Published on January 11, 2024 by Noel Roberts

Introduction

The commercial real estate (CRE) sector is facing high interest rates, an economic slowdown and stringent credit standards. High interest rates are affecting loan performance, making refinancing difficult amid the problems with valuation. Last year’s challenges may stretch a little further, but forward yield curves indicate a low probability of the US Federal Reserve (Fed) raising rates again in 2024, and we expect the CRE market to again enjoy some much-needed stability. Investors would need to take a fresh look at their approach to traditional asset classes, and it would be interesting to see how changing customer preferences and the emergence of the hybrid working model define the sector’s landscape.

In this article, we provide insight on the current situation in the CRE sector and how the market for the various asset classes will likely shape up in 2024.

Lending momentum

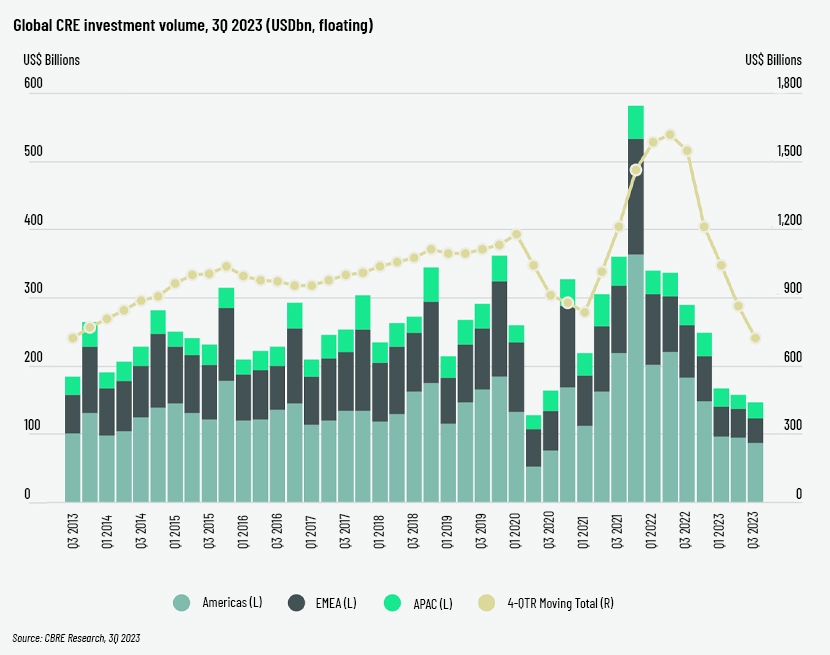

At the start of 2023, global markets were vulnerable to deteriorating economic conditions, with central banks continuing to fight inflation, impacting the CRE sector. The pandemic slowed activity in the sector, and the recovery is gradual. The lending market experienced a 5% q/q decline in CRE lending momentum from 1Q to 2Q 2023, reflecting a substantial 52% y/y decrease. Roughly 75% of the CRE pipeline consists of bridge-to-bridge or bridge refinance requests.

Soaring interest rates

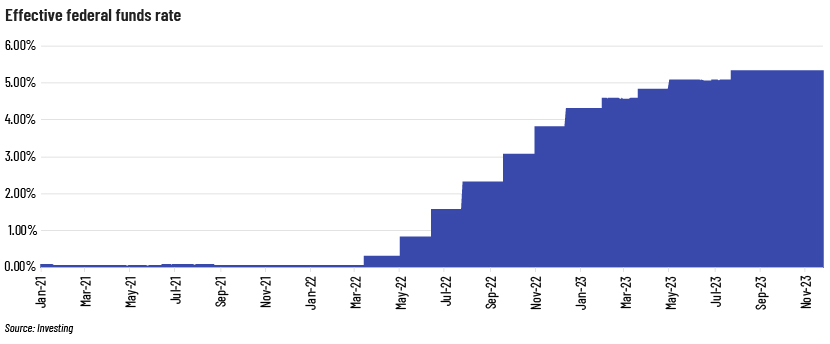

As interest rates increase, property owners/investors find it difficult to make monthly mortgage payments, and refinancing mortgages becomes a challenge. CRE investment activity is expected to reduce further in 2024 due to rising interest rates (5.33% as of November 2023).

