Published on September 8, 2022 by Neha Poddar

Community banking trends

Amid the pandemic-related uncertainties and shifts in market conditions, resilience and flexibility have helped banks discover new opportunities. US community banks survived the unprecedented disruptions due to the crisis, with even more customers and inflated deposit accounts on the back of stimulus programmes and the rapid distribution of funds to customers.

Community bankers once knew every retail and commercial banking customer by name, but personal connections are now built and maintained mostly through digital touchpoints. With the return to pre-pandemic lifestyles, there are new opportunities for growth in community banking, which had been supported by digital technology for the past two years.

Community banks remain challenged by uncertainty, and how they deal with issues relating to balance sheet structure amid a volatile interest rate environment needs to be monitored closely over the coming quarters.

About community banking

Community banking organisations (CBOs) are at the heart of the US banking community. They take deposits and grant loans, helping small businesses and non-profit organisations to grow and strengthening communities. Community banking is based purely on relationships and providing personal attention.

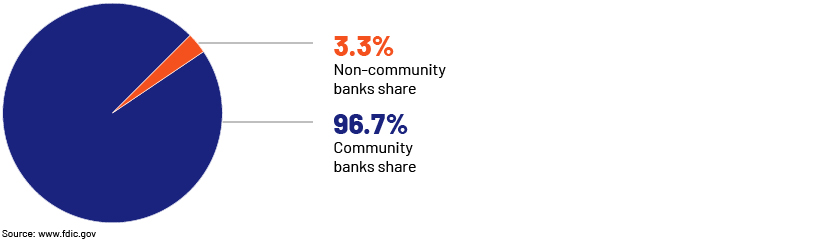

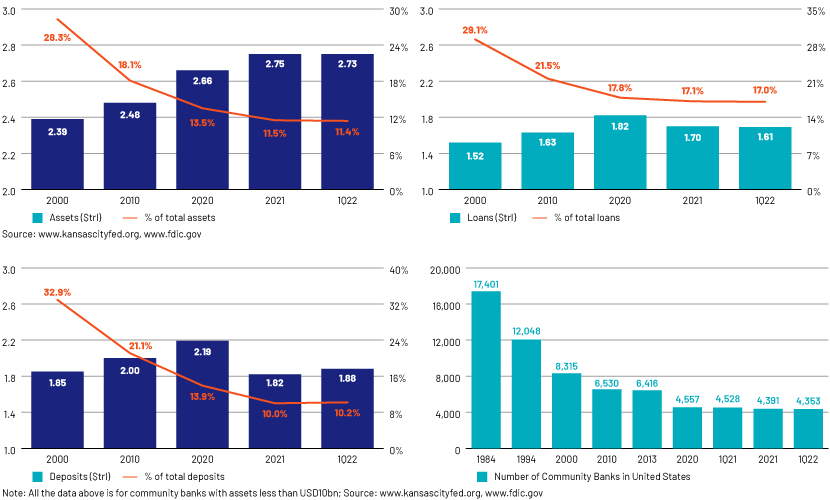

Community banks account for c.97% of banks in the US. However, they represented only 11.4% of total US banking assets, 17% of total US banking loans and 10.2% of total US bank deposits as of 1Q 2022. Small businesses play a large role in the US; c.40% of US bank loans are to small businesses, as 99% of private employers represent small businesses.

CBOs played a large role in providing emergency relief funds amid the pandemic under the Small Business Administration’s Paycheck Protection Program (PPP). They continued to support local communities by actively lending to small businesses and providing crucial credit under this Program.

PPP loans accounted for most of the net growth in community bank loans since the start of the pandemic. CBOs processed 60% of the Program’s funding in the first round and 45% in the second round. Fee income generated from the Program helped boost CBOs’ bottom lines amid the crisis.

Community banks have undergone significant changes over the past 30 years. There were around 17,400 community banks in the US in 1984; the number dropped to 4,353 as of March 2022.

The decline was mainly due to mergers to achieve economies of scale in the community banking space, deregulation, bank failures and fewer new banks being established.

Key factors that have affected community banking

1) Economic mergers and consolidations

Banks restructure and engage in mergers and acquisitions to achieve economies of scale – increased revenue, enhanced product offerings and extensive client bases that present additional cross-selling opportunities. Mergers and acquisitions also help transfer assets from less efficient organisations to more efficient ones that can realise the benefits of scale.

These processes are seen to be the most cost-effective and as opportunities to expand reach. However, those banks that adopt such processes should follow a comprehensive framework to ensure they are in line with each party’s strategic objectives.

2) Change in demographics.

Changing demographics in the US affect demand for community banking services; client bases are changing, and ageing bank management impacts demand for loans and other products and services.

