Published on July 14, 2022 by Hina Singhal

Commercial real estate trends 2022

Each year brings fresh uncertainties, surprises and elements that drive the economy and the industries. For the commercial real estate (CRE) industry, 2022 marks a year of hope and recovery. While the industry was resilient to the worst pandemic ever, its growth trajectory this year will likely be a function of how effectively it manages the expectations of a new normal – fluctuating priorities and operations of businesses.

CRE and investment types

A property used for commercial purposes is categorised as CRE. Five major CRE classes spawn large investment capital – retail, multi-family, hospitality, office and industrial, with the types of investment categorised into direct and indirect. Direct investment entails investment made directly to buy a property, while indirect investment encompasses investment made through real estate investment trusts, which own and operate multiple CRE properties, or commercial-mortgage-backed securities (CMBS) – fixed income mortgage products backed by CRE. Real estate investment banking services play a crucial role in facilitating both direct and indirect investments by providing strategic financial advice, underwriting services, and facilitating property transactions.

Factors and trends likely to dictate the growth of the CRE industry

The COVID-19 pandemic has validated the resilience and adaptability of all the sectors. However, each sector is unique and, hence, the impact of market dynamics differs. While all sectors ultimately overcame everyday hurdles posed by the pandemic, the retail sector had to devise new, innovative means to come out trumps. Retailers were forced to think outside the box for survival, as well as discover new ways to connect with or serve their customers online. If this wasn’t enough, technological disruption threw a massive challenge at most retailers. Unsurprisingly, the online channel exploited the situation, growing in stature as global lockdowns compelled consumers to shun brick-and-mortar stores in favour of the digital conduit. Highlights include:

-

Adaptability and flexibility: These factors proved to be key to recovery and will likely shape future growth. Retailers need to be nimble-footed to make swift changes to their strategy to be able to sway to evolving consumer demands.

-

Technology: Retail must embrace technological changes, as consumers have inculcated the habit of shopping at their convenience. Although physical stores have their vantage, online will likely drive a good share of growth this year. Having said this, a growing number of retailers are taking shelter in technology, offering digital payment options and virtual product experience, as well as reviewing their inventory online.

From an investor’s standpoint, grocery-anchored stores and dollar stores will likely yield optimum returns, more than those of traditional shopping centres and high-street retail.

-

The recovery trend is slightly more positive for the US with retail sales forecasted at ~7% for 2022, while it will be slightly more challenging for UK with an annual growth forecast of 2%.

Another sector whose fortunes may reverse compared to the last two years is the Hospitality sector, unless a new event halts its growth. Travel restrictions for much of the last two years have created pent-up demand. Having survived the toughest setback, markets are experiencing decent occupancy, and with summer just beginning, the numbers are likely to soar. Key future trends in the Hospitality sector include the following:

-

Leisure hotels will likely recover faster than business hotels, as business and international travel is recovering slowly.

-

Technology will likely play a key role. As per PwC, above 80% of travellers are looking for improved digital customer experience.

-

Mask enforcement and other hygiene-related factors are likely to influence travellers’ choice of accommodation.

-

Labour shortage is likely to be the key constraint for the industry given owners had trimmed their staff, who may have moved to alternative employments.

-

A new variant and health/safety concerns may impede the recovery rate of the sector.

-

Supply should be decent, as a good number for hotels that folded operations during the pandemic may intend to enter the market again.

The Industrial sector not only sustained strong momentum amid the pandemic, but gained more muscle. A surge in consumer demand fuelled online spending, increasing the need for storage space. Supply chain bottlenecks this year due to Brexit, the Russia-Ukraine war, parts shortages, higher shipping costs and elevated demand may cripple the industry. Key future trends in the segment include:

-

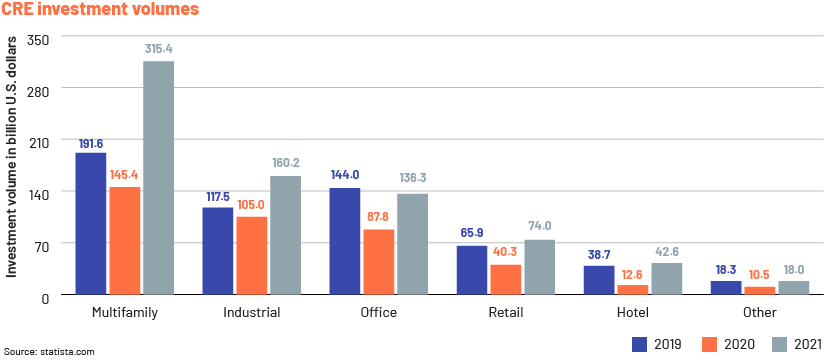

The outlook for this sector appears to be upbeat, due mainly to the heightened need for storage/warehouse spaces expected as demand for e-commerce, medicines, packaging, food products and consumer products is likely to grow exponentially. This is true both for US and UK real estate market. For UK market, the sector is highest contributor at ~30% of all real estate investment activity in 2021, while for US the contribution was 21%.

-

Maintaining a large inventory would be key. This will likely become a new normal as increased demands pressure owners, who would also want to hedge against potential supply chain disruptions.

-

Occupancy would be high, notwithstanding the expected increased rent growth on escalating construction costs and higher demand for warehouse spaces, not to mention lower delinquency rates. Investors will likely bet big on this sector, as it should nourish other sectors.

-

Even though the industrial sector confronts a plethora of challenges such as higher raw material cost, power tariff hikes and ongoing labour shortages, it will likely remain on top of investors’ list this year. Finding the right asset at a competitive price should be a challenge as prices edge higher.

Similar to the industrial sector, the Multi-family sector will likely accomplish new records. With high tenant demand and rents touching a lifetime high, the sector shows no sign of abating. Key future trends in the sector include:

-

Multifamily investment activity will remain robust especially in the US market with ~ 40% contribution of overall CRE investment, and ~27% in the UK market. UK markets like Germany, Denmark, Ireland, Sweden and Finland will be the major contributors.

-

Suburban markets in the US will likely see higher rent and price growth, compared to metros, as people, encouraged by hybrid work models, are flocking to suburbs. Although the UK market would still be dominant by major markets although secondary cities would also see good traction.

-

Builders have to come up with new designs, such as built-in office spaces and additional space for wellness programmes, for better multi-family experience.

-

The peak inflation and developers’ focus on more Class A offerings may push government to provide more tax incentives and other benefits to attract some investment on otherwise fading affordable housing programs.

-

Occupancy levels across all major markets are estimated at above 95% similar to pre-covid trend.

The start of the year saw companies resort to a mix of work practices – some companies continued with their work from home policy, some asked their staff to return to office while most firms pursued a hybrid model. While uncertainties loom on the evolution of the workplace environment, the current practice of large corporations’ rapidly buying and leasing new office areas has kept hopes alive for the Office sector. We are currently witnessing a hiring boom, so companies are doing their best to retain and hire the best talent. Key future trends in the sector include:

-

Spaces with modern amenities will likely attract major investments. Meta, Google, Amazon, Microsoft and other top corporations have expended billions of dollars to buy new office spaces in the last few months – a trend likely to continue this year.

-

Urban centres, such as Atlanta, Manhattan, San Francisco and Los Angeles, are likely to be the key attractions for investors, with new real estate being quickly leased.

-

Flexible layouts in floor plans will likely have higher demand.

The CRE industry this year will likely focus on unconventional themes, with lenders rejigging their portfolios. A growing number of lenders and investors are spurning traditional sectors in favour of demographics-focused sectors – student-housing and senior housing, life sciences/labs, data centres and cold storage, to name a few. Investors are slowly paring their share in conventional properties and shifting to niche categories.

Another key theme for the CRE industry this year is ESG (environmental, social and corporate governance). ESG has been in existence for some time now, but largely on paper. With the US Securities & Exchange Commission in the process of drafting guidelines to help investors understand the impact of ESG policies in their portfolios on ratings, lenders and investors must start integrating them into their CRE portfolios.

