Published on January 9, 2025 by Venkatesh Krishnamurthy and Noel Roberts

Introduction

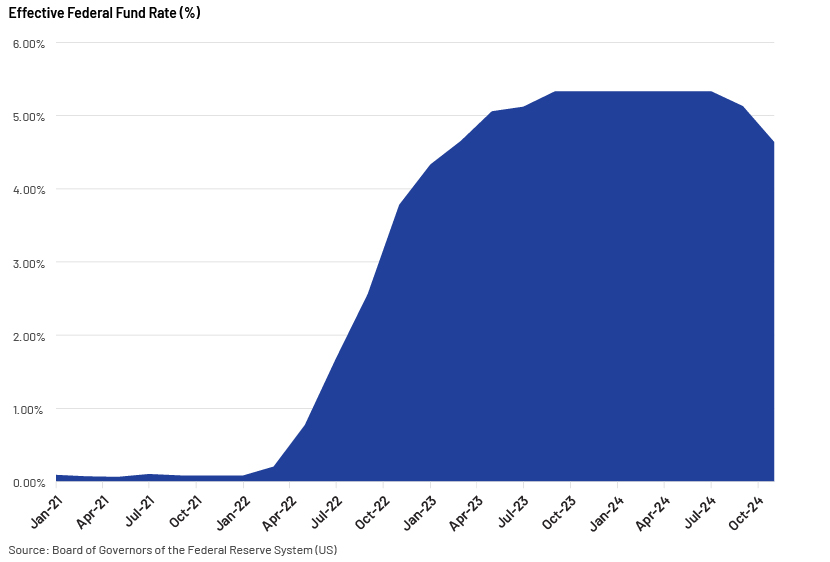

The outlook for commercial real estate (CRE) is cautious but more hopeful than in previous years. It has become one of the most challenging and dynamic markets for bankers to navigate recently, playing a significant role in their portfolios. Although the Federal Reserve's (Fed’s) rate cut of 50 basis points (bps) in September 2024 was not a game-changer, it set the stage for the recovery of the sector. Several rate cuts are expected in the summer of 2025, amounting to a total of 175bps. We foresee "a once-in-a-generation opportunity" as the most significant CRE downturn since the global financial crisis starts to recover. For the CRE market, this is truly encouraging; the storm of high interest rates following the pandemic, coupled with the new work-from-home model, has put significant pressure on the sector, leading to negative sentiment and limited investment appetite. The September cut has raised hope that an easing lending environment would instil new confidence in the CRE market as it has a positive impact on valuations and, therefore, transactions. Rate cuts aim to reduce the cost of borrowing, enabling individuals and companies to invest and spend.

If interest rates decrease, purchasing the same home at the same price would lead to lower monthly payments and reduced total interest over the duration of the mortgage. When interest rates decline, the same home becomes more affordable, making buyers more inclined to make purchases.

Lending momentum and interest rate cuts

The lending momentum in the CRE sector in 2025 is closely linked to interest rate trends. As interest rates fall, borrowing costs decrease, making it more affordable to purchase goods and services such as CRE properties, homes and cars. This affordability encourages consumer spending, boosting demand for goods and services. Increased demand leads businesses to ramp up production and hire more workers, reducing unemployment. Overall, lower interest rates stimulate economic growth.

A reduction in interest rates directly affects adjustable-rate mortgages tied to short-term benchmark rates such as SOFR and the prime rate. On the other hand, interest rate cuts do not directly affect fixed rates, which are linked to long-term inflationary expectations. Economic data such as consumer spending and employment is more likely than interest rate cuts to move these rates. As interest rates decline, cash flow coverage increases, reducing banks’ loan loss reserves. Opportunities now exist for borrowers wanting to take advantage of attractive fixed interest rates.

How declining interest rates affect cap rates

Interest rates and capitalisation rates are closely correlated – low interest rates lead to low capitalisation rates and vice versa. This is because higher interest rates mean higher borrowing costs, which in turn forces you to increase your return to maintain the same level of profitability. Consequently, rising interest rates lead to higher capitalisation rates, which in turn reduce property values and vice versa.