Banks of all sizes are looking for specialised talent and are finding it a challenge to attract and retain such talent. An ageing population is another challenge for CBOs given that over half of their customers are Baby Boomers, accounting for around 57% of total US household wealth. Younger generations have different financial needs. Recognising and responding to these distinctive needs could be an added challenge amid keeping up with the speed of digitalisation in the banking sector.

3) Rapid innovation in financial technology.

Most CBOs are struggling to keep pace with the extensive technology spending on infrastructure, digital platforms, mobile platforms and emerging technologies such as artificial intelligence (AI). Neobanks or “challenger banks” are increasing in popularity as they meet customer demands digitally, offering a faster and more convenient banking experience. They offer more advanced digital services such as a cashless alternative for transferring money to a family in need, an overdraft protection feature to help cover health benefits and online refinancing options. They pose a threat to traditional banks as they deploy technologies such as AI and machine learning to offer hyper-personalised services at lower costs than traditional banks.

The future of and opportunities for community banking

The decline in share of US banking assets and the number of community banks is raising concern about the future of community banking.

There are significant opportunities in store for almost every community bank. More people are looking at how they can be serviced and who can handle their portfolios well. Customers remain comfortable connecting with local banks familiar with their financial needs rather than connecting with the big banks or financial institutions. It is imperative, therefore, that CBOs adapt to the changes. Community banks would have to embrace the increasing popularity of neobanks that offer customer-centricity and hyper-personalisation and use emerging technologies. CBOs would have to learn from these banks and possibly use neobank services as a platform. They could combine the solutions offered by neobanks and still continue to build connections with customers, but meet new customer demands faster, rather than having to build solutions themselves. Banks could continue to streamline their products and services through outsourcing. CBOs could delegate some of their in-house operations to third parties, and improve operational performance, increase speed, reduce operational risks and enhance efficiency through consolidating and centralising functions.

We note below some “must haves” for community banks to stay relevant.

-

Invest in technology

Accelerating adoption of technology poses challenges and presents opportunities. Technology can automate manual lending processes, increase revenue, minimise compliance costs and boost risk management. However, smaller institutions may find it too expensive to deploy such innovation. Many banks capitalised on the opportunity amid the pandemic, centralising and streamlining the PPP process by automating using digital banking tools. CBOs partnered with fintech service companies to build these digital banking services. Digital flexibility smoothened the entire process. It is evident that in today’s environment, technology is a necessity.

-

Offer a service tailored to customer needs

Community banking is also referred to as “relationship banking”, but banks can maintain personal relationships with customers while adopting new technologies. They can continue to incorporate new innovations and approaches to reduce costs and manual intervention, while capitalising on their strengths in customer service.

-

Adopt new revenue models.

Banks should not hesitate to consider new offers that would drive their revenue models. For example, a subscription banking model could offer customers premium services, including a safe deposit box, consultation with a financial planner or a free checking account.

-

Ensure customer convenience

Mobile apps and service providers offer a number of personal and business finance services. Consolidating financial accounts into a single app would make banking easier for customers and provide useful insights and opportunities.

-

Financial unbundling

Pursuing strategic partnerships and adopting the right blend of technology and human support would make decision making faster and easier. Third-party providers could offer highly specialised, value-adding and cost-effective solutions to core banking processes. Customers would also gain access to the rapidly growing number of financial service providers with innovative models that offer products in a different way, at a lower cost and with fewer preconditions.

CBOs will remain integral to rural communities as banking and financial service providers. Community banks have provided substantial amounts of credit to agricultural and commercial borrowers in times of economic uncertainty and are, therefore, expected to continue to play a vital role in their local communities and the broader economy as they capitalise on opportunities to grow.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners is a leading provider of high-value research, analytics and business intelligence to the financial services sector. We have nearly two decades of experience in helping 400+ banks and financial institutions transform their operating models and cost structures. Our Lending Services team provides offshore support to banks and corporates by helping them in prudent origination, underwriting and monitoring of loans. Our credit experts provide granular insights and help banks’ credit risk teams identify potential risks in the portfolio.

Sources:

How US community banks became ‘irreplaceable’ in the pandemic | Financial Times (ft.com)

FDIC Quarterly Banking Profile – 1st Quarter 2022

The threats from challenger banks and fintechs to the incumbents | Elsewhen

The Threat of Challenger Banks: Community Banks' Strategies to Overcome – Abrigo

Tags:

What's your view?

About the Author

Neha Poddar has over 14 years of experience in working with leading global organizations in the banking and commercial lending domains. At Acuity Knowledge Partners, she has managed a large portfolio underwriting team for a mid-size US bank covering diverse industries. Her expertise spans a broad range of credit analysis, financial modelling, portfolio management and onshore client-facing roles. Neha holds a Ms. Finance degree from ICFAI university and a bachelor’s degree on Commerce.

Like the way we think?

Next time we post something new, we'll send it to your inbox