Published on March 3, 2025 by Parth Parikh and Pavan Soni

Understanding Climate Risk for Financial Institutions

It is now increasingly evident that climate risk is no longer a buzzword, neither for humans, nor for financial institutions. Like any other risk factor, regulators are coming up with ways to monitor, measure and integrate the impact of climate risk on banks and other financial institutions. Through this blog, we aim to demystify climate risk – what it means, its types, the regulations surrounding it and its potential impact on financial institutions.

Types of climate risk

Climate risk refers to the potential negative effects of climate change on aspects of the environment, businesses and society. It is made up of two main risk drivers: physical risk and transition risk.

-

Physical risk refers to the direct threats presented by changing climate conditions. These include acute risks from extreme weather events such as hurricanes, floods, heatwaves and droughts. They also include problems that stem from long-term shifts in climate patterns, such as rising sea levels and increasing temperatures.

-

Transition risk refers to an institution’s financial loss that can result, directly or indirectly, from the process of adjusting to a lower-carbon and more environmentally sustainable economy. This could be due to adopting climate- and environment-related policies, policy and regulatory changes, technological advancements and shifts in consumer preferences that may lead to reduced demand for certain products or services.

How Climate Risk Impacts Financial Institutions

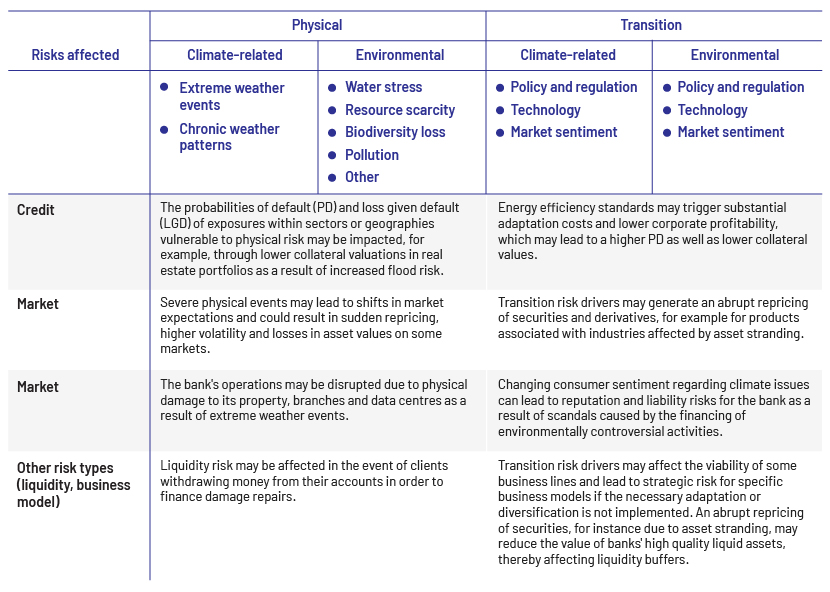

This can be observed through traditional risk categories. The table below summarises the potential effects in each risk type:

Table 1: Examples of climate- and environment-related risk drivers

Regulatory landscape

It is established that climate risk will likely be a significant risk factor for financial institutions. Global regulators are, therefore, taking significant strides to measure and mitigate climate risk. Frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD) and the Network for Greening the Financial System (NGFS) are setting standards for transparency. Regulatory bodies such as the European Central Bank (ECB) and the Bank of England have mandated stringent climate-related disclosures and risk-management practices.

In addition to climate-related disclosures, there are discussions on incorporating climate risk-related stress-testing within Dodd-Frank Act Stress Testing (DFAST). This could involve climate risk-related exploratory scenarios from the NGFS summarised in the table below.

Table 3: Possible stress scenarios relating climate risk:

| Scenario component | Baseline climate scenario | Severely adverse climate scenario |

| Temperature increase | +1.5°C by 2050 | +3°C by 2050 with accelerated global warming |

| Carbon tax | Gradual increase | Immediate implementation, impacting carbon-intensive sectors |

| Sector impact | Minimal disruptions; gradual adaptation in high-emission sectors | Significant decline in oil and gas, heavy sectors; renewable energy accelerates |

| Physical risks | Mild increase in frequency of storms and floods | Severe weather events (e.g., category 5 hurricanes, 100-year floods) occurring annually |

| Default rates (example) | Probability of default (PD) increases by 0.05% annually for coastal regions | Probability of default (PD) spikes by 5% in high-risk areas, especially in flood-prone or drought-impacted regions |

| Energy transition costs | USD10bn/year sector-wide investment in renewable energy | USD50bn/year to meet accelerated decarbonisation timelines |

| Economic impact | GDP growth reduced by 0.1% annually due to moderate adaptation costs | GDP contracts by 2% annually due to rapid regulatory shocks and economic disruptions |

How Financial Institutions Are Adapting to Climate Risk in the Future

While there are no universal regulations mandating that banks set aside additional capital for mitigating climate risk under Basel III guidelines, conversations about this are advancing rapidly. For instance, the ECB and the Bank of England have discussed integrating climate risks into Pillar 2 capital requirements, requiring banks to allocate more capital if they are heavily exposed to climate risks.

In June 2022, the Basel Committee on Banking Supervision (BCBS) released "Principles for the Effective Management and Supervision of Climate-Related Financial Risks", outlining principles for the effective management and supervision of climate-related financial risks. In November 2023, the BCBS released a consultative paper regarding the Pillar 3 disclosure framework for climate-related financial risks. In January 2025, based on the responses from the abovementioned consultative paper, the uropean Banking Authority (EBA) released guidelines on the management of environmental, social and governance (ESG) risks.

How Acuity Knowledge Partners can help

We empower financial institutions to navigate the complexities of climate risk through our advanced ESG solutions. Our capabilities include the following:

-

ESG model development and validation We build robust climate risk models tailored to client needs. Our validation processes ensure model integrity, transparency and compliance with regulatory expectations.

-

Customised ESG scoring Leveraging advanced analytics, we develop bespoke ESG scoring methodologies that incorporate climate risk factors. Our scoring models help institutions assess portfolio alignment with sustainability goals, identify high-risk exposures and make informed investment decisions.

-

Data integration and benchmarking We integrate external ESG datasets with internal risk frameworks to provide a unified view of climate and financial risks. Our benchmarking services also help compare ESG performance against peers’.

Sources

-

https://www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm.202011finalguideonclimate-relate.pdf

-

https://www.federalreserve.gov/publications/2023-june-dodd-frank-act-stress-test-preface.htm

What's your view?

About the Authors

Parth Parikh has 8 years of experience spanning across Model Risk Management and Corporate Finance. He specializes in validation of models across asset classes like Fixed Income, Equity and Real Estate. At Acuity Knowledge Partners, he currently supports model validation engagement for a US-based bank.

He has completed MBA in Finance from T.A Pai Management Institute. Additionally, he holds FRM charter and has cleared all levels of CFA.

Pavan Soni has 3 years of experience in Model Risk Management. He specializes in validation of models across Portfolio optimization, Credit Risk, Climate Risk and Fixed income. At Acuity Knowledge Partners, he currently supports US based credit union in validation of CECL, CPST and Economic Capital models.

Pavan is a FRM charter holder and has completed Bachelor of Engineering from Sinhgad College of Engineering, Pune.

Like the way we think?

Next time we post something new, we'll send it to your inbox