Published on June 24, 2024 by Animesh Trivedi

Introduction

Collateral management is the cornerstone of financial transactions, encompassing the meticulous tracking, valuation and monitoring of assets pledged as collateral. These assets serve as a vital buffer for lenders, offering protection against borrower default and mitigating risk in lending operations. Given the pivotal role of collateral valuation in shaping loan terms and minimising risk exposure, it is imperative to employ robust techniques and adhere to best practices. This comprehensive article explores the nuances of collateral valuation techniques and offers insights on industry-leading practices to ensure accurate and reliable assessment.

In the realm of finance, collateral is more than just a security measure; it is a strategic asset that enhances risk mitigation, bolsters borrowing capacity, lowers interest rates, improves liquidity and optimises capital allocation. By implementing effective collateral valuation practices, financial institutions can fortify their collateral management strategies and safeguard their credit risk in an ever-evolving market landscape.

This blog aims to equip professionals with the knowledge and tools necessary to navigate the complexities of collateral valuation effectively. From risk mitigation to capital optimisation, understanding the intricacies of collateral valuation is paramount for ensuring the resilience and success of lending operations

Understanding collateral valuation

Collateral encompasses a spectrum of assets, ranging from real estate, equipment, securities and accounts receivable, pledged by borrowers to secure loans. The valuation of collateral involves the assessment of these assets' worth, facilitating informed lending decisions. A thorough understanding of collateral valuation techniques is indispensable for lenders, appraisers and financial professionals alike.

Ensuring precise valuation of collateral significantly enhances credit risk management. The value of collateral plays a crucial role in determining the loss given default (LGD). Incorrect valuation of collateral could result in higher-than-anticipated loan losses upon default, putting a substantial strain on a bank's equity capital. By implementing a more precise valuation process, a bank could lower its LGD estimate, subsequently reducing the risk margin incorporated into its pricing mechanisms, such as interest rates.

Collateral valuation techniques

In broad terms, valuation is approached through three widely recognised methods: the income approach, market approach and cost approach. These methodologies adhere to legal frameworks, statutory guidelines, court decisions and established industry practices. The determination of value hinges on the specific objectives of the valuation, which can vary significantly. Therefore, the selection of an appropriate basis of valuation is pivotal.

1. Market approach

The market approach relies on comparative analysis, where the value of the subject collateral is determined by examining comparable assets recently transacted in the market.

Real estate appraisals frequently employ this method, using sales data of comparable properties in the vicinity to ascertain reasonable value.

For instance, when evaluating a residential property, factors such as location, size, condition and recent sale prices of comparable homes are considered.

2. Income approach

The income approach assesses collateral value based on the income it generates or is expected to generate in the future.

Particularly applicable to income-generating assets such as rental properties and business equipment, this method entails discounting projected cash flows to their present value.

In the case of commercial real estate, rental income, occupancy rates, operating expenses and market rental rates are assessed to estimate the property's value.

3. Cost approach

The cost approach entails evaluating collateral based on the cost of replacing or reproducing it.

This method is used for specialised assets with limited market comparables, such as machinery or custom-built structures.

This method is used for specialised assets with limited market comparables, such as machinery or custom-built structures.

Best practices in collateral valuation

Adherence to best practices in collateral valuation is essential to ensure accuracy, transparency and compliance in the financial sector. By complying with established standards, institutions can mitigate risk, enhance credibility and maintain confidence in the valuation process. Consistent application of best practices helps minimise errors, discrepancies and potential fraud, safeguarding the integrity of financial transactions. Overall, implementing best practices in collateral valuation promotes efficiency, reliability and trustworthiness, ultimately contributing to a stable and resilient financial ecosystem.

1. Conduct thorough due diligence

Conduct meticulous research on the collateral asset, including its physical condition, market dynamics, regulatory considerations and legal encumbrances.

Verifying ownership and title is imperative for ascertaining the asset's eligibility for pledging as collateral.

2. Use multiple valuation methods

Employing a blend of valuation techniques enhances the robustness and reliability of assessments.

By corroborating results from different methods, lenders can mitigate the inherent limitations of any one approach and arrive at a more comprehensive valuation.

3. Engage qualified appraisers

Collaborating with competent and accredited appraisers is paramount to ensure the integrity and accuracy of valuation outcomes.

Appraisers with specialised expertise in the relevant asset class should be enlisted, ensuring adherence to professional standards and regulatory guidelines.

4. Perform regular monitoring and review

Collateral values are susceptible to fluctuations influenced by market dynamics, economic conditions and other external factors.

Establish protocols for periodic monitoring and review of collateral valuations to promptly identify and address deviations from expected trends.

Assessing collateral quality

Collateral quality plays a pivotal role in collateral valuation, as it directly influences the risk associated with a financial transaction. High-quality collateral provides a reliable source of security, offering assurance to lenders and investors that their interests are protected in the event of default. Conversely, poor-quality collateral poses greater risk, potentially leading to higher losses in case of default. Assessing collateral quality ensures that the asset's value accurately reflects its risk-mitigating potential, enabling lenders to make informed lending decisions and investors to accurately assess the risk-return profile of their investments.

1. Physical inspection

Conducting on-site inspections of collateral assets to assess their physical condition, maintenance and overall quality.

