Published on May 21, 2024 by Gursharan Singh

The real estate debt landscape is facing significant changes; the demand side is particularly interesting, with commercial loan origination expected to rise 29% to USD576bn in 2024 from an estimated USD444bn in 2023, according to the Mortgage Bankers Association’s (MBA’s) latest survey.

Why is such growth expected?

As the commercial real estate (CRE) market continues to navigate the fluctuating valuations, sectors such as industrial and multifamily may see further compression in valuations, resulting in even more challenging conditions for properties with debt falling due. Increasing stability in monetary policy and yields may ease CRE borrowing costs, but the real concern remains – the need to refinance to avoid distressed-asset sales.

-

A substantial number of real estate loans are maturing in 2024-25. These include loans initially set to mature in 2023 (c.USD700bn, according to the MBA’s estimation), but many have been modified through a strategy known as “blend and extend(1)”.

-

Lending by traditional players is likely to remain limited, as recent extensions resulted in fewer loan repayments, limiting the amount of capital available to be deployed. Furthermore, legacy issues with their “core” property lending remain. Smaller and regional US banks are particularly vulnerable, as they are almost five times more exposed to the sector than larger banks. It is critical to remember that banks provide capital for more than half of the almost USD6tn of commercial mortgages, according to a recent article by the IMF.

-

Lending declined by c.43% in 2023, according to the MBA, and until mid-December, CMBS issuance dropped c.65% and CRE CLO issuance dropped c.85%, according to the CRE Finance Council. A Trepp study recently showed that bank lending fell 32% from 2019 to the third quarter of 2023.

This creates a meaningful opportunity for alternative debt providers to fill the void and increase their share in new originations. Not only CRE, but multifamily lending, too, is set to experience a robust 25% surge, reaching USD339bn in 2024 versus an estimated USD271bn in 2023, according to the MBA(2).

Challenges

Prospects for the sector remain challenging, even with the Fed signalling interest-rate cuts this year and institutional investors’ growing optimism about the sector. Financial intermediaries and investors with significant exposure to CRE face heightened asset-quality risks. Furthermore,

-

The landscape remains complex. Interest rates, property values and market fundamentals are all in a flux, posing challenges to a variety of aspects – from refinancing to performance of new loans. This would require a fresh approach to real estate underwriting.

-

Rising delinquencies and defaults in the sector could restrict lending and trigger a vicious cycle of tighter funding conditions, resulting in falling commercial property prices and losses for financial intermediaries, spilling over to the rest of the economy, according to the IMF.

-

Similarly, high levels of new supply may dissuade developers from taking out new construction loans, according to the MBA. Soaring insurance costs are expected to pose a significant challenge to multifamily property owners in the coming year as they try to manage expenses.

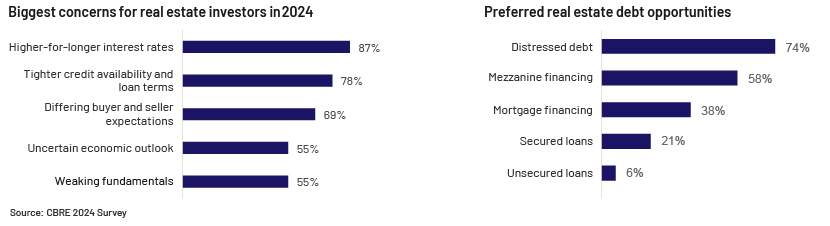

Real estate debt investors’ concerns

CBRE’s 2024 US Investor Intentions Survey(3) found that investor sentiment has improved significantly. Over 60% of the respondents expect to purchase more real estate in 2024 than they did in 2023, compared with only 16% in 2023 versus 2022. More developers, private equity funds, real estate funds and REITs plan to buy more assets in 2024 than do other investor types. However, the biggest concerns for real estate/private equity firms and investors are still higher-for-longer interest rates and tight credit conditions continue to weigh on investor sentiment.

The survey(3) further highlighted that multifamily and “industrial and logistics” remain the most-sought-after property sectors in 2024. 90% of multifamily investors prefer Class A properties, while nearly half favour value-add Class B/C assets. Class A facilities in major markets are most preferred by “industrial and logistics” investors. Grocery-anchored centres are most favoured by retail investors, while nearly 60% of office investors prefer prime/trophy office properties. Similar responses were seen in PERE’s latest Investor Perspectives 2024 Study(4) – it shows that most investors still have an appetite for real estate, even if sector and strategy preferences continue to shift.