Source: Board of Governors of the Federal Reserve System (US)

The Fed has hiked interest rates 11 times since January 2022 to curb inflation, making CRE credit tighter. The collapse of Silicon Valley Bank (SVB), Signature Bank and First Republic Bank in March 2023 worsened the crisis. Lenders’ caution is reflected in stringent credit policies, with loans originated only to those borrowers who have demonstrated strong creditworthiness. Banks would be forced to be more selective in new CRE originations and refinancing. No rate cuts are expected until September 2024. In the meantime, US Treasuries will likely continue to do the heavy lifting and reduce pressure on the Fed.

Rising delinquencies

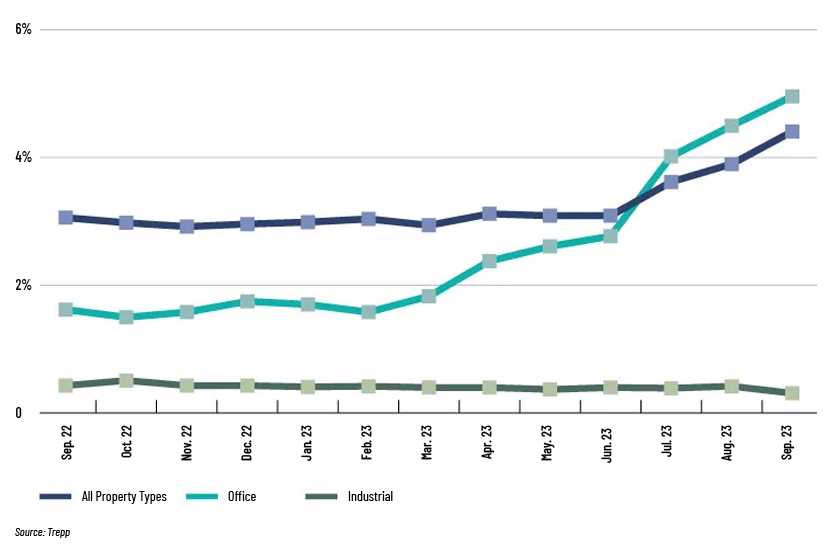

CRE loan delinquency rates are also increasing monthly. The US delinquency rate in August 2023 was a slight improvement from July 2023, but it increased again in September 2023, according to Trepp. The increase in September was due to a sharp rise in the delinquency rate for loans for office properties, mainly due to the post-pandemic trend of remote working. All other major types of commercial property saw only modest movement.

The all-property-types delinquency rate rose 14bps from August 2023 to 4.39% in September 2023, the second-highest reading since the end of the pandemic. In the office segment, delinquencies increased 51bps to 5.58% over the period; this is unlikely to improve, as office occupancy in most major markets is declining, driven by a substantial drop in demand for office space.

