Published on July 30, 2021 by Faisal Riyaz

The environmental crisis is upon us, and there is global consensus that inaction today will lead to breakdown of the natural order and great hardships for the future generations. Many developed countries have already announced climate targets and strengthened environmental regulations to reach their short-term and long-term goals. Chinese President Xi Jinping pledged in September 2020 that China would reach its peak carbon emissions by 2030 and carbon-neutrality by 2060 (called the “30·60” targets). This March, at the annual “Two Sessions” political meetings, China adopted the 14th Five-Year Plan (2021-25) that includes aggressive targets to reduce the country’s energy intensity and CO2 emissions intensity by 13.5% and 18%, respectively. Achieving such ambitious targets would require a radical shift from fossil fuels to clean energy and significant financial investment in green projects, clean energy and new technologies. In this note, we look at some trends in green financing driven by the setting of climate targets.

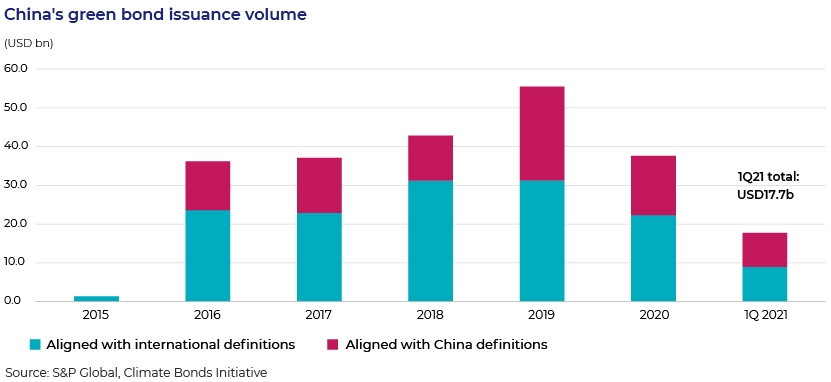

Green bond market rebounds in 2021

China’s green bond issuance volumes dropped for the first time last year mainly because of the pandemic. The country issued USD37.6bn worth of green bonds in 2020, down from USD55.6bn in 2019. However, 1Q21 alone saw issuance rising to USD17.7bn, indicating a strong start to the year and, according to some, the potential to beat the peak 2019 record.

1Q performance is attributed partly to the recovery in China and partly to the government’s move to set clear short-term and long-term environmental targets for the country.

The quarter also saw six Chinese state-owned utilities and infrastructure companies issuing the country’s first batch of carbon-neutral bonds totalling USD 992m. Carbon-neutral bonds are a type of green bonds where the funds raised need to be strictly allocated to green projects. Such bonds require assessment and certification by third-party professional firms to provide a quantitative measurement of environmental benefits such as the reduction of CO2 emissions.

Sustainability-linked bonds take off

On 10 May, the first batch of seven sustainability-linked bonds (SLBs) hit the Chinese market. Issued by China Huaneng, Datang International Power Generation, China Yangtze Power, GD Power, Shaanxi Coal and Chemical Industry Group, Liuzhou Steel Group and Hongshi Group, the bonds a have a total value of CNY7.3bn. Unlike green bonds, the funds from which can be used only for projects with direct environmental impact, proceeds from SLBs have no such capital allocation restriction, and their structural features depend on whether the issuer achieves predefined sustainability objectives (known as Sustainability Performance Targets). SLBs are useful for companies that want to pursue a broader approach to address ESG issues in their business and that cannot issue green bonds due to strict restrictions on capital allocation towards specific green projects. The launch of SLBs is a welcome supplement to the green bond market.

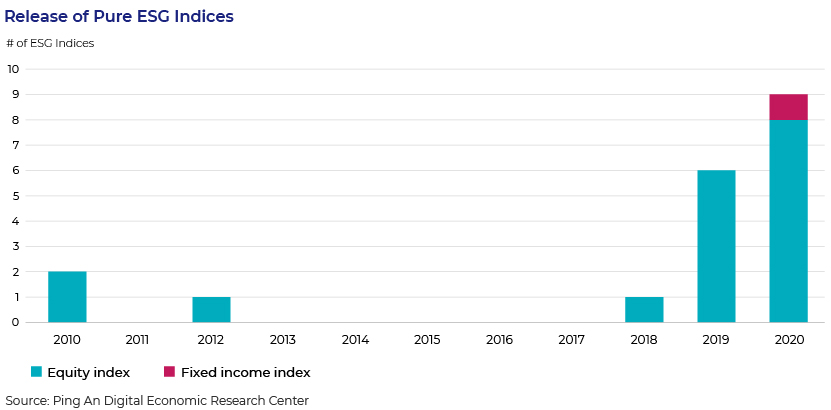

ESG-themed equity investments are on the rise

Capital flow into ESG-themed exchange-trade fund (ETF) investment in China increased 464% from 2018 to 2019, according to a report by Ping An Research. Meanwhile, there has been a rapid rise in the number of pure ESG products made available to investors. Currently, there are 19 pure ESG indices in the Chinese market, of which 15 were released in the past two years.

