Published on August 19, 2023 by Narayan Somani and Hitesh Acharya

Financial institutions are facing a tough operating environment in 2023, driven by stagnating economic growth, high inflation, a liquidity crunch and heightened geopolitical tensions. The failures of Silicon Valley Bank, Signature Bank of New York and First Republic Bank in the US and the downfall of Credit Suisse indicate the challenges due to tighter monetary conditions and their impact on asset prices and quality. However, banks and other major financial institutions have built resilience since the 2008 subprime crisis, as evidenced by their capital and liquidity parameters (tier 1 capital of 14-15% at present versus 10-11% in 2007, with loan-to-deposit ratios below 85%) and shedding non-core activities, which should help them survive the stress of the current economic slowdown.

We list below six salient banking trends visible in 2023:

1) Higher net interest margin (NIM) offset by higher costs: Rising interest rates have led to wider interest spreads and increased yields for lenders. However, surging deposit rates and deposit outflows to higher-yielding alternatives (such as money-market funds) may weigh on net interest income (NII) going forward. Furthermore, the high interest rate environment may dampen economic growth and reduce demand for credit for investment and consumption, while rising wage inflation and infrastructure costs may further offset benefits of interest rate hikes. For instance, although US banks recorded an all-time-high profit of approximately USD80bn in 1Q 2023, up 33% from 1Q 2022, their aggregate interest expenses also rose 10-fold from a year ago to USD85bn in 1Q 2023. Consequently, US bank earnings are expected to fall 18.3% in 2023 year-on-year as deposit outflows and higher deposit betas weigh on NIMs. Moreover, sustained high interest costs, combined with low demand, may lead to increased corporate delinquencies and arrears, although there is no clear distress visible at present.

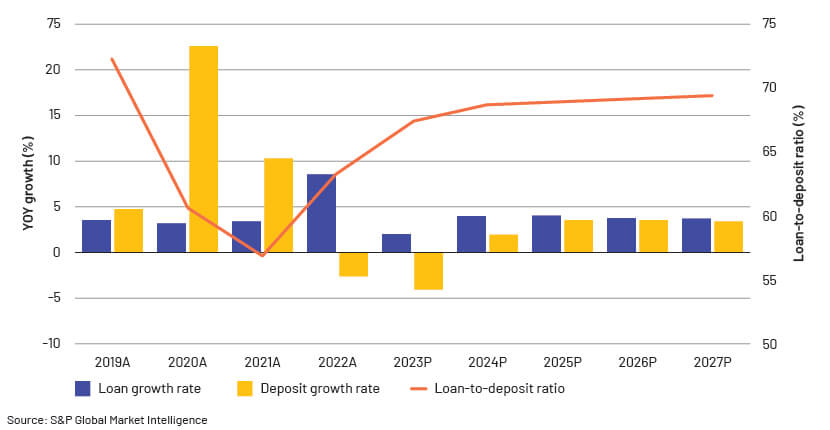

The chart below indicates that lower deposit growth rates of US banks would pressure their liquidity in the short term.