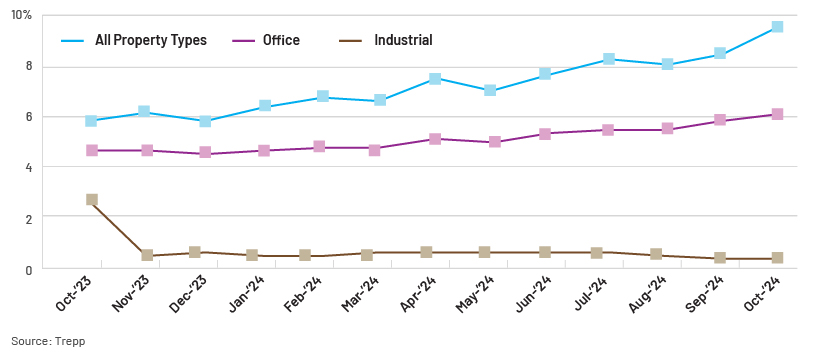

Rising delinquencies

CRE loan delinquency rates are also increasing monthly. The US delinquency rate for all major commercial property types either declined or remained stable in October 2024, except in the office sector, which saw an increase of 101bps, according to Trepp. The office delinquency rate climbed to 9.37% from 8.36% in September 2024, driven primarily by a significant rise in delinquency rates for office property loans, largely due to the post-pandemic shift towards remote working. Other major types of commercial properties experienced only minor changes.

The last time the office delinquency rate surpassed 9.00% was in 2012 and 2013, when the overall CMBS delinquency rate reached a record high of 10.34% in July 2012.

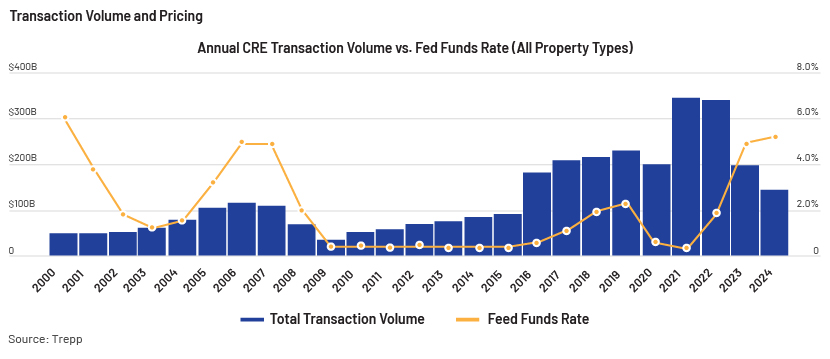

Reduced interest rates facilitate financing for buyers, often leading to an increase in transaction volume. Nonetheless, the complete effect on transaction volume is typically not instantaneous, as the market will require time to adapt to the new rate conditions.

The Fed reduced rates to nearly zero, according to Trepp, leading to a significant increase in transaction volume in 2021 after a brief delay. As the figure above illustrates, transaction volume soared by 76% to USD346m and remained elevated in 2022. However, as indicated by the 2023 bar, transaction volume declined again when rates rose. With rates now starting to decrease, a similar trend is unlikely to be repeated.

Drivers of property valuation

The movement in interest rates is one of the major drivers of property valuation, as it directly affects the cost of borrowing. Lower interest rates reduce mortgage and borrowing costs, making real estate financing more affordable for investors to invest in acquisitions. This increased affordability typically translates into increased demand for real estate, which could lead to increased property values.

Lower interest rates → higher market value of property (increased demand)

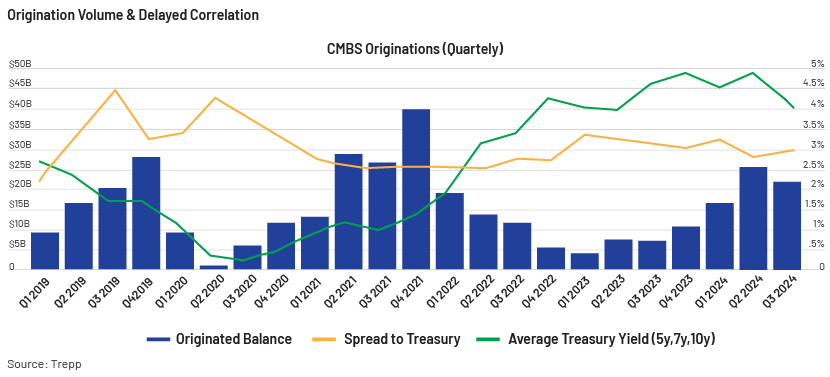

As the figure above shows, although interest rate cuts reduce the cost of borrowing, the relationship between rate cuts and the increase in loan origination volume is often lagged, according to Trepp. It has historically taken as long as 18 months for reduced rates to completely result in increased origination volumes. This is because both the lenders and the borrowers adapt to the new situation and renegotiate the loan terms.

We may not see a notable leap in loan originations in the near term. Lenders may remain cautious, especially if general economic uncertainties persist. Borrowers may also hold off, waiting for a further decrease in rates before seeking new loans. Nonetheless, as the Fed has indicated that it will proceed with its rate cuts, we may see a more significant increase in loan-origination activity in the coming months.