A recent survey of institutional investors by investment bank Brown Brothers Harriman & Co. (BBH) found that 92% of investors in Greater China plan to allocate more capital to ESG strategies in 2021. In five years, 53% of these investors expect to have at least 11% of their portfolios in ESG ETFs, up from 43% in last year’s survey. These trends show a growing appetite for green investments in recent years.

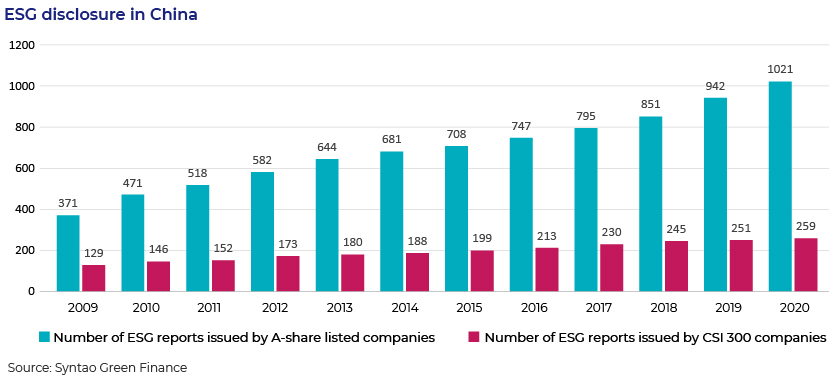

ESG disclosure shows steady improvement

Widespread ESG adoption by investors requires transparent disclosure of ESG data by companies.

ESG reports issuance by listed Chinese companies has increased steadily since 2009. In 2020, over 86% (259) of CSI300 constituent companies issued ESG reports, showing increasing awareness of ESG issues on the part of leading companies.

However, most of the ESG disclosure is still voluntary, with the mandatory part limited to a few key indicators. This has been a key concern for investors who require a standardised mandatory disclosure framework to compare their domestic and international portfolios. Regulations on mandatory disclosure were to be introduced in 2020 but have been delayed due to the pandemic. Governor of the People’s Bank of China Yi Gang mentioned at a conference in June 2021 that, “Our goal is to make unified disclosure standard, and in the future, we will go in the direction of mandatory disclosure of climate-related information.”

Conclusion

Given the climate targets, China’s ESG market is expected to grow rapidly. Goldman Sachs estimates that for China to achieve a net zero target by 2060, it will require USD16tn of investment to 2060, which translates into c.USD400bn of annual investment in green financing, much more than the current level. A lot of this would go into investment in new technologies and upgrading the current infrastructure including renewable energy, power networks, energy storage, electric vehicles, charging networks, hydrogen plants and hydrogen pipeline infrastructure and carbon capture, utilisation and storage (CCUS).

To attract green investors, China issued the Green Bonds Endorsed Project Catalogue (2021 Edition) this May, excluding high-carbon-emission projects from financing, such as projects for the clean utilisation of fossil fuels, and adopts the internationally recognised principle of “no significant harm” to introduce stricter carbon-reduction constraints. This brings China’s green bond taxonomy closer to international standards.

Climate targets are driving the ESG market in China, and investors need to keenly follow the changing landscape. Acuity Knowledge Partners has been assisting sell-side and buy-side research firms, corporates and investments banks with ESG research. Our team of bilingual analysts based in Beijing support clients on ESG due diligence including ESG policies and frameworks, analytics of ESG indicators and themes, scoring, rating and benchmarking, report writing and customised research on ESG themes.

References:

Syntao Green Finance – http://www.syntaogf.com/Uploads/files/China%20Sustainable%20Investment%20Review%202019.pdf

Climate Bonds Initiative – https://www.climatebonds.net/resources/reports/2019-green-bond-market-summary

Ping An, ESG Investment in China, November 2020 – https://group.pingan.com/dam/jcr:4519da79-ddc6-483a-ab82-28a59ff6af4a/ESG_%20Investment_%20in_China.pdf

Brown Brothers Harriman, 2021 Greater China ETF Investor Survey – https://www.bbh.com/content/dam/bbh/external/www/investor-services/insights/2021-greater-china-etf-investor-survey/20210720-IS-Greater%20China%20ETF%20Survey-accessible.pdf

Goldman Sachs, China Net Zero, The Clean Tech Revolution – https://www.goldmansachs.com/insights/pages/carbonomics-china-net-zero.html

What's your view?

About the Author

Faisal has over 13 years experience in investment banking with domain expertise in sustainability. He manages multiple client teams across Corporate Finance / M&A, and Sustainable Finance at Acuity China. A significant aspect of his work involves managing client relationships, setting up new client teams, coaching and mentoring of team members, finalizing methodology documents and knowledge management of ESG content.

Faisal has hands-on experience in financial analysis & valuation and extensive knowledge of sustainability, climate risk, circular economy and ESG standards and frameworks.

He holds an MBA from ICFAI University and the Sustainability & Climate Risk Certification from GARP.

Like the way we think?

Next time we post something new, we'll send it to your inbox