What private real estate fundraising looks like

North America-focused PERE debt fundraising remained below the five-year average (USD21bn) in 2023, with the closed-ended funds amassing USD18bn, according to Preqin. However, the current fundraising pipeline for real estate debt and distressed debt strategy shows healthy investor appetite, with USD106bn being targeted globally, of which USD72bn in commitments is being sought for North America through 243 funds on road (as of 1 March 2024).

-

The top five North America-focused funds are Blackstone Real Estate Debt Strategies V (target: USD8bn), Cerberus Real Estate Debt Fund II (USD4bn), Berkshire Bridge Loan Investors III (USD3.5bn), Oaktree Real Estate Debt Fund IV (USD3bn) and Bridge Debt Strategies Fund V (USD2.5bn).

-

North America-focused real estate debt dry powder decreased further, suggesting capital deployment versus 2022 levels; it stood at USD42.6bn as of December 2023, compared with USD47.1bn in December 2022 and USD53.0bn in December 2021.

Conclusion

While fears of a recession might have eased significantly from last year, expectations of higher-for-longer interest rates and tight credit conditions continue to weigh on investor sentiment. This may keep CRE investment activity subdued in 1H 2024. Nevertheless, healthy investor appetite, coupled with strong real estate debt managers’ fundraising pipelines, suggests a sense of optimism and presents a compelling opportunity for real estate debt investors to generate attractive risk-adjusted returns in the coming year.

How Acuity Knowledge Partners can help

We have multi-sector expertise in the areas of financial analytics, valuation and advisory services. The CRE sector is one of our key focus areas, where we provide support across the CRE deal lifecycle – from loan origination, lease analysis, loan underwriting and valuation, guarantor analysis, covenant monitoring and testing, post-closing and portfolio monitoring to asset management

Footnotes

:-

Blend and extend strategy: In this approach, lenders adjust the interest rate on a loan and ask the sponsor (borrower) for additional collateral. In return, the lender provides a short-term modification to the loan. The goal is to give sponsors with strong properties time to execute their business plans or wait for more favourable interest rates. Essentially, it allows both parties to keep the loan current for another year or two.

-

The 2024 MBA CREF Outlook Survey was conducted over 30 November-15 December 2023. The survey request was sent to leaders at 60 of the top commercial and multifamily mortgage origination firms, as determined by the MBA’s 2022 Annual Origination Rankings Report. The survey had a response rate of 40%, calculated based on applicable responses. Non-responses and “n.a.” responses are excluded from the percentage denominator.

-

CBRE’s 2024 US Investor Intentions Survey: A total of 134 respondents participated, including pension funds, banks, private equity fund managers, real estate fund managers, REITs, developer/owner/operators, high-net-worth individuals (HNIs) and family offices.

-

PERE’s Investor Perspectives 2024 study: A total of 117 institutional investors participated.

Sources:

-

https://www.mba.org/news-and-research/newsroom/news/2024/01/09/mba-cref-outlook-survey-market

-

https://newslink.mba.org/mba-newslinks/2023/march/mba-newslink-monday-mar-13-2023/mba-chart

-

https://www.cbre.com/insights/briefs/2024-us-investor-intentions-survey

-

https://www.costar.com/article/629180922/commercial-real-estate-lending-forecast

-

https://dsnews.com/news/01-24-2024/commercial-borrowing-forecast-grow-2024

-

https://www.matthews.com/increase-in-real-estate-lending-in-2024/

-

https://www.eisneramper.com/insights/real-estate/commercial-real-estate-outlook-0124/

What's your view?

About the Author

Gursharan has over 10+ years of experience working on variety of research including industry deep dives, trend analysis, market mapping and competitive benchmarking. He has been associated with Acuity Knowledge Partners since Jun 2015 and currently works closely with the fund launch and product team of private equity firm across various asset classes, primarily assisting them in understanding fundraising landscape, addressing consultant queries, identifying perceived peers, providing insights on alternative strategy, deals analysis, performance and fee benchmarking and LPs mandates.

He has an MBA with specialization in finance from Indian Institute of Finance, Delhi and has done his graduation in B.com from SGTB Khalsa College, University of Delhi

Like the way we think?

Next time we post something new, we'll send it to your inbox