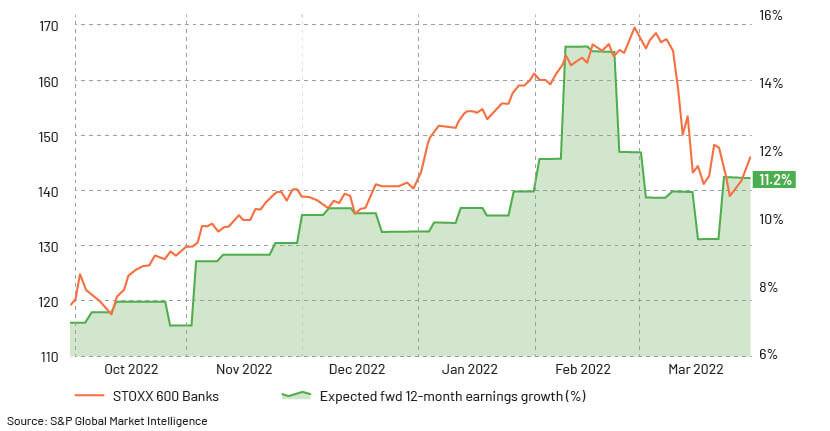

In Europe, 23 of the 25 largest banks are set to record year-over-year increases in NII in 2023. However, as can be seen in the chart below, European banks’ forward 12-month earnings growth expectations fell in March 2023 to their weakest since November 2022. Nevertheless, the liquidity of European banks appears robust in comparison with US banks’ due to relatively less competition from money-market funds and better liquidity coverage ratios (LCRs). The LCRs of European banks stand at 146% for major banks and 200% for smaller banks while the major US banks have LCRs of 119%, with banks’ real estate exposure looking far less vulnerable in Europe.

2) Tighter underwriting standards:

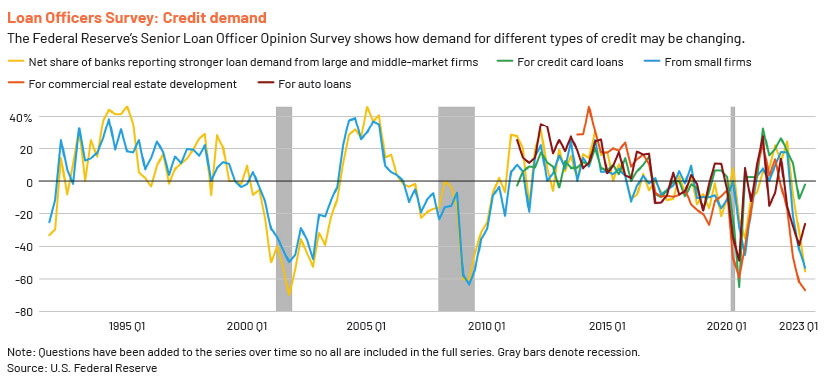

Reflecting broader C&I lending trends, 47% of the large US banks' senior loan officers surveyed by the Federal Reserve (Fed) stated that they tightened credit underwriting standards for commercial and industrial loans in 1Q 2023 due to an unfavourable economic outlook, reduced risk tolerance and sector-specific concerns. Demand for C&I loans was also subdued, more so from smaller firms, reflecting early signals of shifting commercial lending trends going into 2025. Stringent underwriting norms included mandating higher premiums for riskier loans, charging higher costs and interest rate spreads, lower maturity periods for loans and credit lines, and tightening loan covenants.The Fed’s Senior Loan Officer Opinion Survey shows how demand for different types of credit may be changing:

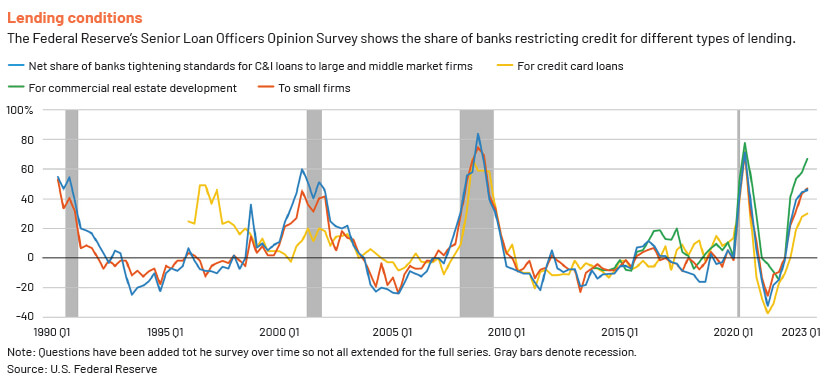

The chart below shows the share of banks restricting credit for different types of lending:

European banks also tightened their loan-approval criteria, especially for new loans, and are expected to tighten them further going forward. Higher collateral requirements, widening margins and stringent loan conditions are also reported by banks in the Eurozone. The following charts show the change in terms and conditions for providing credit facilities to enterprises (net percentages of banks reporting a tightening of terms and conditions):

