is misaligned, and the layout structure does not match the needs of the elderly. Additionally, medical capabilities are limited, and the scope and level of diagnosis, treatment and service quality do not meet the requirements of the elderly.

Furthermore, there is a significant gap in the supply of nursing services for the elderly in China. The number of disabled elderly individuals has increased slightly due to the growing ageing population – the number of disabled elderly individuals aged 60 and above in China was estimated at 46.54m as of 2021-23. Meanwhile, facilities and professional personnel in the nursing sector are insufficient. The National Health Commission reports the number of elderly-care service beds at only 8m, far short of international standards and domestic-market demand. However, as China places greater emphasis on nurturing nursing skills and continues to provide government subsidies and policy support to increase bed supply, the nursing market is set for new developments.

3.The “silver economy”

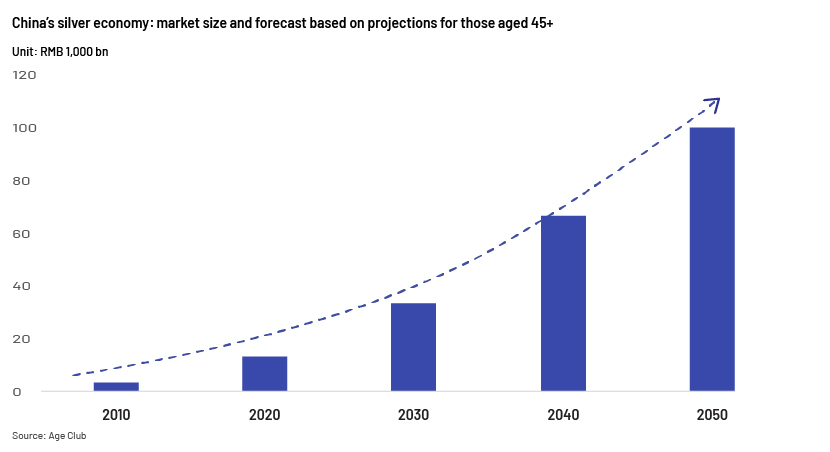

This refers to the burgeoning array of sectors and services dedicated to meeting the needs and enhancing the lives of the elderly. It is particularly focused on the fusion of technology and gerontology. In China, the market for elderly-related sectors is in its nascent stages but shows significant potential. The value of China’s silver economy is expected to spike to RMB102.7tn by 2050 from RMB3.4tn in 2010, according to projections by AgeClub, which focuses on individuals aged 45 and above.

Moreover, China’s second generation of baby boomers (those born between 1962 and 1975) boasts an impressive average annual birth rate of 26.28m. Having reaped the benefits of nearly two decades of national development, this demographic’s average assets in major cities are estimated to reach RMB3-4m. As they near or enter retirement, their substantial purchasing power and potential herald significant opportunities for China’s consumer goods market and the socio-economic fabric at large.

The ageing population is increasingly becoming the primary consumer group, particularly in the realm of digital consumption, with Alibaba reporting 20.9% growth in spending by the elderly in 2022. This shift towards high-quality, enjoyment-focused purchases includes investment in beauty, wellness, smart devices and healthcare tourism. The use of shopping apps by the elderly rose by over 80% and smart device purchases by more than 52%. As they seek convenience and comfort, personalised services and smart products that enhance life quality are becoming essential for the elderly.

The silver economy is on the brink of transformation. While current offerings in elderly care do not fully meet the diverse needs of the elderly, a shift driven by both market forces and supportive polices is expected to catalyse substantial growth. Strategic positioning by enterprises, coupled with increasing internet use among the elderly, points to a golden decade ahead for the sector, potentially culminating in a milestone by 2030.