Upcoming CRE loan maturities

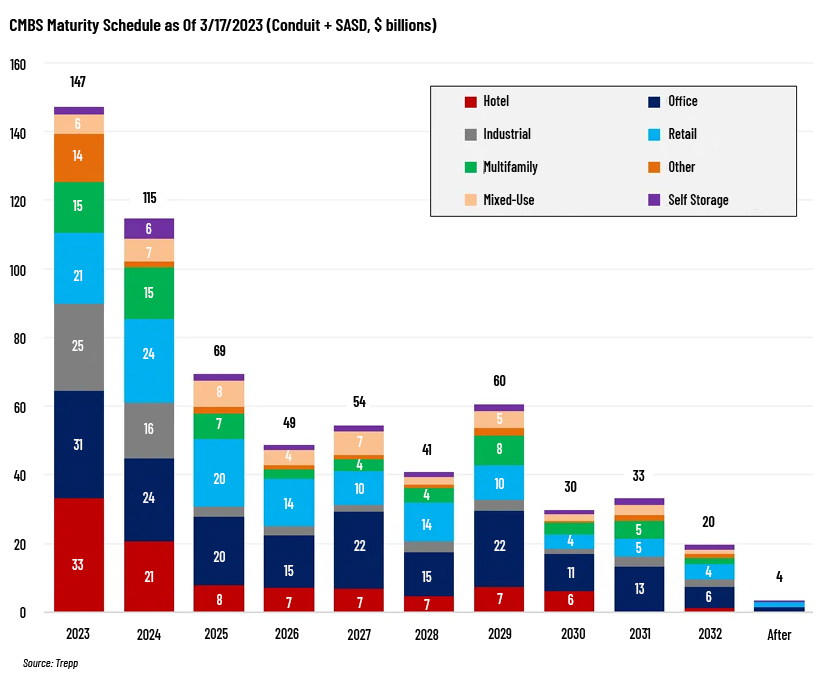

There are substantial CRE loans maturing in the next two to three years. The CRE sector is likely to face a significant challenge, as, based on current market conditions, low-interest loans mature at higher rates, increasing the difficulty in refinancing. Increasing defaults at maturity would affect the weaker CRE assets, depending on asset quality, type and location. Borrowers are likely to seek asset based lending services to access liquidity and mitigate refinancing risks.

The chart above presents maturities of commercial mortgage-backed securities (CMBS) over the next 10 years. Approximately USD620bn of CMBS (both conduit and single-asset single-borrower) is expected to mature over the next 10 years, with over USD147bn (24%) maturing in 2023, USD115bn (19%) in 2024 and USD69bn in 2025 (11%), according to Trepp. Office property leads maturities in 2024, with USD55bn (21%), followed by hotels at USD54bn (21%), retail at USD45bn (17%), industrial at USD41bn (16%) and multifamily at USD30bn (11%). Based on this, borrowers are likely to struggle to refinance mortgages in the next two years due to the tightening loan-to-value (LTV) parameter and would need additional equity capital to refinance successfully.

Outlook by property type

Office

The pandemic resulted in a need to work remotely and risks to office space due to a drop in demand, lease expiries and market fluctuations. The crisis also highlighted the need for flexibility in the use of office space. Although the US economy saw the addition of millions of new jobs, office occupancy declined, reducing property values. Office space is expected to remain underutilised given the widely adopted work-from-home format, and the suburban and downtown office asset class is expected to attract low investment over the next 12-18 months.

Retail

The retail segment was weak in the first half of 2023 but started recovering in the latter half. Smaller retailers are increasingly facing bankruptcy, while big-box retailer activity is picking up, as evidenced by more store openings than store closings in 2023. The future of retail is in ecommerce, defining how this sector would shape up in the coming year. Generally, regional/national retailers offering good service and better-quality goods performed better than weaker competitors. Investment patterns may remain the same as in 2023 as the luxury retail segment shows signs of steadying and increases its footprint by occupying large spaces in prime locations.

Industrial

Industrial properties experienced significant disruption at the start of the pandemic but then saw a boom. Heavy competition, coupled with strong consumer spending patterns, led to full occupancy levels and very strong growth in rents. Active competition among ecommerce retailers reduced delivery time, and this, combined with nearshoring, helped the industrial/warehouse business flourish. The outlook for 2024 looks promising for warehouse properties. There is heavy demand for space, and a record level of new inventory is scheduled to be added this year.