Even in relatively unscathed Asia Pacific, banking regulators are likely to further tighten their macro-prudential policies in 2023, indicating that C&I lending trends are being shaped by global regulatory caution.3) Greater scrutiny of sustainable finance: Sustainable finance (which refers to financing the transition to cleaner technology and processes) rose by 5% in 1Q 2023. S&P estimates that green, sustainable and social bond issuance surpassed USD6tn in 2022. However, the focus would now be on ensuring greater transparency in ESG reporting by banks, and increased assessment of their ESG methodologies and impact. Banking regulators have identified greenwashing (companies using data to project that their products and policies are environmentally friendly) as one of the main challenges that need to be overcome in the coming years. The US SEC fined Bank of New York Mellon and Goldman Sachs in 2H 2022, and European regulators are investigating Deutsche Bank, over misleading claims relating to ESG investments. Environmental groups criticised National Australia Bank for labelling a AUD515m loan to the world’s largest coal-shipping port as “sustainable”. European banking regulators have identified focus areas for improving ESG reporting in the near term, including upskilling banks’ capabilities to assess and monitor ESG risks, sharing supervisory best practices, identifying common supervisory guidelines and leveraging current data-analytical practices (such as stress testing and scenario analysis) for sustainable finance.

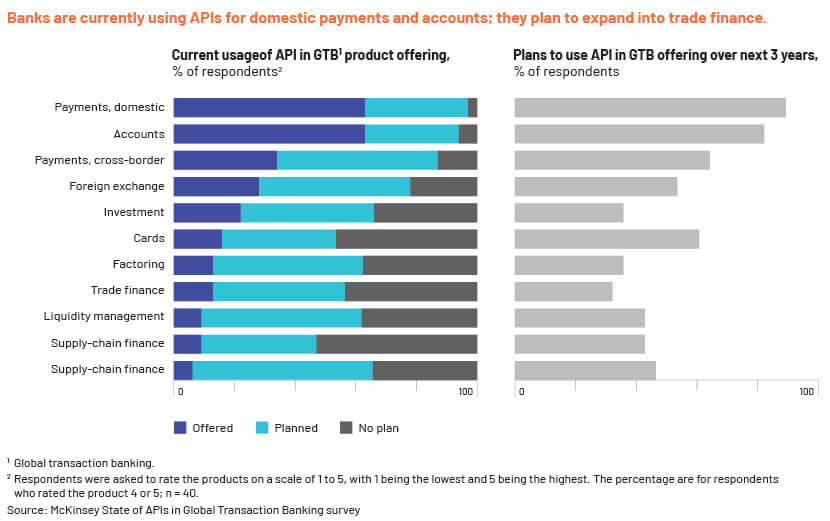

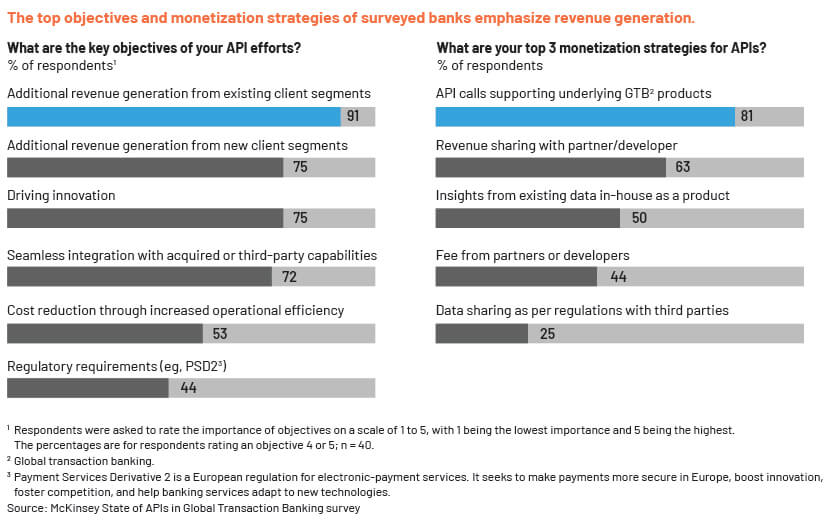

4) Widespread acceptance of open banking and application programming interfaces (APIs): Banks and corporate borrowers have traditionally been concerned about the impact of open banking and APIs, where third-party technological applications integrate with a bank’s core banking systems to increase functional efficiency and enhance user experience. Banks were reluctant to lose their monopoly over borrowers’ data, while companies worried about data privacy. However, continued digital innovation has increased the benefits of open banking, which may lead to greater adoption of APIs. A study by McKinsey states that 75% of the top 100 global banks have made APIs available to the public. North American and Asia Pacific banks are leading the trend, with Europe following closely behind. Key benefits of API use include the following:

-

Data accessibility and intelligence through extracting borrower data from different silos and presenting it in useful ways

-

Integrating disparate legacy banking systems to resolve data communication challenges

-

Automating manual tasks such as data entry and numerical calculations

-

Improving banks’ internal functioning and data management

-

Greater data security by using renowned programming standards such as REST and Open API

-

Enhancing revenue-generating sources and cost reduction

APIs such as Plaid and Yodlee are now commonly used in the small-business lending market to integrate borrower data directly with lenders’ systems, while PrimaDollar is used extensively for trade finance functions. Banks are now looking to leverage artificial Intelligence and generative language tools such as ChatGPT to improve productivity, streamline operations and enhance their services. Some early-use cases implemented by banks include client-facing chatbots, fraud detection and AML, automating KYC and loan origination processes, and customisation of investment advice.

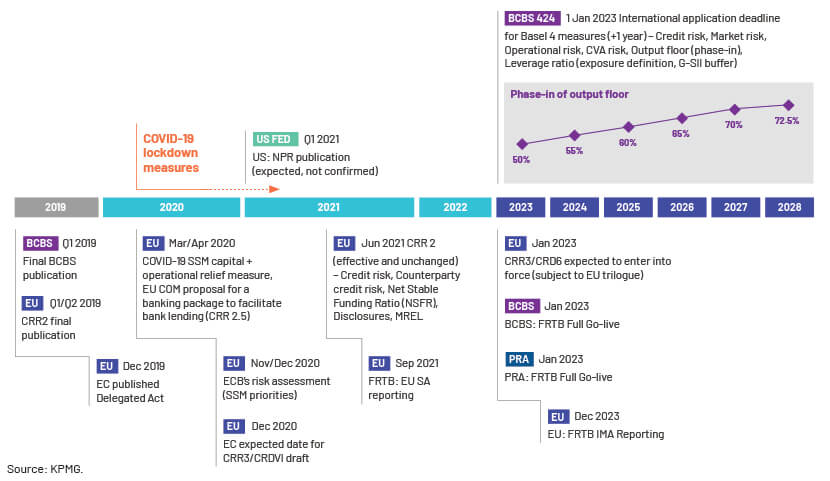

5) Challenges relating to implementing Basel norms: The date for implementing Basel 4 norms has been extended repeatedly, but regulators have been firm on 1 January 2023, despite concerns from banks.

The new norms are expected to constrain banks’ use of internal risk-rating models such as adopting a standardised approach to credit risk, quantifying credit valuation adjustment risk, changes in market risk and operational risk, enhancing the leverage ratio framework and determining the output floor. These changes would force banks to reframe their risk models, rework and possibly reprice product offerings, update policies on collateral and guarantees, and even optimise their legal-entity setup. Banks are concerned that these new norms may lead to additional capital being required at a time when they are struggling amid the impact of a global slowdown.

While the UK and the European Union expect to implement the new norms from January 2025, impacting regulatory dynamics across sectors including mortgage lending trends 2025, the US has not started the consultation process for the new Basel rules.Thus, implementation of the complete Basel 4 framework in 2023 seems optimistic, and forced implementation by regulators is likely to result in “watered-down” compliance by banks.6) Future of work: Managers may have to redefine post-pandemic workplaces to develop an agile and tech-enabled workforce, while facing challenges such as a talent crunch, resistance to technology adoption, experimental hybrid working models and gig economies. For instance, 4 of 10 financial services leaders surveyed by Deloitte stated that their employees were unwilling to reskill or take up new roles amid the pandemic. To counter these challenges, leaders would have to rely on softer skills such as understanding employee motivations, managing a distributed workforce, eliminating inequities between remote-working and in-office employees, and encouraging diversity. For example, managers would need to learn to recognise “unseen” work and pivot to task-based workdays rather than tracking employees’ screen time. While these strategies may help retain and recruit talent, banks may still need to increase reliance on outsourced workforces and gig-based contractors to augment capabilities in niche areas such as credit analysis and treasury operations.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners develop bespoke risk-integrated lending frameworks to address the need for depth, speed and frequency in credit risk assessment and to achieve operational efficiency and profitability.With two decades of experience in delivering research and analytics services, we have built a robust ecosystem of people, process and technology.We have unmatched credentials within the corporate and commercial banking space in supporting banks and financial institutions across the lending value chain, helping them stay ahead of evolving commercial lending trends 2025, enabling them to centralise, standardise and digitalise lending processes.