To understand the evolving portfolios or ESG’s role in portfolio management, one must understand the growing impact of technology on the CRE industry. Technology is evolving daily, and it is getting hard to catch up. Metaverse will likely dominate 2022 and the coming years. Given its potential, metaverse may become the flagship marketing tool for CRE lenders and developers.

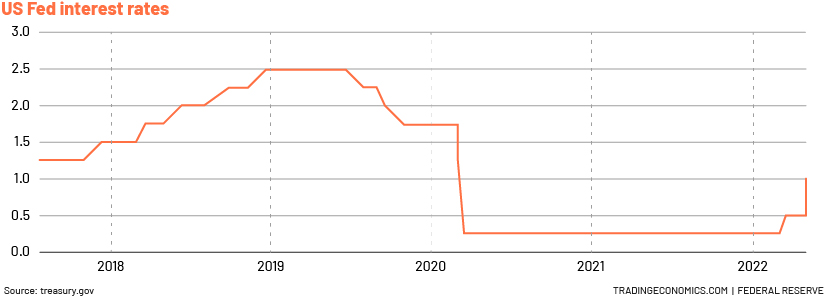

Cost of borrowing: The Fed upped the borrowing rate by 75bps on 15 June, the third in a row, following the 50bps hike in both April and March 2022 – the highest in decades. More hikes could be on the way to tame inflation, which could send the mortgage industry into a tizzy. It won’t be surprising if the curve below touches 180-200bps by year-end, in line with pre-COVID-19 levels.

Since the start of the year, the 10-year Treasury yield has inched up c.150bps, inducing the Fed to hike rates aggressively. Banks have already widened their spreads to account for the higher risk of inflation.

Theoretically, rising interest rates will likely bolster capitalisation rates. However, with so many other market forces reeling up market prices, we expect a marginal upward revision to cap rates by end-2022 across all sectors. Also, property values would advance slowly the rest of this year after the abnormal growth last year, however, stronger markets with rent-growth opportunities may see further compression in cap rates.

How the CMBS market would shape up this year

CMBS issuances have been on the ascendency for several years, and the trend will likely continue. Issuance in 2021 surpassed $100bn, led by SASB loans. With increasingly more corporates and developers gaining access to large pools of money and the demand for upscale Class A+ properties (chiefly hospitality and office space) on the rise, 2022 would be no exception.

Conclusion

Although the COVID-19 pandemic and the new virus variants have created uncertainties, the outlook for the CRE industry is largely positive. The Warehouse, Storage and Multi-family sectors would be the safest bet for investors, followed by Retail, Hotel and Office. The UK CRE market is expected to grow at a CAGR of approximately 5% over the next five years, while the estimated CAGR is 3.5% for the US market.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners has multi-sector expertise in the following areas: financial analytics, valuation and advisory services. The CRE sector is one of our focus areas, and our large team of CRE analysts and subject-matter experts shore up global financial institutions, lenders, brokers, investment firms and service providers. We provide support across the CRE deal life cycle – loan origination, lease analysis, loan underwriting and valuation, guarantor analysis, covenant monitoring, portfolio monitoring and asset management.

We tie up with our clients to drive their revenue, implement global best practices and transform operating models. We have proven experience in helping our clients grow their organic portfolio, migrate their loan platform or shift to a more qualitative risk platform. We also support our clients in assessing the impact of environmental risk factors on their portfolios and ensuring the executive members have all the information they need to better manage the health of their portfolios. Additionally, our proprietary suite of Business Excellence and Automation Tools (BEAT) offers an edge, and we offer bespoke products and tailor-made services.

Sources

U.S. Bureau of Labor Statistics (bls.gov)

Tags:

What's your view?

About the Author

Hina Singhal has over 12 years of experience in commercial lending domain. At Acuity Knowledge Partners, she currently leads CRE client engagement for one of the largest global insurance corporation and is actively involved in new process transitions, client management, training and quality control of deliverables. She holds a MBA (Finance) and a bachelor’s degree on Commerce.

Like the way we think?

Next time we post something new, we'll send it to your inbox