Multifamily

Consistent spikes in interest rates have made homeownership a costly affair for many. There has been a large disparity between supply and demand for low-income housing for several decades now. Despite this, multifamily property is seeing strong occupancy and consistent growth in rents, increasing property values. Interest rate hikes are cyclical in nature, and we expect rates to reduce eventually. However, we see no signs of relief for the low-income housing crisis. Demand for affordable housing will likely remain very high considering the shortage of supply. The Department of Housing and Urban Development would need to launch new programmes in 2024 to promote affordable housing among investors.

Hospitality

The hotel asset class witnessed moderate growth in 2023 as more and more tourist destinations opened up and travel increased. Average occupancy hovered around pre-pandemic levels. The average daily rate (ADR) is expected to grow amid increasing demand, especially during peak seasons. The hotel asset class overall has significant potential but may be impacted slightly by geopolitical concerns such as the Israel-Palestine conflict and China’s economic woes.

Emergence of niche sectors

In addition to traditional property types such as multifamily, office, retail, industrial, hotel and lodging, niche property types such as senior living, student housing and medical offices are gaining popularity.

(a) Senior living: The pace of population ageing is now much faster than in the past, creating ongoing demand in the senior living segment. The emergence of video consultation, prescription drugs being made available at the doorstep and the increased use of technology-driven devices – such as smart sensors, wearable devices and emergency care notification devices – are paving the way for increased demand for senior living space.

(b) Student housing: Demand for student housing is soaring due to a number of reasons, such as cross-border flows of students, an increasing student population, students looking for affordable accommodation with basic amenities and their preference for mixed-use properties that provide residential facilities and commercial space (such as for restaurants and grocery stores) and the flexibility of walking to work. This increased demand has not been addressed completely, despite private-sector establishments and institutions of higher education offering student housing facilities on-campus.

(c) Medical offices/life sciences: In spite of the drop in demand for office space due to the pandemic and remote working, medical office space remains a strong segment, driven by a stable client base and long-term leases. The passage of the Affordable Care Act increased growth in the space, with the US healthcare sector currently representing 17% of GDP. Investment in the life sciences segment also spiked amid strong demand in the biopharma and bio-technology sectors, and 2024 is likely to be a strong year for this asset class.

(d) Data centres: This is a growing asset class, with demand expected to grow by roughly 10% every year for the next five years. It provides a safe investment option with steady cash flow, as it is a critical asset for any organisation. It provides investors with an option to diversify their investments and earn stronger returns. However, data centres consume large amounts of energy, and there is constant effort to make them more sustainable.

Emerging trends in ESG lending

Environmental, social and governance (ESG) lending is increasing in popularity. The 2004 United Nations report, Who Cares Wins, contained the first mention of ESG in the modern context, and the concept grew in the mid-2020s. ESG has now become a composite framework that comprises key elements relating to an organisation’s environmental and social impact, and how governance structures can be designed to maximise investors’ wellbeing.

Relevance of ESG in CRE lending

The “environmental” pillar is a vital dimension in real estate given the physical nature of the assets. Buildings and construction account for 36% of global energy use and 39% of energy-related carbon dioxide emissions, according to a report from the International Energy Agency. Thirty-five percent of real estate investment trust properties are vulnerable to climate hazards; 17% of these are exposed to risk of flood, 6% to risk of rising sea levels and coastal floods and 12% to risk of hurricanes or typhoons. To limit global warming, the real estate sector is required to meet certain objectives such as all new buildings operating at net zero carbon from 2030 and 100% of buildings operating at net zero by 2050. Given these multiple environmental risks, major investors, fund managers and property developers in the real estate sector have started focusing on reducing carbon emissions, using renewable energy and incorporating sustainable material into the design and management of their buildings.

The “social” dimension relates to the social wellbeing of the tenants of the buildings and those living in surrounding areas. Lenders previously failed to analyse social concerns, but awareness of responsible investing – which revolves around having a meaningful and positive impact on society and the wellbeing of tenants, and helping create sustainable neighbourhoods – is now increasing. We expect modern building designs to include a human-centric approach, which could be achieved by inclusive design and providing easy access for differently abled persons and easy access to public transport and modern amenities, including easy parking for elders/the differently abled, charging stations for electric cars and parking facilities for bicycles.