We facilitate the following key transformations:

-

Adopting a comprehensive risk-based underwriting approach – we have helped several clients streamline the credit review process and achieve front-office effectiveness

-

Centralising and standardising data infrastructure by consolidating internal and external data sources

-

Proactive portfolio monitoring to effectively manage loan exposures – we develop early-warning systems with tailor-made, sector-specific triggers and headroom indicators, current and predictive credit scoring and remediation strategies

-

Using alternative credit data for improved risk decisions and making this data available through APIs for almost-real-time input of information critical for underwriting decisions

Sources:

-

S&P Global Market Intelligence – European banks set to enjoy higher lending income in 2023, 2024

-

US banks generated record $80bn first-quarter profits despite turmoil | Financial Times (ft.com)

-

European Central Bank – The euro area bank lending survey – First quarter of 2023 (europa.eu)

-

Reuters – Banks tighten credit terms, see loan demand drop, Fed survey shows |

-

S&P Global Market Intelligence – US Community Bank earnings to fall more than 22% this year

-

The Economist Intelligence Unit Limited – Report on Finance Outlook 2023

-

Deloitte – 2023 Banking and Capital Market Outlook

-

Fitch ratings – APAC Bank Macroprudential Policies to Tighten in 2023

-

Deloitte – Bank of 2030 – The future of banking

-

Forrester – Predictions 2023

-

Reuters – German police raid Deutsche Bank’s DWS unit

-

Deloitte – 2022 banking and capital markets outlook

-

Forbes – The Top 5 Trends In Fintech And Banking For 2022

-

European Central bank – Sustainable finance roadmap

-

S&P – Report on ESG Research

-

gov – SEC Charges BNY Mellon Investment Adviser for Misstatements and Omissions Concerning ESG Considerations

-

gov – SEC Charges Goldman Sachs Asset Management for Failing to Follow its Policies and Procedures Involving ESG Investments

-

McKinsey – What’s new in banking API programs

-

McKinsey – From tech tool to business asset: How banks are using B2B APIs to fuel growth

-

KPMG – Basel 4 – The final countdown?

-

KPMG – Basel 4 – The journey continues

-

Sustainable finance markets: Q1 2023 in charts | Nordea

What's your view?

About the Authors

Narayan has over 14 years of experience in lending services offshoring supporting multiple corporate and investment banks, commercial banks, retail banks, and credit unions. At Acuity Knowledge Partners, he leads multiple client engagements within the lending services supporting SME, Syndicated, Consumer Lending and Asset Based Lending divisions. He is experienced in loan portfolio monitoring and performing activities such as annual and interim credit reviews, spreading, covenant monitoring and borrowing base monitoring. Narayan has expertise in loan process consulting and support, end-to-end loan underwriting and credit monitoring, including process transformation. He is well-versed in regulatory requirements in the US and Europe with respect to loan portfolio monitoring. Narayan holds..Show More

Hitesh has over 14 years of experience in working with leading global organizations in the banking and commercial lending domains. His expertise spans a broad range of analyses, including credit appraisal, leveraged lending, stressed assets, industry reports, cash flow modelling, and client pitch presentations. At Acuity Knowledge Partners, he has led sector and product-specialist pilot teams in Commercial Lending, focusing on diverse sectors such as real estate, manufacturing, aerospace and defense, transport and logistics, and business services.

Hitesh holds a Masters in Management Studies from K.J. Somaiya Institute of Management Studies and Research, University of Mumbai, and a B.Com from University of Mumbai.

Like the way we think?

Next time we post something new, we'll send it to your inbox