Positive signals for CRE

Lower cost of borrowing

The expected interest rate cuts would lower borrowing expenses for real estate investors, leading to decreased mortgage rates for purchasers and more advantageous financing conditions for developers. Lower borrowing costs are likely to result in more real estate transactions, subsequently driving up property values.

Boost to investor confidence and demand

The likelihood of lower interest rates would increase investor confidence, promoting higher investment in CRE. Investors who view the environment as lower-risk are more likely to deploy their capital in new projects, subsequently increasing demand and valuations. This positions real estate as a more appealing choice for investors seeking greater returns, increasing demand for CRE and boosting CRE property value.

Refinancing opportunities

Falling interest rates create an opportunity for existing property owners to refinance their loans, enhancing cash flow and bolstering the overall financial stability of real estate portfolios. With lower interest costs, property owners may save thousands of dollars in interest payments, enabling them to invest more in property improvement and expansion, further boosting property values.

Economic growth and job creation

Declining interest rates promote economic growth by encouraging borrowing and spending. As businesses grow and new ventures emerge, job opportunities multiply. A robust job market increases demand for commercial property, including multifamily, office and retail space, leading to elevated occupancy levels and rental revenue.

Loan-to-value and debt-service ratios

The lower the interest rate, the more debt can be offered, since one of the credit metrics used to assess the default risk of a prospective borrower is the loan-to-value ratio.

The lower the interest rate, the easier it is to meet the DSCR target and vice versa.

Challenges for CRE lenders

Unpredictable economic outlook increases stress on already tight profit margins

Central banks globally are beginning to gradually reduce interest rates. However, several economists have declared the end of the “easy-money era”, and lenders are facing the repercussions. As depositors withdraw their funds and some borrowers default on loans, amid a steady rise in labour costs, banks are swiftly trying to cut expenses to maintain profits. Lenders must respond not only to their members and regulators but also to their boards, which focus on tightening profit margins. Cautious lenders will integrate approaches into their 2025 strategies and will operate effectively regardless of market circumstances. This could include modifying workflows, adopting new risk-management techniques or selecting the appropriate technology stack to enhance efficiency.

Regulatory pressure demands enhanced reporting and maintaining detailed loan-level data

The financial services sector saw the collapse of two banks last year; this led to the question whether these events were isolated incidents or indications of a longer-lasting trend in CRE financing. Regulators may previously have accepted portfolio-level stress-testing, but they now demand reporting on stress-testing at the loan level. To yield significant outcomes, lenders require advanced economic projections and reliable, validated information regarding the markets in which they lend.

CRE lenders must have a deeper understanding than before of their markets

It is widely recognised that a clear understanding of the market is essential when assessing a potential financing deal, but time and resource limitations frequently hinder the ability to accomplish this analysis. Nonetheless, considering the previously mentioned regulatory obligations, performing such an analysis is no longer an option but a crucial element of the procedure.

If you don’t modernise, you’ll fall behind

The future of CRE lending will probably feature an increased emphasis on advanced technology and more extensive data. Reporting functions require enhancement, and operations must be optimised as the commercial lending market picks up momentum. Therefore, lenders need to invest in technology that aids each phase of the loan cycle.

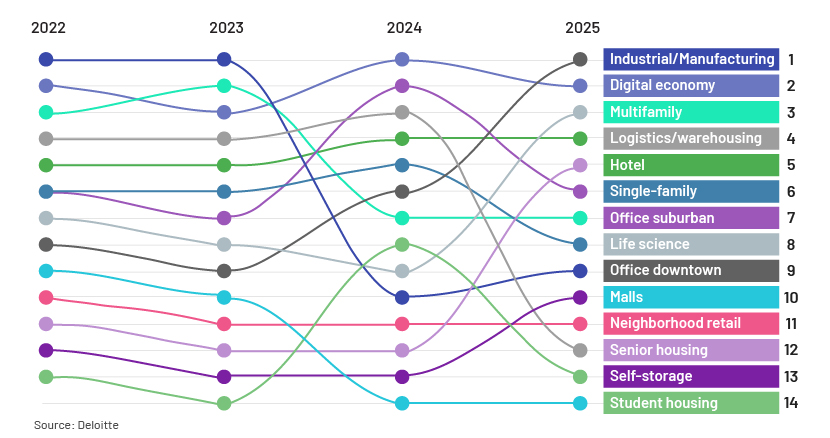

Outlook by property type

The most opportunities for real estate owners and investors – a sneak peek at historical, current and future trends:

Office:

Office properties are expected to remain under pressure, with elevated vacancy rates. Consolidation of lower-value properties may increase as financing conditions remain tight. Selective investment in high-quality or well-located office space could present opportunities.