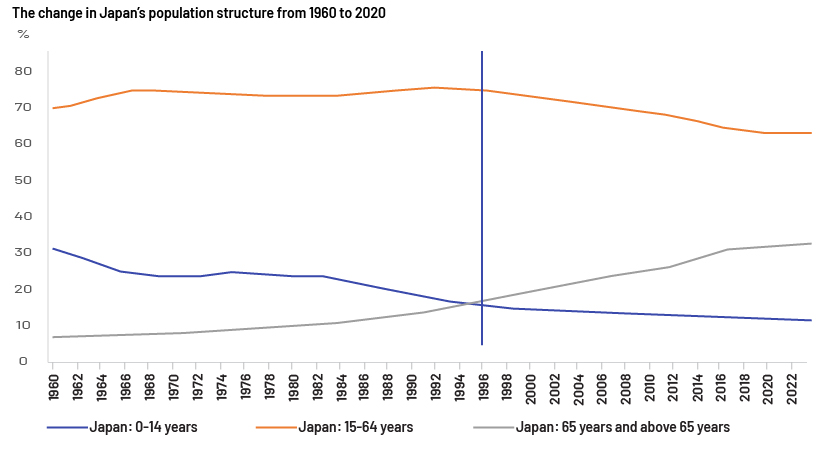

Similarities between China and Japan

China can draw valuable lessons from Japan’s experience to expedite growth of its pension sector. Japan’s pension sector, after decades of evolution, has reached a level of maturity. Furthermore, the demographic cycles of China from 2020 to 2050 and Japan’s from 1990 to 2020 show remarkable similarities in terms of trajectory – historically and for the future. Specifically, those aged 14-65 (working age) accounted for 68.6% of China’s population; those aged over 65 for 13.5% and those under 14 for 17.9%. These figures closely align with Japan’s in 1991, with those aged 14-65 accounting for 69.8% of the population, those aged over 65 for 12.9% and those under 14 for 17.3%. The UNFPA forecasts the proportion of China’s elderly (over 65) to rise to approximately 30% from 2020 to 2050, a trend that mirrors Japan’s demographic shift from 1990 to 2020.

Lessons from Japan

China can learn from Japan’s innovative approach and respect for the elderly, such as its social security system, comprehensive elderly-care services and smart elderly-care products:

-

Social security system: Japan’s robust social security system is a testament to its commitment to elderly care. With a three-tiered structure consisting of national subsidies, employee pensions and private pension, complemented by specialised medical and long-term care insurance systems for the elderly, Japan has created a safety net that other countries aspire to replicate.

-

Comprehensive elderly-care services: In Japan, conglomerates such as Nichii Gakkan and Benesse have revolutionised elderly care by extending their services beyond the basics. They offer a holistic suite of services that cater to the diverse needs of the elderly, including the rental and sale of senior housing, leasing of elderly-care products, medical services, universities for the elderly, senior clubs and nursing training programmes. This integrated approach ensures that every aspect of elderly life is supported and enriched.

-

Smart elderly-care products: The Japanese government’s proactive stance on the research and development of smart elderly-care products is commendable. These products, focusing on mobility assistance, walking support, automatic excretion management, health monitoring and wandering surveillance, are not just gadgets but lifelines that significantly improve the daily lives of the elderly.

Conclusion

China’s ageing population is not just a societal challenge, it is a fountain of opportunity for forward-thinking businesses. This shift in demographics is a call to action for sectors, especially healthcare, elderly care and tourism, to innovate and evolve. Companies that strategically embrace this change are poised to reap substantial benefits. By engaging with the burgeoning ageing market, business can spur economic growth and social progress, creating a harmonious environment where ageing becomes valuable wealth, enhancing the lives of the elderly and ensuring a thriving society for all.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners assist wealth managers by extending their research capabilities across equity, credit and funds, while also offering services in sales, marketing, portfolio management, compliance and credit risk analysis. Our Beijing centre leverages its local expertise and bilingual analysts to support global wealth managers with corporate access in China, overcoming language and cultural barriers. Partnering with us, clients achieve significant cost savings and enhanced investment performance.

Sources:

-

chinas_population_projection – medium_variant_0.pdf (unfpa.org)

-

观点 | “新老年养老消费元年”已至,2025-2035年将成老年行业发展黄金期_澎湃号·湃客_澎湃新闻-The Paper

-

https://www.hkhomecare.com/?msclkid=834887971d3d1170083fe10041d2f986&utm_source=bing&utm_medium=cpc

Tags:

What's your view?

About the Author

Yu Yang has over 7 years of experience in the financial services industry. Since joining Acuity, Yu has provided Equity Research support services for multiple global Top-tier Investment banks, focusing on China’s Banking, Property, EV, transportation, and leisure sectors. Yu holds a master’s degree in Financial Management from the University of Birmingham.

Like the way we think?

Next time we post something new, we'll send it to your inbox