Governance, often an ambiguous aspect, is not physical; it relates to best practices, leadership qualities and creating a safe and inclusive workplace. However, in terms of real estate, it relates mainly to the quality of documents, the nature of the sponsor and its business strategy, the reputation of the sponsor/borrower in the sector and the borrower’s repayment history and creditworthiness. Analysis of a borrower’s performance in terms of governance could be valuable for lenders, as a good governance mechanism would ensure good performance on environmental and social considerations.

Overall, we believe that of the ESG-related risks, poor governance is the most critical, which would lead to ineffective, unsustainable and non-scalable strategy and incompetent management, driving environmental and social risks. This would reduce the value of a business and increase risk of the borrower failing to meet financial obligations.

What the future holds for smaller players with mezzanine or equity financing

The large number of opportunities in the current scenario has increased institutional investor interest in private capital. The use of mezzanine debt/preferred equity funding as a volatility moderator is increasing. Some investors provide limited equity financing and at times consider obtaining a share of the coupon or a share in general partnership.

Although this is a difficult time for senior loans, mezzanine debt and preferred equity lending have a more favourable outlook than they did in the past because of tighter liquidity in the market, higher interest rates and fewer lenders. The current scenario for mezzanine debtholders is a market where rent growth is slowing or cash flow is declining, but they continue to receive a steady coupon payment, or even higher ones, due to rising interest rates.

Given the probability of decline in certain property values, mezzanine and other CRE lenders are demanding higher debt yields while lending at lower LTVs (requiring borrowers to bring in more equity). The outlook for mezzanine debt/preferred equity funding, therefore, is positive.

Conclusion

The ambiguity in the global economy due to the Fed increasing interest rates and higher inflation will likely continue to impact real estate transactions and activity in the coming months/quarters. The CRE sector is likely to gain momentum as investors move towards niche sectors. The traditional stable multifamily class A/A+ would continue to grow, but rising delinquency rates in office, retail and hotel will likely be a concern for another six to nine months. Refinancing would also be a challenge until inflation eases. Interest rates would determine the performance of the sector; they are likely to reduce eventually, but it would be interesting to see how the market deals with them until then.

How Acuity Knowledge Partners can help

We have multi-sector expertise in the areas of financial analytics, valuation and advisory services. The CRE sector is one of our key focus areas, and we have a large team of CRE analysts and subject-matter experts who support global financial institutions, brokers, investment firms and service providers. We provide support across the CRE deal lifecycle – from loan origination, lease analysis, loan underwriting and valuation, guarantor analysis, covenant monitoring and testing, post-closing and portfolio monitoring to asset management. Our proprietary suite of Business Excellence and Automation Tools (BEAT) gives clients leverage, and we provide them with bespoke products and services customised to their requirements.

Sources:

-

Rising Interest Rates Curb Q3 Global Investment Activity | CBRE

-

Moody's Analytics CRE | Q3 2023 Preliminary Trend Announcement (moodysanalytics.com)

-

2023 CMBS Delinquency Rates – Commercial Property Executive (commercialsearch.com)

Tags:

What's your view?

About the Author

Noel has over 18 years of experience in working with leading global organizations in the financial services sector, with expertise in lending services, exclusively in commercial real estate (CRE). His expertise spans a broad range of analyses, including CRE loan underwriting, loan servicing, due diligence, portfolio monitoring, and market research reports. At Acuity Knowledge Partners, he manages the CRE Portfolio Monitoring team of a top three global bank based in Japan. Prior to joining Acuity, Noel was part of Moody’s Investors Services Private Ltd., supporting its Structured Finance team.

Like the way we think?

Next time we post something new, we'll send it to your inbox