This enables lenders to verify the accuracy of reported asset details and identify any discrepancies or potential risks.

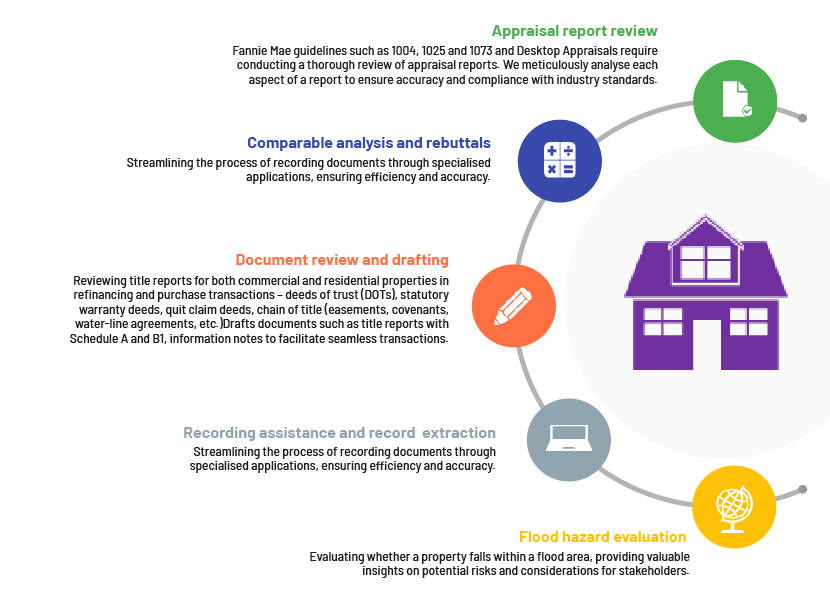

2. Documentation review

Examining documentation relating to the collateral, including final title policy, security documents, UCC, ownership deeds, maintenance records and insurance policies.

Thorough documentation review helps ascertain the legitimacy of collateral ownership and uncover encumbrances or legal issues.

3. Third-party reports

Using third-party reports such as property inspections, environmental assessments and title searches to obtain independent validation of collateral quality.

Third-party reports offer unbiased insights on the condition and viability of collateral assets, enhancing the accuracy of valuation assessments.

Common challenges in valuation

Dealing with collateral valuation poses multifaceted challenges amid market volatility, subjective assessments and complex asset structures. Addressing these challenges necessitates adopting adaptable methodologies, leveraging advanced analytics and fostering transparency to ensure accurate and reliable collateral valuation in dynamic financial landscapes.

The following are common challenges that affect the valuation process; they require close attention if they are to be addressed properly.

1. Market volatility

Fluctuations in market conditions can impact the value of collateral assets, posing challenges in determining accurate valuations.

Mitigation: Employ robust risk management strategies and regular monitoring to track market trends and adjust valuations accordingly.

2. Subjectivity in valuation

Valuation assessments may involve subjective judgements and assumptions, leading to discrepancies in valuation outcomes.

Mitigation: Engage qualified appraisers with expertise in the relevant asset class who will adhere to standard valuation methodologies to ensure objectivity and consistency.

3. Complex asset structures

Certain collateral assets, such as complex financial instruments or intellectual property, present challenges in valuation due to their intricate nature.

Mitigation: Collaborate with specialised valuation experts and leverage advanced analytical tools to accurately assess the value of complex assets.

The collateral valuation process involves a multitude of complex factors that demand substantial time and pose considerable challenges to institutions and agencies engaged in collateral evaluation. The entire process requires meticulous examination of collateral documentation, leveraging expert resources for thorough review and timely preparation of packages for pre- and post-valuation.

How Acuity Knowledge Partners can help

With our steadfast commitment to excellence and innovation, we are a premier provider of collateral management solutions tailored to meet the diverse needs of financial institutions worldwide.

For 20 years, we have been at the forefront of the sector, empowering our clients with robust tools and expertise to effectively manage collateral assets and mitigate credit risk. We offer a comprehensive suite of collateral management services, including collateral valuation, eligibility assessment, monitoring and optimisation. Our team of seasoned professionals leverages cutting-edge technology and industry best practices to deliver accurate, timely and actionable insights on collateral portfolios.

We understand the complexities and challenges of collateral management in today's dynamic financial landscape. Hence, we collaborate closely with our clients to develop customised solutions that align with their unique requirements and objectives. Whether it is optimising collateral usage, enhancing regulatory compliance or improving operational efficiency, we are dedicated to helping our clients achieve their goals and driving success.

Sources

Tags:

What's your view?

About the Author

Animesh Trivedi is a part of commercial lending with nearly a decade of experience in the U.S. real estate market. His expertise spans property appraisals, quality assurance, and managing tax certificates. He has also worked extensively with homeowners' association documents and project associations, including condominiums and planned unit developments. Animesh's expertise further extends to title and escrow processes, from drafting titles to managing documents from start to finish. His attention to detail and thorough understanding of real estate regulations ensures smooth transactions and successful outcomes in process transition and functioning. He holds a Post Graduate Diploma in International business and Marketing from Jaipuria Institute of Management, Noida

Like the way we think?

Next time we post something new, we'll send it to your inbox