Industrial:

Industrial properties continue to perform well, driven by strong demand for logistics, e-commerce and manufacturing facilities. This trend is expected to persist; with a shrinking construction pipeline potentially driving further rent growth, industrial properties remain one of the most resilient sectors, especially for investors seeking stable returns.

Multifamily and residential:

The multifamily market is expected to stabilise as interest rates ease slightly and supply constraints balance out. Built-to-rent properties, single-family homes and senior housing are becoming increasingly popular.

Retail:

Retail properties have emerged as a surprise performer, with historically low vacancy rates driven by limited new construction and steady consumer demand. The impact of e-commerce is a structural challenge but less pressing in premium locations. This momentum is likely to persist, especially for high-quality retail assets. The focus may shift to mixed-use developments integrating retail with residential and office space.

Hospitality:

Hotels are recovering gradually from pandemic-related disruptions, with demand bolstered by leisure travel. Business travel remains below pre-pandemic levels, affecting profitability. A full recovery of the hospitality sector is anticipated, with investment focusing on experiential and boutique properties catering to evolving traveller preferences.

Emerging property types:

Demand for alternative assets such as data centres, life-science facilities and self-storage properties is gaining traction, driven by technological and demographic trends. This demand will likely remain high, with digital infrastructure and sustainability features becoming key investment criteria.

Emerging trends in ESG lending

Trends in environmental, social and governance (ESG) lending in CRE have evolved rapidly from 2024 to 2025, driven by regulatory pressures, investor demand and strategies to mitigate climate change. Key trends include the following:

-

Enhanced ESG reporting and data integration: The importance of ESG data is growing, with stricter requirements for transparency. This year, many firms would have incorporated tenant and supply-chain data into ESG metrics, leveraging frameworks such as the European Union’s Corporate Sustainability Reporting Directive and emerging benchmarks such as the National Australian Built Environment Rating System (NABERS) and the Global Real Estate Sustainability Benchmark (GRESB). This shift supports better-informed investment and operational decisions.

-

Net-zero commitments and retrofitting: There is significant focus on reducing carbon footprints through retrofitting older buildings to meet net-zero targets. This includes improving operational energy efficiency, upgrading HVAC systems and integrating renewable energy sources. Such initiatives are critical, as most buildings would still be in use by 2050.

Conclusion

Interest rate cuts generally have a positive impact on the CRE sector, as they reduce borrowing costs, increase property values and stimulate transactions. However, their effects can vary across asset classes and regions, and they carry risks such as overleveraging and market distortions. The impact on CRE depends on broader economic conditions and the magnitude of rate reductions. Overall, 2025 is expected to see a gradual improvement in most property types, with industrial and alternative assets benefiting the most. Office and retail would require more strategic investments to adapt to changing demand. We expect a bust-to-boom phenomenon for CRE in the coming years.

How Acuity Knowledge Partners can help

We have multi-sector expertise in the areas of financial analytics, valuation and advisory services. The CRE sector is one of our key focus areas, and we have a large team of CRE analysts and subject-matter experts who support global financial institutions, brokers, investment firms and service providers. We provide support across the CRE deal lifecycle – from loan origination, lease analysis, loan underwriting and valuation, guarantor analysis, covenant monitoring and testing, post-closing and portfolio monitoring to asset management. Our proprietary suite of Business Excellence and Automation Tools (BEAT) gives clients leverage, and we provide them with bespoke products and services customised to their requirements.

Sources:

-

Learning from History: How Previous Fed Interest Rate Changes Have Impacted CRE

-

Federal Reserve lowers interest rates by 0.25 percentage points in second cut of 2024 – CBS News

Tags:

What's your view?

About the Authors

Venkatesh Krishnamurthy has been with Acuity for over 10 years and has over 18 years of overall experience in Commercial Real Estate (CRE). At Acuity Knowledge Partners, he leads multiple CRE client engagements based out of US and is actively involved in client management, training, and quality control of deliverables. He holds a MBA (Finance) and a bachelor’s degree on Commerce.

Noel has over 18 years of experience in working with leading global organizations in the financial services sector, with expertise in lending services, exclusively in commercial real estate (CRE). His expertise spans a broad range of analyses, including CRE loan underwriting, loan servicing, due diligence, portfolio monitoring, and market research reports. At Acuity Knowledge Partners, he manages the CRE Portfolio Monitoring team of a top three global bank based in Japan. Prior to joining Acuity, Noel was part of Moody’s Investors Services Private Ltd., supporting its Structured Finance team.

Like the way we think?

Next time we post something new, we'll send it to your inbox